INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Computer chipmaker Advanced Micro Devices Inc. delivered another strong quarter with earnings and revenue topping expectations today, plus a forecast that came in above expectations too and a higher full-year revenue outlook.

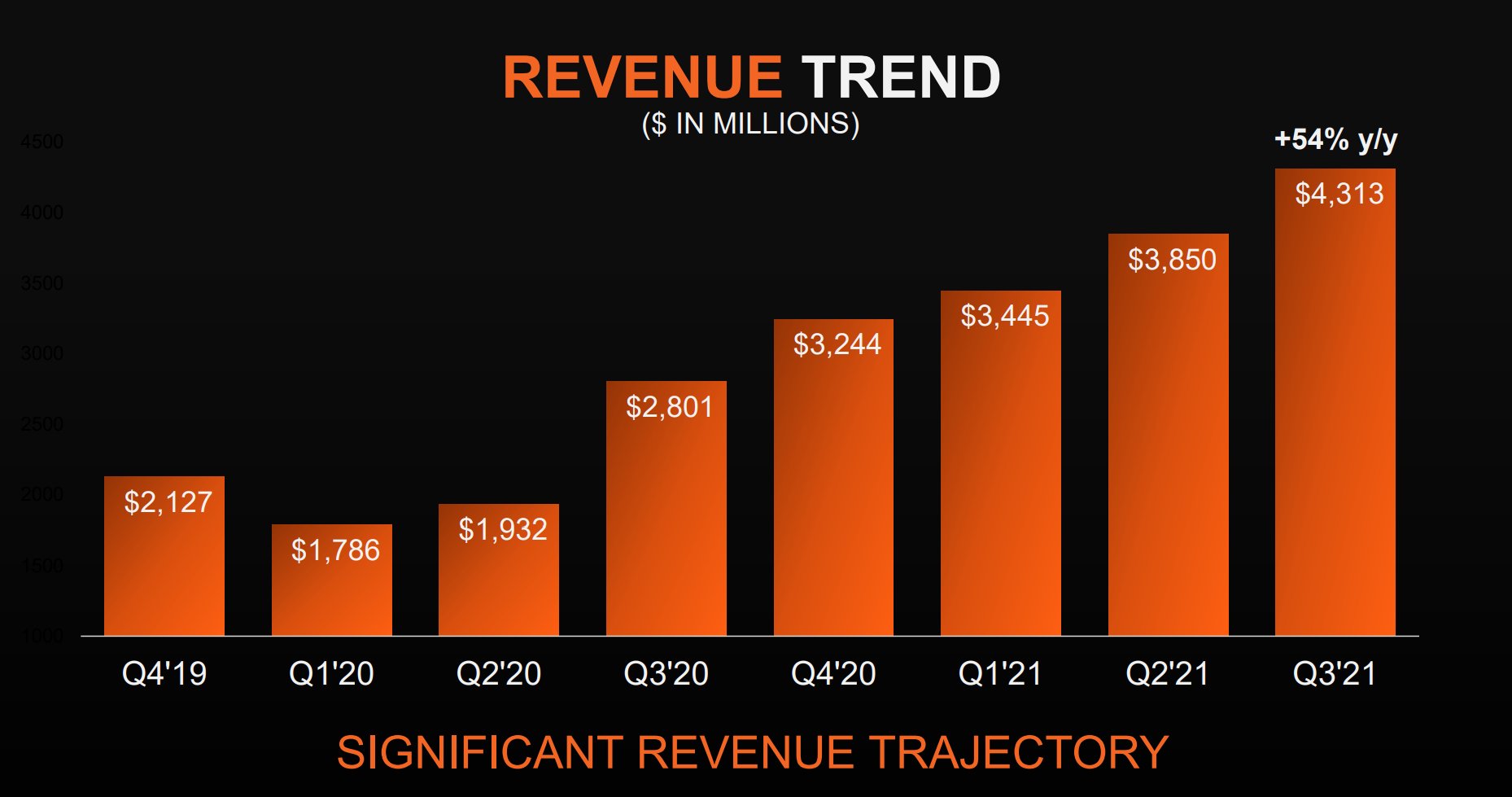

The company reported a third-quarter profit before certain costs such as stock compensation of 73 cents per share on revenue of $4.3 billion, up 54% from a year ago and well ahead of Wall Street’s targets of 66 cents per share in profit and $4.11 billion in sales.

AMD Chief Executive Lisa Su (pictured) said the company delivered another record quarter, noting that its operating income also doubled year-over-year. “Our business significantly accelerated in 2021, growing faster than the market based on our leadership products and consistent execution,” she said.

The growing demand for electronics products and the well-documented global chip supply crisis over the last 18 months has helped AMD immensely. The company has benefited from surging sales of central processing units and graphics processors that power personal computers, servers and games consoles, massively accelerating its revenue growth in the process.

AMD’s Computing and Graphics business, which includes personal computer and console sales, saw sales rise 44%, to $2.4 billion, during the quarter, helped by what Su said was double-digit growth in sales of its new Ryzen 5000 “Threadripper” processor.

Sales of GPUs were also boosted by AMD’s work on the Oak Ridge National Laboratory’s new exascale computing system, called Frontier. “Data center graphics revenue more than doubled year-over-year and quarter-over-quarter led by shipments of our new AMD CDNA 2 GPUs for the Frontier exascale supercomputer at Oak Ridge National Laboratory,” Su said in her statement.

As for server chip and console chip sales, these are reported in AMD’s Embedded, Enterprise and Semi-Custom business. That unit logged $1.9 billion in sales, up 69% from a year ago. As in the previous quarter, the growth was driven by AMD’s Epyc server chips and semi-custom sales, which are the chips it sells to games console manufacturers.

AMD has made strong progress in the server market and is believed to be taking market share from rivals such as Intel Corp. as companies such as Microsoft Corp. and Google LLC buy more of its chips to run their cloud computing infrastructure. Su said AMD’s data center chip sales doubled compared with a year ago and now account for more than 20% of the company’s overall revenue.

That’s thanks to the epic performance of its Epyc data center chips, Su said. She explained that adoption is “ramping faster” than earlier generations of those chips, thanks to Microsoft and Google and also new business from firms such as Netflix Inc. “Enterprise growth was particularly strong in the quarter for Epyc,” said Su.

Added to that, games consoles such as Microsoft’s Xbox Series X and Sony Corp.’s PlayStation 5 remain in high demand.

“Semicustom revenue grew sequentially and year-over-year as demand for the latest Microsoft and Sony consoles remains very strong,” Su told analysts on a call. “We expect semicustom revenue to increase sequentially in the fourth quarter as we further ramp supply to address the ongoing game console demand.”

Analyst Patrick Moorhead of Moor Insights & Strategy called out a number of highlights for AMD in the quarter:

$AMD does what you’d expect and smashes Q3. Highlights:

-Rev +54%; GM +70%; GM percent +450 bps

-Opinc +111%

-NI +137%

-DC market doubles (Epyc + Instinct)

-CCG +44%; CPU/GPU ASP increase

-EESC +69%; Epyc and semi-custom

Isn’t growth mode fun? pic.twitter.com/et8VYOd6yi— Patrick Moorhead #IntelON #MWCLA21 #WebexOne (@PatrickMoorhead) October 26, 2021

let’s see how long the vendor can ride the upwards wave, because only one thing is certain – chip markets have their ups and downs.AMD is also making progress on cost control, helping to boost its overall profits. It reported a gross margin of 48%, up from 44% one year ago, which it said is thanks to existing customers buying more expensive processors than before. The company is forecasting a gross margin of 49.5% for the fourth quarter.

“AMD had another epic quarter thanks largely to Epyc, showing how a new modern processor platform released at the right time can provide a big growth jump, in this over 50%,” said analyst Holger Mueller of Constellation Research Inc. “Given AMD’s good cost management, profitability is up even more. Things are going very well for AMD.”

For guidance, AMD expects sales of $4.5 billion in the fourth quarter, ahead of Wall Street’s projection of $4.25 billion in revenue. For the full year 2021, AMD expects revenue growth of 65%, up from its prior guidance of 60% growth.

Despite the strong performance and bullish outlook, investors were unmoved. Early gains in the extended trading session were quickly reversed, and AMD’s stock was down a half-percentage point.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.