INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Advanced Micro Devices Inc. has closed its acquisition of programmable chipmaker Xilinx Inc., the company said today.

AMD first announced plans to buy Xilinx in October 2020 through an all-stock transaction originally valued at $35 billion. According to Reuters, the deal’s value has since climbed to about $50 billion because AMD’s share price increased substantially since the acquisition was first announced.

Xilinx shareholders received 1.7234 shares of AMD common stock and cash for every Xilinx share they sold in the transaction.

Now that the acquisition is complete, AMD is turning the chipmaker into a new business unit dubbed the Adaptive and Embedded Computing Group, or AECG for short. The unit will be led by former Xilinx Chief Executive Officer Victor Peng. The combined company has more than 15,000 engineers and a total addressable market that is expected to reach $135 billion next year, AMD stated.

Xilinx, or AMD’s AECG business unit as it’s now known, is a leading maker of field-programmable gate arrays. An FPGA is a chip equipped with circuits called logic blocks that can be customized for different computing tasks. The customizability of logic blocks makes it possible to optimize them for a specific task, such as running a certain type of neural network. FPGAs can often perform the specific task for which they are optimized faster than a traditional processor.

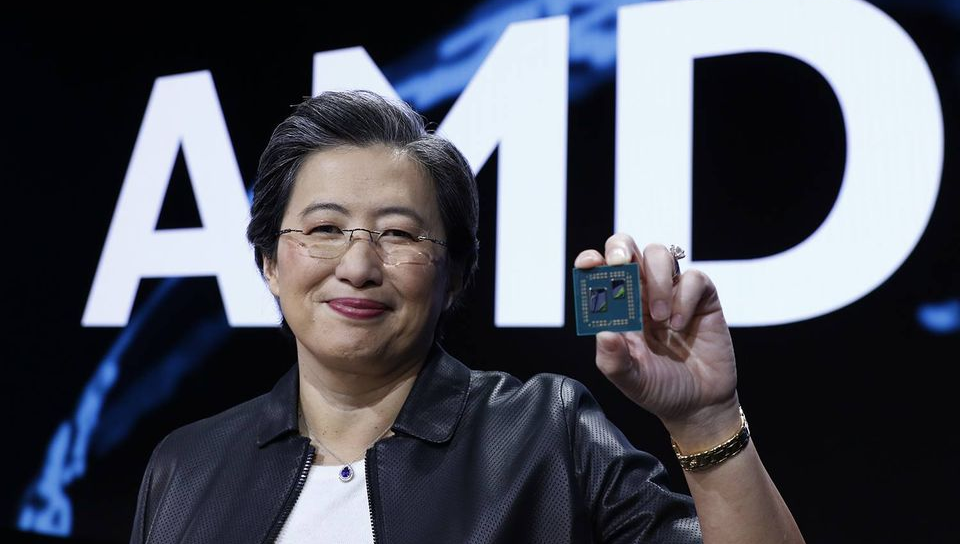

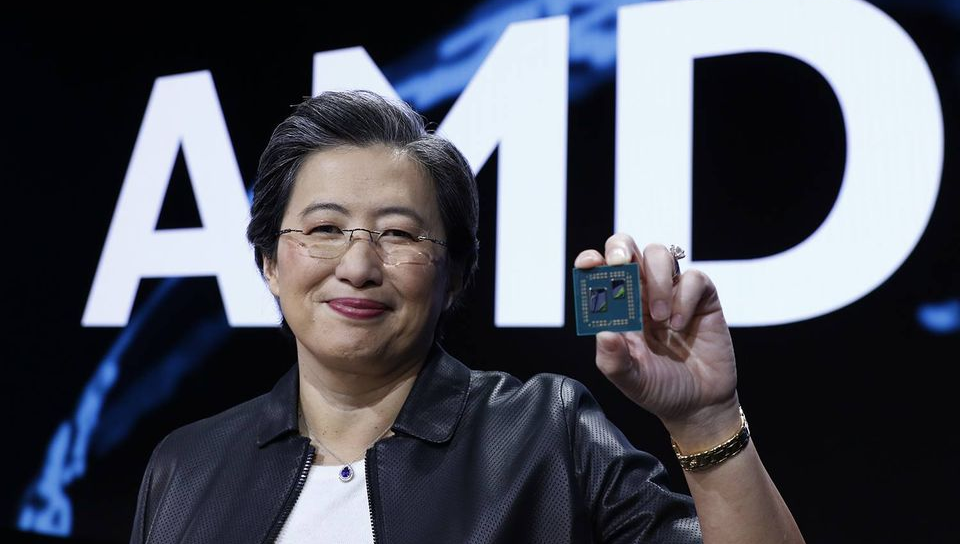

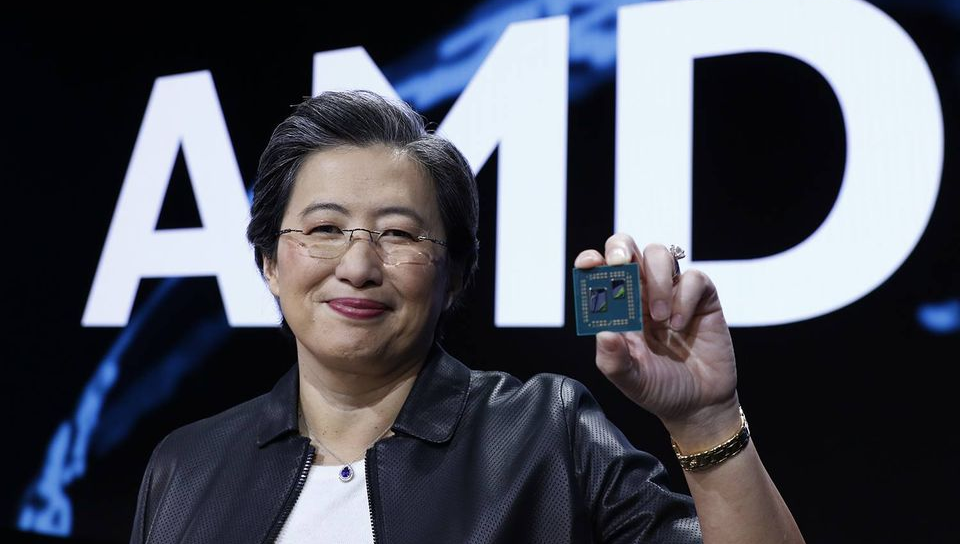

AMD CEO Lisa Su (pictured) told Reuters that the acquisition will help the company expand its presence in the data center market. In its last earnings report prior to the acquisition’s competition, Xilinx detailed that its data center business’ revenue jumped 81% year-over-year. The company attributed the increase to the growing use of its chips in networking and compute hardware.

The deal will also enable AMD to grow its presence in several markets where it currently has a limited presence, including the 5G equipment segment. Besides the FPGAs for which it’s best known, Xilinx also makes chips that are used to power 5G cell towers. This is an area where AMD rival Intel Corp. has also sought to increase its presence: The company in 2020 introduced several processors with specialized networking features designed for carriers.

“The acquisition of Xilinx brings together a highly complementary set of products, customers and markets combined with differentiated IP and world-class talent to create the industry’s high-performance and adaptive computing leader,” Su said in a statement. “Xilinx offers industry-leading FPGAs, adaptive SoCs, AI engines and software expertise that enable AMD to offer the strongest portfolio of high-performance and adaptive computing solutions in the industry and capture a larger share of the approximately $135 billion market opportunity we see across cloud, edge and intelligent devices.”

The acquisition continues the industry trend of major chipmakers expanding to more parts of the semiconductor market in a bid to drive revenue growth. Qualcomm Inc., best known as a maker of mobile processors, in 2020 launched a line of chips for autonomous vehicles. Intel Corp. has in recent years similarly expanded beyond its core focus area, the central processing unit segment, by introducing artificial intelligence chips, consumer graphics cards and a blockchain accelerator.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.