INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Advanced Micro Devices Inc. might have beaten expectations today as it posted its second-quarter results, but it was unable to set aside fears of an imminent slowdown in the chipmaking industry as it offered guidance for the current quarter that came in below expectations.

The company reported earnings before certain costs such as stock compensation of $1.05 per share on revenue of $6.55 billion for the quarter, up by an impressive 70% year-over-year. That was just ahead of Wall Street’s targets, with analysts modeling earnings of $1.03 per share on sales of $6.53 billion. AMD also reported operating income of $526 million, with net income for the period coming to $447 million.

It was a solid quarterly performance by AMD, but investors were more concerned with the company’s prospects going forward, and those are apparently less than impressive. For the third quarter, AMD is guiding revenue of $6.7 billion, an estimate that trails Wall Street’s forecast of $6.83 billion. That caused some investors to bail on the company. AMD’s stock, which had gained almost 3% in the regular trading session, lost more than 6% after-hours.

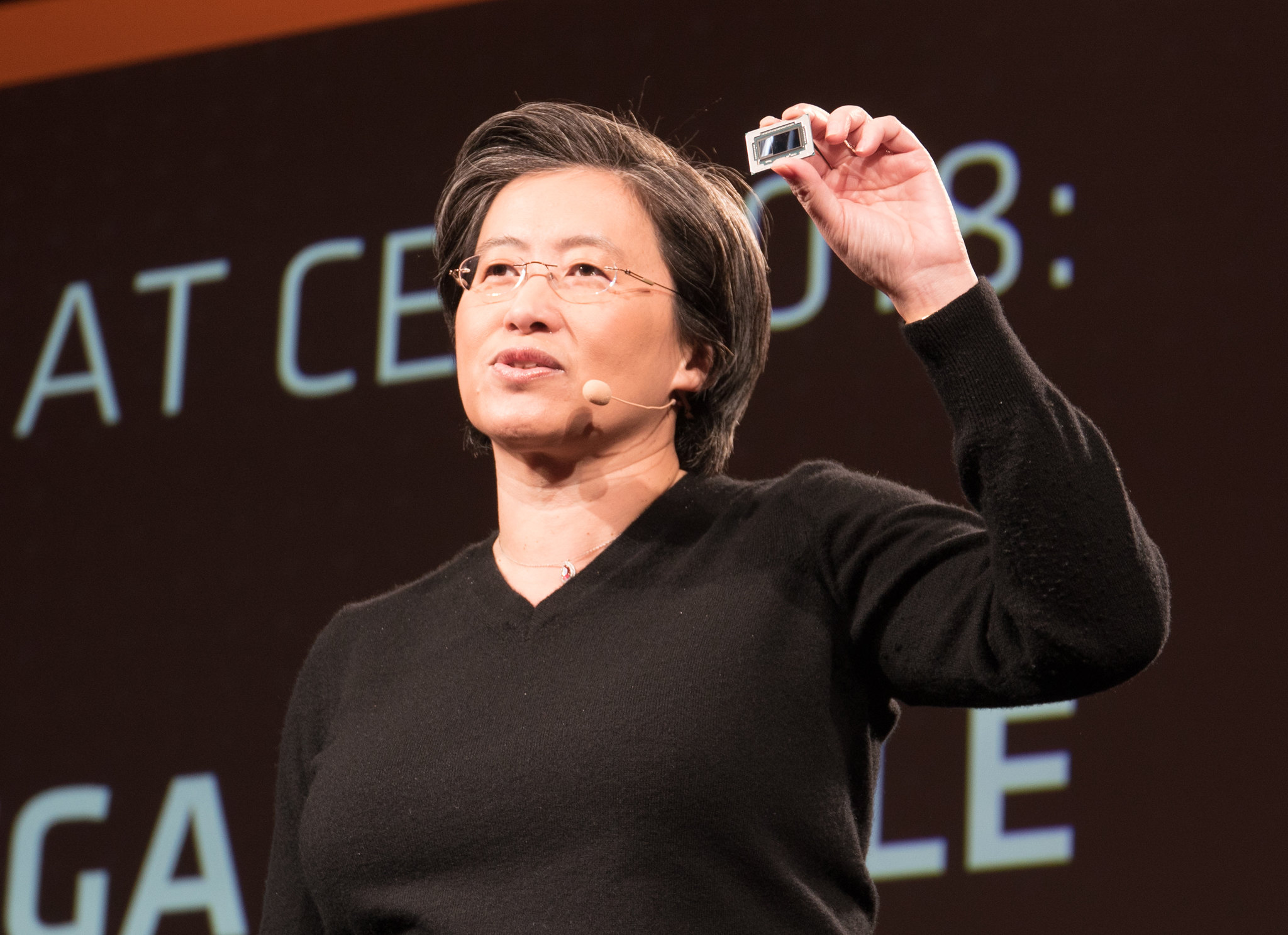

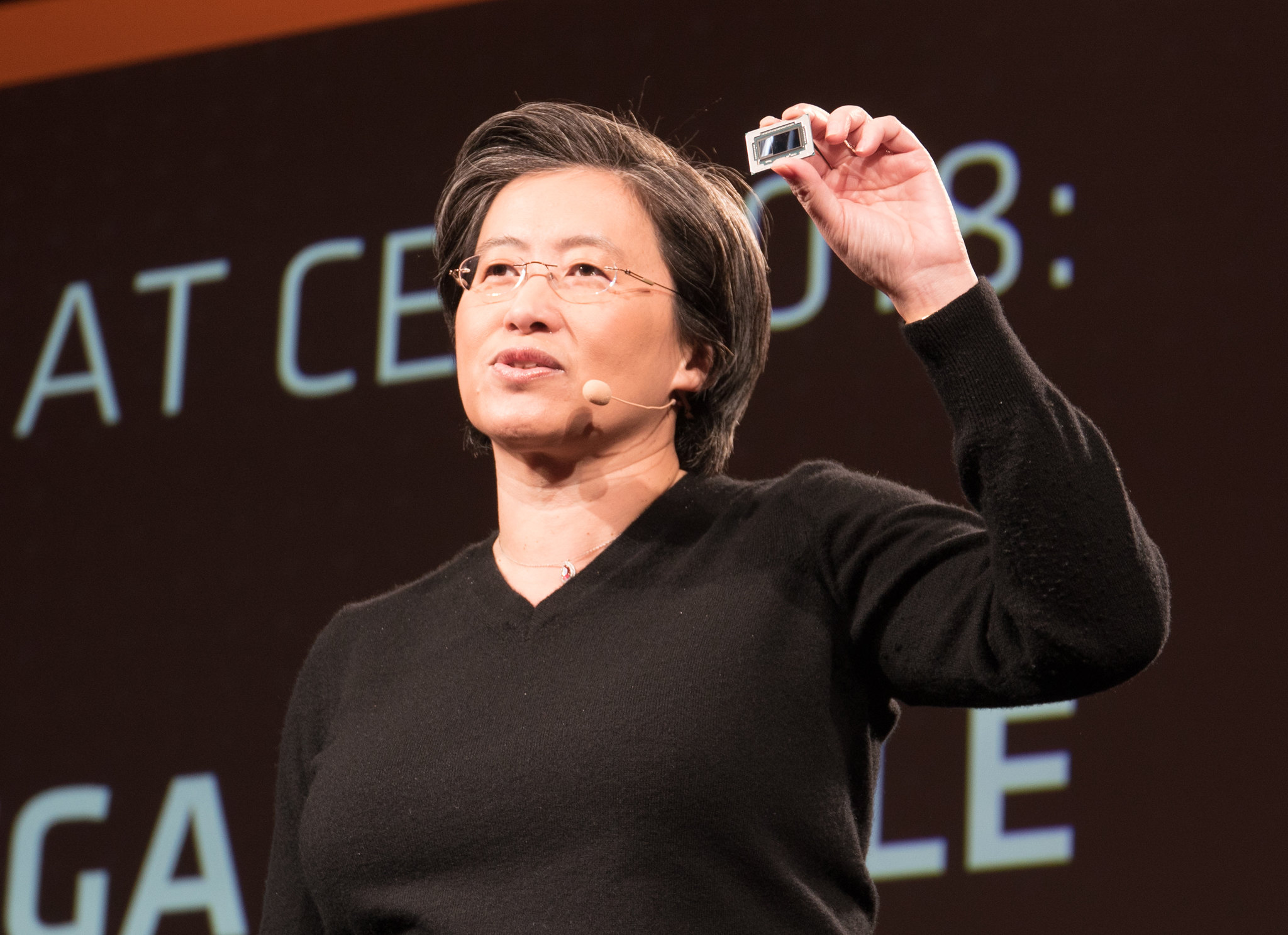

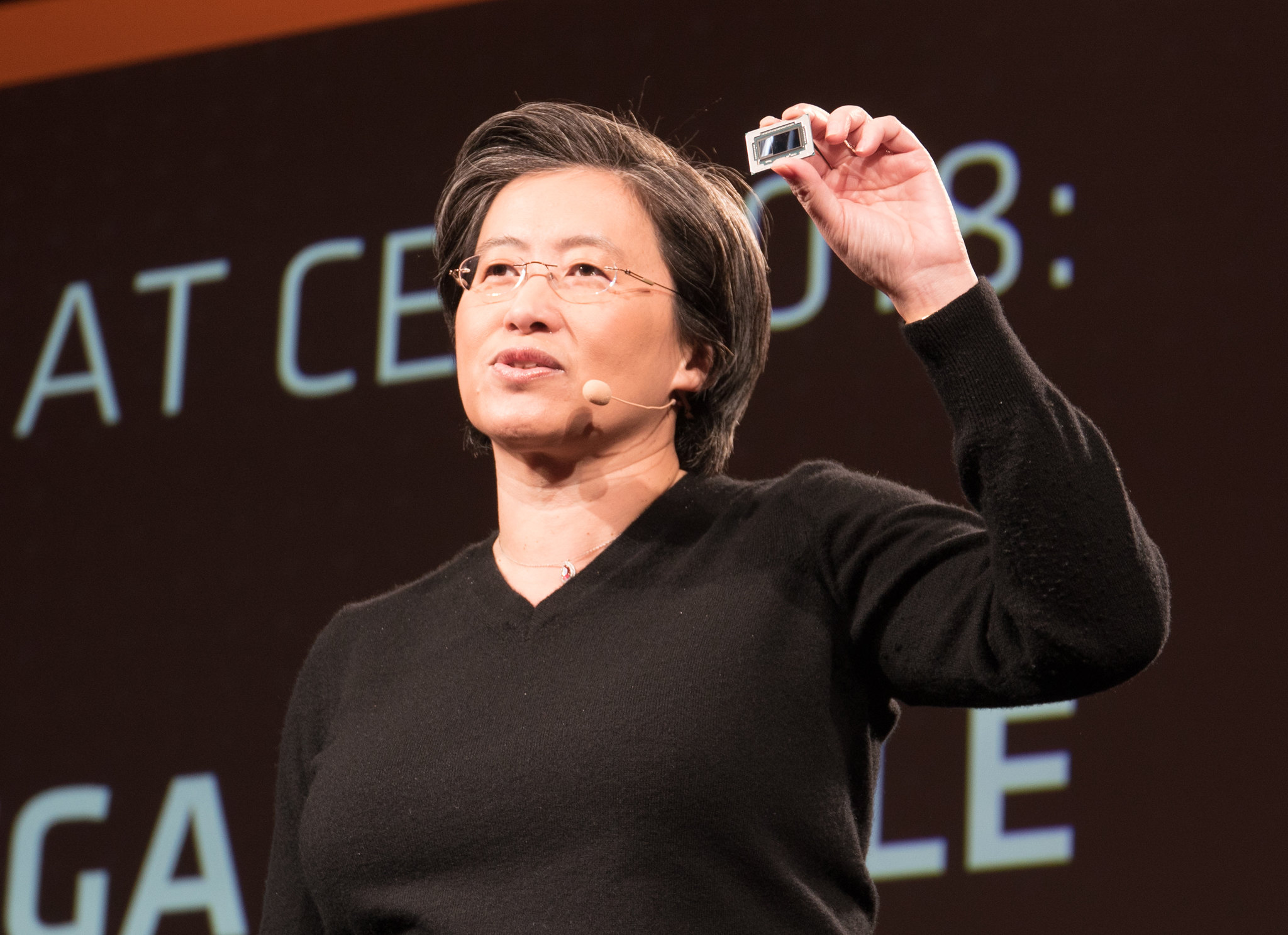

AMD Chairwoman and Chief Executive Lisa Su (pictured) sought to focus on the company’s achievements, reiterating how the company delivered an eighth successive quarter of record revenue.

“Each of our segments grew significantly year-over-year, led by higher sales of our data center and embedded products,” Su said in a statement. “We see continued growth in the back half of the year highlighted by our next generation 5nm product shipments and supported by our diversified business model.”

Analysts say AMD has a significant opportunity in front of it because its chief competitor in the personal computer and server chip market, Intel Corp., recently admitted it has stumbled badly with poor execution. Most observers rate AMD’s current generation silicon as being superior to Intel’s in terms of performance. Moreover, Intel is reportedly struggling to deliver on its next-generation computer chips, constantly missing deadlines. So investors are keeping a watchful eye over AMD to see if it has the smarts to take advantage and secure a bigger slice of the chip market for itself, at the expense of its rival.

All the signs suggest it can do that. During the second quarter, all four of its major business units achieved strong growth. The star of the show was AMD’s data center unit, which includes server chips for cloud computing providers like Amazon Web Services Inc. and Microsoft Corp., as well as large enterprises that operate their own data centers. AMD said data center chip sales jumped 83% from the same period a year earlier. Moreover, it said it doesn’t anticipate any slowdown in demand.

Holger Mueller of Constellation Research Inc. said the performance of AMD’s EPYC server chips in the data center was the primary driver of its growth in the quarter, with the company securing notable wins with cloud providers Google LLC and Oracle Corp. “Infrastructure-as-a-service vendors are putting AMD’s chips to use in data centers around the world, motivated by client demand and superior performance,” he added.

Revenue from AMD’s Client Computing business, which includes chips for personal computers, grew by 25% to $2.2 billion, despite alarm bells ringing elsewhere that suggest computer sales are now in decline following a two-year coronavirus-fueled boom. Within this segment, AMD said the growth was largely due to mobile processor sales, meaning chips for laptops.

In a conference call, Su said the company’s PC business might struggle during the next quarter. “We have taken a more conservative outlook on the PC business, so a quarter ago we would have thought the PC business would be down… let’s call it high single digits,” Su said. “Our current view of the PC business is that it will be down mid-teens.”

Su did insist that her company is taking market share in both the server and the PC markets.

Another highlight for AMD was chips for consoles such as the PlayStation 5 and Xbox Series X. It said gaming chip sales rose 32% to $1.7 billion, helping to offset a decline in graphics processors for gaming PCs. Finally, AMD said its embedded segment, which encompasses chips for networking and cars, delivered $1.3 billion in sales, up more than 22-fold thanks to the company’s acquisition of Xilinx Inc.

Mueller said AMD’s smaller net profit at the end of the quarter was because the company decided to double its write-down relating to the acquisition of Xilinx. “It makes sense to pay for this on a good day rather than a rainy day, as rainy days could be coming for AMD soon,” he said.

Analyst Charles King of Pund-IT Inc. said AMD’s stock fell after-hours on its reduced outlook, though he added that the theatrical saber-rattling from China over U.S. House Speaker Nancy Pelosi’s visit to Taiwan and an overall poor day on Wall Street may have also influenced that. “It’s worth pointing out that in the month prior to this earnings call, AMD’s shares moved from a low of $73.67 to over $100 earlier today,” King said. “The company’s cautionary outlook may have persuaded some investors to capture gains while the going is good, and check back after the dust settles.”

Patrick Moorhead of Moor Insights & Strategy told SiliconANGLE that AMD had a great quarter with impressive results across the board. He added that he didn’t believe the company’s lower guidance warranted an after-hours selloff.

“My biggest macro takeaway is how different AMD is today,” Moorhead said. “It used to grow in different pockets here or there. One quarter consoles did well, another servers would do well, and then another it would be PCs. This quarter, it was the whole package with end-to-end growth in many different businesses.”

During the quarter just gone, AMD announced a new generation of PC chips called the Ryzen 7000 series that’s based on a five-nanometer Zen 4 architecture. The company also introduced an updated product roadmap, saying its next-generation laptop processors, codenamed Phoenix Point, are expected to arrive in early 2023 based on Zen 4 cores but using a four-nanometer manufacturing process.

THANK YOU