APPS

APPS

APPS

APPS

APPS

APPS

Shares in PayPal Holdings Inc. surged in late trading after the financial services firm delivered stronger-than-expected second-quarter results and confirmed Elliott Management Corp. as an investor.

For its second quarter ending June 30, PayPal reported a profit before costs such as stock compensationof 93 cents a share, down 19% from the same quarter of last year. Revenue rose 10%, to $6.81 billion. Analysts had been expecting an adjusted profit of 86 cents per share on revenue of $6.79 billion.

Operating cash flow in the quarter came in at $1.5 billion and free cash flow at $1.3 billion, up 12% and 22% year-over-year, respectively. Total payment volume rose 9%, to $339.8 billion.

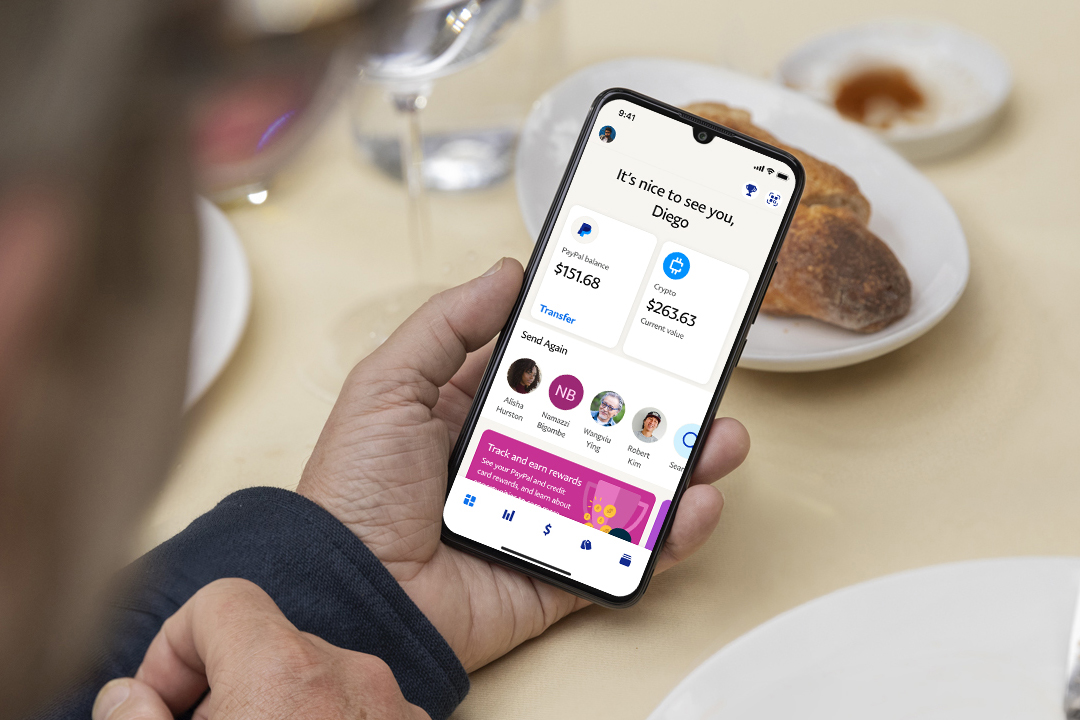

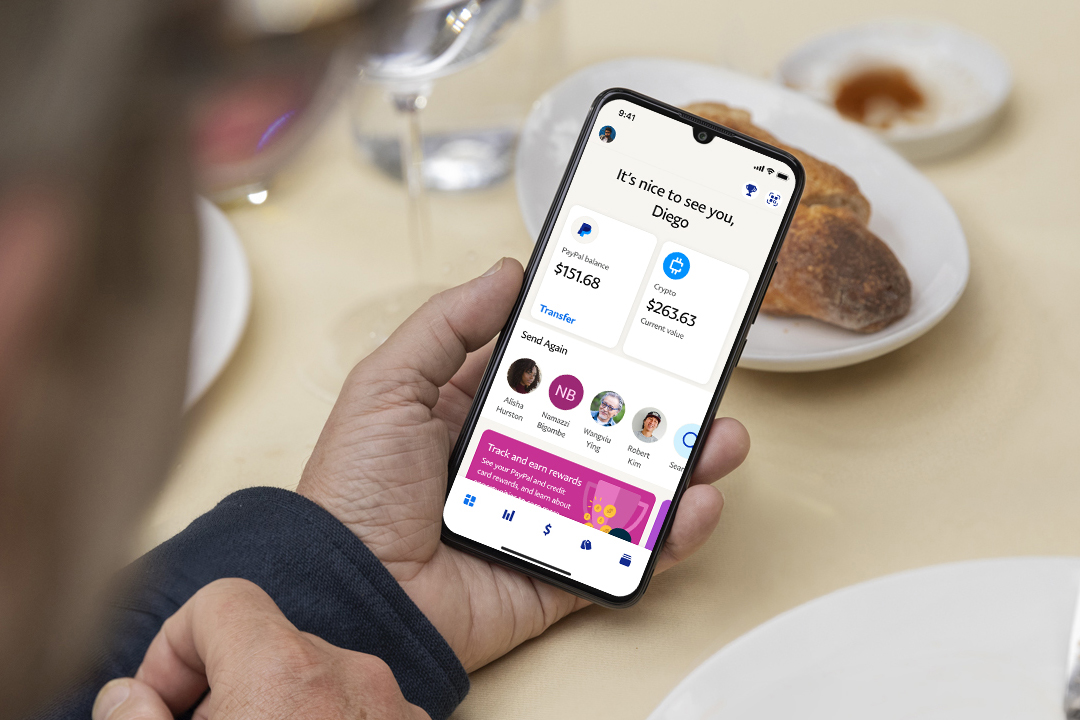

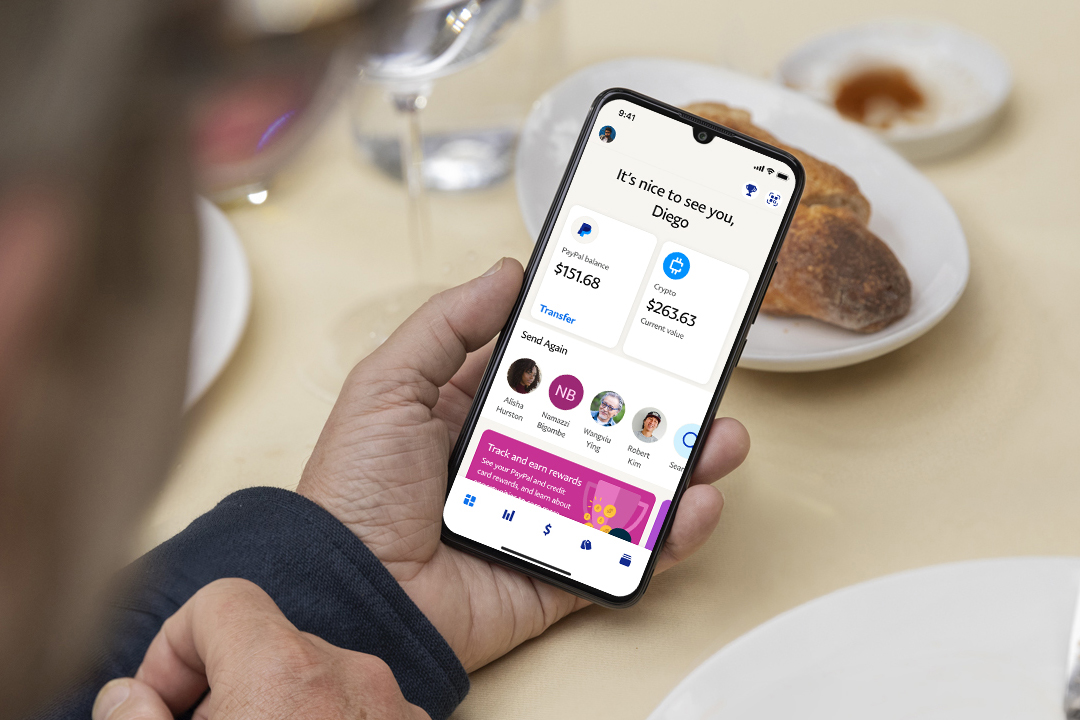

Highlights in the quarter included the rollout of new credit offers for small to medium-sized enterprises, including the PayPal Business Cashback Mastercard in the U.S. PayPal also announced expanded cryptocurrency features in June to allow users to send and receive cryptocurrency to and from other wallets.

“Our second-quarter results were solid with currency-neutral revenue and non-GAAP earnings growth exceeding expectations,” PayPal President and Chief Executive Officer Dan Schulman said in the earnings release. “We continue to gain share as we execute across our key strategic initiatives, even as we drive operational efficiency across our business.”

Along with the regular financials, PayPal also authorized a $15 billion share buyback scheme and a cost-savings program and confirmed that Elliott Management has taken a strategic stake in the company. Elliott, well-known as an activist fund, now holds a $2 billion stake in PayPal and is a key driver in PayPal’s cost-savings program.

Schulman confirmed that discussions on improving the business with Elliott are ongoing. “Our discussions are focused on operational improvements, revenue-generating investments and capital allocation and they are consistent with our short and long-term objectives and plans,” Schuman said.

In the third quarter, PayPal expects an adjusted profit of 94 to 96 cents a share on revenue of $6.8 billion. For the full year, PayPal is predicting a profit of $3.87 to $3.97 per share on revenue of $1.4 trillion.

The combination of an earnings beat and confirmation that Elliot Management has taken a stake in the company caused PayPal’s share price to surge almost 12% after the bell.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.