INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Dell Technologies Inc. delivered another solid quarter today, crushing Wall Street’s estimates thanks to strong demand for personal computers as people continue to work and learn from home.

The company, led by its founder, Chairman and Chief Executive Michael Dell (pictured), reported a third-quarter profit before certain costs such as stock compensation of $2.03 per share. Its revenue rose 3% from a year ago, to $23.5 billion.

That blew past analysts’ best estimates. Wall Street had expected Dell to report earnings of just $1.40 per share on revenue of $21.85 billion.

Dell Vice Chairman and Chief Operating Officer Jeff Clarke said the company’s success was thanks to “unprecedented demand” for systems that can aid remote work and learning. “At the same time, we accelerated our as-a-service strategy and hybrid cloud capabilities at the edge – positioning us to win in these growing markets and making it easy for customers to manage data and workloads across all their operations,” Clarke added.

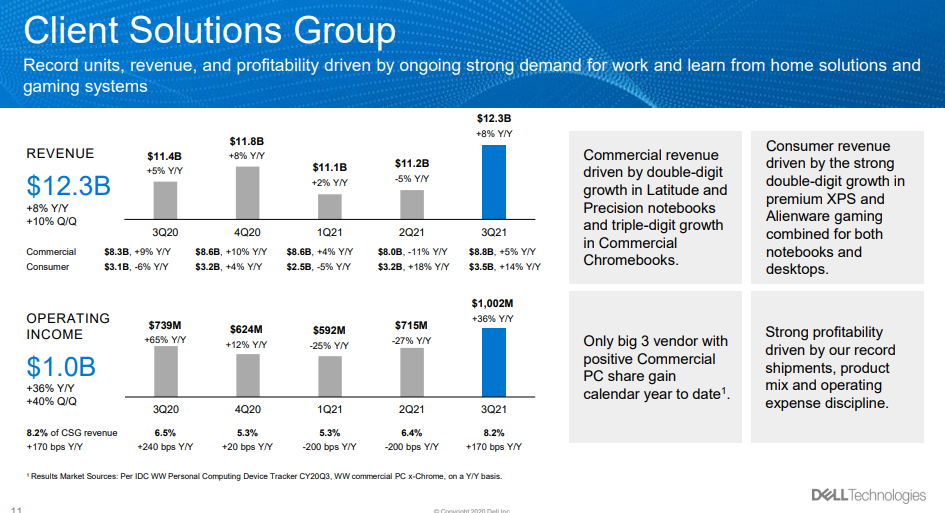

The COVID-19 pandemic has been a godsend to Dell’s Client Solutions Group, which includes its PC sales. The unit reported sales of $12.3 billion, with consumer revenue growing by 14% and commercial rising by 5%.

The company said its commercial Chromebooks in particular were very popular, with triple-digit revenue growth, while its Latitude and Precision notebooks both saw revenue grow by double digits. Altogether, the PC unit delivered more than $1 billion in operating income, Dell said.

“The PC business has been a continued gift to the company’s income statement,” said Dave Vellante, chief analyst at SiliconANGLE sister market research firm Wikibon.

Dell wasn’t alone in benefiting from higher PC sales as its main rival in that market, HP Inc., also reported strong third-quarter results. In HP’s case, it reported a profit of 62 cents per share on revenue of $15.26 billion, versus Wall Street’s forecast of 52 cents per share in earnings and $14.71 billion in revenue.

But Dell is far from being just a PC company, with a good portion of its revenue coming from data center infrastructure sales to large enterprises and mid-sized businesses. And while many of those customers have been cutting back on hardware spending due to the uncertainty caused by the pandemic, Dell said that some have had to step up their investments to ensure business continuity as their employees work remotely.

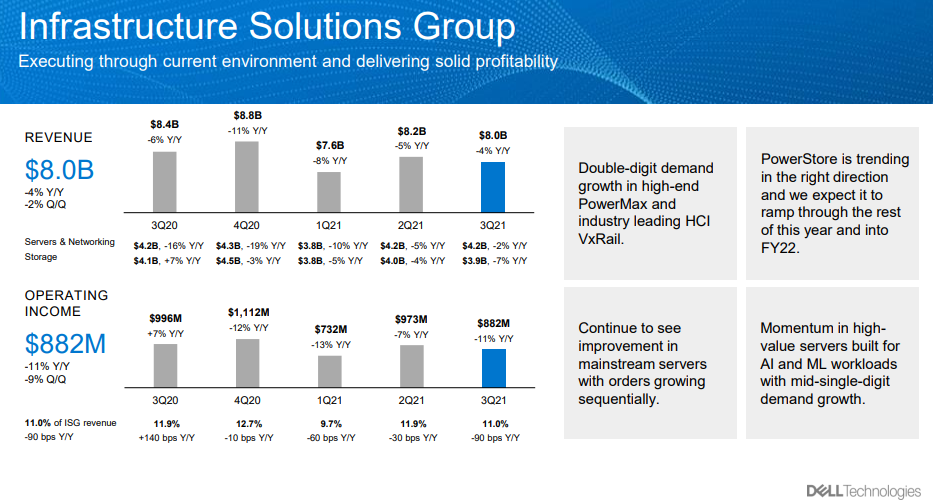

So the Infrastructure Group didn’t do too badly, with revenue of $8 billion for the quarter, down 4% from a year ago. Dell said storage sales made up $3.9 billion of that total, while servers and networking revenue came to $4.2 billion. PowerMax servers and VxRail systems both saw double-digit growth for the third straight quarter.

Analyst Charles King of Pund-IT Inc. told SiliconANGLE that one of the reasons that Dell has been so successful in aiding remote work is that it has one of the most flexible policies in that regard to its own employees who are working at home.

“That’s put it in a great position to provide knowledgeable counsel to businesses struggling to adapt to the ravages of COVID-19,” King said. “Additionally, Dell has proactively launched new services, like Project APEX, consumption models and payment plans designed to help ensure that customers have the technologies they need to survive on terms they can live with.”

Vellante said Dell’s performance was all the more remarkable considering the situation with the COVID-19 pandemic. He said that back in April he’d thought the company was more likely to contract than show sustained revenue, given its exposure to on-premises hardware installations. But that hasn’t been the case at all.

“Despite softness in storage, the company blew away consensus expectations,” Vellante said.

Dell was given a big boost by its subsidiary VMware Inc., which contributed $2.9 billion in revenue as more enterprises embrace the hybrid cloud operating model.

“Hybrid cloud seems to be coming into its own,” Vellante said. “Our data confirms what Dell indicated as a strong uptake for VMware Cloud on AWS and we also see VMware’s and Dell’s on-prem cloud solutions as performing well.”

Not everyone was quite so impressed by Dell’s performance, though. Constellation Research Inc. analyst Holger Mueller noted that the company is still trailing nine-month 2019 revenues by more than $1.5 billion, and the PC boom and VMware have been unable to make up for its inability to grow its infrastructure business.

“A stellar fourt-quarter performance may push Dell overall into growth territory, but the improvements right now are mainly on the cost side, with selling, general and administrative costs down by 8%,” Mueller said. “The challenge for Dell is that it’s still not participating in the cloud with its infrastructure group. Its transition to a service portfolio may aid that, but long-term, Dell must find a ticket to participate in the growth seen at AWS, Microsoft, Google and other cloud infrastructure players.”

That said, Vellante insisted that Dell looks to be in a good position to achieve long-term sustainability, even though its storage business remains stuck in a challenging environment.

“We continue to wait and watch what the outcome of the VMware spinoff will be, as the company is keeping its plans close to the vest,” Vellante said.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.