INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Chief information officers and chief information security officers in some of the hardest-hit industries now see significant near-term and many permanent shifts to their information technology and security strategies.

That’s the consensus of four technology executives at leading companies that are feeling the brunt of the coronavirus pandemic. In this week’s CUBE Insights, powered by Enterprise Technology Research, we want to accomplish three things:

The ETR Venn is a roundtable discussion that applies a tried and true methodology similar to focus groups or in-depth interviews or IDIs.

ETR invites executives from its community to participate in a private but open conversation. ETR clients get to listen in. The names of the execs and their companies are transparent but theCUBE is only allowed to refer to them generically as shown on the slide above. We can attest to the fact that these participants were legit CIOs and CISOs, some at very well-known firms.

The overall budget impact for these four organizations is severe since they are in industries that were significantly affected by COVID-19.

Large projects are being put on hold, although digital transformation initiatives remain a priority. Broadly, there were four significant areas of emphasis cited by the execs:

Here’s a clip of how Erik Bradley of ETR summarized the VENN takeaways:

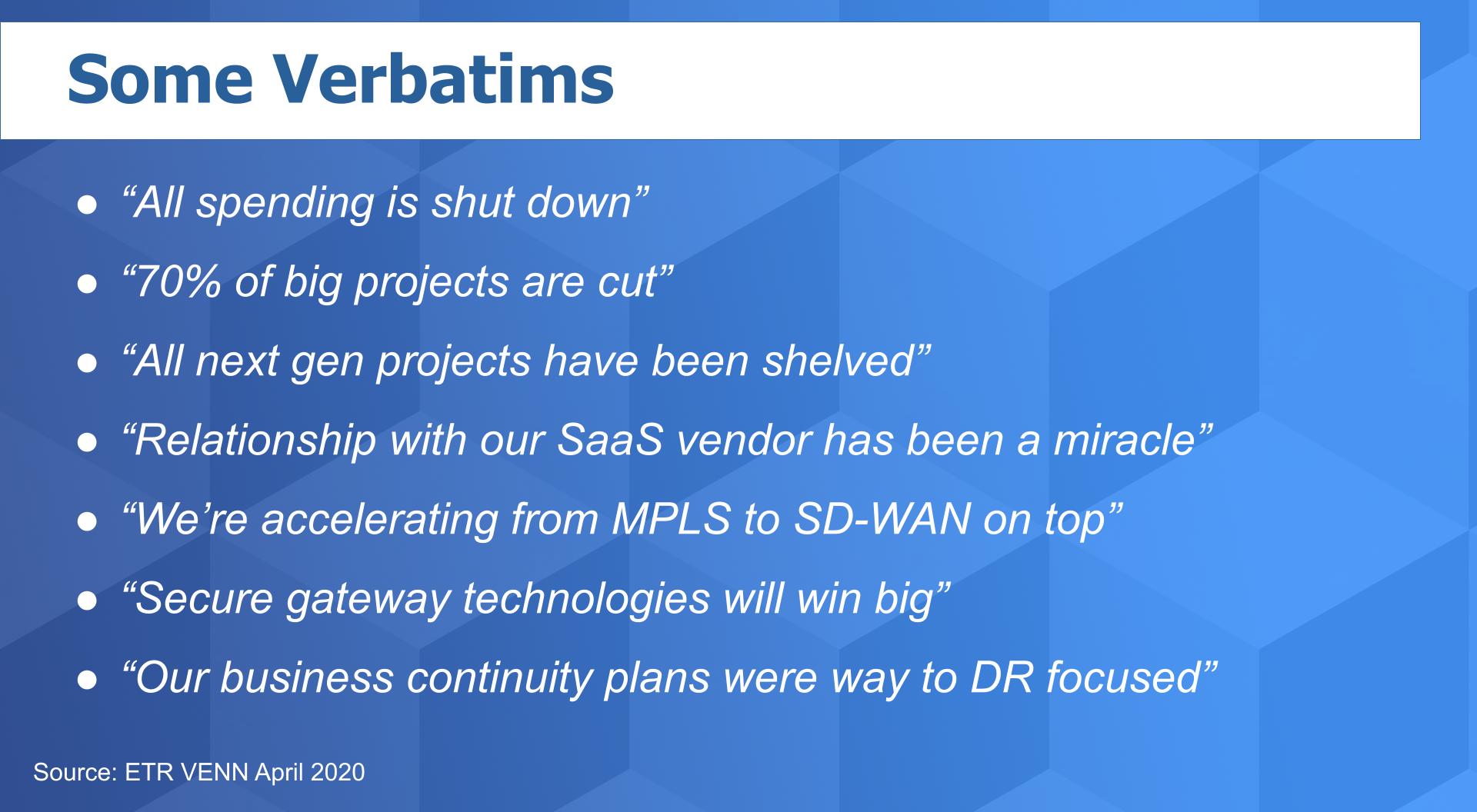

There were so many to choose from, but the slide below gives a good summary of the overall sentiment within the panel:

Sometimes it feels like all we do is talk about the cloud. But it’s clear from the data that spending on the cloud will only be accelerated. We said this in 2008 and 2009. Downturns have been good to the cloud. One exec even said:

I would like to see my data centers completely deleted.

Let’s listen to Erik’s Bradley’s take on this comment:

We’ve been talking a lot about those aspects of people, process and technology that may be permanent post-COVID and clearly you see C-level execs as having a bit of an awakening for things such as cloud and work from home. It’s not that they didn’t see them before coronavirus, but these things will accelerate in our view as a result of this pandemic.

The panel members really trashed MPLS networks in a big way. You find this infrastructure in big telecom networks and it’s there to route traffic. MPLS is used to create dedicated and reliable connections and enables VPNs, QoS, and traffic engineering or shaping. Although MPLS is cheaper than T1, it’s more expensive than Ethernet and came into prominence well before the cloud. These execs and many other customers see it as outdated and inflexible.

This is where SD-WAN comes into play. They’re gaining in popularity, especially with the SaaSification of applications and the general trend toward the cloud.

Here’s a clip of Erik Bradley explaining what the panel members said on this topic:

The challenge, of course, is customers have multiple MPLS contracts with several different providers and often they just rubber-stamp the renewal. But what customers are going to do is start layering in SD-WAN and letting those agreements expire.

We’ve said many times on theCUBE that the idea of digging a moat around the castle doesn’t protect your queen anymore because your queen –that is, your data — has left the castle. We feel the companies that can secure gateways and endpoints will have continued momentum going forward.

In the panel, Zscaler Inc. came up a lot in this context. As did Fortinet Inc. which as we’ve reported has been done a good job in getting its cloud products to market. And the ETR data shows Fortinet and Zscaler both have strong Net Scores or spending momentum and Fortinet especially has pervasiveness in the ETR data set. We’ve also reported that there’s been a valuation divergence between Palo Alto Networks Inc. and Fortinet, and how Zscaler is a disrupter in this market.

Here’s a clip of Erik Bradley’s take on Zscaler and Palo Alto Networks as well as zero-trust networks:

We agree with Erik that Palo Alto Networks is definitely going to be in the mix. Customers we’ve talked to want to work with it, but there’s a sea change going on here and it’s being driven by SaaS, cloud and now COVID19 accelerating the trend to remote workers.

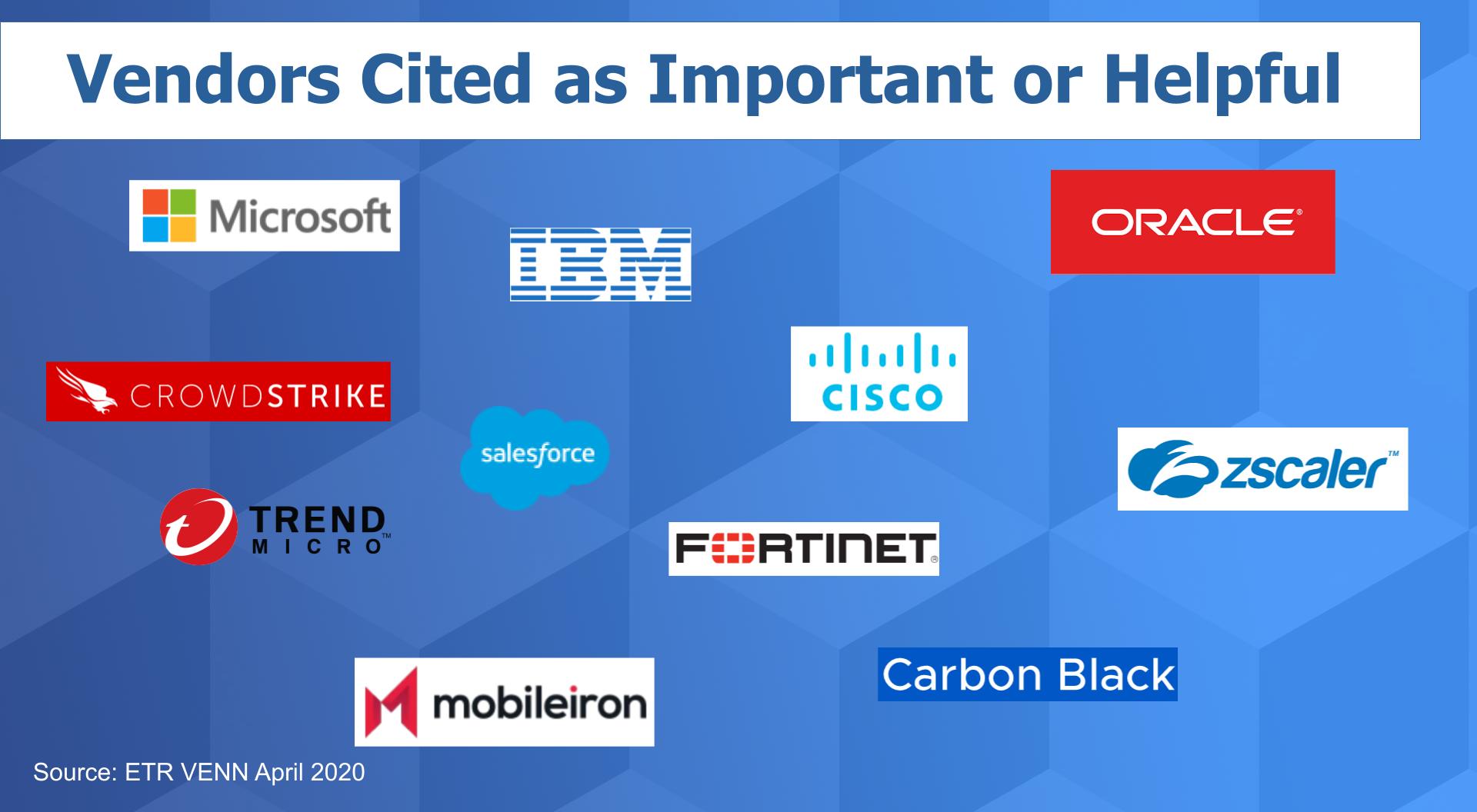

This chart shows some of the vendors that were called out as either being great to work with or super-important to the CIOs and CISOs. These executives really stressed how thankful they are for those companies that have worked closely with them and have been flexible on pricing and payments. They also specifically mentioned how they were put off by “ambulance chasing” and trials that required them to make some type of commitment; they just don’t have time right now.

Here are some comments on a few companies that were cited in a positive light. Microsoft Corp. is all over the ETR data set — Microsoft Teams, security solutions, cloud and more. IBM Corp. was mentioned as being a great partner, as was Oracle Corp. – many times. We talked about Fortinet and Zscaler earlier. Also Cisco Systems Inc. was called out as a strategic vendor that was very helpful both in networking and with Cisco Teams for collaboration. CrowdStrike Holding Inc. and Trend Micro Inc. came up quite a bit and Carbon Black Inc. got a mention via the VMware Inc. acquisition. And MobileIron Inc. makes sense in terms of securing and managing remote worker devices.

Finally, Salesforce.com Inc. was also brought up many times as a critical vendor. Interestingly, one exec said that before coronavirus, multiple workers could share Salesforce licenses, but with the spike in work-from-home, they had to purchase more licenses.

You might think that in this climate, especially among four hard-hit customers, they might be risk-averse as it pertains to using startups. One CIO said the following (we’re paraphrasing):

You always hear about the guy who says I pick out three guys in the upper right hand corner of the Gartner Magic Quadrant and test them out. What I always do is pick two from the upper right, and one from the lower left – one of the emerging techs – and give them a shot.

Here’s how Erik Bradley describes that comment:

So there were really interesting and somewhat nonintuitive comments on startups. Of course that means that despite all the consolidation and acquisitions, many parts of the IT industry will still be highly fragmented, as we’ve said many times – especially in the security market.

We realize these are narrow comments from four CIOs and CISOs, but they give us added texture and color to the core ETR data set. We’ll continue to report on these trends and share more details as they become available. And over the next several weeks we’ll really dig into the ETR data set on a regular basis.

Look for updates on the ETR website and make sure to check out SiliconANGLE for all the news and analysis. Remember these episodes are all available as podcasts wherever you listen.

Ways to get in touch: Email david.vellante@siliconangle.com, DM @dvellante on Twitter, and comment on our LinkedIn posts.

Also, you may want to check out this ETR Tutorial we created, which explains the spending methodology in more detail.

Here’s the full video analysis:

THANK YOU