BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

Cryptocurrency exchange Coinbase Global Inc. today announced that it plans to go public via a direct listing some six weeks after disclosing that it has filed its initial public offering paperwork with the U.S. Securities and Exchange Commission.

Direct listings have the advantage of allowing companies to go public by simply listing existing shares for sale on an exchange without the additional costs involved in a traditional IPO. Direct listings have slowly grown in popularity due to the cost savings they provide. Notable companies that have pursued a direct listing include Spotify Technology SA, Slack Technologies Inc., Palantir Technologies Inc. and Asana Inc.

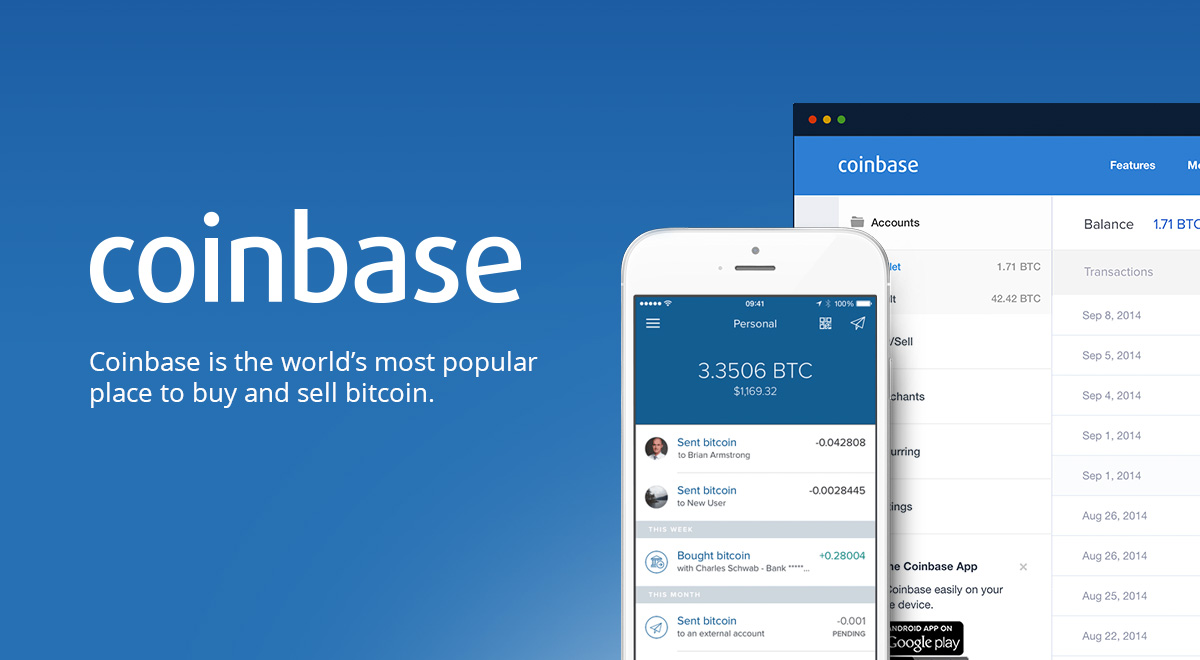

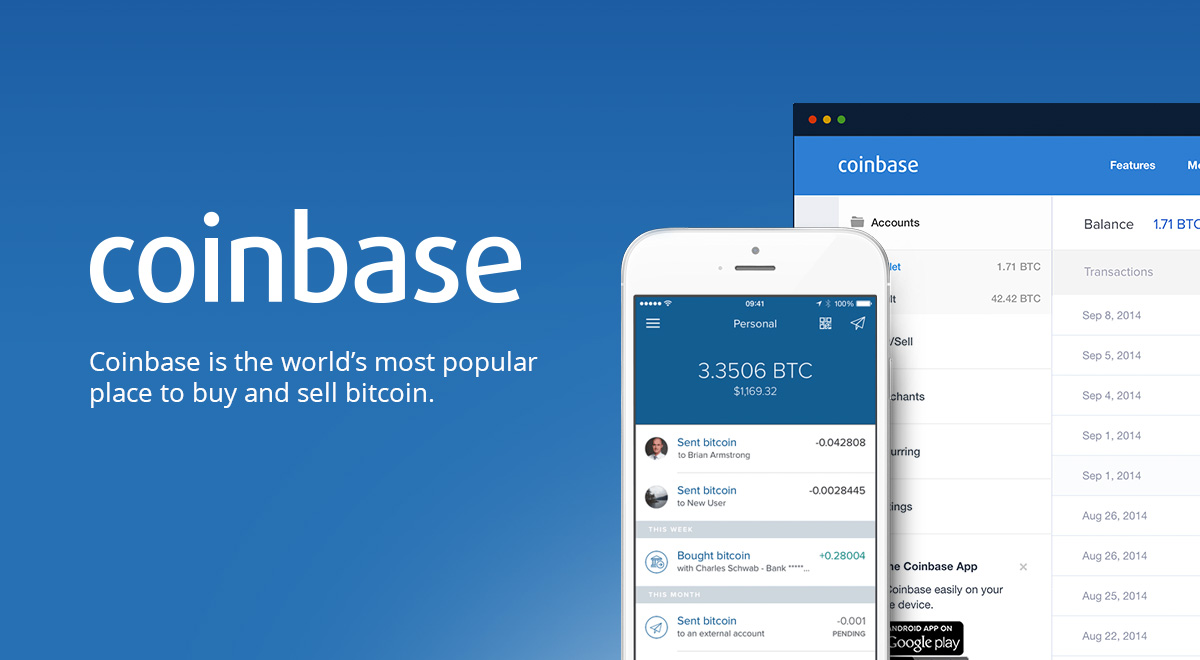

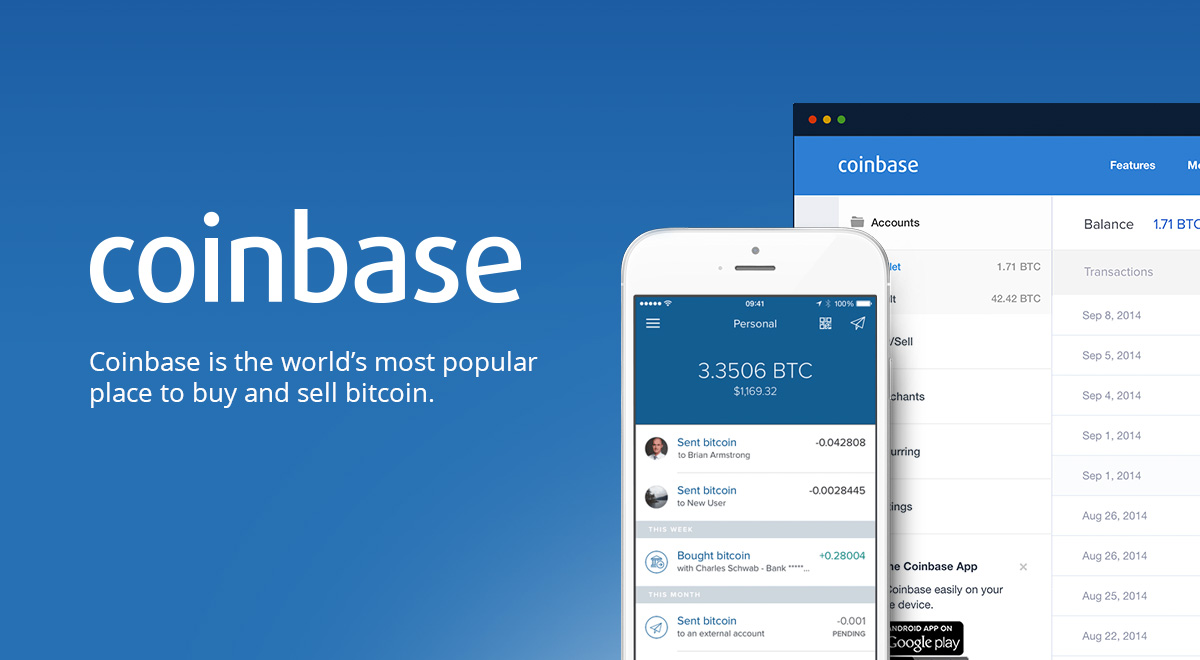

Founded in 2012, Coinbase has grown to become the largest U.S. registered cryptocurrency exchange, although it offers more services than simple cryptocurrency buying, selling and wallet functions. It has an application programming interface for developers and merchants to build applications and accept payments, cryptocurrency custody services for institutional investors, a venture capital arm and an educational service where users can earn small amounts of cryptocurrency. In August it launched a new service that allows investors to borrow money against their cryptocurrency holdings.

Exactly how much Coinbase could be valued in its IPO is unknown. As of its last venture capital round in 2018, Coinbase was valued at $8 billion but is significantly bigger in 2021. The company has been voracious in acquiring smaller startups, including blockchain tracking startup Neutrino srl in February 2019, bitcoin custody provider Xapo Inc. in August 2019, the Peter Thiel-backed cryptocurrency brokerage startup Tagomi Systems Inc. in May and most recently trade execution startup Routefire Inc. Jan. 8.

Coinbase’s IPO is still subject to approval by the SEC, however, and it’s not guaranteed that it will gain approval given the commission’s previous caution when it comes to anything cryptocurrency-related. Should it gain approval, Coinbase will be the first U.S. cryptocurrency exchange to list on the stock market.

Coming into its IPO, Coinbase has raised $547.3 million in venture capital, according to Crunchbase. Investors include Tiger Global Management, Y Combinator Continuity, Wellington Management, Andreessen Horowitz, PolychainSection 32, Balyasny Asset Management, Draper Associates, Battery Ventures, Greylock Partners, Tusk Ventures, Spark Capital, Bank Of Tokyo, USAA, DFJ, BlockChain Capital and the New York Stock Exchange.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.