CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Oracle Corp. announced a meaningful earnings beat and strong guidance on Friday on the strength of its license business and slightly better-than-expected cloud performance. The stock rose sharply on the day and closed up nearly 16%, surpassing $280 billion in market value.

Oracle’s success is thanks largely to its execution of a highly differentiated strategy that has evolved over the past decade or more: deeply integrating its hardware and software, heavily investing in next generation cloud, creating a homogeneous experience across its application portfolio and becoming the No. 1 platform for the world’s most mission-critical applications.

While investors piled into the stock, skeptics will point to the beat being tilted toward license revenue and investors will likely keep one finger on the sell button until they’re convinced Oracle’s cloud momentum is more consistent and predictable.

In this Breaking Analysis, we’ll review Oracle’s most recent quarter and pull in some Enterprise Technology Research survey data to frame the company’s cloud business, the momentum of Fusion ERP, where the company is winning and some gaps and opportunities we see that can be addressed in the coming quarters.

The numbers this quarter were strong – particularly the revenue beat. The question is: How much of the story is the result of the investments Oracle has made in the past decade and how much relates to cycles in the company’s heritage business? Sometimes, because of the way Oracle reports, it’s hard to tell if the company is spinning a story around a onetime trend or if this is the start of a new growth trajectory. That’s the question investors will have to now answer. The accelerated guidance is certainly a positive sign.

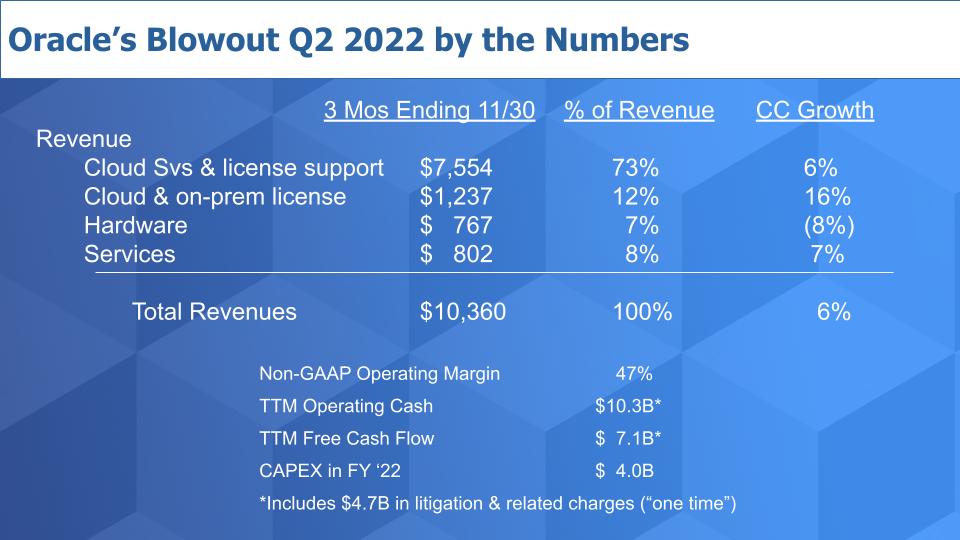

Above are a few highlights supplied by Oracle. Revenue grew 6% year on year and surpassed $10 billion for the quarter. Oracle’s adjusted operating margins were an impressive 47%. Chief Executive Safra Catz has always said that “cloud is a more profitable business,” and it’s starting to show on the income statement.

Operating cash and free cash flow were $10.3 billion and $7.1 billion, respectively, for the past four quarters and would have been higher if not for $4.7 billion in charges largely related to litigation expenses associated with the hiring of the late former CEO Mark Hurd. The company said these legal expenses would not repeat in future quarters.

And you can see in this chart how Oracle breaks down its business — which is a mashup of items it lumps into two lines that imply cloud. The largest piece of the revenue pie is Cloud Services & License Support, about which in reading 10Ks you’ll find statements such as the following:

License support revenues are our largest revenue stream and include product upgrades and maintenance releases and patches as well as technical support assistance.

Cloud and license revenues include the sale of cloud services, cloud licenses and on-premises licenses which typically represent perpetual software licenses purchased by customers for use in both cloud and on-premises IT environments.

Cloud license and on-premise license revenues primarily represent amounts earned from granting customers perpetual licenses to use our database, middleware application and industry-specific software products, which our customers use for cloud-based, on-premise and other IT environments.

So, you decide – is that cloud?

In the early days of Oracle Cloud, the company broke out infrastructure-as-a-service, platform-as-a-service and software-as-a-service revenue separately but changed its reporting, which makes it difficult to determine what’s happening in true cloud. To be clear, we have no problem including “same: same” hardware, software, control plane and the like if it’s on-premises in a true hybrid environment, like Exadata Cloud@Customer, or AWS Outposts to use an Amazon Web Services Inc. example. But one has to question what’s really cloud in these numbers.

Adding to the confusion, Oracle co-founder and Chief Technology Officer Larry Ellison on the earnings call mentioned that Salesforce.com Inc. licenses Oracle’s database to run its customer relationship management cloud (implying that’s really cloud), but Oracle doesn’t count that in its cloud number, rather it counts it in license revenue. But as you can see above, it buries that into a single line item that starts with the word “cloud.”

Given the uncertainty, it’s difficult to say what really is and isn’t cloud in these numbers. So we have to keep watching the public data, talking to customers, analyzing the nuggets and relying on survey data to satisfy our curiosity.

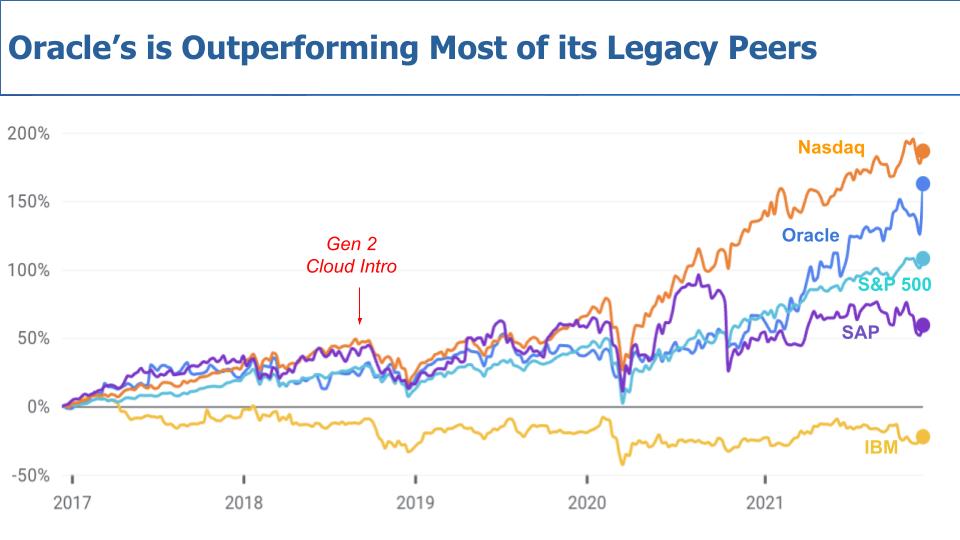

Despite the uncertainty we’ve cited, Oracle is getting it done for investors.

Above is a chart comparing the five year performance of Oracle to two of its historical competitors. We excluded Microsoft Corp. because it skews the numbers – Microsoft would crush these names. But look at Oracle, wedged in between the performance of the Nasdaq and S&P 500, up over 160% in that timeframe. Oracle’s performance is well ahead of SAP SE’s, up 59%, and way ahead of the dismal negative 22% performance of IBM Corp. What a shame – the tech tide is rising, lifting all boats, but IBM has unfortunately not been able to capitalize – a story for another day.

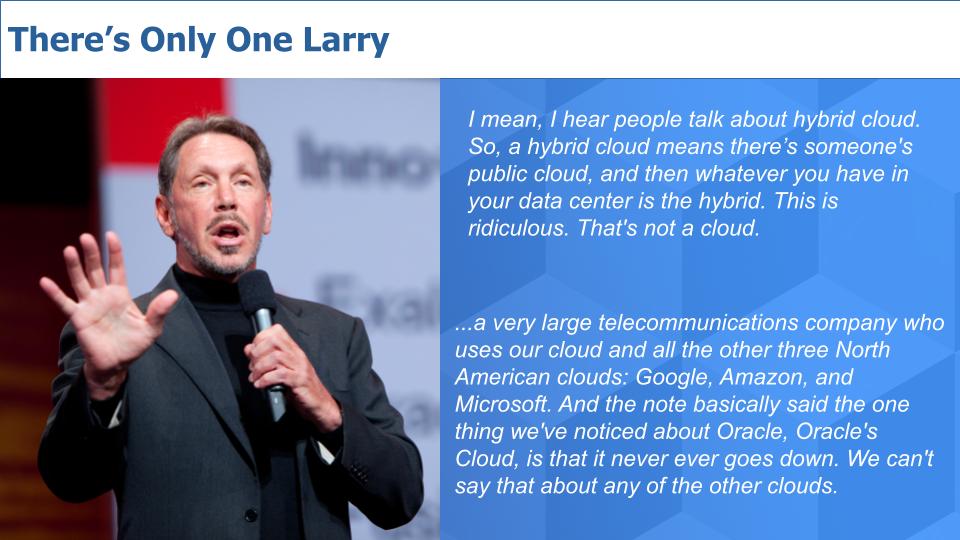

As a market watcher, you can’t help but love Larry Ellison. He’s confident, brash and not afraid to talk about the competition, often in humorously insulting ways. He’s a clear thinker with a presence and a historical perspective and he’s very good at explaining how Oracle thinks about the business opportunity.

On the earnings call Friday, he went off, educating the analyst community on the upside in the Fusion ERP business, making the case that because only 1,000 of the 7,500 legacy enterprise resource planning customers from Oracle, JD Edwards and PeopleSoft have moved to Oracle’s Cloud ERP platform, the upside is large. He predicted that Oracle’s cloud ERP business will surpass $20 billion in five years. And he slammed the hybrid cloud washing that’s going on when companies have customers running in the cloud and they claim whatever they have on-prem is hybrid. He called that “ridiculous.”

And then he took an opportunity to hit the hyperscale cloud vendors, citing a telco customer that said Oracle’s cloud never goes down… of course, the same week AWS had a major outage.

One other note: Ellison stressed on the call that Oracle is taking on the heavy lifting of developing new capabilities for its customers. Rather than customers writing custom code, Oracle claims that customers are communicating requirements to Oracle and Oracle is developing these capabilities and delivering them in future releases – “for free.” Imagine how sticky that will make its software — especially given that the company’s focus is on the most demanding mission-critical workloads.

This is a strategy Mark Hurd explained to John Furrier on theCUBE nearly six years ago. Listen to Mark Hurd explain how Oracle is shifting IT expense to Oracle R&D.

Oracle really was the first tech company to announce a true hybrid cloud strategy where you have an entirely identical experience on-prem and in the cloud, a strategy that was announced with the Oracle Cloud Machine (aka Cloud@Customer) in spring of 2016. Now, it probably took Oracle two years to get it working properly, but it was first.

And to the second point – this is where Oracle differentiates itself. Oracle is No. 1 for mission-critical applications. No other vendor (other than perhaps IBM) can challenge Oracle in this regard vis-a-vis market presence, recoverability, security and quality. Oracle’s recent quarterly performance, to a large extent, is thanks to this differentiated approach.

Over the past 10 years, we’ve talked to hundreds of Oracle customers, and though they may not always like the tactics and licensing policies of Oracle, they will tell you the business case for investing and staying with Oracle is strong. And yes, a big part of that is lock-in, but R&D investments, innovation and a keen sense of how to fast-follow a clear market direction are just as important to these customers. When your executive chairman and co-founder is a technologist and also the CTO, and has the cash on hand to invest, the results are a highly competitive story.

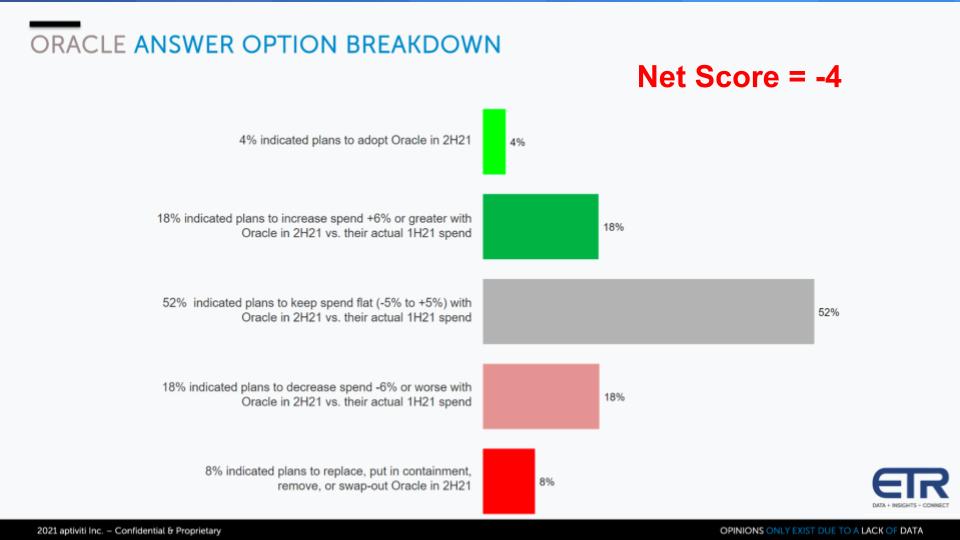

Oracle is not without its challenges. Those who follow Breaking Analysis know that when it comes to ETR survey data, the story is not always pretty for Oracle. So let’s take a look.

The chart above shows the breakdown of ETR’s Net Score method. Net Score measure spending momentum and works as follows. Each quarter, ETR asks customers are you adding a platform new – that’s the lime green; are you increasing spend by 6% or more (forest green); is your spending flat – plus or minus 5% – that’s the gray; is your spending declining by 6% or more (the pink); or are you leaving the platform (bright red). Subtracting the reds from the greens yields a Net Score – which in Oracle’s case in an uninspiring negative 4%.

OK, so this is one of the anomalies in the ETR database. Net Score doesn’t track level of spend. Remember – as the leader in mission-critical workloads, Oracle commands a premium price, so what happens here is the gray is still spending a large amount of money – enough to offset the declines — and the greens are spending more than they would on other platforms because Oracle can command higher prices. So that’s how Oracle is able to grow its overall revenue by 6% (for example), while the ETR methodology doesn’t capture this trend.

You have to dig a bit deeper in the ETR data to see the full story. Let’s take a look at how some of Oracle’s businesses are performing relative to its competitors.

The graphic above is a popular view we like to share. It shows Net Score or spending momentum on the vertical Y axis and Market Share – which measure pervasiveness in the survey – on the X axis. And we’ve broken down and circled Oracle overall and Oracle on-prem, which is declining on the vertical axis, as well as Oracle Fusion and NetSuite, which are both much higher than Oracle overall. In the case of Fusion, it’s much closer to that 40% red horizontal line. Remember, anything above that line we consider elevated.

We’ve added SAP overall, which has spending velocity in the survey comparable to Fusion; and IBM, which is in between Fusion and Oracle overall on the Y axis. Oracle, as you see on the horizontal axis, has a larger presence than any of the firms below the 40% line.

Above the 40% line, you see Salesforce.com, which has a significant presence along with strong momentum. Others above that line have a smaller presence in the survey than Oracle. These include Workday Inc., Google Cloud and Snowflake Inc. – which has a much higher Net Score than any on this chart.

Of course, AWS and Microsoft overall have both a strong presence (higher than Oracle’s) and impressive momentum– especially for their respective sizes.

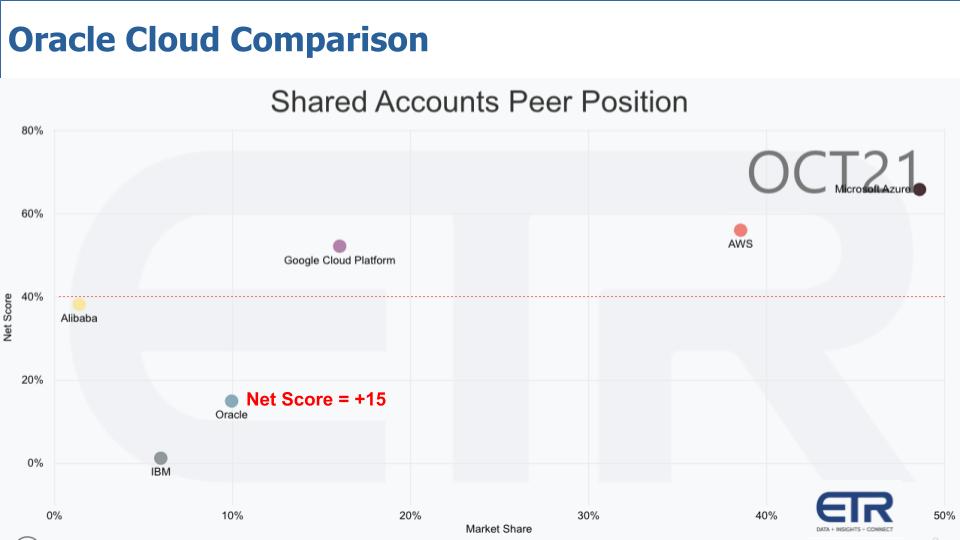

The view we just showed you purposely excluded Oracle’s specific cloud offering. So let’s now take a look at that relative to other major cloud providers.

The chart above shows the same XY view but it cuts the data by cloud only. And you can see Oracle, while still well below the 40% line, has a Net Score of +15, compared with a -4 overall shown earlier. So here we see two key points: 1) Despite the convoluted reporting we discussed earlier, the ETR data supports that Oracle’s cloud business has significantly more momentum than Oracle’s overall average spending velocity; and 2) Although Oracle is smaller and doesn’t have the growth stats of the hyperscale giants, its cloud is performing respectably and noticeably better than IBM’s within the ETR survey data.

We’ve often made the point that Oracle’s effort in Fusion was monumental in that it rebuilt the company’s middleware and ERP portfolio from the ground up. Oracle invested major resources into Fusion middleware and apps. It took a long time and was painful, but in the process, the company’s engineers made accommodations for cloud and as-a-service capabilities. We’ve always felt these investments have conferred competitive advantage to Oracle.

Moreover, we’ve always stated that Oracle didn’t have to take AWS head-on in cloud. Rather, it could compete in IaaS using AWS’ margin umbrella as a buffer and use its software margin to thrive in cloud. Even though Oracle cloud doesn’t have the revenue momentum and scale of AWS, it has massive software margins and an extremely compelling business model.

A key point Ellison emphasized on the earnings call was the importance of ERP and the work that Oracle has done in that space. Living by a cloud first mentality and attracting new customers. He said Oracle has 8,500 Fusion ERP customers and 28,000 NetSuite customers in the cloud and, unlike Microsoft, Oracle hasn’t yet migrated its on-prem installed base to the cloud. That means these are largely new customers and there’s lots of upside opportunity. ERP is a linchpin of Oracle’s cloud strategy.

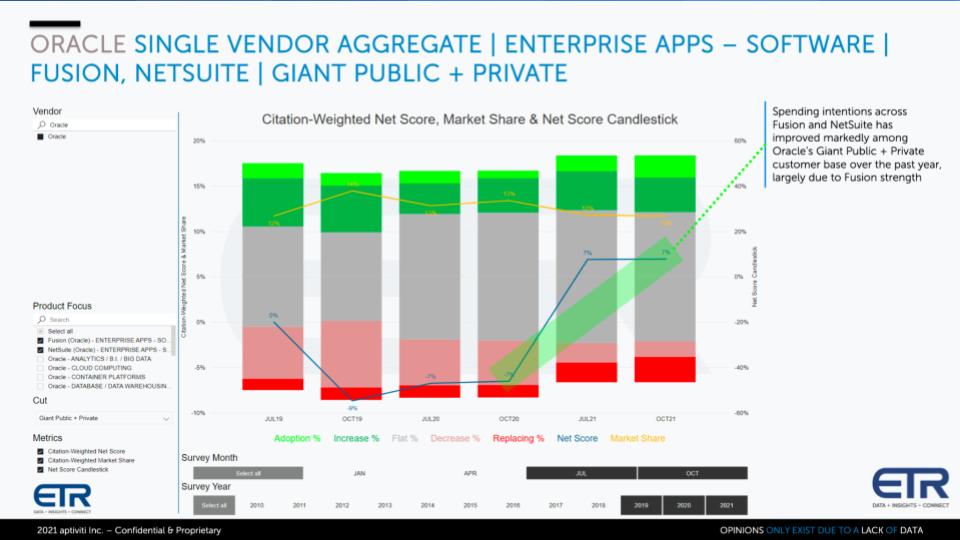

The chart above isolates Fusion and NetSuite within the GPP sector of ETR’s survey. GPP is the very Giant Public and Private companies – a bellwether in the ETR dataset. Think large public companies and also privates such as Mars or Cargill or Fidelity. The chart shows the Net Score breakdown over time for Fusion and NetSuite going back to 2019 and you can see a big uptick as shown in the blue line from the October 2020 survey. So Oracle has done a good job building and now marketing its ERP to these important customers. This confirms the momentum Oracle discussed on its call.

If you buy into the premise that the customers are largely new to Oracle with a large installed base to mine, then the story becomes more compelling.

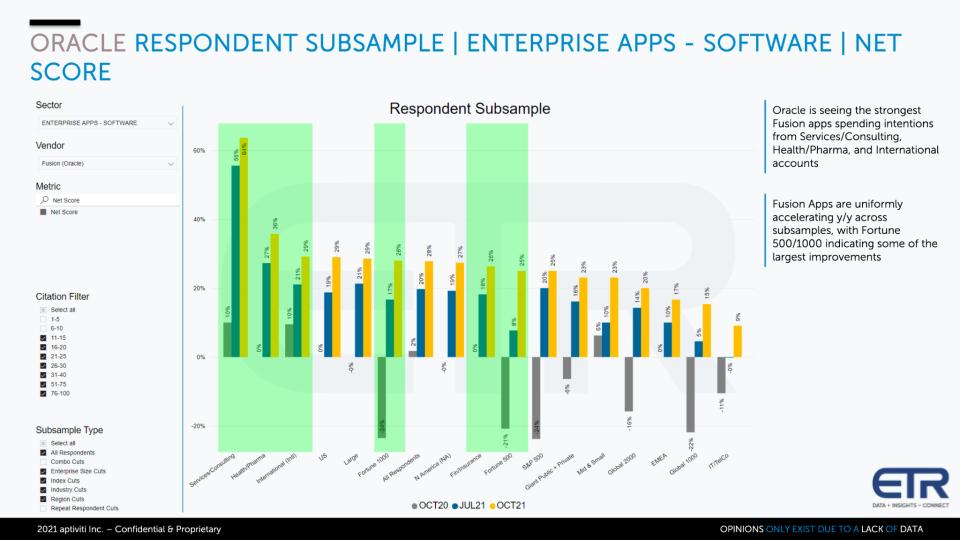

The last data points we want to show relate to Oracle’s Fusion performance within industry sectors as shown below.

On the earnings call Oracle said it had very strong momentum for Fusion ERP in financial services and healthcare. The chart above shows the Net Score for Fusion across each industry sector for three survey points, October 2020 (the gray), July 2021 (the blue bars) and October 2021 (the yellow bars).

Note that the yellow bars show across-the-board upward momentum, confirming Oracle’s assertions that Fusion is performing very well, including in healthcare and financial services.

The big question is: Where does Oracle go from here? Oracle has examples over time where it looked like it’s going to take off, only to hit some bumps in the road that caused investors to pause. And so the Street is likely to remain a bit cautious and take profits off the table along the way up. But since the Barron’s article came out earlier this year, declaring Oracle a cloud giant, the stock is up more than 50%. Of course, 16 of those points were from Friday’s move upward.

Nonetheless, Oracle’s highly differentiated strategy of integrating hardware and software together, investing in a modern cloud platform and selectively offering services that cater to the hardcore mission critical buyer, have served the company, its customers and investors well.

From a cloud standpoint, we’d like to see Oracle be more inclusive and aggressively expand its marketplace and ecosystem. This would provide both greater optionality for customers and further establish Oracle as a major cloud player. Indeed, one of the hallmarks of both AWS and Azure is the momentum being created by their respective ecosystems. As well, we’d like to see more clear confirmation that Oracle’s performance is being driven by its investments in technology – that is, cloud, same: same hybrid cloud and industry feature rollouts versus legacy license cycles.

We are generally encouraged and are reminded of a time years ago when Sam Palmisano was retiring and leaving IBM. At the time, HP, ironically under the direction of Mark Hurd, was the “now” company. Palmisano was asked if he worries about HP and he said, in effect: I don’t worry about HP, I worry about Oracle. Oracle invests in R&D.

That statement has proved prescient.

What do you think? Has Oracle hit the next inflection point? Let us know how you see Oracle’s future.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.