CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

As we watch a historic election unfold before our eyes, we look back at the early days of this millennium and the memorable presidential race of 2000. That decade was defined by 9/11, which permanently reshaped our thinking. We exited the 2000s at the tail end of a massive financial crisis only to enter the 2010s with hope, and the momentum of fiscal stimulus, a flat globe, job growth and — very importantly — the ascendance of the cloud.

Cloud computing unquestionably powered the innovation engine over the last 10 years and the pandemic marks a new era in which the adoption of cloud, data and artificial intelligence have been accelerated by two to three years. These trends will shape the future of the technology industry and all businesses.

In this Breaking Analysis, we’ll update you on our latest cloud market share data and dig into some fresh October survey data from our partners at Enterprise Technology Research.

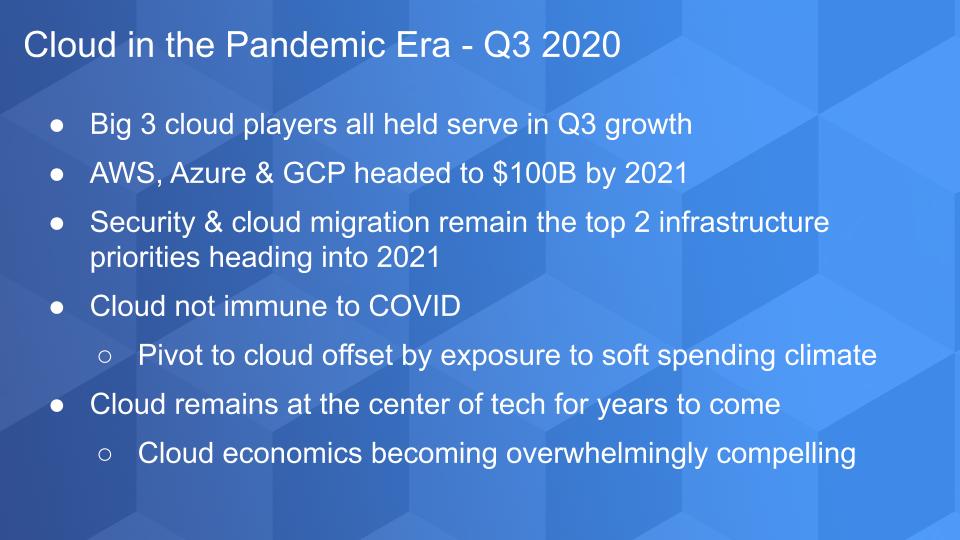

Interestingly, each of the big three cloud players showed nearly identical year-on-year growth rates in Q3 relative to Q2. We’ll dig into that more in a moment, but our data suggests that these three companies combined will account for more than $75 billion in infrastructure-as-a-service and platform-as-a-service revenue this year and are potentially on track to hit $100 billion in 2021.

Customer survey data indicates that chief information officers’ top two infrastructure priorities remain security and cloud migration.

That said, as we’ve previously reported, the cloud is not immune to the pandemic. The remote-worker pivot, while a positive, hasn’t completely eradicated certain headwinds. What we mean here is that because the cloud vendors are now so large, they are exposed to the softness in information technology spending and the industries hardest-hit by the pandemic.

Would the cloud growth be better if the pandemic didn’t hit? We’ll never know for sure but our data suggests: No. COVID has been a benefactor to cloud.

In our view cloud will remain at the center of technological innovation for the foreseeable future. The economics of cloud are becoming so compelling that we think the power of the big cloud companies will only increase this decade.

Importantly we’re talking about the costs of running hyperdistributed systems; we’re not commenting here on what cloud players charge customers. We believe the hyperscalers’ cost structure is superior to alternative approaches and we believe this advantage will continue to accelerate. We also believe competition will drive competitive pricing and innovation, although the prospects of a cloud oligopoly could eventually temper our conviction.

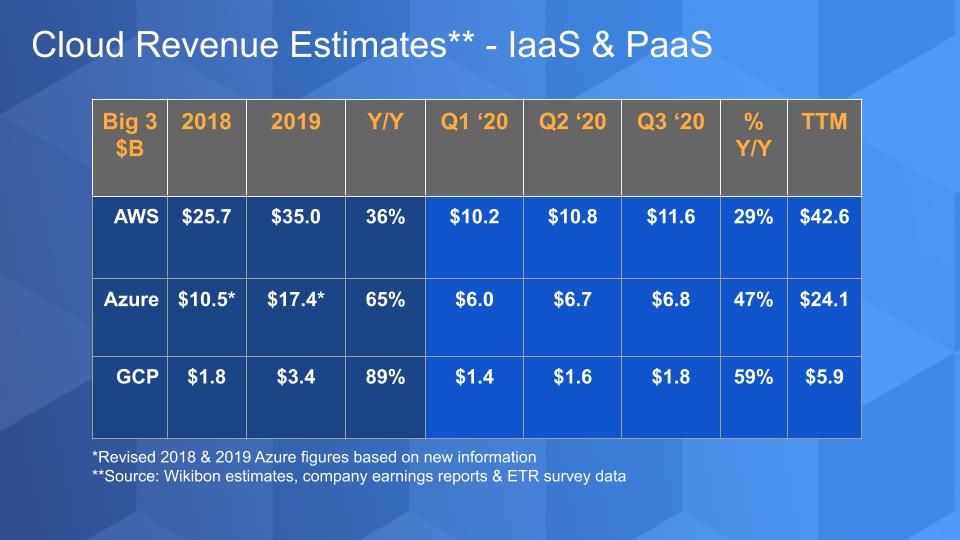

The chart below shows our estimates of Amazon Web Services, Microsoft Azure and Google Cloud Platform. Readers of Breaking Analysis know that AWS provides clean numbers and Azure and GCP are estimates that we derive based on tidbits of guidance from the companies, survey data from ETR and other information that we analyze from our community.

Note that we’ve slightly restated some of our earlier estimates for Azure to reconcile some differences that we had between constant currency and reported growth. We try to keep things in constant currency where possible.

According to our estimates Azure, as we reported last week, is now 18% of Microsoft’s overall revenue number; we estimated that at 19% last week but have toned it down a bit. AWS represents a much smaller percentage of Amazon’s revenue – 12% – but it represents 56% of Amazon’s profits. GCP, on the other hand, accounts for less than 5% of Google’s overall revenue, which as we stated recently needs more attention from Google.

But look at the growth rates for these three platforms and the respective size of their IaaS/PaaS businesses. You hear all this talk about cloud repatriation – that is, people move to the public cloud but are unhappy or it’s too expensive so they come back on-premises. But you just don’t see that in the numbers, so be careful when a vendor tries to sell you on that trend. I don’t buy it except for selective situations. By the way, hybrid cloud is not repatriation.

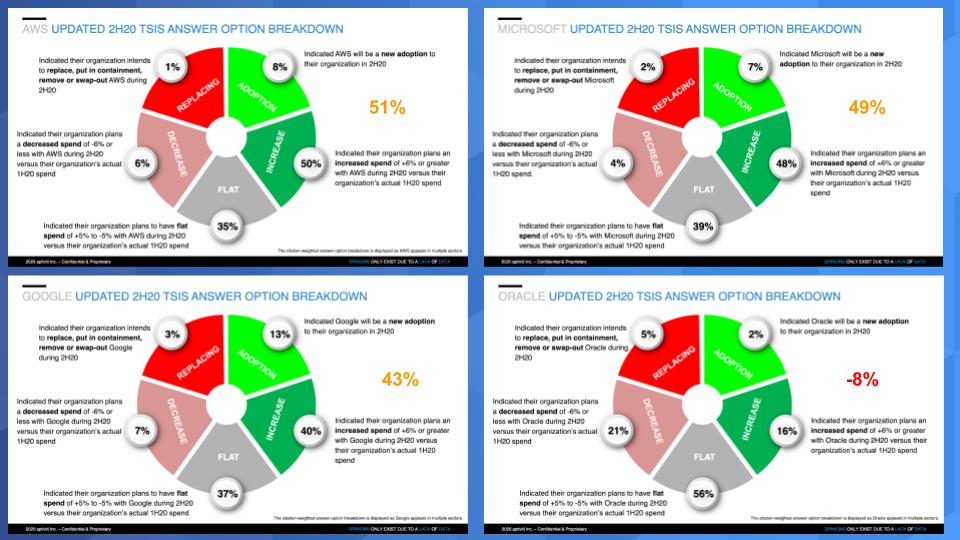

The “wheel graphs” below show the breakdown of Net Scores for AWS, Microsoft and Google. One note – these figures represent these three companies’ overall performance within the ETR technology taxonomy, meaning we’re evaluating responses across their entire portfolio. So for example they include all of AWS (they don’t include Amazon’s retail business) and they include Microsoft’s entire tech portfolio – not just cloud. For context we’ve also added Oracle to show what a mature company’s spending breakdown looks like.

The green portion of the wheel represents increases in spend, whereas the red sections show decreases. Net Score is shown in orange (red for Oracle) and is calculated by subtracting the two reds from the greens. In other words, Net Score = (Adoptions + Increase) Minus (Decrease + Replacements).

The takeaway here is these are all strong, with AWS leading the pack. Microsoft is exceptionally strong in our view because the company is so huge and it still has a Net Score comparable to AWS, which has a more focused business.

Google is a laggard and is showing softness in the data – despite our sanguine outlook back in 2019. Perhaps Google’s smaller presence muted its customers’ ability to take advantage of the platform when the pandemic hit. The thinking here is that customers needed to pivot to the cloud very quickly and AWS and Azure were the most expedient path – hence the higher increases in the “Spend More” category — whereas GCP required new connection points and processes. But still, Google showed 13% new adoptions, which is good and perhaps expected given its smaller size.

These are not pure-play cloud comparisons, but they give a good indication of spending momentum. We would also note that all three show very low defections while each has solid increases in new adoptions.

Serverless is a strange term and not really accurate, but it has stuck. Serverless computing is a model where the cloud platform dynamically delivers services as the application requires. There’s no need to deploy and configure compute and containers, for example, rather when an application needs resources – it goes and gets them and you only pay for the services that are in use. Serverless is very good for workloads that spin up and spin down frequently.

It’s an increasingly popular model and there’s a lot of spending momentum in this area. But before we look at that, we want to share some comments made by AWS Chief Executive Andy Jassy awhile back about serverless. Jassy essentially commented to us on theCUBE that if Amazon’s retail business had serverless available at the time it was building out, it would have build its platform on Lambda, AWS’ serverless offering. Here’s what he said:

If you think about Amazon’s retail business and take, for example, the frequent spin-up and spin-down of resources for something like Black Monday, serverless would be a much more cost effective approach. Same for a managed data warehouse service where you don’t want to pay for the compute if it’s idle. The app just calls for compute when it’s needed.

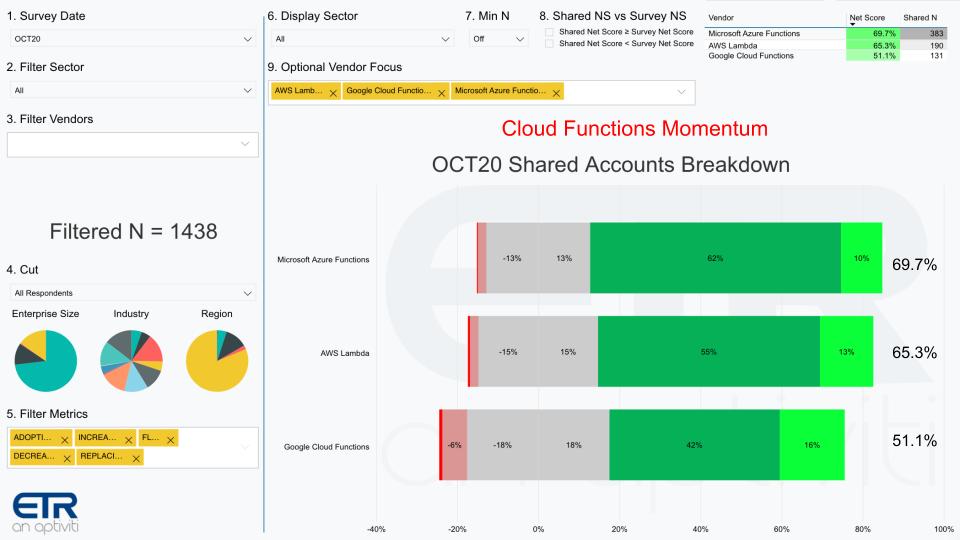

Serverless is becoming a very popular computing model today with increasing momentum, as you can see in the slide below.

It shows the Net Scores for serverless for Azure, AWS Lambda and Google Cloud Functions. Look at the Net Scores – Azure Functions, nearly 70%, with AWS at 65%. Google again is lagging at 51% and it’s a bit of a concern because this is a really hot space.

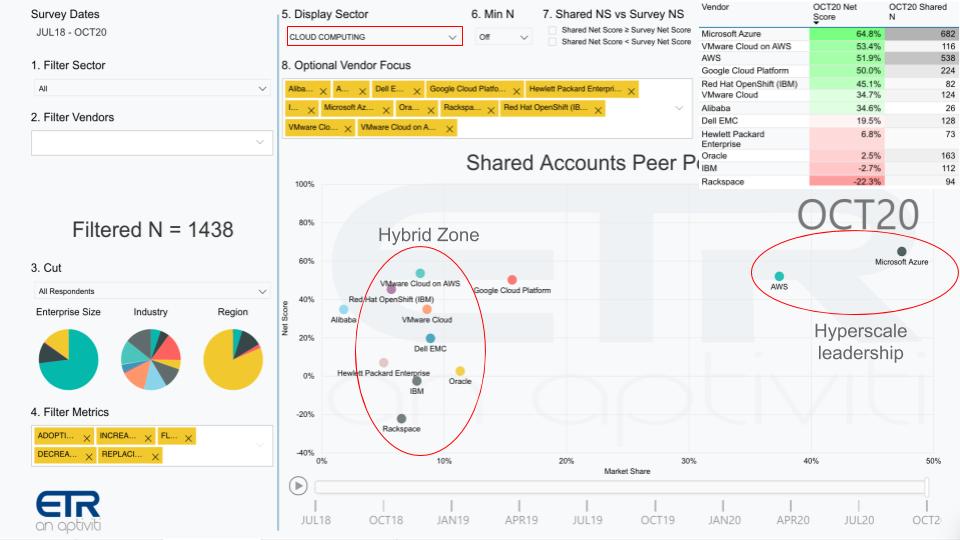

This XY graph below shows Net Score or spending momentum on the vertical axis and Market Share on the horizontal axis. Market Share is a measure of pervasiveness in the ETR data set. In the upper right you see the table that ranks each vendor by Net Score and shows the number of shared accounts for this cut out of the total 1,438 respondents.

You can see up top in the middle we’ve selected on the cloud computing category – this represents only the cloud businesses for each of these players. There is a bit of nuance here in that we’ve pulled Microsoft Azure specifically from the data and we’re comparing that with AWS overall. So there are things in AWS overall that fit into other parts of the ETR taxonomy, such as AI and collaboration, whereas Azure and GCP represent just their IaaS businesses. We know it’s a bit strange because AWS is all cloud, but don’t get caught up in the taxonomical nuance. The point is, it’s good to be Azure and AWS. They stand alone in cloud leadership.

Google Cloud has elevated Net Score levels but just doesn’t have the presence in the market. Now look at that hybrid cloud zone emerging. We’ve shared this previously, but we want to call out VMware Cloud on AWS, Red Hat OpenShift and VMware Cloud (Cloud Foundation and the like). All of these appear to be gaining traction and you can see the number of occurrences in the upper right in the table. We’re starting to see real numbers that are meaningful. VMware Cloud on AWS, for example, has a Net Score of 53% with 116 accounts within the total respondent sample. OpenShift has 45% Net Score with 82 accounts, and Red Hat is in beta with what look to be some really strong offerings on AWS.

For context we’ve added Dell Technologies Inc.’s cloud offerings, with Hewlett Packard Enterprise Co., Oracle Corp., IBM Corp. and Rackspace Inc. Dell actually looks pretty strong with a Net Score of 20% and 185 shared accounts. Oracle, IBM and Rackspace are not killing it in the survey by any means, so we’d like to see the data match the marketing rhetoric from these companies.

And Alibaba is starting to show in the data – only 26 shared Ns but we thought we’d throw it in.

Three key points here: 1) AWS and Microsoft keep on trucking and Google needs to do better; 2) Hybrid cloud is becoming real and eventually that bodes well for multicloud; 3) legacy on-prem players have some work to do – it’s still a case where their on-prem decline isn’t being offset by large enough cloud momentum.

There’s a lot of talk again in our community about AWS’ slowing growth rates and whether it will have to enter the software-as-a-service market directly to expand its total addressable market. We’ve said consistently that although we never say never about AWS, we don’t think so – at least not yet.

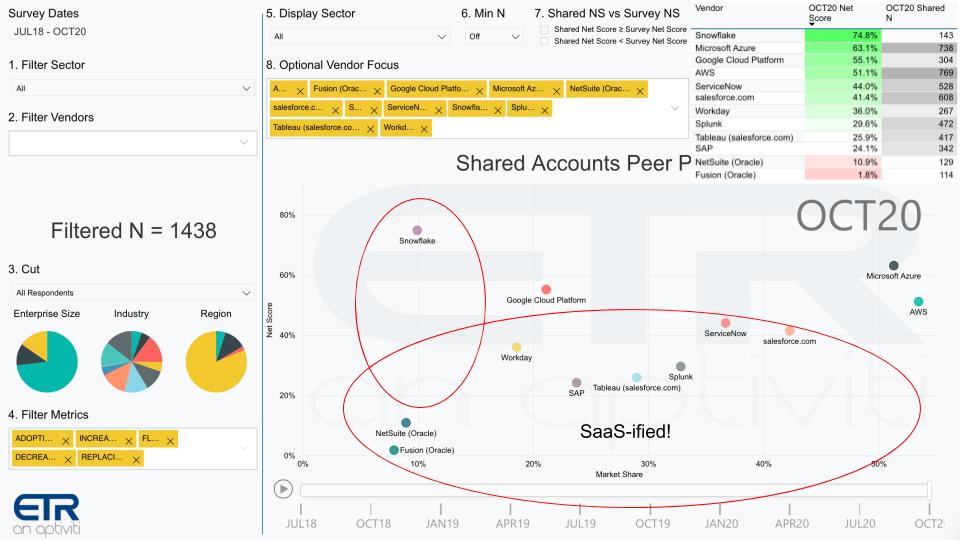

The chart above plots the big three cloud players along with some prominent SaaS platforms and independent software vendors. Note that AWS has a bigger piece of this pie now that we’ve turned off the Cloud Computing (that is, IaaS-only) filter. In other words, this cut represents all of AWS’ portfolio and only Microsoft Azure, so AWS overtakes Azure on the X-Axis (Market Share).

Now we’ve plotted some of the major SaaS vendors. And you can see ServiceNow Inc. and Salesforce.com Inc. are both large and have strong spending momentum. Workday Inc. is somewhat less of a presence buthas solid Net Scores. SAP SE, despite some earnings challenges, actually is pretty impressive, right up there with Splunk Inc. and Tableau, though Splunk has softened in recent surveys. And we’ve plotted NetSuite and Oracle Fusion, which are not looking too impressive compared with the momentum of the others.

Back to the original question. We think for now anyway, AWS will position itself as the best, most friendly and highest-quality cloud on which to run your SaaS. Workday runs on AWS and AWS is Salesforce’s preferred infrastructure platform. Infor’s SaaS also runs on AWS.

So our premise here is that just as retail companies may not want to run on AWS, many SaaS companies that compete with Microsoft might think twice about running on Azure So AWS would be better off (for now) attracting SaaS players and sticking to infrastructure.

Snowflake Inc. is interesting. For context we’ve included it because its Net Score is off the charts and it’s an ISV running on the cloud. But it is different from the other SaaS players in that Snowflake is a database. Most of Snowflake’s business runs on AWS. AWS competes with Snowflake with RedShift, but AWS has the best cloud and drives lots of business for Snowflake. And the reverse is true. It’s a mini-version perhaps of Netflix and Amazon Prime Video.

So we think that AWS will continue to grow by attracting SaaS players as the preferred platform. And it will attract developers to try to disrupt SaaS players such as ServiceNow, which runs on its own cloud. Years ago, when we first saw ServiceNow, we were impressed but we noted that by running its own cloud, at some point its infrastructure cost structure is going to be less competitive. ServiceNow has this multi-instance architecture, which it can’t just port over to the cloud very easily. But it can charge a lot and it does.

At some point, we think some sharp developers are going to look at ServiceNow and other SaaS players and say, “I can build this for less.” And they’ll attack the seat-based license models of the big SaaS players with a consumption pricing model that is more attractive and less expensive.

Still, there are those who firmly believe that AWS will and must enter the SaaS space. And we talked last week about how beneficial Microsoft’s application business is for Azure. But we think not yet if ever. Give it some time – maybe four to five years before AWS may start to look at filling some spaces in SaaS.

The bottom line: It’s good to be in tech these days, it’s even better to be in cloud and it’s the best if you’re AWS and Microsoft — and we don’t see that changing for a while.

Remember these episodes are all available as podcasts – please subscribe. We publish weekly on Wikibon.com and SiliconANGLE so check that out and please do comment on the LinkedIn posts we publish. Don’t forget to check out ETR for all the survey action. Get in touch on twitter @dvellante or email david.vellante@siliconangle.com. Breaking Analysis posts, videos and podcasts are also all available at the top link on the Wikibon.com home page.

Here’s the full video analysis:

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.