INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Intel Corp.’s future would be a disaster without Pat Gelsinger. But even with the chief executive’s clear vision, fantastic leadership, deep technical and business acumen and amazing positivity, the company’s future is in serious jeopardy.

It’s the same story we’ve been telling for years. Volume is king in the semiconductor industry and Intel no longer is the volume leader. Despite Intel’s efforts to change that dynamic with several recent moves, including making another go at its foundry business, the company is years away from reversing its lagging position relative to today’s leading foundries and design shops.

Intel’s best chance to survive as a leader in our view will come from a combination of a massive market, continued supply constraints, government money and luck – perhaps in the form of a deal with Apple Inc. in the mid- to long term.

In this Breaking Analysis, we’ll update you on our latest assessment of Intel’s competitive position and unpack nuggets from the company’s February investor conference.

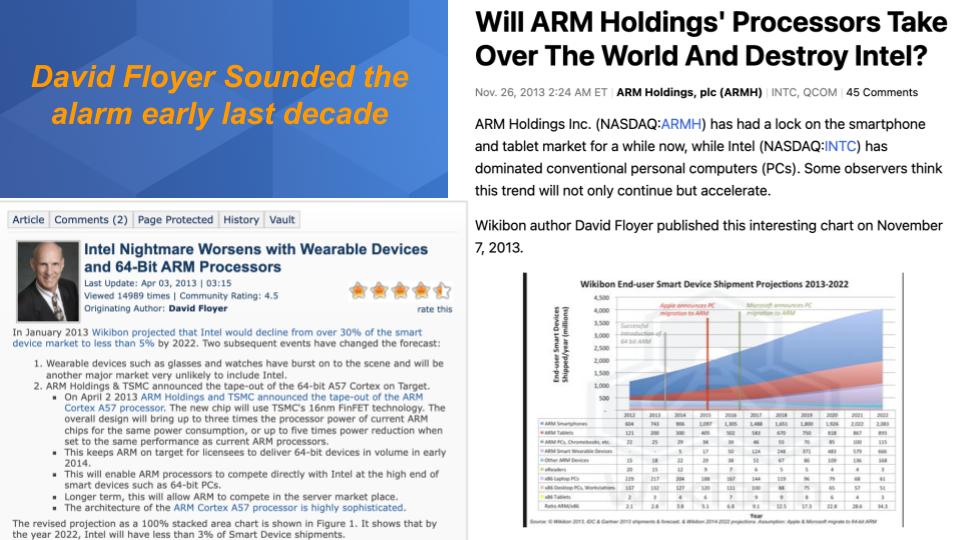

If you’ve followed this program and the Wikibon community, you know that our David Floyer sounded the alarm as far back as 2012, the year after personal computer volumes peaked. Yes, PC demand has ticked up and held well in the past couple of years, but unit volumes pale in comparison with those the Arm Holdings Ltd. ecosystem is producing.

The world has changed. Data volumes in Web 1.0 and 2.0 were largely driven by keystrokes and clicks. Web 3.0 is going to be driven by machines entering data. Sensors, cameras and other edge devices will drive enormous amounts of data and processing power. Every windmill, every factory device, every consumer device, every car will require processing at the edge to run AI, facial recognition and data intensive workloads. And the volume of this space compared with PCs and even the iPhone itself is about to be dwarfed by an explosion of devices.

Intel is not well-positioned for this new world, in our view. Intel has to catch up on process, architecture, security and, most of all, volume.

Intel’s biggest challenge remains volume leadership. The Arm ecosystem has cumulatively shipped 200 billion chips to date and is shipping 10 times Intel’s wafer volume. Intel must have an architecture that accommodates much more diversity and although it’s working on that, it is years behind.

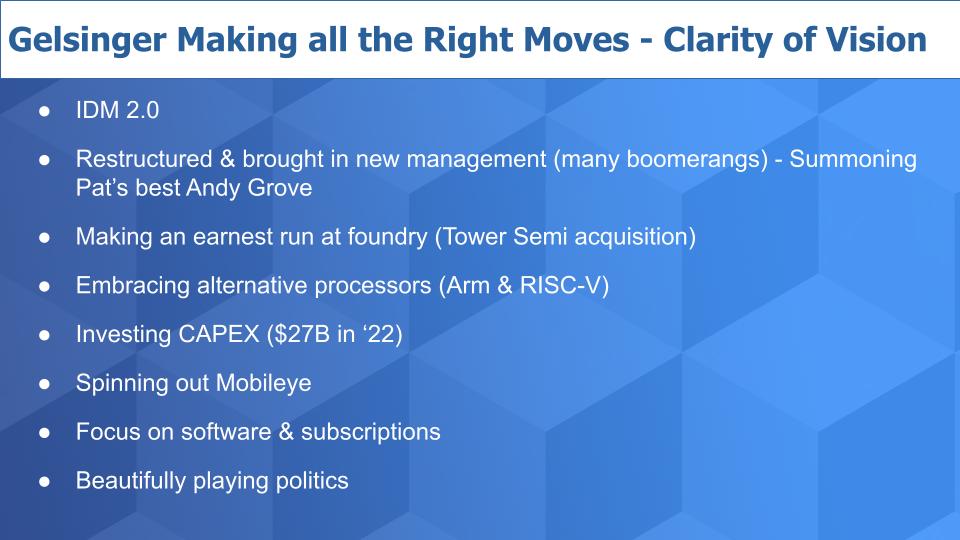

Above, we list some of the key moves Pat is making. The speed of change and sense of urgency he’s injecting into the company is both impressive and sorely needed.

A year ago he announced IDM 2.0 – a new integrated device manufacturing strategy that opened up its world to partners for manufacturing and open innovation.

Intel has restructured, reorganized and boomeranged in many previous Intel execs who understand the business and have a deep passion to help the company regain its prominence.

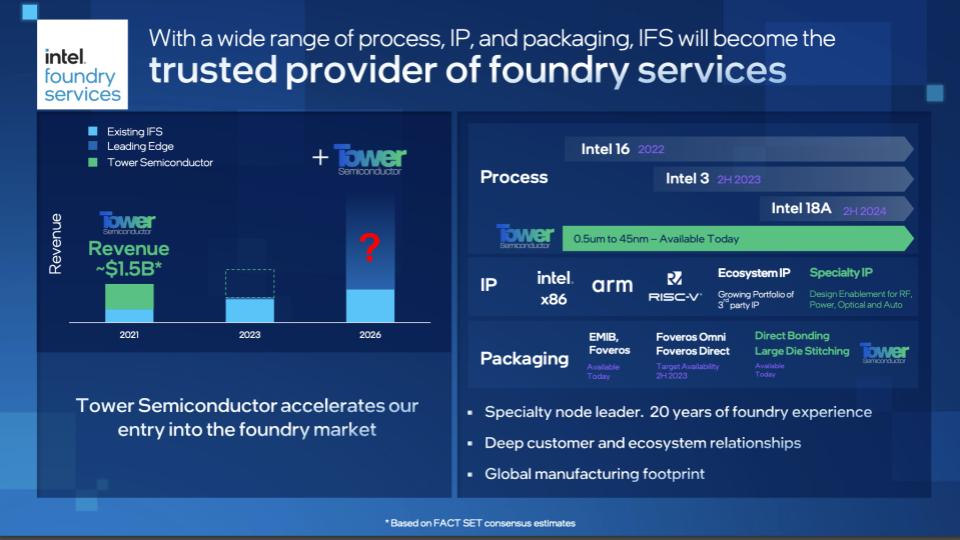

As part of the IDM 2.0 announcement, Intel created (recreated) a foundry division and recently acquired Tower Semiconductor to firm that up. It’s opening up to partnering with alternative processor manufactures and the company has announced major capital investments to build out foundry capacity.

Intel is going to spin out Mobileye – a company it acquired for $15 billion in 2017. The word is it’s trying to get a $50 billion valuation. Mobileye has about $1.4 billion in revenue and we would be surprised to see it valued at $50 billion. But Intel will get perhaps as much as $10 billion in cash from the transaction that it can use to fund fabs.

Intel is leveraging its 19,000 software engineers to move up the stack and sell more subscriptions and high-margin software.

And finally, Pat is playing politics beautifully – announcing, for example, fab investments in Ohio, which he dubbed Silicon Heartland – brilliant.

There’s little doubt Pat Gelsinger is moving fast and doing the right things.

Above are two pictures. On the left is Pat at his investor event in a T-shirt that says “Torrid” – that is, bringing back discipline to Intel and moving at an ultrafast pace. And on the right is Pat at the State of the Union address, looking sharp in shirt and tie. And he has said, “A bet on Intel is a hedge against geopolitical instability in the world.” That’s just so smooth.

A bet on Intel is a hedge against geopolitical instability in the world — Pat Gelsinger

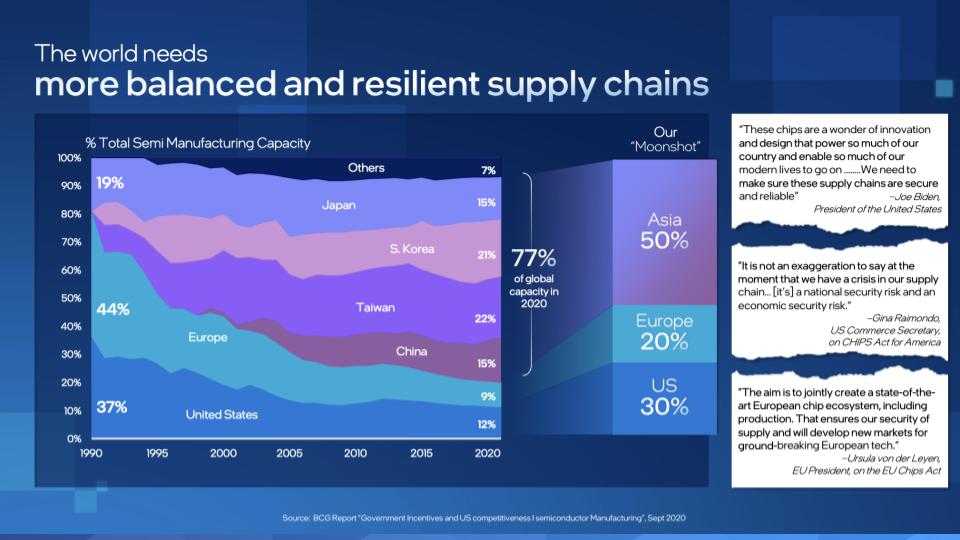

The graphic above shows that Western semiconductor manufacturing capacity has gone from 80% to 20%, and he wants to get it back to 50% by 2030 — and reset the supply chains in an an industry that has become as important as the energy sector, according to Gelsinger. Again – it’s just brilliant positioning and pushing all the right hot buttons.

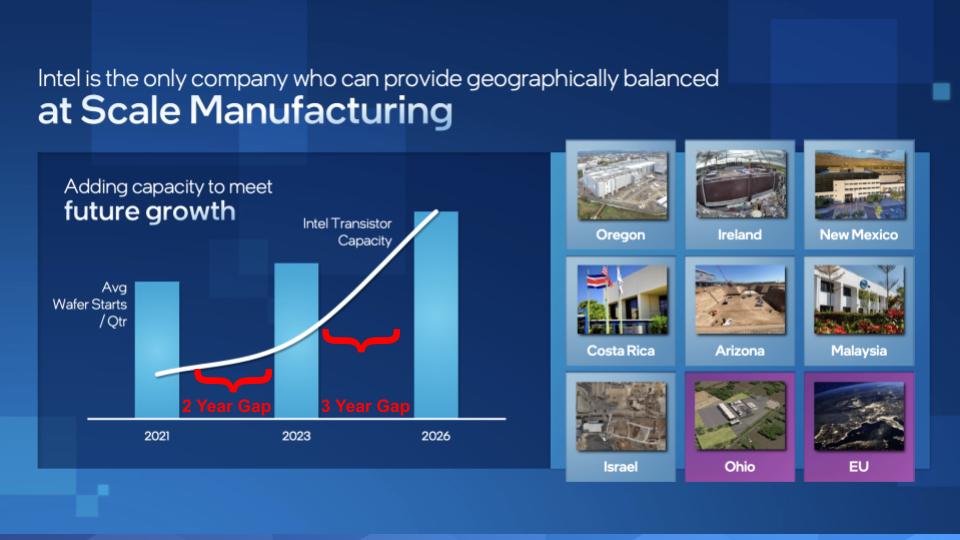

Below is a slide underscoring Intel’s global commitment to add capacity, showing manufacturing facilities around the world on the right with new capacity coming on line in the next few years in Ohio and in the European Union.

Pat mentioned the Chips Act in the U.S. and Europe as part of a public private partnership. No doubt he’s going to need all the help he can get.

On the lefthand side is a graph with no unit measures that shows Intel’s commitment to output. Now, we couldn’t resist. The chart shows Intel’s wafer starts on the bars and transistor capacity on the line over time and speaks to its volume aspirations. But we couldn’t help notice that the shape of the curve is misleading because it shows a two-year comparison and then widens the aperture to three years to make the curve look steeper. Fun with numbers! OK, maybe a nitpick, but these are some of the telling nuggets we pulled from the investor day and they’re important.

Pat went through a detailed analysis of the various Intel business and committed to mid- to high-double-digit growth by 2026.

Half of the growth will come from Intel’s traditional PC, data center & network/edge businesses and the rest from advanced graphics, high-performance computing, Mobileye and foundry. This sounds pretty good, but it has to be taken in context to the balance of the semiconductor industry. And this would be a pretty competitive growth rate in our view — especially for a $70 billion-plus company – so kudos to Pat for sticking his neck out on this one.

We focus now on the foundry side of Intel’s business because that’s the only way the company is going to get back the volume levels necessary to compete more effectively.

Pat built out this slide above showing the baby blue bar sections for today’s foundry business at just under a billion dollars and then he added on top an additional $1.5 billion in revenue for Tower Semiconductor. So he starts with a few billion dollars of foundry business in the near term. And then by 2026, the really fuzzy blue bar. Remember Taiwan Semiconductor Manufacturing Co. is the volume leader and has around $50 billion in revenue. So there’s definitely a market there and adding in Arm processors can only help volume if Intel can win the business – which it should be able to do given the likelihood of long-term supply constraints.

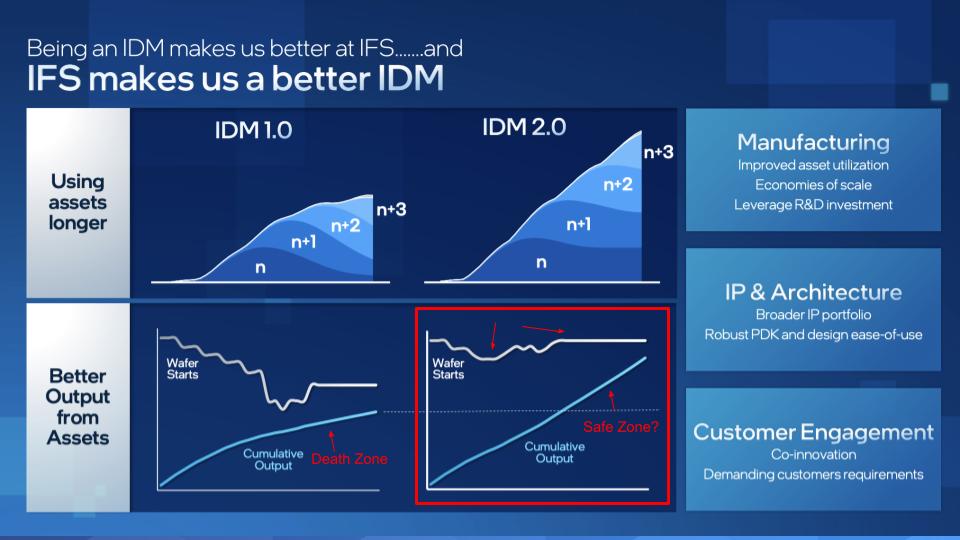

Above is another chart Pat presented at the investor event, which makes the case that foundry and IDM 2.0 will allow expensive assets to have a longer useful life. And that Intel has a solution to its cumulative output problem – highlighted in red at the bottom right.

We’ve talked at length about Wright’s Law – that is, for every cumulative doubling of units manufactured, costs will fall by a constant percentage. We like to say that benefit is around 15% in semiconductors. This law is vitally important to accommodate next-generation chips because they are always more expensive to produce at the start of a cycle and manufacturers need that 15% buffer to jump curves.

Our premise since PC volumes peaked is that Intel has not be able to take advantage of Wright’s Law to the same degree as its competitors. And that is the root of the company’s problems.

So let’s unpack this bit and ask: Does this chart above — the diagram at the bottom right — address our Wright’s Law concerns? Does Pat’s new IDM 2.0 put Intel back in a position to take advantage of Wright’s Law?

Note the decline in wafer starts and then a slight uptick and then a flattening. It’s hard to tell which years we’re talking about above. Intel is not going to share the sausage-making because it’s probably not pretty. But you can see on the bottom left the flattening of cumulative output – otherwise known as the death zone.

The chart on the bottom right appears to put Intel back on the curve to leverage Wright’s Law.

Assume for a second that the number of transistors you can get on a chip and the number of chips on a wafer is constant. And wafer yields are constant. Assume you produce 50 million units per year each year.

Your cumulative output looks like this: Year 1 = 50 million; year two = 100 million. By year two, your cumulative output = 100 million (doubles). It takes two years to take advantage of Wright’s Law.

By year three, your cumulative output is 150 million; year four = 200 million; year five = 250 million; year six = 300 million. It takes four years to double cumulative output and take advantage of Wright’s Law.

Keep going at flat wafer starts at 50 billion a year and… well, you get the point – it’s now eight years to get Wright’s Law to kick in and you’re dead.

In other words… you can grow the density of transistors on a chip, right?

Yes, that’s correct.

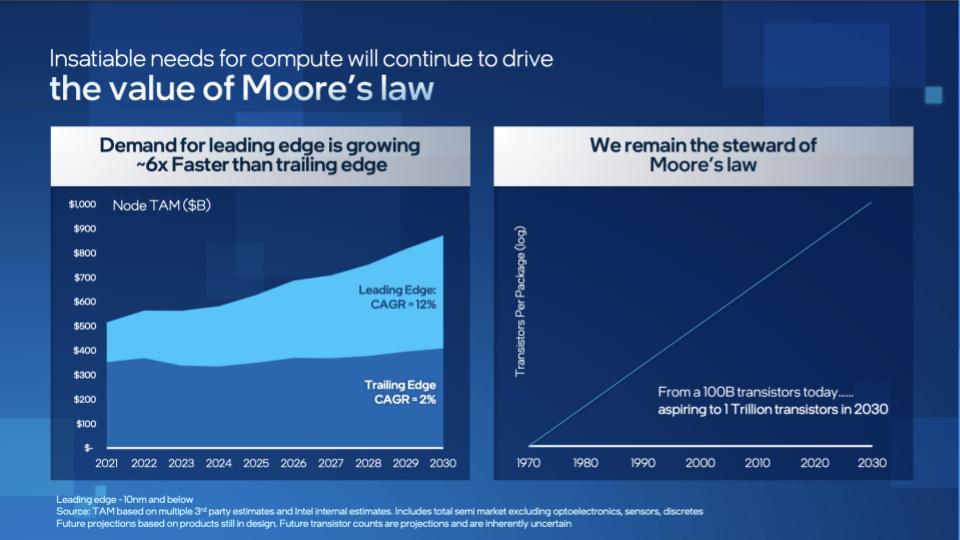

The graphic above on the left says all the growth is in new stuff. And we totally agree. It’s an enormous total available market: 1 trillion dollars. Now, Pat said that until we exhaust the periodic table of elements, Moore’s Law is alive and well and Intel is the steward of Moore’s Law.

Until we exhaust all the elements in the periodic table, Moore’s Law is alive and well and Intel is the steward of Moore’s Law – Pat Gelsinger

OK, that’s cool.

The chart on the right shows Intel going from 100 billion transistors per package today to 1 trillion by 2030 – hold that thought.

So Intel is assuming it will keep up with Moore’s Law, meaning a doubling of transistors on a chip every two years. We believe it. So bring that back to Wright’s Law and the previous chart, and it means that with IDM 2.0, Intel can get back to enjoying the benefits of Wright’s Law every two years — versus IDM 1.0, where it was failing to keep up.

OK – so Intel is saved, right?

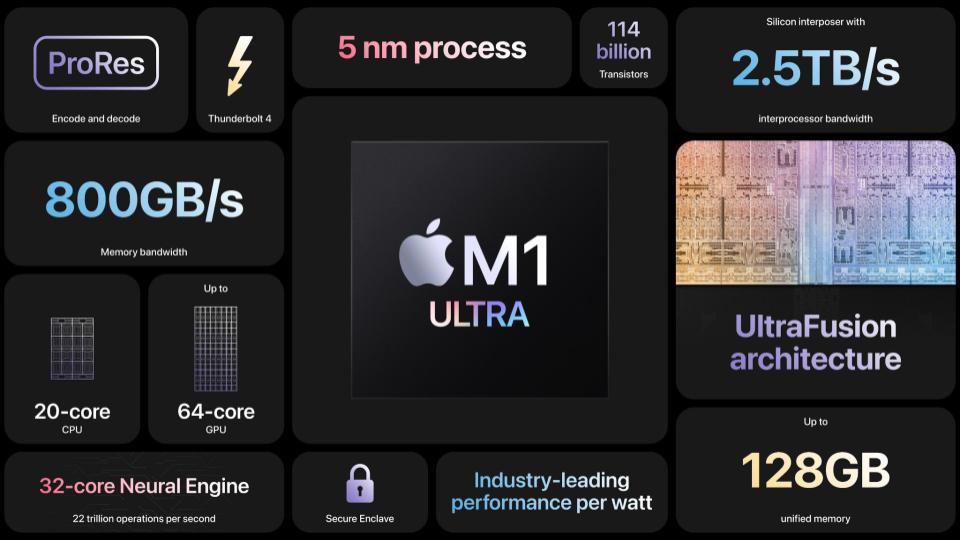

Let’s bring into this discussion one of our favorite examples – Apple’s Arm-based M1 chip.

The M1 Ultra is a new architecture. You can see the stats above – 114 billion transistors on a five-nanometer process with some other impressive specs.

The M1 Ultra has two chips bonded together. Apple put an interposer between the two chips. An interposer is a pathway that allows electrical signals to pass through onto another chip. Apple has created a superfast connection at an amazing 2.5 terabytes per second!

But the brilliance is the two chips act as a single chip. So you don’t have to change the software at all. The way Intel’s architecture works is that it takes two different chips on a substrate and each has its own memory. The memory is not shared.

Apple shares the memory for the central processing unit, the network processing unit, the graphics processing unit – all of it is shared, meaning it needs no change in software to run programs.

Intel is working on a new architecture, but Apple and others are well ahead.

Let’s make this really straightforward. The original Apple M1 had 16 billion transistors per chip. As you can see above, the recently launched M1 Ultra has 114 billion transistors per chip. If you take into account the size of the chips – which is increasing – and the increase in the number of transistors per chip, Apple has increased the number of transistors per chip by a factor of six times in just 18 months.

Apple with its Arm-based package: six times every 18 months.

Intel: two times every 24 months (at best).

Apple, with its Arm-based package, is on a curve to increase transistor density by 6X every 18 months; compared to Intel at 2X…

Remember, Advanced Micro Devices Inc. and Nvidia Corp. are close to Apple’s curve as well, because they can take advantage of TSMC’s learning curve.

So with Moore’s Law alive and well, Intel gets to 1 trillion transistors by 2030, while the Apple, Arm and Nvidia ecosystems will arrive at that point years ahead of Intel. That’s not to mention Amazon Web Services Inc. with Graviton and other processors. And Microsoft Corp., Google LLC and Alibaba Group Holding Ltd., which are following in Amazon’s footsteps.

That means lower costs and a significantly better competitive advantage for Intel’s competition.

Pat’s presentation, while superpolished, cogent and compelling, really didn’t resonate with investors. Gelsinger inherited a mess and it shows in the chart below comparing Intel’s stock performance with some of its major competitors.

On Feb. 18, the day after its investor meeting, the stock was off. It has rebounded a little, but investors are probably prudent to wait unless they have a really long-term view.

In his presentation, Pat talked about five nodes in four years and shared several proof points around Alder Lake and Meteor Lake and other nodes. But Intel just delayed Granite Rapids last month – pushed it out from 2023 to 2024. We fear the first disappointment, with regard to delays, won’t be the last.

And Intel told investors that it has to boost spending to turn this ship around – which is absolutely the case. So how else would you expect investors to react? As we’ve said many times, it’s very difficult… actually, it’s impossible to quickly catch up in semiconductors. And Intel will never catch up without volume.

So we’ll leave you by reiterating a scenario that could save Intel and that’s if its foundry business can eventually win back Apple to supercharge its volume story. It’s going to be tough to wrestle that away from TSMC… especially as TSMC is setting up shop in Arizona. But look, maybe the government cuts deal with Apple as part of the Chips Act and says you have to throw some business to Intel. Would that be enough when combined with the other foundry opportunities Intel could theoretically produce?

Maybe, but from this vantage point, it’s very unlikely Intel will gain back its true No. 1 leadership position. If it truly was paranoid back when David Floyer sounded the alarm 10 years ago – yeah, that would have maybe made a difference.

Honestly, the best we can hope for is that Intel’s strategy and Pat’s leadership allow the company to get to competitive volumes by the end of the decade. And then maybe this national treasure survives to fight for its leadership in the 2030s… because it would take a miracle for that to happen in the 2020s.

What do you think?

Thanks to David Floyer, who collaborated on this and all our semiconductor research. Stephanie Chan does a lot of background research for Breaking Analysis. Alex Myerson does our production and handles the podcasts and all the digital media workflows. And special thanks to Kristen Martin and Cheryl Knight, who help us keep the community informed and get the word out, and Rob Hof, SiliconANGLE’s editor-in-chief, for his ongoing contributions.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.