APPS

APPS

APPS

APPS

APPS

APPS

Policy advisory and research firm Startup Genome today released a report on the impact of the COVID-19 pandemic on the startup ecosystem — and though the short-term impact is unsurprisingly not good, there may be some light at the end of the tunnel.

Starting with mainland China, the report notes that venture capital deals have contracted between 50% and 57% in the Middle Kingdom since the onset of the crisis in the first two months of the year, relative to the rest of the world. If that drop is reflected worldwide now that the pandemic is global, $28 billion in startup investment could go missing in 2020 — with a dramatic impact in the tech sector.

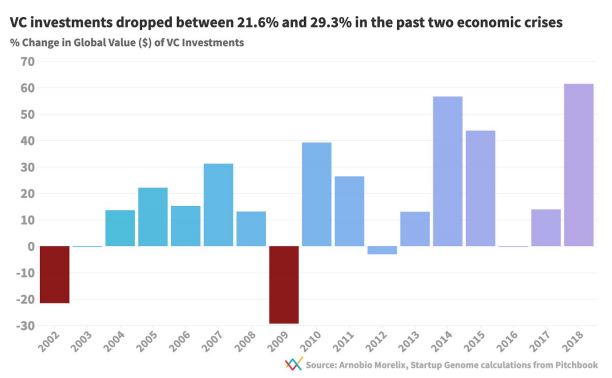

Noting that the length of the pandemic and its ongoing economic impact remains unknown, the report said that if it should last for longer than two months, the likely economic outcome will be similar to the dot-com bubble crash of 2000-2001 and the financial crisis of 2007-8.

If the coronavirus pandemic delivers a similar outcome — a drop of between 21.6% and 29.3% in VC over twelve months — the equivalent in 2020 would see a drop of $86.4 billion in VC investment. Both the 2000-2001 and 2007 recessions also saw a 90% decline in tech initial public offerings as well.

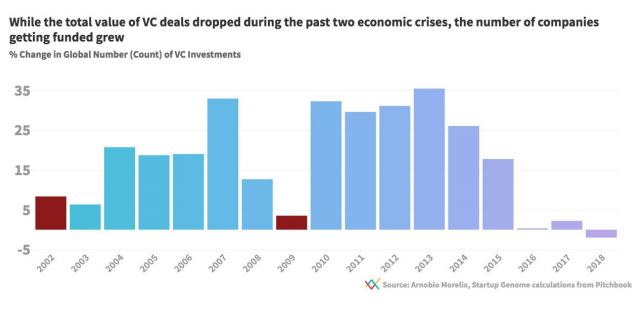

A drop in VC funding does not necessarily mean that fewer companies will find investors, however. The report notes that during the past two recessions, more companies were funded, though at lower valuations and lower fundraising, “suggesting that businesses that are able to become cash efficient might become even more likely to raise money following a recession.”

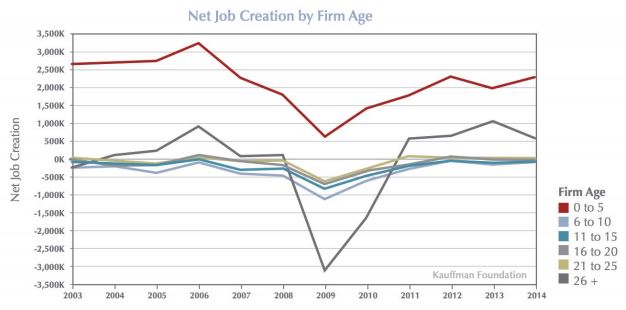

Newer, smaller startups may also be better-placed to drive jobs growth once the crisis passes as larger, older companies have often been hit harder. “This need for net new jobs means the economy needs startups now even more than usual,” the report states.

Looking forward, the report noted that there is a reason to be optimistic about economic restarts following the shutdowns. “China, the place first hit by the virus, is coming back to work: offices are becoming used again as we see from our ecosystem partners in the country and manufacturers like Foxconn (the maker of most of iPhones in China) announced it will be back to normal production schedule by the end of March,” the report states. “Supporting this trend, LinkedIn data shows Chinese hirings slowly rebounding, though not anywhere near the previous level.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.