AI

AI

AI

AI

AI

AI

In its early days, robotic process automation emerged from rudimentary screen scraping, macros and workflow automation software. Once a script-heavy and limited tool that was almost exclusively used to perform mundane tasks for individual users, RPA has evolved into an enterprisewide megatrend that puts automation at the center of digital business initiatives.

In this Breaking Analysis, we present our quarterly update of the trends in RPA and share the latest survey data from Enterprise Technology Research.

RPA is maturing. has grown quite rapidly and the acronym is becoming a convenient misnomer in a way. The new momentum in RPA is around enterprisewide automation initiatives. Once exclusively focused on back office automation in areas such as finance, RPA has now become an enterprise transformation catalyst for many larger organizations. Initially focused on cost savings in the finance department and other back-office functions, RPA has moved beyond the purview of the chief financial officer.

RPA is attacking new problems. We predicted in early Breaking Analysis episodes that productivity declines in the U.S. and Europe especially would require automation to solve some of the world’s most pressing problems. And that’s what’s happening. Automation today is attacking not only the labor shortage but its supporting optimizations in environmental, social and corporate governance or ESG, supply chain, helping with inflation challenges and improving capital allocation. For example, dealing with the supply chain issues of today require research, inventory management, prioritizations, price matching and other complex and time-consuming processes. The combination of RPA and machine intelligence is helping managers compress the time to value and optimize decision-making.

Cloud migration is an accelerant to digital business. Organizations are moving to the cloud and building new capabilities on top. A digital business goes beyond cloud and software as a service and puts data, artificial intelligence and automation at the core, leveraging cloud and SaaS, but it reimagines entire workflows and customer experiences.

Low-code expands the total addressable market. Moreover, low-code solutions are taking off and dramatically expanding the ability of organizations to make changes to their processes.

RPA is disrupting adjacent markets. We’re also seeing adjacencies to RPA becoming folded into enterprise automation initiatives and that trend will likely continue. For example, legacy software testing tools are being disrupted. This is especially important as companies cloudify and SaaS-ify their businesses and look for modern testing tools that can keep pace with their transformations.

Strategic priority with more CIO involvement. RPA or intelligent automation has become a strategic priority for many companies. And that means involving the chief information officer to ensure that the governance and compliance edicts of the organization are met; and that alignment occurs across technology and business lines.

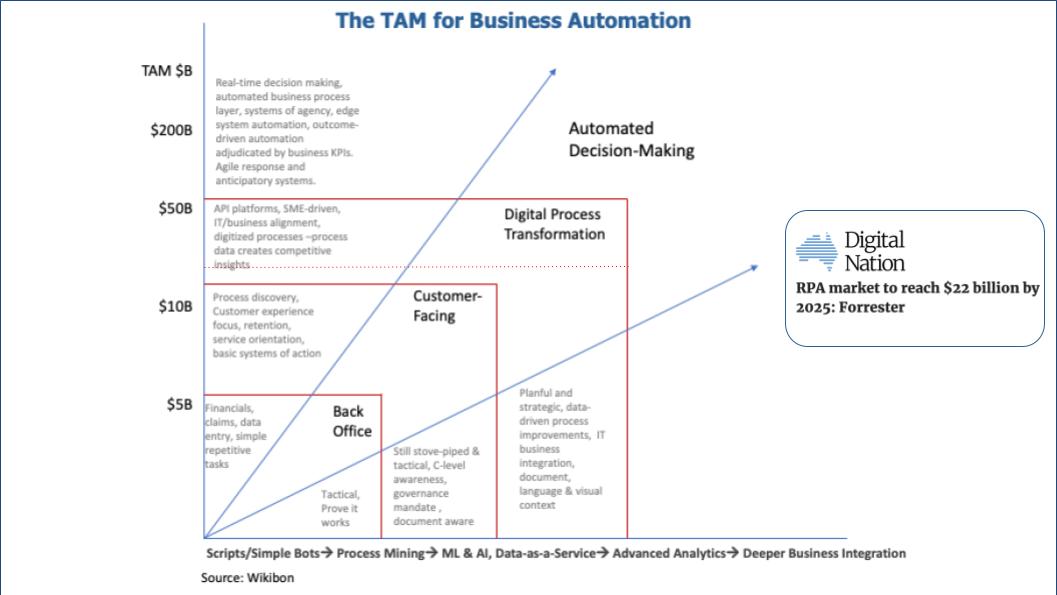

A couple years ago, when we saw that RPA could be much more than individual user bots, we revisited our total available market analysis, as shown above.

In doing so, we felt there would be a confluence of cloud, automation, AI and data… and that the front- and back-office schism would converge.

We were interested to see that just a few days ago, Forrester put out a new report picked up by Digital Nation that the RPA market would reach $22 billion by 2025. As we said at the time, our TAM includes the entire ecosystem, including services – as does Forrester’s projection. That dotted red line is at about the $22 billion mark. We’re a few years away, but we definitely feel as though this is taking shape the way we had previously envisioned.

That is to say, there’s a progression from back office, blending with customer-facing processes, becoming a core element of digital transformations and eventually entering a realm of automated systems of agency, where automations are reliable enough to make real-time decisions at large scale for a much wider scope of enterprise activities.

We see this evolving over the 2020s and becoming a massive multihundred-billion-dollar market.

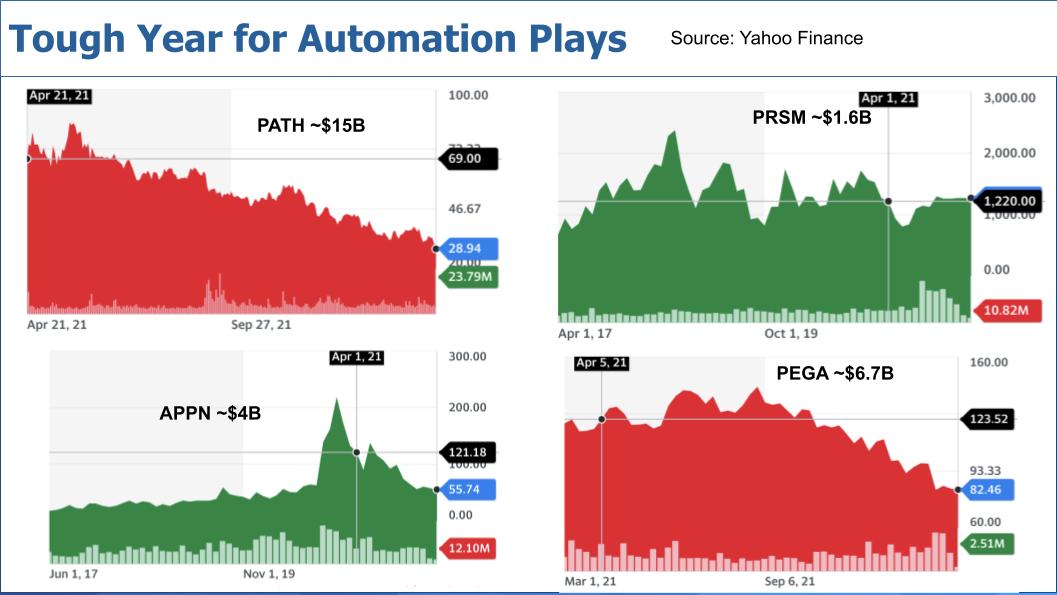

Unfortunately for investors over the past 12 months, the customer enthusiasm around automation has not translated into price momentum for stocks in the sector, as shown below.

Here are the charts for four RPA-related players with market values inserted in each graphic. We’ve set the crosshairs at roughly the timing of UiPath Inc.’s initial public offering.

The problem with hot tech companies is the cat gets let out of the bag well before IPO because they raise so much private money, they tout their valuations and by the IPO, there’s so much froth in the market that it’s hard to get a return in the near term. Combine that with a zero-interest-rate environment, the tech stock boom during the pandemic and the high growth of these firms, and you get overvalued and often profitless stocks that can’t sustain the revenue multiples– especially when inflation kicks in and destroys analysts’ net present value models. So investors just have to wait it out to get a nice return, which this business should deliver over the long term.

UiPath went public last April, and you can see above the steady decline in price. UiPath’s Series F investors got in at a $35 billion valuation, so that has been cut by more than half. However, UiPath is the leader in this sector, as we’ll see in a moment, so investors will just have to be patient and hope the sector lives up to its hype over the long term.

Blue Prism Group plc’s pattern is the one anomaly because it is being bought by SS&C Technologies Holdings Inc. after a bidding war with Vista. So that’s why the stock has held up. Vista is a private equity firm that owns Tibco Software Inc. and was going to mash these two firms together. This was a play we always liked because RPA is going to be integrated across application suites and we felt Tibco, as an integration player, was in a good position to execute on that strategy. But SS&C obviously said, “Hey, we can do that too.” And look, they’re getting a proven RPA tech stack for 10% of the value of UiPath. So, maybe a sharp move, we’ll see – or maybe they’ll jack prices and squeeze the cash flow. We honestly don’t know and will have to wait and see.

We show two other players above who really aren’t RPA specialists. Appian Corp. is a low-code business process development platform and Pegasystems Inc., of course, is a longtime business process player that has done quite well. But both stocks have suffered pretty dramatically since last April.

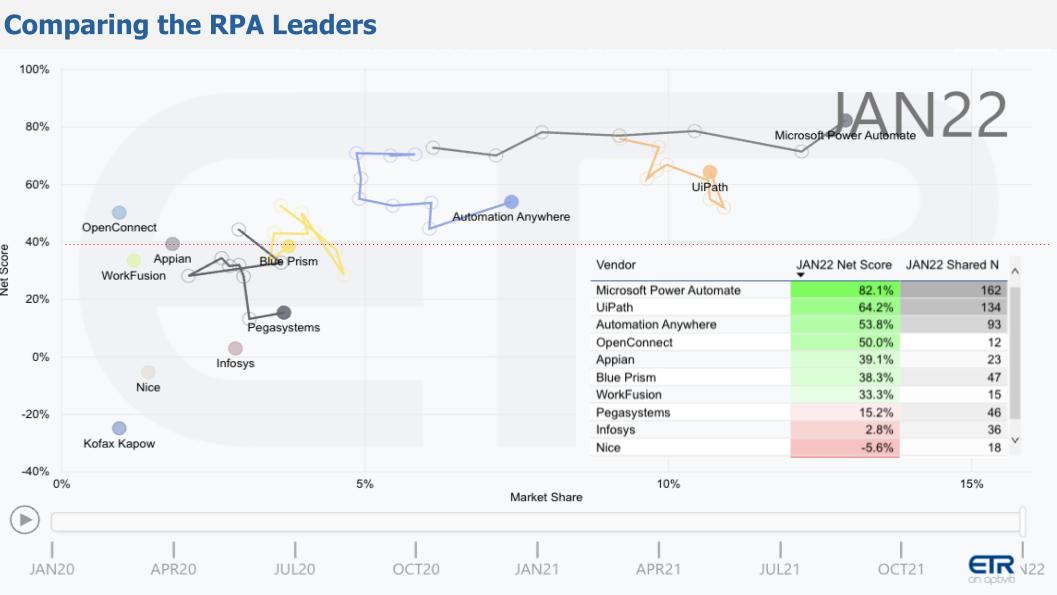

The Enterprise Technology Research survey data above shows a pretty robust picture for most players in the sector. This chart depicts the Net Score or customer spending momentum on the vertical axis and Market Share or pervasiveness relative to other companies and technologies in the ETR data set on the horizontal axis. The red dotted line at 40% indicates an elevated spending level for a company. The chart insert shows how the company positions are plotted.

ETR’s tool has a cool feature where it allows you to track the progression over time – in this case going back to January 2020. That is shown by the various squiggly lines on the chart.

In 2020, Microsoft Corp. acquired Softomotive Ltd., an RPA firm, for a reported $100 million-plus to boost its Power Automate offering. That’s pretty much lunch money for Mr. Softy. So Microsoft bought the company in May and look at the gray line where it showed up in the October ETR survey at a highly elevated level. And it has stayed there and gone up and to the right — just a dominant picture in truly Microsoft fashion.

However, Power Automate is really a personal productivity tool that’s just part of the giant Microsoft software offering. There’s a substantial amount of customer overlap between UiPath, Automation Anywhere Inc. and Blue Prism customers with Power Automate users. In fact, of the 162 Microsoft Power Automated customers shown in the ETR survey, 51 are also using UiPath, 34 are using Automation Anywhere and 25 Blue Prism. This represent a significant percentage (30%-plus) of these respective firms’ customers in the survey. And all three of these vendors have a Net Score well above the 40% line within those Power Automate customer accounts – meaning despite colocating with Power Automate, these software companies have spending momentum in Microsoft accounts.

Why is this? In speaking with numerous customers, we hear that they see enterprise automation platforms from the focused RPA players as much more feature-rich and capable than Power Automate. But Power Automate is a convenient, low-code, easy-to-deploy tool for users. So there’s a role for both. But it’s something to watch out for as Microsoft should never be taken lightly.

The other two leaders in the chart above that stand out are UiPath and Automation Anywhere. Both have elevated Net Scores and both have a meaningful presence in the data set. And you can see the path they took to get where they are today by the squiggly lines. We had predicted in our 2021 predictions post that AA would go public, but that hasn’t happened yet. The company obviously wasn’t ready and it brought in new management. We reported in July of 2020 on the move to bring in Chris Riley as chief revenue officer, and the company has made other changes to shore up its business. But it missed the IPO window created by the Fed in the last two years presumably because it still doesn’t have the predictability in its business model.

Riley was a key hire. We suspect that though Automation Anywhere has shown it has product fit, perhaps it didn’t have go-to-market fit. And for sure that’s what Riley has been working on. We’ve known Chris Riley for years. He’s a world-class sales leader, one of the best in the tech business. And he knows how to build a quality go-to-market team and we’re quite certain he’s capable of succeeding. He’s likely completely reinventing his sales team, partner alliances and the channel. We have a great deal of confidence that if Automation Anywhere’s product is as good as we believe (and the ETR data clearly shows it this), then the company will thrive.

As for the timing of an IPO or other exit such as an acquisition for AA, it remains unclear. With the current market choppiness, who knows if an IPO is feasible? Automation Anywhere raised a ton of dough (more than $800 million) and was last valued just north of $7 billion. If UiPath is valued at $15 billion, you could speculate that AA can’t be valued at much more than $10 billion. An acquirer would have to pay north of $10 billion and we’re not sure it would make sense for a large software vendor such as Salesforce.com Inc., ServiceNow Inc. or SAP SE to make such a move. They all have their own little RPA plays within their walled gardens, whereas RPA/intelligent automation is really a horizontal play. It would have to be a major transformative chess move for a software acquirer.

Now, switching gears to Blue Prism and Pegasystems: Look at the position of Blue Prism on the vertical axis in the chart above. It’s very respectable. So as an acquisition for less than $2 billion in a large and growing market, that feels like a nice medium-sized pickup for a SS&C Technologies – a company with a $19 billion valuation and a strong stock performance.

And one last finer point on Pega: We’ve always said it’s not an RPA specialist but it has an RPA offering, a presence in the ETR data and a sizable market cap, so we like to include it.

Below is another look at the Net Score spending data.

The way Net Score works is that ETR asks customers: Are you adopting a platform for the first time? That’s the lime green. Are you accelerating spending on the platform by 6% or more relative to last year? That’s the forest green. Is your spending flat (the gray)? Is spending declining by 6% or worse; or are you churning and retiring the platform? That’s the bright red.

You subtract the reds from the greens and you get Net Score – which is shown for each company on the right along with the Ns in the survey.

So other than Pega, every company shown has new adoptions in the double digits, a very positive sign for the sector. UiPath and AA have Net Scores well over that magic 40% mark at 64 and 54, respectively. And we have some other data points on those two from peeling the ETR survey onion a bit more. Here are those nuggets:

By the way, we really believe that for both Automation Anywhere and UiPath, the time to value is much compressed relative to most technology projects historically. RPA generally gives pretty fast returns.

Let’s wrap up. The bottom line is that this space is moving – it’s evolving quickly and will keep on a fast pace given the customer pull, the funding levels that have been poured into the market and the competitive climate.

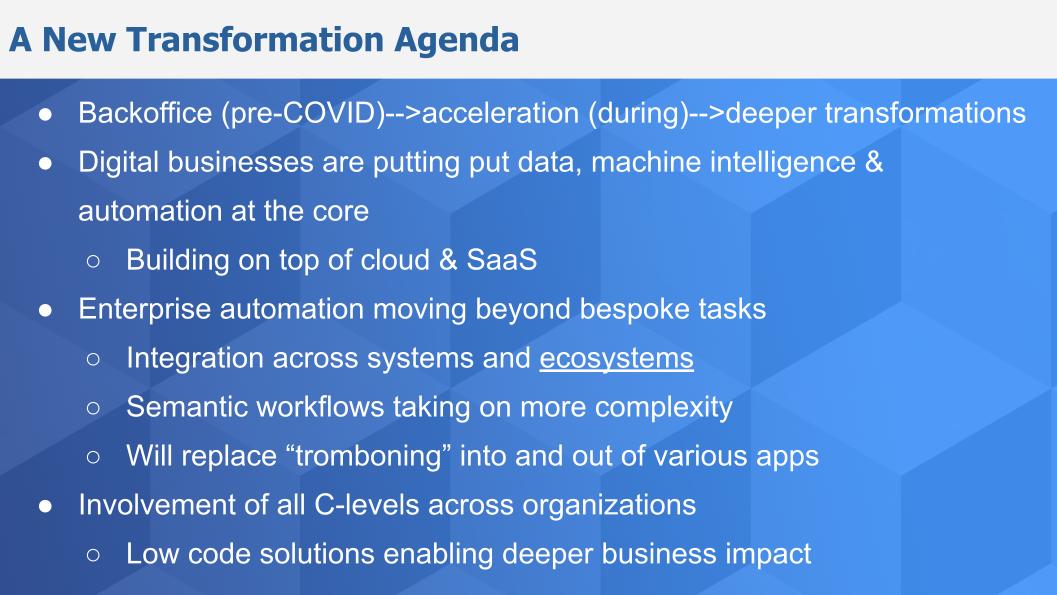

Expanded use cases. We’re seeing a new transformation agenda emerging. Pre-COVID the catalyst was back office efficiency. During the pandemic we saw an acceleration to drive efficiencies. Organizations are taking the lessons learned from that forced march to digital experience and realizing: 1) They can attack much more complex problems than previously envisioned; and 2) In order to cloudify and SaaS-ify their business, they need to put automation along with data and AI at the core to completely transform into a digital entity.

Cross-enterprise systems integration. We’re moving well beyond automating bespoke tasks and “paving the cowpath,” as we often like to say. And we’re seeing much more integration across systems like enterprise resource planning, human resources, finance, logistics, collaboration, customer experience… and importantly, this must extend into broader ecosystems through application programming interface integrations to drive further expansion and integration.

Tackling more complex problems. We’re also seeing a rise in semantic workflows to address more challenging problems. We’re talking here about going beyond a linear process automation of “read this, click on that, copy that, put it here, join it with that, drag and drop it over here and send it there” to much more interpretive actions using machine intelligence to watch, learn, infer and act… as well as discover other process automation opportunities. So think about the way work is done today – going into applications, grabbing data, tromboning back out and doing it again into and out of another system, and so on. Imagine replacing that with a much more intelligent process that learns, anticipates, senses and acts. That is the future of automation at work.

C-Suite execs are leaning in. We’re also seeing much more involvement from C-level executives, especially the CIO but also the chief digital officer, the chief data officer and line-of-business leaders benefiting from low-code solutions that enable many more players to be directly involved in putting automations to work.

Still early days. In our view, this sector hasn’t yet hit the steep part of the S curve. It’s still building momentum, with larger firms leading the innovation, investing in centers of excellence and training, digging in to find new ways of doing things. It’s a huge priority because the efficiencies drop right to the bottom line and the bigger you are, the more money drops. We see that in the adoption trends and we think it’s just getting started.

So keep an eye on this space – it’s not a flash in the pan.

Thanks to Stephanie Chan, who researched several topics for this episode, and to Alex Myerson on production. Alex handles the podcasts and media worklflows. And special thanks to Kristen Martin and Cheryl Knight, who help us keep our community informed and get the word out.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

THANK YOU