INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Mobile World Congress is on for 2021, and theCUBE will be there in Barcelona to let you know if it’s alive and well. So as we approach a delayed MWC, it’s appropriate to reflect on the state of the telecommunications industry.

Let’s face it: The telcos have done a great job of keeping us all connected during the pandemic, supporting the work-from-home pivot, accommodating the rapid shift to landline traffic, securing the network and keeping it up and running.

But it doesn’t change the underlying dilemma telcos face. Telecoms is a slow-growth or no-growth industry, with revenue expectations in the low single digits. At the same time, network traffic continues to grow at 20% annually and last year grew at 40% to 50%. Meanwhile, over-the-top or OTT media services and cloud vendors continue to leverage telco infrastructure to support their rapid growth and skyrocketing valuations.

Despite these challenges, telcos are investing heavily in the future. For example, the telco industry collectively is shelling out more than a trillion dollars in the first half of this decade on 5G and fiber infrastructure. It’s estimated that there are now more than 200 5G networks worldwide.

But many questions remain, not the least of which is whether telcos can and should go beyond connectivity. Can the telcos actually monetize 5G or whatever’s next – or is that going to be left to the ecosystem? And what about the ecosystem – how is that evolving and very importantly, what role will the cloud hyperscalers play in telco? Are they infrastructure on which the telcos can build or are they going to suck value out of the market as they have done in the enterprise 0n-premises market?

In this Breaking Analysis, we welcome Chris Lewis, a longtime telecoms industry analyst and the founding director of Lewis Insight. We’re going to cover a lot of ground in this post:

First we’re going to talk about Mobile World Congress and what to expect. We’ll review the current state of telecommunications infrastructure and where it should go. And then we’ll dig into telco transformation. Is it a mandate? Is it aspirational? Can telco’s successfully enter adjacent markets in ways they haven’t been able to in the past? How will the ecosystem evolve as telcos transform? Very importantly, we’re going to talk about cloud and the role of the hyperscalers in telco. And then we’ll riff a bit on the technologies and the competitive landscape.

According to Lewis, Mobile World Congress is like the Super Bowl of telecommunications events. The press and analyst corps stress themselves building a matrix of meetings in 30-minute time slots and then return at the end of it trying to remember what they’ve all been told that week.

“The great thing is that with the last time we had a live event, with around 110,000 people there, you could see anyone and everyone you needed to within the industry and its adjacent ecosystem,” Lewis said. “So, you got that once-a-year, big download of everything new, obviously because it’s the Mobile World Congress, a lot of it around devices. But increasingly over the last few years, we saw many, many stands with cars on them because the connected car became an issue, a lot more software-oriented players there — but always the telcos, always the people providing the network infrastructure.”

Lewis also indicated that in the past few years, software and information technology infrastructure were more prominent at the event. These themes were more geared toward what the network should be in the future. But the reach of the network has been growing.

During the lockdown it was all about connecting people in their homes and we’ve also been extending that connection to different devices, monitoring of doorbells, lights and other home equipment. In the industry environment the new focus has been on things such as connecting robots and sensors. So, actually the perimeter of the industry has been expanding quite dramatically.

The bottom line is, despite low growth, the telco industry represents and enormous market – roughly $1.5 trillion globally – and a diverse and expanding ecosystem.

Watch Chris Lewis break down Mobile World Congress.

Telco infrastructure is fit for purpose. The telcos’ strength is a network that is reliable and the way they got there is to harden their systems. From an IT industry perspective, this is territory that is ripe for disruption. The infrastructure in telco is fossilized, and inflexible. And there’s lots of discussion about opening up the walled gardens of the networks with open systems, such as open source, open radio access network or O-RAN, open application programming interfaces and the like.

But the question remains, as you make the network more open and start deploying microservices and containers, can you replicate the reliability and security of today’s networks? The bottom line is that the industry must and the cloud will have its role in that transformation – more on that later.

“There’s always a bit of an identity crisis when it comes to telco,” Lewis said. “I think going forward, the connectivity piece is seen as table stakes, and then people thought, ‘Where can we go beyond connectivity?’ But actually to the connectivity under the scenario we just discussed above, of connecting people, buildings, things and society – there’s much more work to be done to make that connectivity extend and to be more reliable and secure.

“So, the state of the network is that we have been building out infrastructure, which includes fiber to connect households and businesses. It includes that next move to cellular from 4G to 5G. It obviously includes Wi-Fi, wherever we’ve got that as well. And actually it’s been a pretty good state — as you said in your opening comments, they’ve done a pretty good job keeping us all connected during the pandemic, whether we’re a fixed-centric market like the U.K. and U.S. with a lot of mobile on top, or the other end of the spectrum like many markets in Africa and Asia, where we’re very mobile-centric at the core.”

The diversity of markets on a country-by-country basis adds to the complexity of the telco industry. As such, many top-level assumptions don’t apply broadly. However, it seems apparent to us that the telcos’ focus should remain building out the network and associated services, focusing on that connectivity and making sure cost of delivery is in line. Competition is pushing us toward having these capabilities yet keeping fees stable as consumers don’t want to pay a lot extra every time a new generation of technology is introduced.

But the big issue, according to Lewis, is how to fuse IT and the network parts of this story to make sure that efficiency is built in. In many ways, this is where the cloud becomes critical to the future of telco.

We asked Lewis to elaborate on this crucial issue – that is, as you open up the hardened network, does it compromise the historical reliability and recovery mechanisms? Will customers have to trade recoverability and security to get the added flexibility and agility they crave? We remember the transition from mainframe computing. It was walled-off, secure and reliable. Open systems weren’t nearly as predictable, yet the value they brought in terms of new workloads, features, speed and ecosystem evolution was worth the added risk.

“For me, this is the big tradeoff and in my great telco debate every year, I always try and put people against each other to try and to literally debate the future,” Lewis said. “And one of the things we looked at was is a more open network against this desire of the telcos to actually have a smaller supplier roster. And of course, as a major corporation, these are on a national basis, very large companies, not large compared to the hyperscalers for example, but they’re large organizations, and they’re trying to slim down their organization, slim down the supplier ecosystem. So actually in some ways, the more open it becomes, the more someone’s got to manage and integrate all those pieces together. And that isn’t something we want to do necessarily. So, I see a real tension there between giving more and more to the traditional suppliers — the Nokias, the Ericssons, the Huaweis, the Amdocs, the Ciscos and so on.

“And then the people coming in breaking new ground like Mavenir — the sort of approach that Rakuten and Curve have taken in bringing in more open and more malleable pieces of smaller software. So yeah, it’s a real challenge. And I think as an industry which is notorious for being slow-moving, actually we’ve begun to move relatively quickly, but not necessarily all the way through the organization. We’ve got plenty of stuff sitting on mainframes still in the back of the organization. But of course, as mobile has come in, we’ve started to deal much more closely with the customers. So actually, at that front end, we’ve had to do things a lot more quickly. And that’s where we’re seeing the quickest adaptation to what you might see in your IT environment as being much more, continuous integration/continuous deployment.”

Watch Chris Lewis’ commentary on the state of telco infrastructure.

Telco is a $1.4 trillion dollar industry ripe for disruption and transformation. What will that look like?

The main theme of this episode of Breaking Analysis is telco transformation. There’s lots of discussion and much debate on this topic. Specifically, can telcos move beyond connectivity and managing fiber? Is this a mandate or a literal “pipe dream”? Can they attack adjacencies, which historically we seen telcos struggle to do so successfully, such as in content and media? What are those possible adjacencies and how will the ecosystem develop to support or compete with these objectives?

As the telecoms industry breaks out from being a self-contained island into the wider world of digital infrastructure, key questions revolve around demand and supply and the role of telecoms and connectivity in the digital society.

The issue of sustainability is also important. Getting everyone connected and benefiting from the digital wave, while at the same time trying to curb carbon emissions and reduce energy consumption. So, if the revenue is large but flat, this results in two key dynamics: significant transformation of the inner workings of the industry to reduce cost whilst coping with major growth in traffic; and competitive positioning of services (fixed and mobile) plus third-party services to reduce churn and improve customer satisfaction.

Here’s how Chris Lewis sees it:

“Normally, pipe is a negative comment in the telecom world. But pipe dream gives it a real positive feel. So can they move beyond connectivity? Well, first of all, connectivity is growing in terms of the number of things being connected. So, in that sense, the market is growing. What we pay for that connectivity is not necessarily growing. So, therefore the mandate is absolutely to transform the inner workings and reduce the cost of delivery. So, that’s the internal perspective.

“The external perspective is that we’ve tried in many telcos around the world to break into those adjacent markets, being around media, being enterprise, being around IoT, and actually for the most part they’ve failed. And we’ve seen some very significant recent announcements from AT&T, Verizon, BT, beginning to move away from owning content; not just delivering content, but owning content.

“And the same as they’ve struggled often in the enterprise market to really get into that, because it’s a well-established channel of delivery bringing all those ecosystem players in. So, actually rather than the old telco view of ‘We’re going to move into adjacent markets and control those markets’ actually moving into them and enabling fellow ecosystem players to deliver the service is what I think we’re beginning to see a lot more of now.

“And that’s the big change, it’s actually learning to play with the other people in the ecosystem. I always use a phrase that there’s no room for egos in the ecosystem. And I think telcos went in initially with an ego thinking, ‘We’re really important, we are the connectivity.’ But actually now they’re beginning to approach the ecosystem saying, ‘How can we support partners? How can we support everyone in this ecosystem to deliver the services to consumers, businesses and whoever in this evolving ecosystem?’

“So, there are opportunities out there, plenty of them, but of course, like any opportunity, you’ve got to approach it in the right way. You’ve got to get the right investment in place. You’ve got to approach it with the right open API so everyone can integrate with your approach, and approach it, do I say with a little bit of humility to say, ‘Hey, we can bring this to the table, how do we work together?’”

Watch Chris Lewis’ commentary on telco transformation.

The rollout of 5G is a revenue opportunity for telcos, but how will they exploit it? Sure, there are opportunities to reduce costs and make the infrastructure operate more efficiently. But there are many use cases within industry that 5G will support. Where are those opportunities and how will the future unfold?

Chris Lewis sees it this way:

“I prefer to think of 5G as being a sort of a metaphor for the whole future of telecom. So, we usually talk, and MWC would normally talk, about 5G just as a mobile solution. It’s a potential replacement for some fixed lines. And of course, it also gives you the ability to build out, let’s say in a manufacturing or a campus environment, a private 5G network. So, many of the early opportunities we’re seeing with 5G are actually in that more private network environment addressing those very low latency, and high bandwidth requirements. So yeah, there are plenty of opportunities. Of course, the question we ask in the context of telcos is ‘Is connectivity enough?’ This is especially relevant with your comment around the edge. At the edge we need to manage connectivity, storage, compute, analytics and of course the applications.

“So, that’s a blend of players. It’s not going to be in the hands of one player. Plenty of opportunities but understanding what comes the other way from the customer base – you and I in our homes — or outward from a business point of view, an office or a campus environment. That’s what should be driving the discussion, not the technology itself.

“And I think this is the trap that the industry has fallen into many times, that we’ve got a great new wave of technology coming, how can we possibly deliver it to everybody rather than listening to what the customers really require and delivering it in a way consumable by all those different markets?”

Chris Lewis comments on the 5G opportunity and how telcos need to think differently.

The topics on our agenda blend together despite our efforts to address them separately. But one of the areas that we don’t have a specific agenda item on is in this Breaking Analysis is data and artificial intelligence. And of course there’s all this data flowing through the network, so presumably it’s an opportunity for the telcos.

At the same time, they’re not considered AI experts like the cloud players. With the edge, where AI inferencing will be prominent, it would appear telcos have a latency advantage because of the last mile and their proximity to various end points. But the cloud is building that out as well with things such as Outposts and Local Zones — and that will continue.

As we’ve reported extensively, we believe that most of work at the edge is going to be about AI inferencing in real time. And we believe most of the data is going to stay at the edge. Some will come back for sure. And that is a big opportunity for whether you’re selling compute or connectivity, or maybe storage as well, but certainly insights at the edge.

Here’s how Chris Lewis sees the data and AI opportunity for telco”

“I think the whole data and AI piece for me sits on top of the cake or pie. What we’re doing with all this connectivity, what we’re doing with all these moving parts and gathering information around it, and building automation into the delivery of the service, and using the analytics, whether you call it ML or AI, it doesn’t really matter. But actually using that information to deliver a better service, a better outcome. Now, of course, telcos have had much of this data for years and years, for decades, but they’ve never used it.

“So, I think what’s happening is, the cloud players are beginning to educate many of the telcos around how valuable this stuff is. And that then brings in that question of how do we partner with people using open APIs to leverage that data. Now, do the telcos keep hold of all that data? Do they let the cloud players do all of it?

“No, it’s going to be a combination depending on particular environments, and of course the people owning their devices also have a vested interest in this as well. So, you’ve always got to look at it end-to-end and where the data flows are, and where we can analyze it. But I agree that analysis [happens] on the device at the edge, and perhaps less and less going back to the core, which is of course the original sort of mandate of the cloud.”

The cloud and hyperscalers and the big elephant in the telco room. What role the cloud will play in the transformation of telecoms? At the great Telco debate, Lewis likened the hyperscalers to Dementors from “”Harry Potter” hovering over the industry. So, the question is, are the cloud players going to suck the value out of the telcos? Or are they more like Dobby the elf – powerful, sometimes friendly, but unpredictable?

Here’s how Lewis responded:

“Thank you for extending that analogy. Yes, it got a lot of reaction when I used that, but I think it indicates some of the direction of power shift where we’ve got to remember here that telcos are fundamentally national, and they’re restricted by regulation, and the cloud players are global, perhaps not as global as they’d like be, and there are some regional restrictions, but the global players, the hyperscalers, they will use that power and they they will extend their reach, and they are extending their reach. If you think they now command some fantastic global networks, in some ways they’ve replaced some of the telco international networks, all the submarine investments that tend to be done primarily for the hyperscalers. They’re building that out. So, as soon as you get onto their network, then you suddenly become part of that environment.

“And that is reducing some of the spend on the longer distances we might have got in the past approaches from the telcos. Now, does that mean they’re going to go all the way down and take over the telcos? I don’t believe so, because it’s a fundamentally different business digging fiber in people’s streets and delivering to the buildings and putting antennas up. So, there will be a coexistence. And in fact, what we’ve already seen with cloud and the hyperscalers is that they’re working much more closely together than people might imagine.

“Now, you mentioned about data in the previous question. Google, probably the best known of the AI and ML [providers], delivers from the cloud side, working with many of the telcos, even in some cases to actually have all the data outsourced into the Google Cloud for analytics purposes. They’ve got the power, the heavy lifting to do that. And so, we begin to see that, and obviously with shifting of workloads as appropriate within the telco networking environment, we’re seeing that with AWS, and of course with Azure as well.

“And Azure of course acquired a couple of companies in Affirmed Networks and Metaswitch, which actually do some of the formal 5G core and the likes there within the connectivity environment. So, it’s not clean cuts. And to go back to the analogy, those Dementors are swooping around and looking for opportunities, and we know that they will pick up opportunities, and they will extend their reach as far as they can down to that edge.

“But the edge is where, as you rightly say, the telcos have the control. They don’t necessarily own the customer. I don’t believe anyone owns the customer in this digital environment, because digital allows you to move your allegiance anyway. But they do own that access piece, and that’s what’s important from a national point of view, from an economic point of view. And that’s why we’ve seen some of the geopolitical activity banning Huawei from certain markets, encouraging more innovation through open ecosystem plays. So there is a tension there between the local telco, the local market and the hyperscaler market, but fundamentally they’ve got an absolute brilliant way of working together using the best of both worlds to deliver the services that we need as an economy.”

We believe one obvious role for cloud in telecoms is telcos will move portions of the network operations into the cloud. The telcos all run big data centers, and like most private data centers, much of that IT infrastructure can and should move into the cloud. But it’s very clear they’re not going to give up the entire family jewels to the cloud players– that is, their local access. Why would they? But there are portions of their IT that makes sense to move.

In particular, the front-end systems will move and, like many corporate data centers, the telcos will, we believe, want to build an abstraction layer to their core backend systems, such as their Oracle databases. They’ll put a brick wall around those, but they will build a layer to take advantage of microservices that use data from those back-end systems. But the web front-end work makes sense to put into cloud.

We asked Lewis if he agrees.

“I think you’ve hit the nail on the head. So you can’t move those big back-end systems straight away, gradually over time you will, but you’ve got to go for those easy wins. And certainly in the research I’ve been doing with many of my clients, they’ve suggested that front-end piece, making sure that you can onboard customers more easily, you can get the right mix of services. You can provide the omnichannel interaction from that customer experience that everybody talks about, for which the industry is not very well-known at all by the way. So any improvement on that is going to be good from an NPS point of view is good.

“So it’s leveraging what we call BSS OSS in the telecom world, the business and operational systems, and actually putting that into the cloud, leveraging both the hyperscalers, but also by the way, many of the traditional players who people think haven’t moved cloudward. But they are moving that way and they’re embracing microservices and cloud native.

“It’s not a bad industry to be in. Even if they were just pushed back to be in the access market, it’s a great business. We need it more and more. The elasticity of demand is very inelastic, we need it.”

Watch Chris Lewis’ analysis of the cloud’s impact on telco.

We don’t have a separate topic on security, but we wanted to touch on security here, as it’s such an important topic. And it’s top of mind obviously for everybody — telcos, hyperscalers. The cloud players use the shared responsibility model. A lot of times it’s really confusing for cloud customers. They don’t fully understand it until there has been a problem. The telcos are going to be very much tuned into this. How will all this openness, how will this transformation to the cloud, with the shared responsibility model, how will that affect the whole security posture?

Here’s how Lewis sees it:

“I don’t claim to be an expert by any stretch of the imagination, but I would say security for me is a bit like AI and analytics. It’s everywhere. It’s part of everything. And therefore you cannot think of it as a separate add-on issue. So every aspect, every element, every service you build into your micro services environment has to think about how do you secure that connection, that transaction, how do you secure the customer’s data? Obviously, sovereignty plays a role in that as well in terms of where it sits, but at every level of every connection, every hop that we look through, every route to jump, we’ve got to see that security is built in.

“And in some ways, it’s seen as being a separate part of the industry, but actually, as we collapse parts of the network down, we’re talking about bringing optical and routing together in many environments, security should be talked about in the same breath. So when I talked about edge, when I talked about connectivity, storage, compute, analytics, I should’ve said security as well, because I absolutely believe that is fundamental to every chain in the link. And let’s face it, we’ve got a lot of links in the chain.”

Watch Lewis’ analysis of the cloud security topic.

What technologies should we be paying attention to that are going to accelerate this transformation? We hear a lot about 5G, Open RAN and other emerging technologies. We asked Lewis what he’s watching and who are the players that we should be paying attention to.

“Cloudification of the networking environment is obviously really important,” he said. “The automation of the process we’ve got to move away from bureaucratic manual processes within these large organizations, because we’ve got to be more efficient, we’ve got to be more reliable. So, anything which is related to automation.

“And then the Open RAN question is really interesting. Once again, you raised this topic of when you go down an Open RAN routes or any open route, it ultimately requires more integration. You’ve got more moving parts from more suppliers. Therefore, there are potential security issues there, depending on how it’s defined, but everybody is entering the Open RAN market. There are some names that you will see regularly next week, being pushed, I’m not going to push them anymore, because some of them just attract the oxygen of attention.

“But there are plenty out there. The good news is, the key vendors who come from the more traditional side are also absolutely embracing that and accept the openness. But I think the piece which probably excites me more, apart from the whole shift towards cloud and microservices, is the coming together, the openness between the IT environment and the networking environment. And you see it, for example, in the Open RAN, this thing called the RIC, the RAN Interconnection Controller. We’re actually beginning to find people come from the IT side able to control elements within the wireless controller piece. Now that that starts to say to me, we’re getting a real handle on it, anybody can manage it. So, more specialization is required, but understanding how the end-to-end flow works.

“What we will see is announcements about new devices, the big guys like Apple and Samsung do their own thing during the year, and don’t interrupt their beat with MWC, but you’ll see a lot of devices being pushed by many other providers, and you’ll see many players trying to break into the different elements of the market. But I think mostly, you’ll see the people approaching it from a more ‘cloudified’ angle where things are much more leveraging that cloud capability and not relying on the sort of rigid and stodgy infrastructure that we’ve seen in the past.”

Watch Chris Lewis’ analysis of the technologies to watch and their impact.

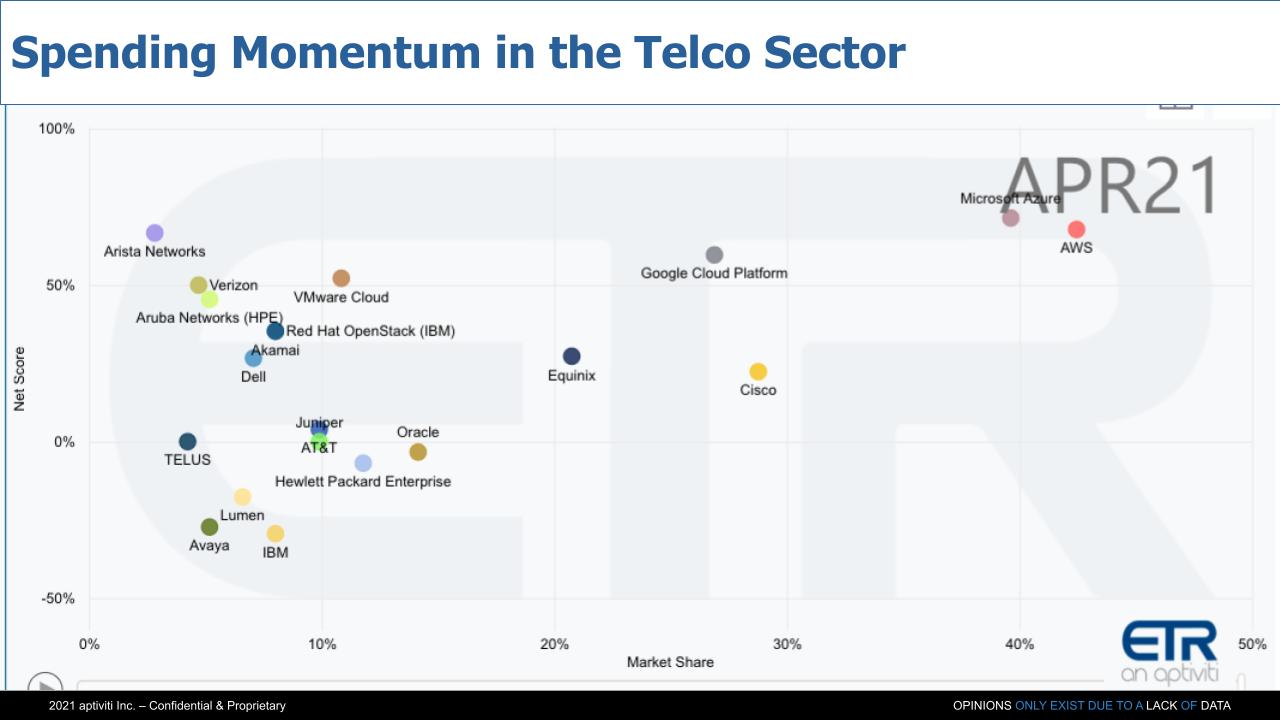

Let’s now bring in some survey data from our partner Enterprise Technology Research. Of course the telcos have lots of data centers and as we talked about will be moving certain portions into the cloud – lots of the front-end pieces. But let’s look at the momentum of some of the IT players within the ETR data set and look at how they compare to some of the telcos that ETR captures, specifically within the telecoms industry.

This XY graph above plots on the vertical axis, Net Score, which measures spending momentum. On the horizontal axis is Market Share, which is a measure of pervasiveness in the data set. Now this data is for shared accounts just in the telco sector and we filtered on certain sectors like cloud and networking. So it’s a narrow slice of the 1,500 respondents. This represents 133 shared accounts.

A couple of things jump right out. Within the telco industry, it’s no surprise, but Azure and AWS have massive presence. But what’s also notable is they score highly on the vertical axis with extremely elevated spending velocity on their platforms within telco. Google Cloud doesn’t have as much of a presence, but it’s elevated as well.

Arista and Verizon along with VMware are also elevated as is Aruba but they don’t have the presence on the horizontal axis. Red Hat OpenStack is actually quite prominent in telco, as we’ve reported in previous segments. No surprise that Akamai is up there.

Now remember this survey is weighted toward enterprise IT, so you have to take that into consideration. But look at Cisco – strong presence and nicely elevated, as is Equinix — both higher than many others, including Dell. But you can see Dell has pretty respectable spending momentum in telco – within the ETR data. Then there’s the cluster below, which includes Juniper, AT&T, Oracle, the rest of HPE, Telus and Lumen – the former Century Link, Avaya and IBM.

Now again, this is an enterprise IT-heavy survey, but the big takeaway is the cloud players have a major presence inside firms that categorize themselves as in the telecommunications industry. And certain IT players, such as Cisco, VMware and Red Hat, appear to be well-positioned inside of telco accounts.

Watch Chris Lewis’ comments on the ETR survey data.

As the lines blur between telco and traditional enterprise IT, the cloud appears to be the glue that will connect core back-end systems to the open world of developers, microservices, containers, AI, data and the edge. As we exit the pandemic, the sense of urgency to transform has heightened and everyone wants a piece of the large telco pie.

Key issues remain in terms of how the ecosystem develops, how the channel will evolve, public policy, the narrative around breaking up big tech, local privacy laws, integration, security and new business models that will emerge. Telco is a mature and historically isolated business but it’s entering the digital age and there’s no question it will play a huge role in transforming industries and companies.

It’s hard to compress the trends within a $1.4 trillion dollar industry in 30 minutes – but many thanks to our friend Chris Lewis for helping us do that. TheCUBE, SiliconANGLE’s livestreaming video studio, will be at Mobile World Congress all week, inside the Cloud City space built out by TelcoDR. It’s a 65,000-square-foot digital experience with interviews live onsite, remote guests, pre-recorded analysis and a headliner musical guest – Jon Bon Jovi.

Here are all the details on how to watch the coverage from theCUBE at MWC21.

Remember these episodes are all available as podcasts wherever you listen. Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.