INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Now that it’s apparent Dell Technologies Inc. is evaluating what to do with its majority share of VMware Inc., we’ve identified five strategic options for Dell and VMware that we believe are under consideration.

They are:

In this Breaking Analysis, we’ll assess these five options and what it means for Dell, VMware, customers and partners. As always, we’ll bring in the spending data from Enterprise Technology Research to add the customer perspective.

On June 23, The Wall Street Journal reported that Dell is exploring strategic options for its approximately 81% share in computing virtualization provider VMware. Both Dell and VMware stocks popped on the news. We believe that Dell is floating this trial balloon to gauge investor, customer and partner sentiment and perhaps send a signal to short sellers that Dell founder and Chief Executive Michael Dell (pictured) has other arrows in his quiver to unlock value in his companies– that is, squeeze me and I will squeeze you back.

The Journal story said Dell was considering spinning off VMware or buying the remaining 19% of VMware stock that it doesn’t own.

The article cited unnamed sources and said that a spinoff would not likely happen until September 2021 for tax reasons. That would mark the five-year anniversary of Dell acquiring EMC and would allow for a tax-free transaction.

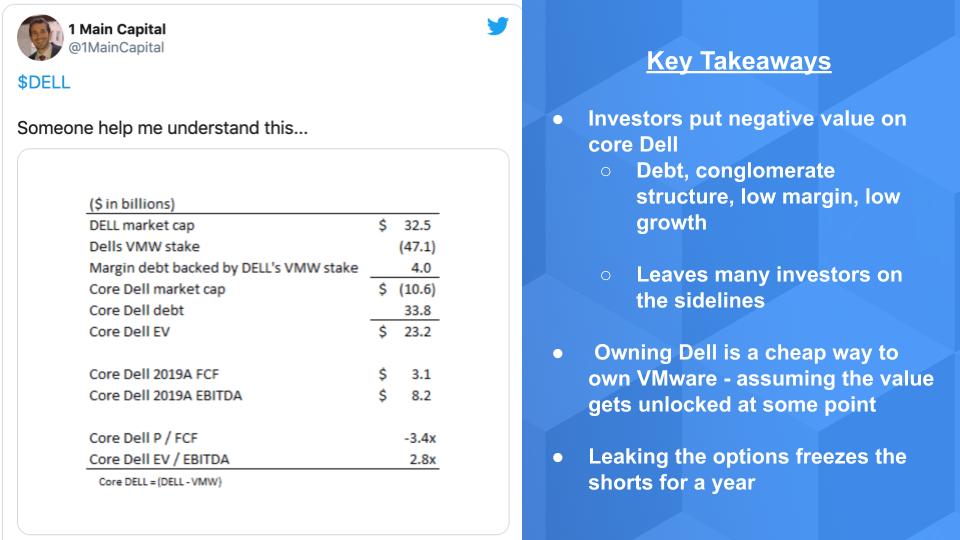

This tweet from Yaron Naymark, a portfolio manager at 1 Main Capital sort of sums it up:

He laid out this chart that shows Dell’s market capitalization prior to the stock pop is about $38 billion today, and the value of its VMware ownership, which is more than $50 billion since the news leaked. Let’s cut to the chase and right through all the data: Investors value the core assets of Dell somewhere south of minus $11 billion.

Folks who follow Dell know this story. But those who don’t may be surprised to know that though Dell, without VMware, has revenue of more than $80 billion, the Street puts a negative value on the stock.

Why? Because Dell is carrying more than $30 billion of core debt. It owns and controls the vast majority of VMware shares– Michael Dell has something like 97% voting control — and the Street puts a conglomerate penalty on the stock.

Moreover, core Dell is a low margin, low growth business with exposure to hardware. Further, people complain that Dell uses VMware as his funding machine and many investors just won’t touch the stock. So Dell’s stock has underperformed the broader tech sector.

As we’ve often said – even going back to EMC days – owning the stock of VMware’s owner is a cheap way to buy VMware — assuming that value gets unlocked at some point.

So Dell is perhaps signaling that it has some options and other levers to pull in order to juice its value. And as we said, maybe Dell is trying to give pause to any big shorts trying to profit on the downside over the next twelve months.

Before we dig into the five scenarios, let’s look at the spending climate. We’ll assess selected ETR data for Dell and VMware and evaluate the respective positions of a combined Dell/VMware relative to the competition.

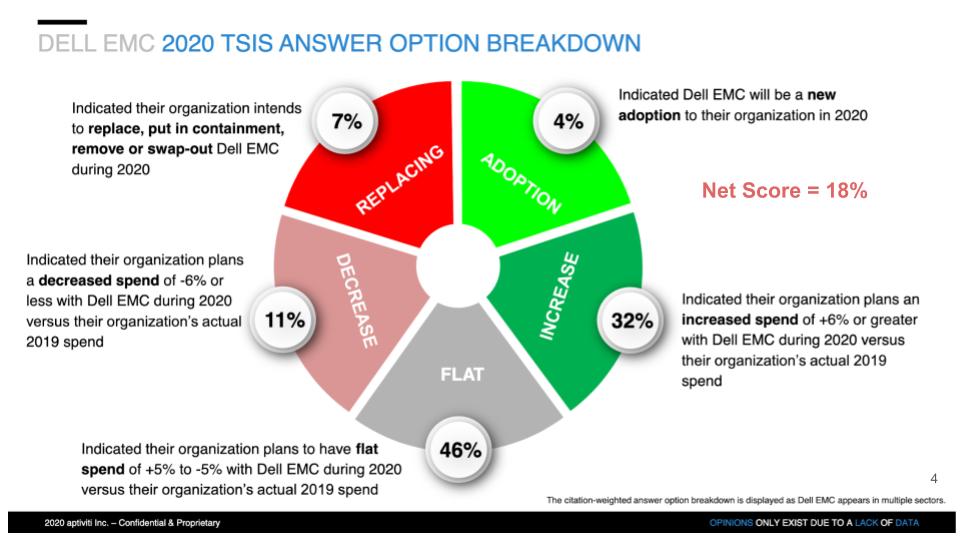

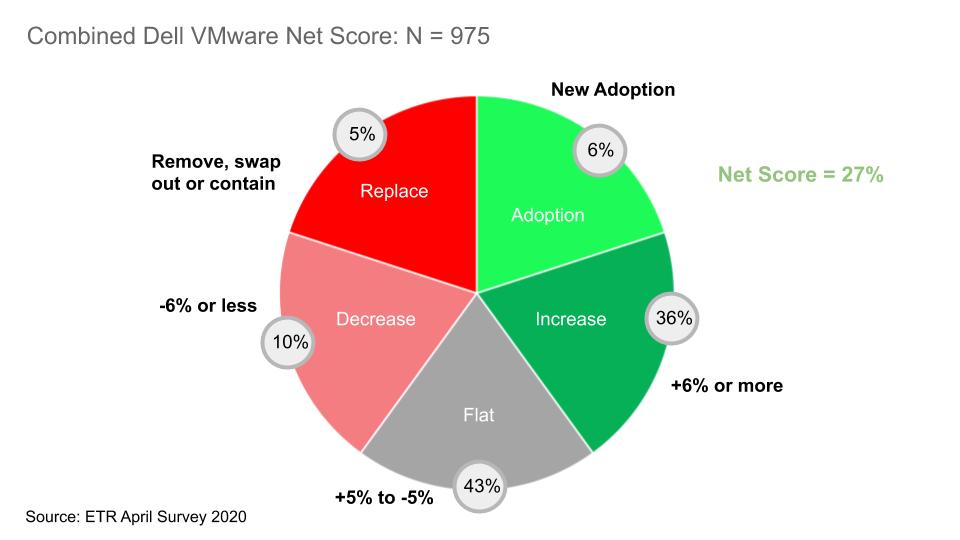

This chart uses the core ETR methodology that we’ve shared many times. For those not familiar, we use the concept of Net Score. Net Score is a simple metric like Net Promoter Score.

The chart above shows the five elements of Dell’s Net Score. Each quarter, ETR asks customers if they plan to adopt the vendor new – that’s the lime green at 4%, spend more relative to last year, such as more than 6% – that’s the forest green at 32%. Flat spend is the gray – meaning plus 5% to minus 5%. Decrease spend by 6% or greater – that’s the pink at 11% – or are they replacing the platform – bright red at 7%.

Net Score a measure of spending momentum and is derived by adding the greens and subtracting the reds. You can see Dell in the last survey – which was taken at the height of the pandemic – has a Net Score of 18%. We make that soft red – it’s not terrible but it’s not great either. Of course, this is across Dell’s entire portfolio from client to data center and it excludes VMware.

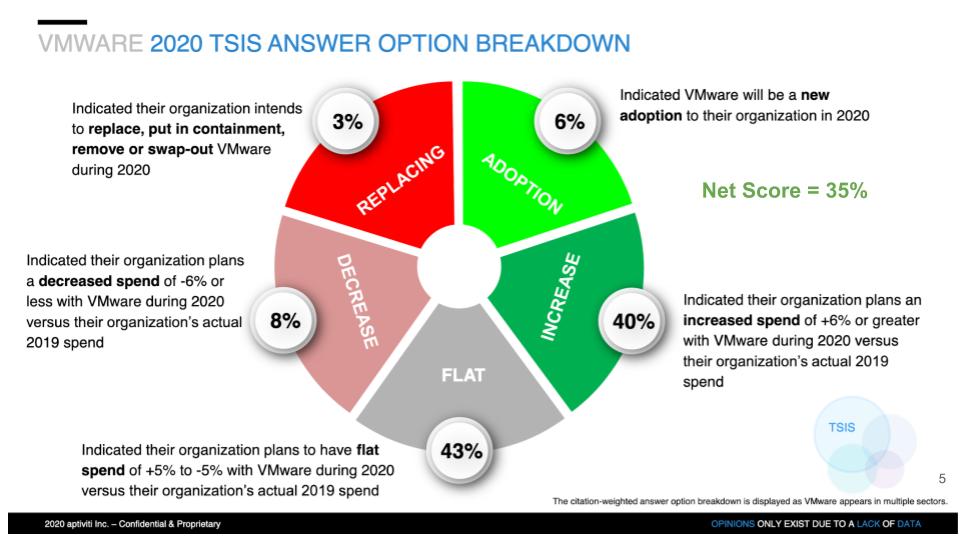

This next graphic applies the exact same methodology to VMware:

As you can see above, VMware has a much higher Net Score at 35%, which is not surprising for a higher-growth company. Some 46% of VMware customers are planning to spend more in 2020 relative to 2019.

One of the scenarios put forth in the Journal article was Dell acquiring the remaining shares of VMware. It’s something we’ll analyze later in this post, but what would that look like from an ETR spending perspective? The chart below does that:

There are 975 combined Dell VMware respondents in the last ETR survey . You can see above the combined company Net Score is 27%, with 42% of respondents planning to spend more than they did last year.

So you may be asking: Is this good? How does this compare to Dell and VMware competitors?

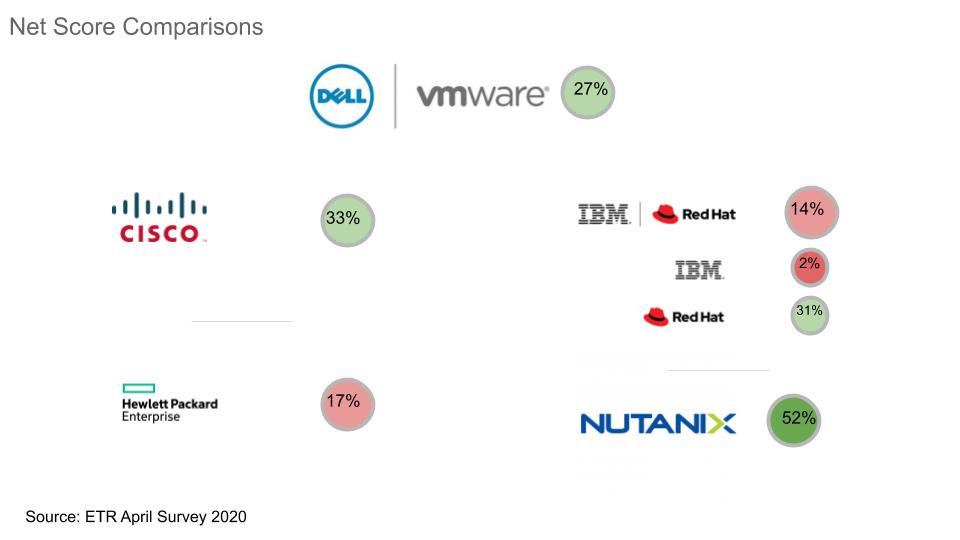

In the chart below we show the Net Score comparisons:

In the above graphic, we see the combined Dell VMware at 27%. Cisco Systems Inc., as we have often reported, consistently shows strength relative to other enterprise data center players. You can see Hewlett Packard Enterprise co. is a tepid 17%, so it has some work to do to live up to the promises of the HP-HPE split.

We also show IBM Red Hat at 14% and the granular scores for each company. There’s some room for improvement from IBM Red Hat. You can see IBM in the danger zone and Red Hat much stronger, but it has softened somewhat in the surveys since last year. So we would like to see better momentum from IBM Red Hat. It’s unfortunate that COVID-19 hit when it did as IBM began ramping up its Red Hat go-to-market efforts.

For further comparison purposes, we include Nutanix Inc. in the chart. Nutanix is a much smaller company but one that is still fairly mature. But you can see that at 52% its Net Score is much higher than the big enterprise whales. As a final comparison, we’ve been reporting for months on high-flying companies such as Automation Anywhere Inc., CrowdStrike Holdings Inc., Okta Inc., Zscaler Inc., Rubrik Inc., Snowflake Inc. and UiPath Inc. These emerging companies have Net Scores north of 60% and even in the 70% percent range. But they’re growing from a much smaller base.

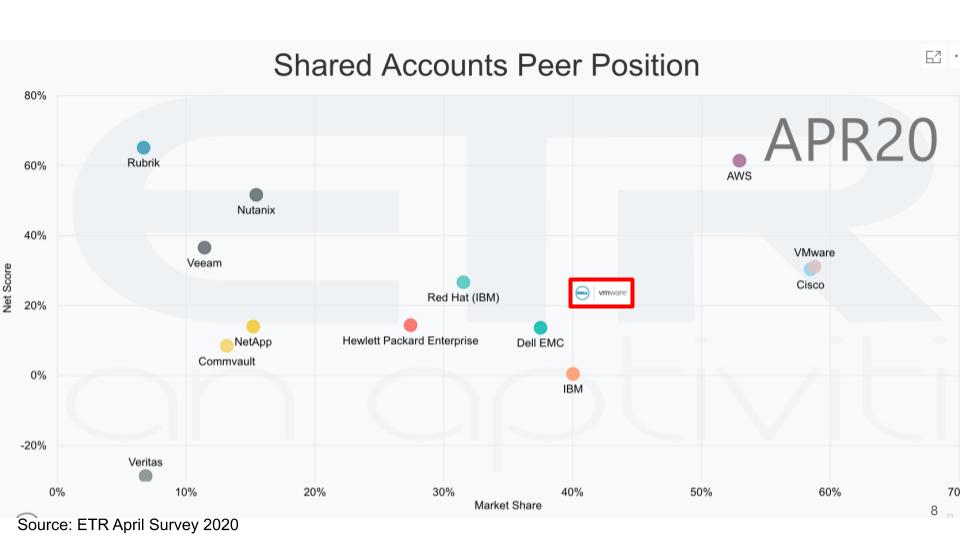

As you know, in addition to the Net Score metric we like to use another ETR measure called Marketshare. It’s a measure of pervasiveness or marketshare within the survey and is a proxy for real marketshare. It’s calculated by dividing the number of mentions of a vendor by the total number of mentions within a sector.

The chart below plots several companies with their Net Score on the y axis and Marketshare on the x axis:

We combined Dell and VMware together and plotted them in the Red Box for comparison purposes.

What does this tell you about the competitive landscape? First, everyone would love to be Amazon Web Services Inc. Microsoft Corp. too, though we didn’t plot Microsoft because it’s so dominant that it skews the chart somewhat. But it would be way out to the right on the X-Axis because they have such a huge number of products and mentions in the data set.

You can see VMware and Cisco right on top of each other, which is appropriate because they increasingly overlap in offerings. And you can see the other companies and for context we’ve added a few more competitors such as Veeam Software Inc. and Commvault Systems Inc. And you can see the combination of Dell and VMware is pretty strong.

Perhaps this gives some credibility to the scenario calling for Dell to acquire the remaining VMware shares.

So let’s start there in unpacking Dell’s options.

Stifel analyst Brad Reback was quoted in MarketWatch as saying the following:

We have long believed Dell would ultimately buy-in the ~19% (~$12.5B) of VMware that it does not own in order to gain full control over VMware’s substantial [free cash flow] of about $4B annually and still expect this to be the ultimate outcome.

This declaration surprised us. On the one hand, you can see from the previous chart this would be a better outcome for Dell from a competitive standpoint. It pulls Dell up and to the right. But perhaps not so much for VMware, since it went down and to the left.

And Dell would have to raise more cash to do the deal and take on even more debt. Maybe it could get Silver Lake Partners, Dell’s long time investment ally, to finance the deal. Dell would then become the Oracle Corp. of infrastructure. It certainly would make Dell even more strategic to chief information officers.

Would this move be good for customers? On the one hand, we feel it would bring better integration between Dell and VMware. We wonder, though, if that is the critical issue for customers. Rather, we think the VMware ecosystem of partners who for years have integrated through VMware application programming interfaces already gives customers choice and adequate if not excellent integration.

We think this approach would stifle VMware’s innovation engine, which is already squeezed with the way Dell has used VMware’s cash. We also wonder what would happen to VMware leadership. Our guess is CEO Pat Gelsinger would call it a day. And what about Sanjay Poonen, who is the obvious next in line for the CEO job at VMware? Would he become the president of Dell’s software division? And what about the rest of the team at VMware – a Silicon Valley stalwart would slowly morph into Austin-based Dell?

Post “spin-in,” with the debt burden growing, it means more of VMware’s cash would go to paying down the debt, meaning less money for research and development or even stock buybacks. We’re not a huge fan of this scenario and for sure the technology partner ecosystem (which is admittedly Dell’s competitors) would be ice cold on such a deal, even if one could argue they already are less than lukewarm.

Bottom line: Positive for core Dell. Negative for competitors and ecosystem partners. Neutral to negative for customers. Positive near-term for shareholders. Unclear longer-term.

Dell could sell VMware to a strategic company or a private equity firm. It would wipe out Dell’s debt and it would have some cash left over to sail into the sunset on a boat with a bunch of hardware in the cargo hold.

This would be a big pill to swallow for a buyer. Even though Michael Dell has something like 97% voting power, we think there’s fine print somewhere that says he has a responsibility to protect the interests of the minority shareholders. So to get approval, it would have to sell at a premium., as high as $70 billion at today’s prices.

Microsoft has the cash, but it doesn’t need VMware. Amazon could pull it off but that certainly is not likely even if Google LLC – which also has the cash – were interested in buying VMware. Google would be the most likely candidate. It would give Google Cloud instant access to the coveted enterprise. But it’s hard to conceive because it would unwind the relationship between AWS and VMware, which is quite productive at the moment.

For a PE firm, it would have to come up with $65 billion to $70 billion and it would take 15 to 20 years to get its money back through cash flows. If we recall, to finance the EMC acquisition Michael Dell (through MSD Capital, his family office), Silver Lake and some other PE investors had to put up only about $4 billion of hard cash to acquire EMC at $67 billion. That was the PE deal of the century, as Silver Lake now owns about 29% of Dell, which includes about 23.5% of VMware.

Bottom line: unlikely.

In such a transaction, Dell shareholders would get VMware stock. There may be some financial wizardry that Dell Chief Financial Officer Tom Sweet and his band of financial geniuses could swing to take some cash out of this deal and chip away at the debt. But we’re not qualified to speculate on some magic move that they could make to create liquidity in such a transaction.

Nonetheless, that would unlock the value of both Dell and VMware by removing the conglomerate hangover for Dell and it would undoubtedly attract more sideline investors into VMware’s stock. Michael Dell personally and Silver Lake would still own a boatload of VMware stock, so there’s an ongoing incentive there. But it would leave Dell untethered from VMware.

So this is interesting and we think remotely possible if there’s a way for Dell to create liquidity. It would be good for VMware customers. VMware gets full autonomy and control over its destiny without Dell bogarting its cash. So it could freely innovate. VMware’s technology ecosystem partners — aka Dell’s competitors, such as HPE, IBM, NetApp Inc. and others, would like it, although they are already well down the path of looking to optimize VMware alternatives (think Cisco).

However, Dell would become less strategic for customers, so we don’t like that for Dell’s installed base.

Bottom line: Positive for investors. Positive for VMware and VMware customers. Negative for Dell’s core customers.

We think this is as possible as any outcome. Dell can keep chipping away at its debt with its cash flow. It can use VMware as a strategic linchpin with customers. Sure, Dell continues to pay the liquidity overhang tax and frustrate some shareholders, but that has been the pattern anyway.

The problem with this scenario is core Dell is currently worth minus $12 billion, which is frustrating for Dell, Silver Lake and Dell shareholders. And it doesn’t unlock any near term value.

Bottom line: Negative for investors. Neutral for Dell, VMware, customers and partners/competitors.

The more we think about it, the more we like this scenario. What if Dell sold 20% of its VMware stake and raised $10 billion in cash that it could use to really eat into its debt burden. A move like this combined with some additional debt pay-down from cash flow could cut Dell’s core debt close to $20 billion by the end of 2021. This would make the balance sheet more attractive and could get the company back to an investment-grade credit rating, which would drop hundreds of millions if not a billion dollars to the bottom line. It would allow Dell to continue to control VMware with improved cash flow and earnings.

What we don’t know is if there are nuances to this scenario. In other words, does dropping ownership from roughly 80% to about 60% trigger some loss of control or some other reporting issue. We’ve been scanning SEC filings, but at the time of this publication we haven’t found a definitive answer. Dell declined to comment.

This move doesn’t radically alter relationships with customers or partners. VMware maintains its existing autonomy. It somewhat lessens Dell’s perceived control over VMware and it attacks Dell’s debt burden. Yes, it’s still a bit of a halfway house but a more attractive and stable option for the near term in our view. And it would, we think, unlock more value for shareholders – at least VMware shareholders.

Bottom line: Positive for Dell, positive for VMware, positive for investors, neutral for customers, neutral for partners/competitors.

It looks like the stock market is coming to the reality that we are in a recession, although much of the downward pressure in the market at the end of last week was related to the prospects of a Biden presidency.

We will see what the economic shutdown will mean for tech companies this earnings season. ETR’s next survey is in the field and it will have fresh data on the impact of COVID-19 going into the dog days of summer.

For now, here’s our current thinking. Tech spending is going to be soft broadly. Our current forecast remains at -4% to -5% for IT spending in 2020 relative to 2019. We think the softness is going to be especially notable for legacy on-premises infrastructure and we expect traditional enterprise businesses to deteriorate in the second half of 2020.

There will be bright spots in tech, particularly the ones we’ve reported on: Cloud. Automation, such as Automation Anywhere and UiPath. And other names we’ve highlighted, such as Snowflake, CrowdStrike, Okta and Zscaler, will continue to do well in a post-COVID environment. We also expect Microsoft to continue to show staying power, although because of its size, it’s exposed to pockets of soft demand.

For Dell, we think the data center business will continue to be tough despite some new product cycles in storage. But we think Dell will continue to benefit from the remote-worker pivot because we believe there was and still is some unmet demand in laptops that will show up in Dell’s income statements in the form of client revenue.

What do you think?

Tweet @dvellante, email david.vellante@siliconangle.com or comment on our LinkedIn posts. We post weekly on SiliconANGLE and Wikibon, so check out those properties. And go to ETR for all the survey action. These episodes are all available as podcasts wherever you listen.

Here’s the full video analysis:

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.