APPS

APPS

APPS

APPS

APPS

APPS

Apple Inc. set new records today as it posted third-quarter results that easily beat market estimates thanks to double-digit growth in both its products and its services.

The iPhone maker also said it’s going to give its investors three additional shares of the company per share already owned in a four-for-one stock split designed to make its stock accessible to more investors.

The company reported a profit of $2.58 a share on revenue of $59.7 billion, up 11% from a year ago. Wall Street had expected a profit of $2.04 per share on revenue of $52.25 billion.

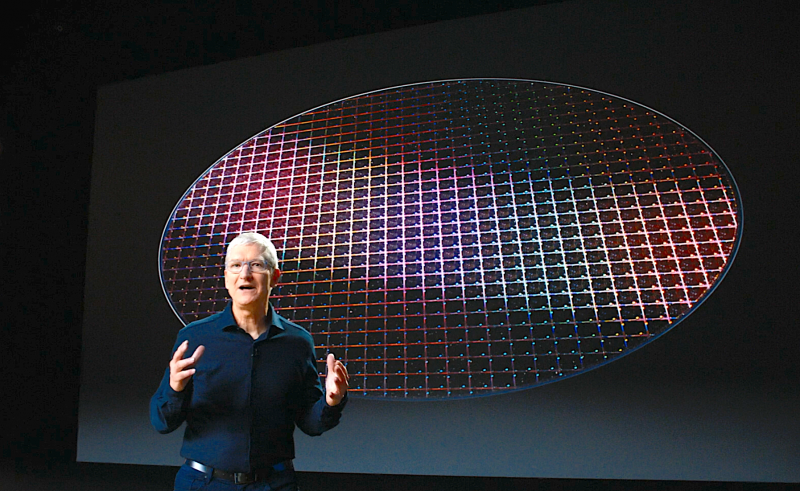

“In uncertain times, this performance is a testament to the important role our products play in our customers’ lives and to Apple’s relentless innovation,” Apple Chief Executive Tim Cook (pictured) said in a statement.

Apple’s stock rose almost 6% in after-hours trading.

Apple’s business is notoriously a seasonal one, and its third quarter is typically its quietest period of the year, coming just before its annual launch of new products. But the company managed to deliver record revenue for the period, with every major product line and its services business all seeing strong growth.

The company was also hamstrung by ongoing retail closures in the quarter due to the coronavirus pandemic, but said strong online sales helped to overcome them. It also cited work-from-home trends as another reason for the strong sales.

Apple said that iPhone sales pulled in $26.4 billion in revenue, up 2% from the same period one year ago. Cook said in a call with analysts that was thanks to better-than-expected demand in May and June, which resulted from the launch of its more affordable iPhone SE model and from continued economic stimulus from governments.

Elsewhere, Mac sales came in at $7.08 billion, up 22%, while iPad sales totaled $6.58 billion, up 31%. Cook said that both of these products saw growth in spite of supply chain constraints, something that underscores “how integral they have become to working and learning from home.”

“Apple had an outstanding quarter despite store closings in April and economic disruptions globally,” eMarketer principal analyst Yoram Wurmser told SiliconANGLE. “Some of the disruptions may have benefitted Mac and iPad sales, which were very strong and will likely remain strong as people continue to work and study at home in greater numbers. Even iPhone, however, did well based on strong SE sales. “

Apple’s Wearables, Home and Accessories business reported $6.45 billion in revenue, up 17% from a year ago. That business is now the size of a Fortune 140 company, Apple said.

Analyst Charles King of Pund-IT Inc. said Apple’s revenue growth was pretty balanced across the board, though it enjoyed some solid bumps in Mac and iPad sales. He added that the company’s sales in Europe and the U.S. were “particularly strong” but said the company may be a bit concerned by its performance in China, where sales were essentially flat in the period.

“There may be a political element to that given the continuing strained relations between the U.S. and China, but it’s difficult to say for sure,” King said.

Services was another bright spot for Apple, with revenue of $13.16 billion, up almost 15% from a year prior. Apple said this was due to strong double-digit sales for services such as its App Store, Apple Music and Apple Video, as well as sales from new offerings such as Apple TV Plus and Apple News Plus.

The numbers mean the company has achieved its internal goal of topping $50 billion in annual service revenues. “We are proud to announce that we have achieved our goal of doubling our fiscal 2016 services revenue six months ahead of schedule,” Cook said.

Apple declined to provide guidance for the next quarter, citing uncertainty amid the ongoing pandemic. However, Chief Financial Officer Luca Maestri did warn investors that iPhone supply could be delayed by “a few weeks” during fall. Apple normally launches new iPhones in September.

That’s actually good news, though, since reports earlier this month has suggested a much longer delay. “Despite reports of supply problems slowing the introduction of the next iPhone launch, it looks like delays will be limited to a few weeks rather than months as some had suspected,” eMarketer’s Wurmser said.

Apple’s board of directors declared a cash dividend of 82 cents per share of its common stock. It also approved a four-for-one stock split aimed at making the company’s stock more accessible to a wider base of investors. Each Apple shareholder at close of business on Aug. 24 will gain three additional shares for each one they hold, with trading beginning on a split-adjusted basis the following week.

“The stock split is somewhat odd to me since Apple shares trade at a fraction of what Alphabet, Amazon and others are selling for,” King said. “The move won’t make Apple’s stock more valuable or have any impact on the institutional investors that own 60%+ of the company’s shares.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.