INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

SoftBank Group Corp. is in exclusive talks with Nvidia Corp. to sell chip designer Arm Holdings Ltd. to the graphics chipmaker for more than $40 billion, according to a report this morning in the Wall Street Journal.

Citing people familiar with the talks, the Journal said the cash-and-stock deal could be sealed in the low $40 billions and could be announced early next week, but apparently it’s not yet a done deal. Talks reportedly have been ongoing for several weeks, though Bloomberg had reported in late July that SoftBank and Nvidia were already in preliminary talks about a deal.

If the deal happens, it could be one of the biggest of 2020 in any industry and might be the largest one ever in semiconductors.

Technology conglomerate SoftBank bought Arm only four years ago for $31.4 billion in the hope of Chief Executive Masayoshi Son that it represented a “paradigm shift” toward processors in “internet of things” devices. However, in July Arm said it would spin out two of its IoT businesses to SoftBank, though last month it called off that plan.

The sale of Arm would provide a boost for SoftBank, which has been struggling with investments turned bad, in particular the spectacular implosion of tech real estate firm WeWork. It has pledged to sell some $41 billion in assets, and although Arm might accomplish that in one fell swoop, some sales are already underway or done, including its holdings in Alibaba Group Holding Ltd. and T-Mobile USA Inc.

More recently SoftBank has been buying up options in publicly traded tech companies, moves that contributed to the huge run-up in tech stock prices this year.

Regulatory approval of Nvidia buying Arm might be an issue, since Arm creates and licenses the basic architecture used in most mobile processors used in Apple Inc.’s iPhones as well as hones made by Samsung Electronics Co. Ltd. and Huawei Electronics Co. Ltd. But if the deal happens and is approved by regulators, Nvidia would vastly expand its already fast-growing business in chips for gaming and artificial intelligence workloads in data centers.

Patrick Moorhead, president and principal analyst at Moor Insights & Strategy, has told SiliconANGLE that a deal, if signed, would likely pass muster. “Getting it approved would be challenging but not insurmountable,” he said. Despite the high price involved in a potential deal, he added that “financially they could absolutely pull it off.”

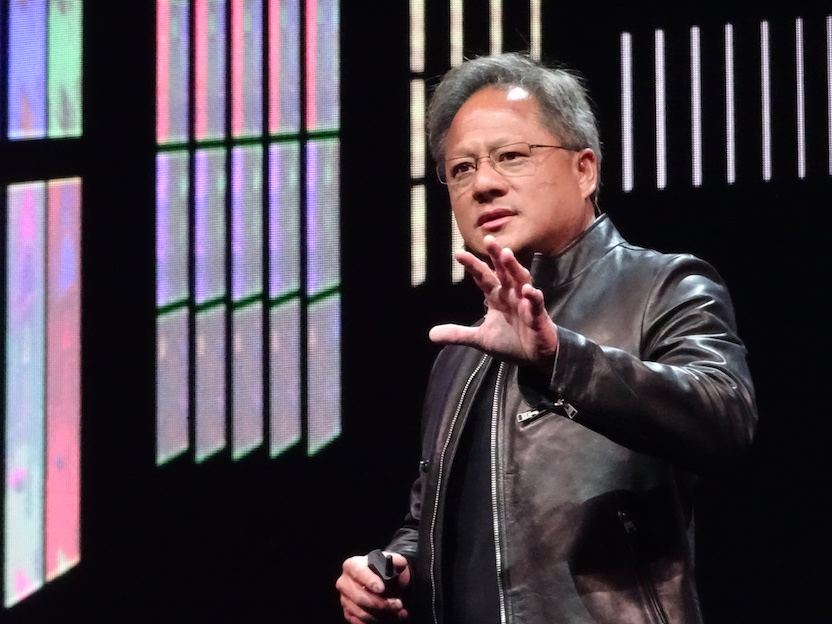

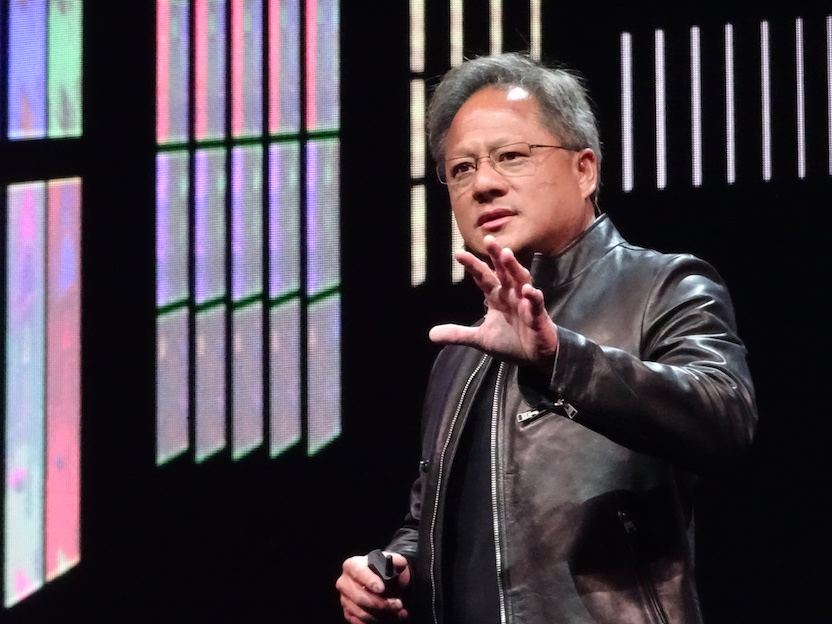

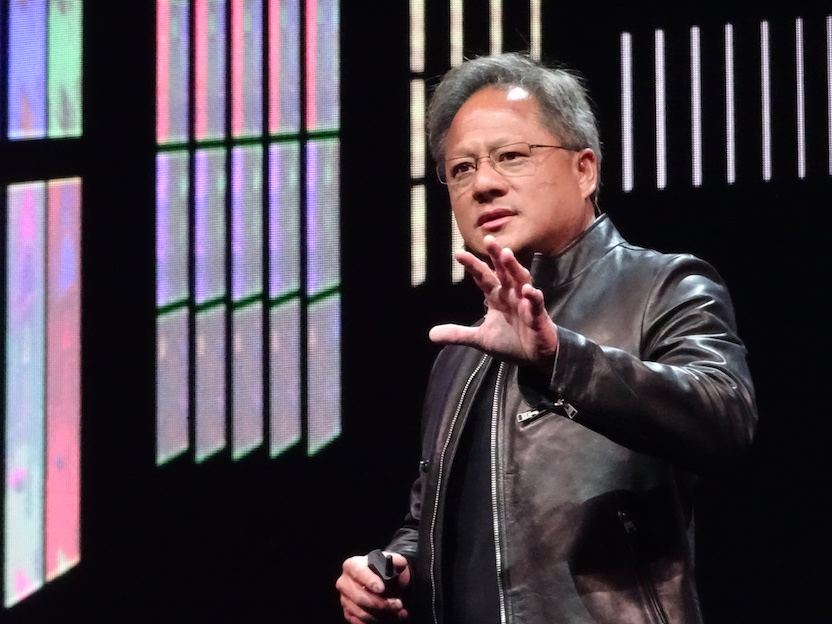

Nvidia’s stock has more than doubled so far this year thanks to strong growth in its data center chip business. Chief Executive Jensen Huang (pictured) noted after the company’s fiscal second-quarter earnings report last month that it and Arm have been long-term partners.

“They’re really great guys, and one of the special [things] about the Arm architecture that you know very well is that it’s incredibly energy-efficient, and because it’s energy-efficient, it has the headroom to scale into very high performance levels over time,” he said.

THANK YOU