BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

Updated:

Reflecting intensifying interest in cryptocurrencies such as bitcoin, crypto exchange provider Coinbase Global Inc. today saw its shares soar in their market debut.

Coinbase shares began trading at $381 a share, more than 50% higher than the $250 reference price set Tuesday and valuing the company at about $100 billion. Shares rose even further, to nearly $425 a share, but then settled back to close at $328.28, down 14% from the initial trading price, but still up 31% from the reference price.

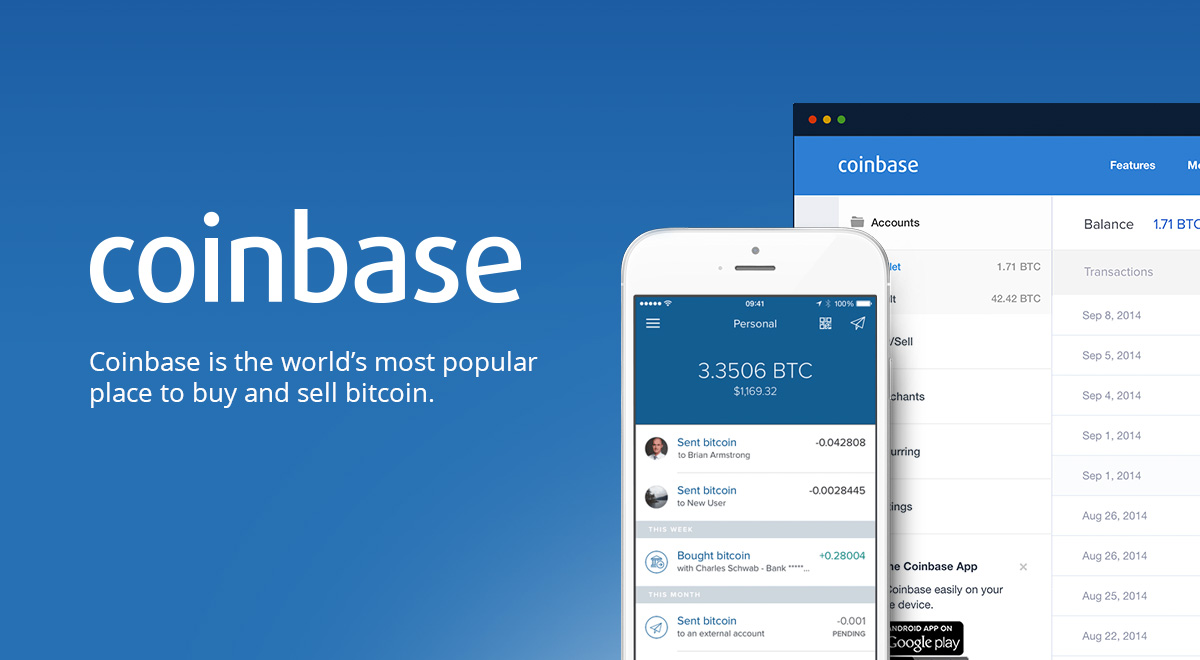

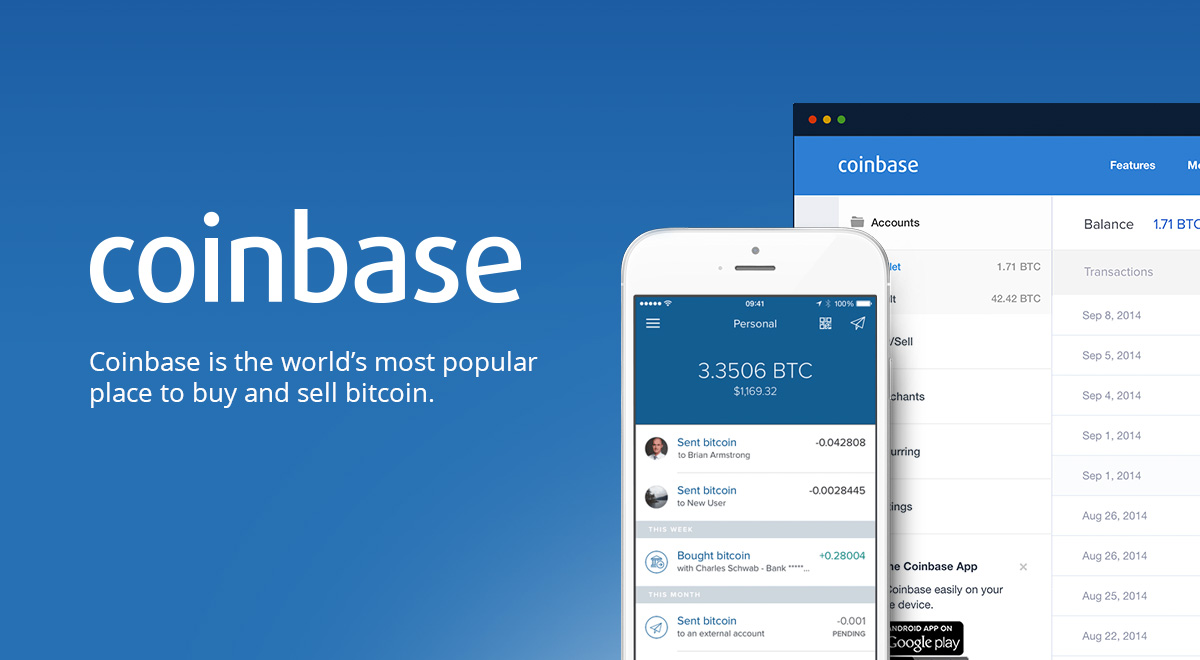

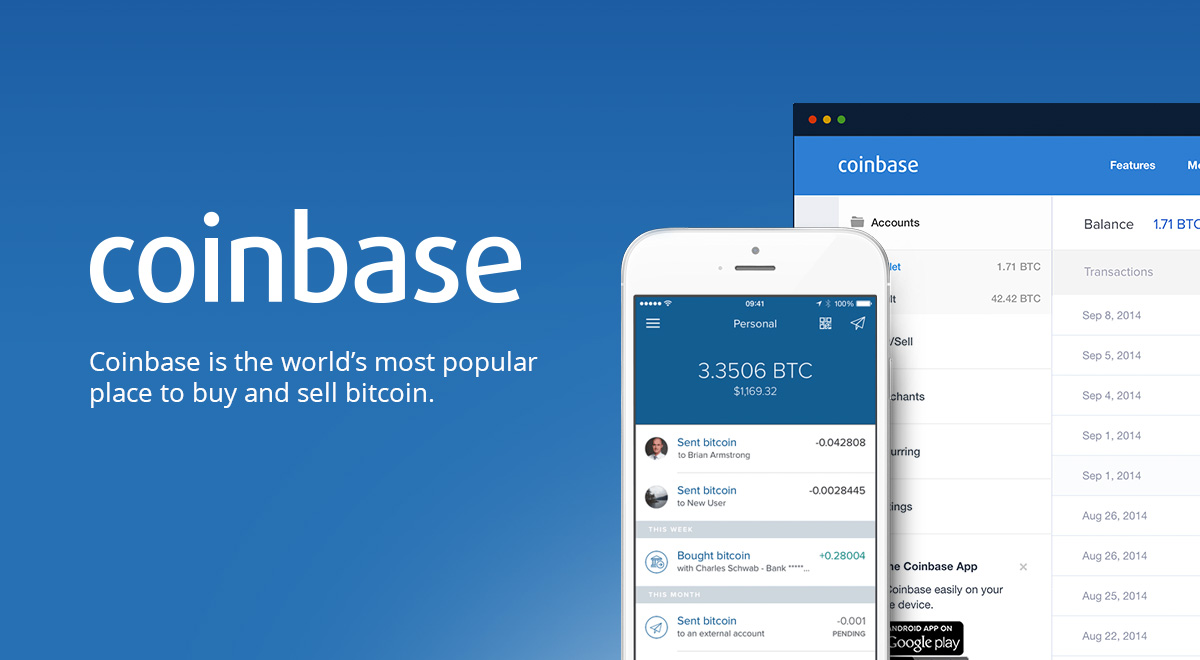

Coinbase announced its decision to go public via a direct listing in January before announcing the planned date earlier this month. Founded in 2012, the company has grown to become the largest U.S. registered cryptocurrency exchange, although it offers more services than simple cryptocurrency buying, selling and wallet functions.

The company has an application programming interface for developers and merchants to build applications and accept payments, cryptocurrency custody services for institutional investors, a venture capital arm and an educational service where users can earn small amounts of cryptocurrency. In August it launched a new service that allows investors to borrow money against their cryptocurrency holdings.

On April 6, Coinbase released its quarterly financial data and, as noted at the time, the numbers were impressive. For the quarter ended Dec. 31, Coinbase reported trading volume of $335 billion, with the platform holding $223 billion in assets, representing 11.3% share of the cryptocurrency market as of the end of the year.

Net income in the quarter came in at a range of $730 million to $800 million on revenue of $1.8 billion. Adjusted for interest, taxes, depreciation and amortization, Coinbase booked a $1.1 billion profit, up from $190.6 million in the same quarter in the previous year.

Although it’s not the first cryptocurrency business to go public globally, Coinbase is the first to do so in the U.S. As CNBC noted, if it reaches a $100 billion market cap it will instantly become one of the country’s 85 most valuable companies.

The choice by Coinbase to pursue a direct listing comes amid a near mania of tech companies pursuing going public using special-purpose acquisition companies. Companies that have pursued a direct listing include Spotify Technology SA, Slack Technologies Inc., Palantir Technologies Inc. and Asana Inc.

Coming into its direct listing, Coinbase has raised $547.3 million in venture capital, according to Crunchbase. Investors include Tiger Global Management, Y Combinator Continuity, Wellington Management, Andreessen Horowitz, PolychainSection 32, Balyasny Asset Management, Draper Associates, Battery Ventures, Greylock Partners, Tusk Ventures, Spark Capital, Bank Of Tokyo, USAA, DFJ, BlockChain Capital and the New York Stock Exchange.

With reporting from Robert Hof

THANK YOU