APPS

APPS

APPS

APPS

APPS

APPS

San Francisco-based mobile banking startup Varo Money Inc. revealed today that it has raised $241 million in new funding to expand development of its mobile banking products.

The Series D round was co-led by Gallatin Point Capital and The Rise Fund and included HarbourVest and Progressive Insurance.

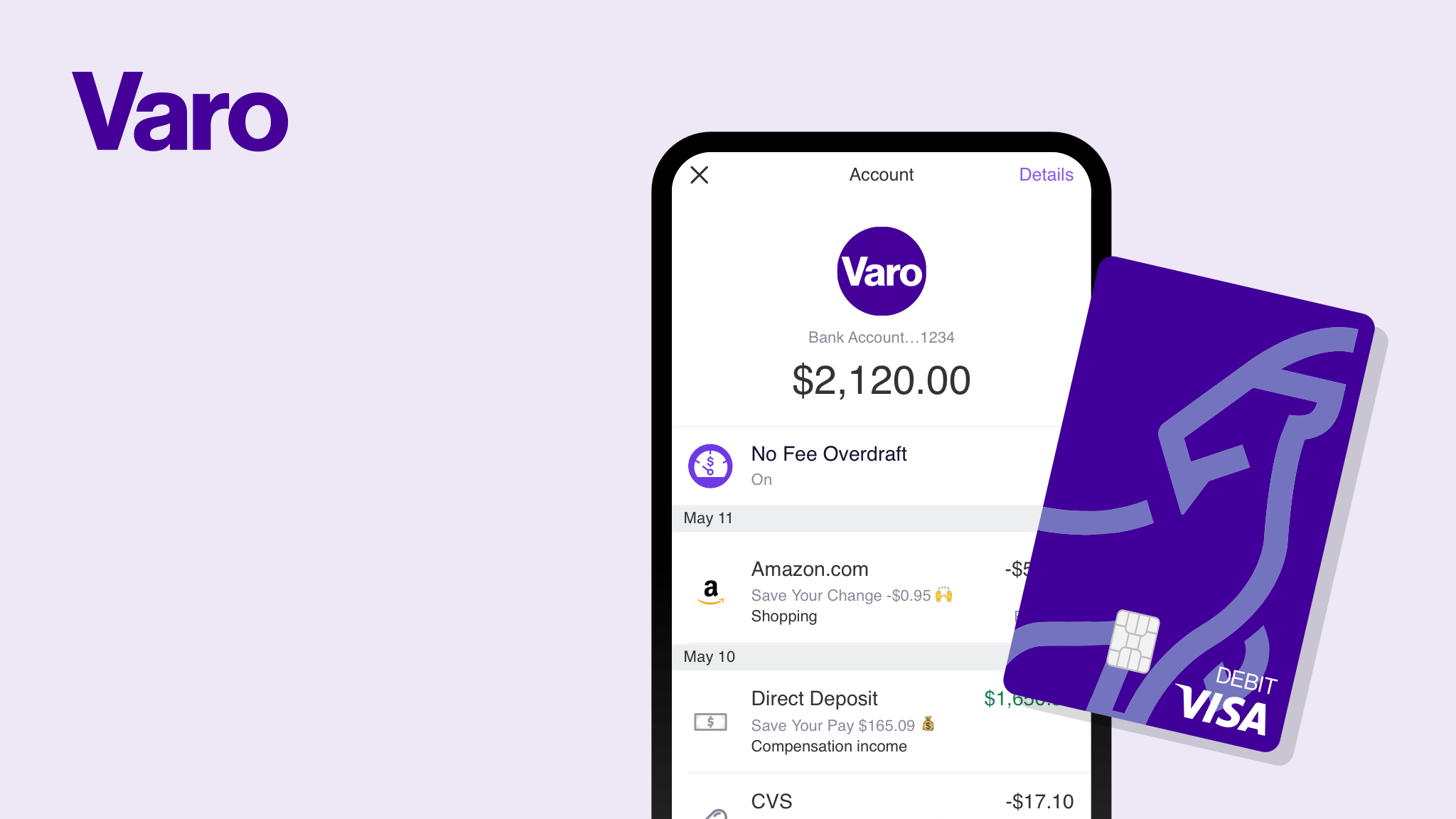

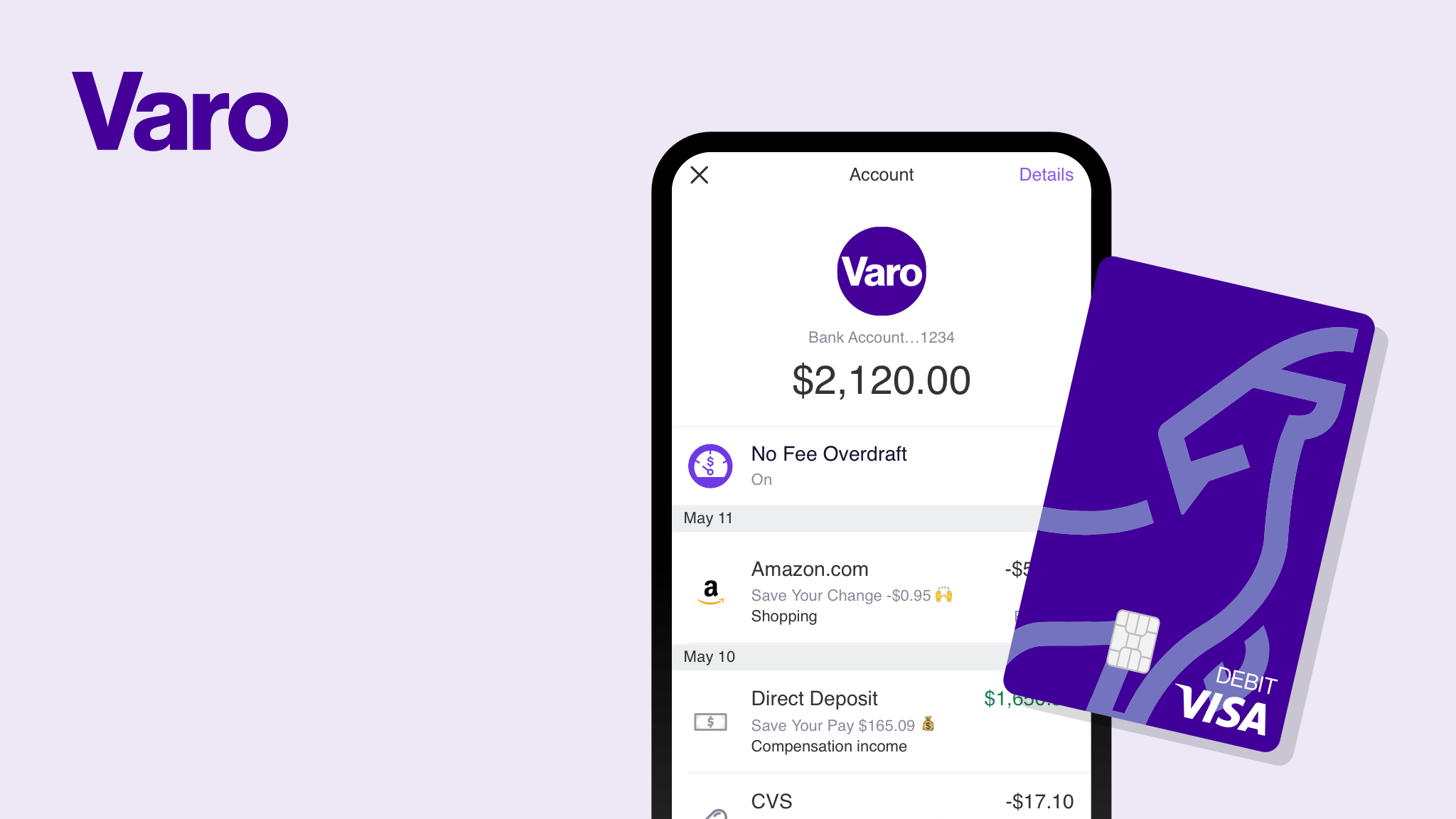

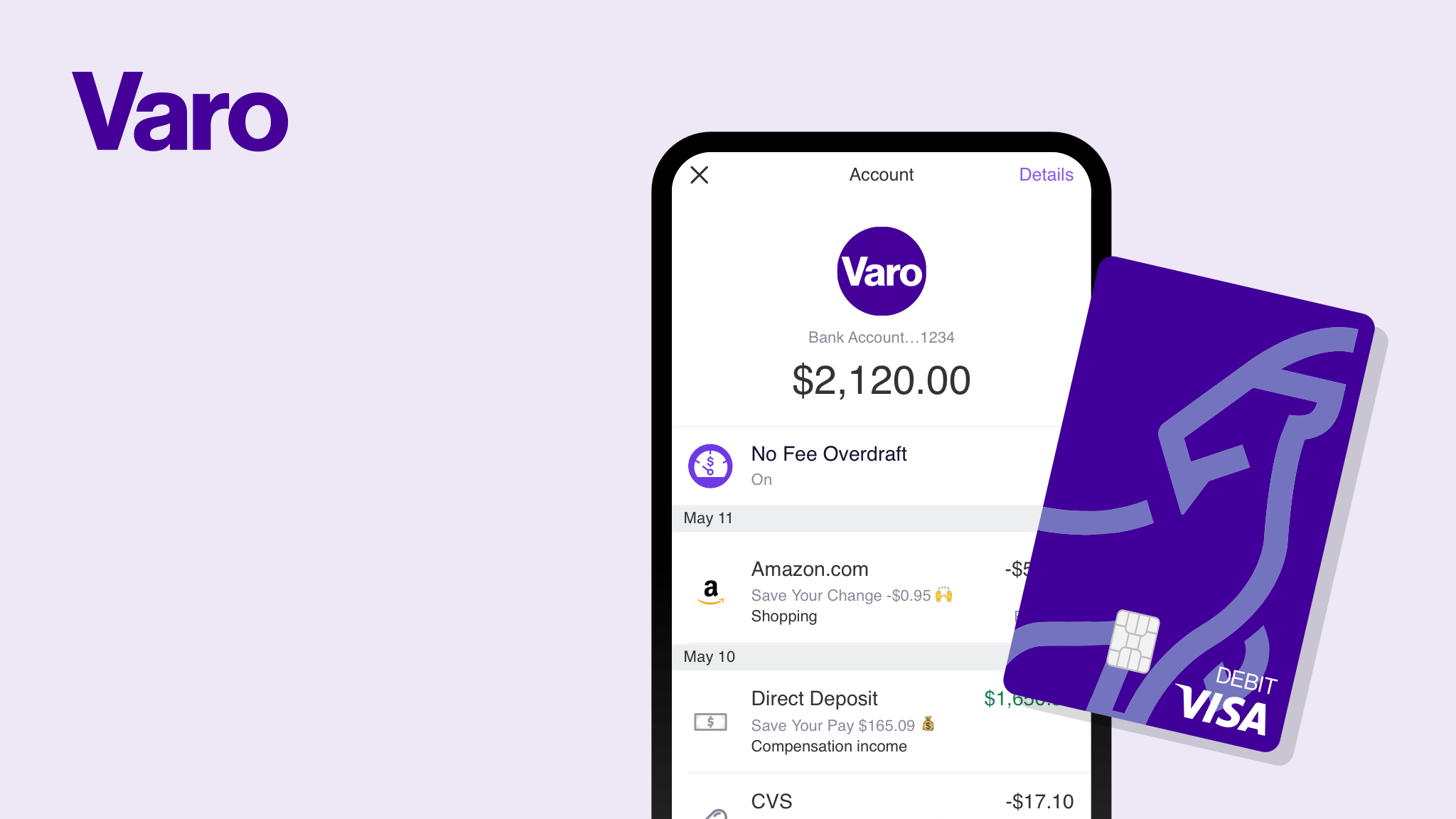

Founded in 2015, Varo offers a mobile-first banking service designed to assist customers in covering their expenses, pay bills and build their wealth over time. The company takes a Silicon Valley approach to fintech and banking with a mission to “redefine banking so it’s easy for everyone to make smart choices with their money.”

The company offers customers no-cost premium bank accounts and high-interest savings accounts. Varo also pitches itself as differing from existing big banks in having no hidden fees. The banking services are offered with the support of Bancorp Bank, with U.S. Federal Deposit Insurance Corp. insurance of up to $250,000.

“Trends we did not expect to see for 10 years are happening now,” Colin Walsh, co-founder and chief executive officer of Varo, said in a statement. “More than ever, consumers are seeking the safety and convenience that digital banking provides. Since our inception, we have been laser-focused on becoming the first fully digital bank, giving us greater opportunity to deliver the affordable financial services that all Americans need today.”

Walsh added that the investment will enable Varo to complete the chartering process, a notable achievement for a fintech startup. While currently providing services in conjunction with Bancorp, Varo is aiming to become a chartered bank in its own right.

The company is in the final stages of its national bank charter application. Pending completion of the conditions of the Office of the Comptroller of the Currency, the FDIC and the Federal Reserve, Varo will receive approval to be a national bank which is expected this summer. Upon charter approval, Varo will expand its services to offer credit cards, loans and additional savings products.

Including the new funding, Varo has raised $419.4 million to date. Previous investors include Silicon Valley Bank, Manatt Venture Fund, Warburg Pincus, Gaingels and Gopher Asset Management.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.