INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

After two years of pandemic-fueled, double-digit growth, shipments of personal computers fell by more than 5% in the first quarter of this year from the same period a year ago.

However, International Data Corp. said in its report released today that although the decline is a reflection of both higher costs and market saturation in some segments of the PC market, it’s by no means a “downward spiral.”

For instance, even though shipments of notebooks declined year-over-year, desktop sales witnessed slight growth. Plus, the numbers exceeded IDC’s own forecast.

In other words, IDC believes the PC market is a strong one. PC makers still managed to ship more than 80 million desktops, notebooks and workstations throughout the first quarter, the seventh consecutive quarter that milestone has been achieved. Before the pandemic, the industry has to go back to 2012 to find the last quarter so many PCs were shipped.

IDC Group Vice President Ryan Reith said PC shipments would likely have been higher if not for the renewed supply chain and logistics challenges caused by COVID-19-related lockdowns in China, which is persisting with its zero-COVID strategy despite a recent rise in cases.

Reith added that although the education and consumer PC markets slowed down a bit, demand for commercial PCs remains very strong.

“We also believe that the consumer market will pick up again in the near future,” Reith continued. “The result … was PC shipment volumes were near record levels for a first quarter.”

Regarding the encouraging forecast, IDC Research Manager Jay Chou said there’s a lot of unfulfilled demand in the market. That’s especially true for buyers of higher-end PCs in emerging markets. Assuming vendors can ship their products to these markets, that could offset slowing sales in other markets and segments.

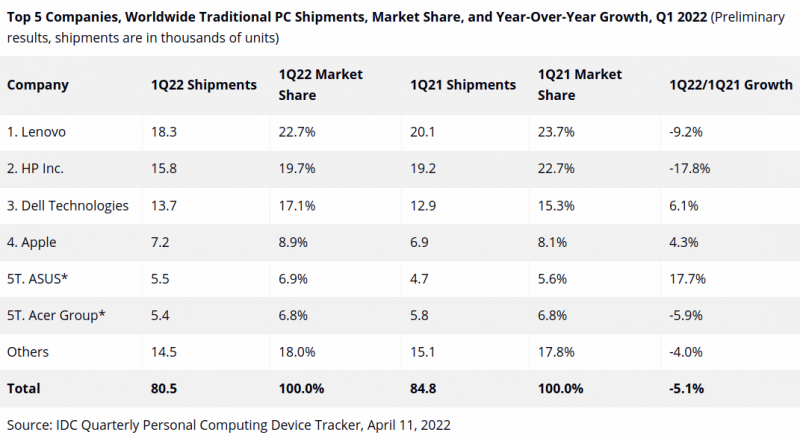

Lenovo Ltd. once again led the way as the world’s top PC manufacturer with 22.7% of all shipments during the quarter. HP Inc. came second with a 19.7% share of the market, while Dell Technologies Inc. was third with 17.1% of the market. Fourth place went to Apple Inc. with 8.9%, while the Taiwanese brands ASUSTek Computer Inc. and Acer Inc. were tied for fifth place with 6.9% of shipments each.

Lenovo, HP and Acer all saw their total market share decline in the quarter, while Dell, Apple and Asus enjoyed growth. The top five PC vendor rankings have remained more or less the same for the past few years.

THANK YOU