INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Dell Technologies Inc. delivered a strong second quarter today, reporting financial results that topped expectations thanks to the growth of remote work and demand for educational devices.

The company, which sells personal computers and data center infrastructure, reported a profit before certain costs such as stock compensation of $1.92 per share on revenue of $22.7 billion, down 3% from a year ago.

Wall Street had expected Dell to report earnings of $1.40 per share on revenue of $22.52 billion. Dell’s stock rose 2% in after-hours trading.

Dell, which is led by founder and Chief Executive Michael Dell (pictured), said it saw strong demand for its products in both government and education. “In Q2, we saw strength in the government sector and in education, with orders up 16% and 24%, respectively, as parents, teachers and school districts prepare for a new frontier in virtual learning,” said Dell Chief Operating Officer Jeff Clarke.

Wikibon analyst Dave Vellante told SiliconANGLE there were no real surprises in the quarter, with the COVID-19 related challenges to Dell’s core infrastructure business being offset by cost controls. “It was good expense management on the SG&A and Opex lines that allowed Dell to beat earnings,” he said.

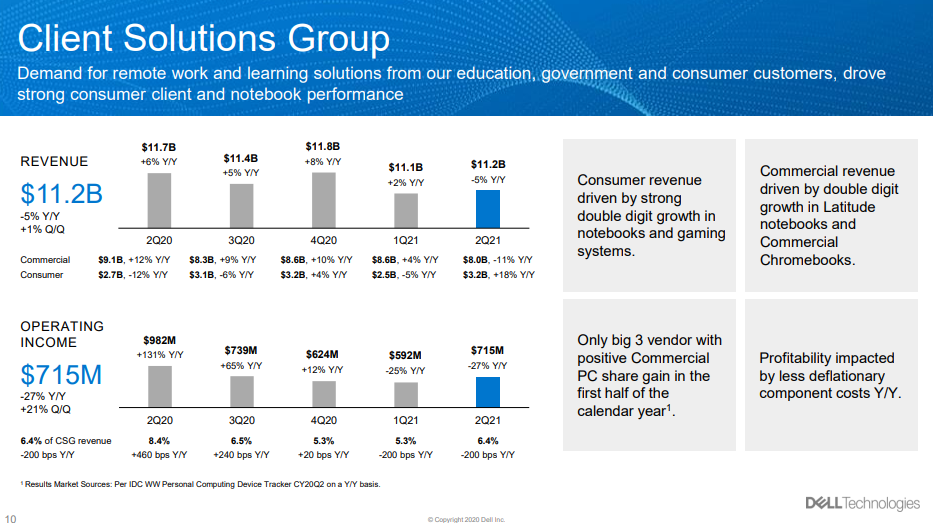

Dell’s Client Solutions Group reported revenue of $11.2 billion for the quarter, down 5% from a year ago. Operating income came to $715 million. Dell said that notebooks, consumer PCs and gaming systems all delivered double-digit revenue growth, with consumer revenue up 18% overall. Commercial revenue fell by 11%.

Dell wasn’t alone in that success, as its main rival in the PC arena, HP Inc., saw similar demand, beating third-quarter estimates today thanks to a big rise in notebook sales.

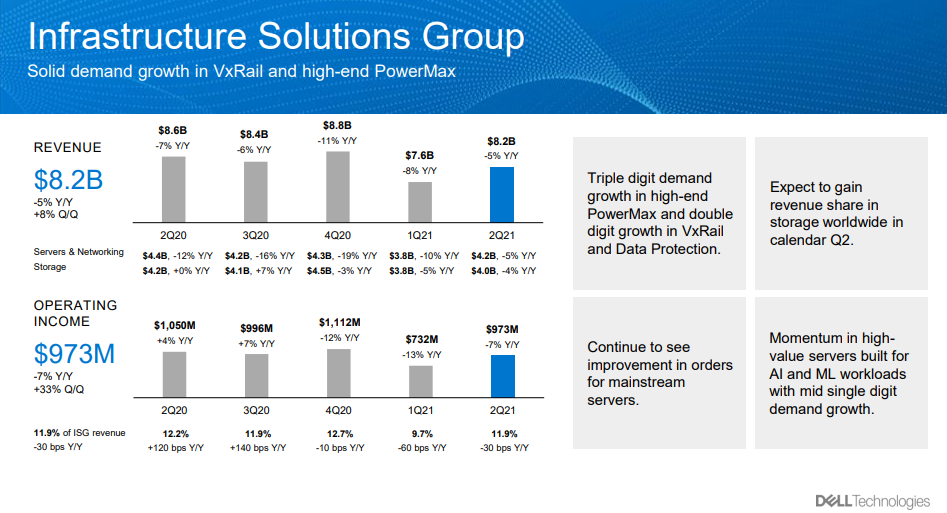

On the other hand, Dell’s Infrastructure Solutions Group struggled with soft demand. It reported second-quarter revenue of $8.2 billion, down 5% from a year ago, with operating income of $973 million. Officials said the star performers were its PowerMax servers, which saw triple-digit demand growth, plus its VxRail and Data Protection products, which saw double-digit growth.

VMware Inc. contributed $2.9 billion in revenue for the infrastructure business, topping expectations thanks to strong growth in software-as-a-service revenue.

“Like other companies focused on work-from-home solutions, Dell enjoyed a solid quarter and beat analysts’ expectations,” said Charles King of Pund-IT Inc. “The company was also helped along the way with a strong performance by VMware, underscoring the continuing value of Dell’s acquisition of EMC.”

Moor Insights & Strategy analyst Patrick Moorhead told SiliconANGLE he was impressed by the growth in PC sales, and said that Dell also managed to grow its private cloud revenue during the quarter, while maintaining its No. 1 position in areas such as external storage, storage software, all-flash arrays and server units.

“Overall, I believe Dell Technologies is executing well, maintaining or increasing share in current markets, participating in growth markets like cloud and security, and delivering solid profits to deliver to shareholders,” he said.

Constellation Research Inc. analyst Holger Mueller added that it was encouraging to see that Dell was paying down its substantial debts while managing to spare its research and development budget, which grew in the quarter. However, he said he was worried about Dell’s prospects of achieving longer-term growth at a time when its rivals in the public cloud infrastructure business are all growing in the 20%-plus range.

“It’s all about using both the technical and commercial elasticity of the cloud for enterprise IT loads, which cannot be achieved with traditional on-premises investments,” Mueller said. “Unfortunately for Dell, its stake in cloud growth with VMware is not large enough yet to compensate for the shrink across its server, data center and storage product lines.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.