APPS

APPS

APPS

APPS

APPS

APPS

Arc Technologies Inc., a startup that’s providing an alternative source of funding for other startups, said today it has raised $20 million in a traditional funding round.

Today’s Series A round was led by Left Lane Capital and included participation from a host of other investors, including NFX, Y Combinator, Clocktower Technology Ventures, Torch Capital, Atalaya, Bain Capital Ventures, Soma, Alumni Ventures and Dreamers VC.

Arc was founded in 2021 and offers startups with an alternative source of funding to venture capital through an array of financial products and services. The basic premise is that it allows startups to convert their future revenue into upfront capital, while providing tools to manage their finances. In this way, startups don’t have to give up equity to get funding to get their ideas off the ground.

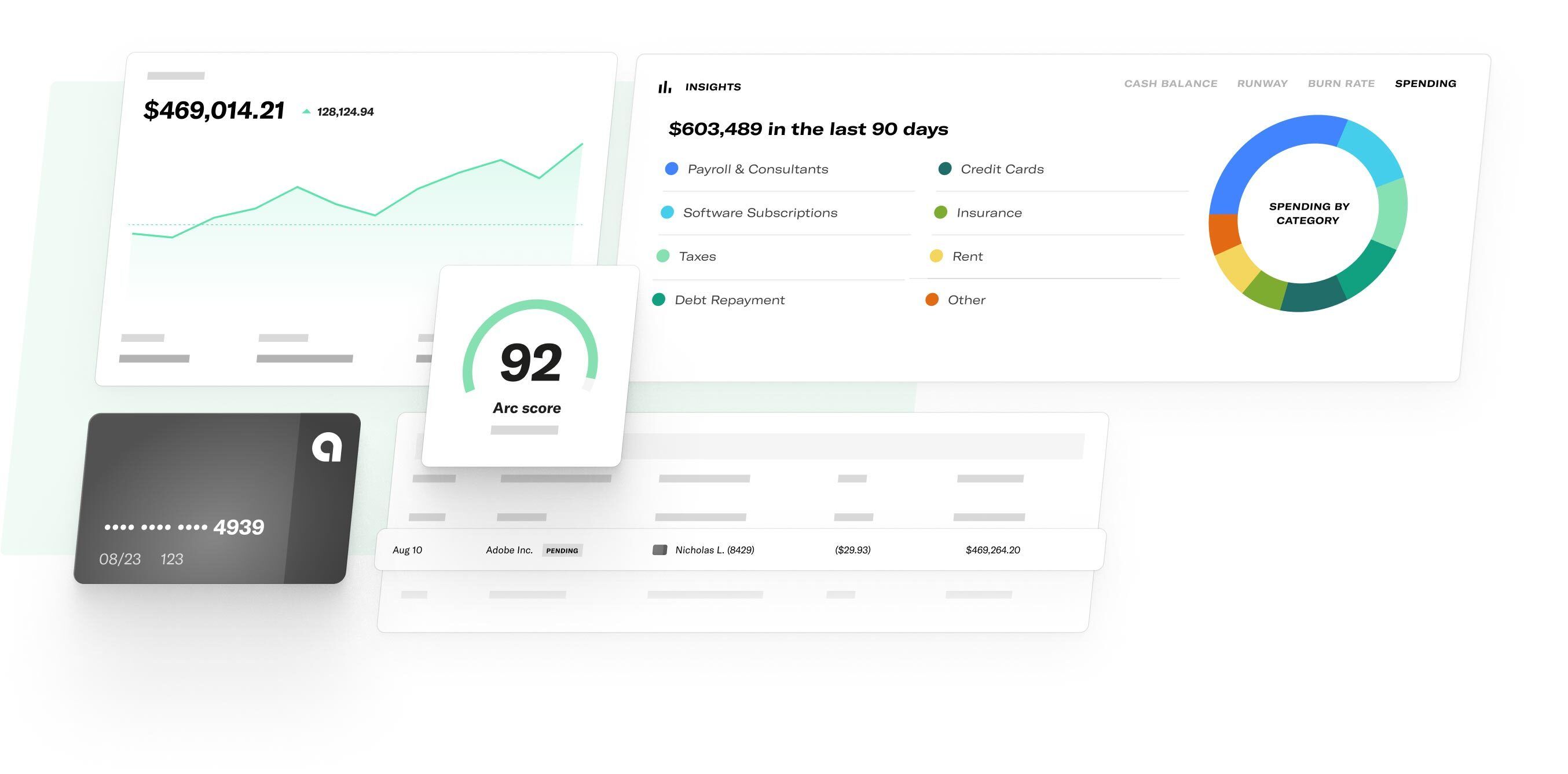

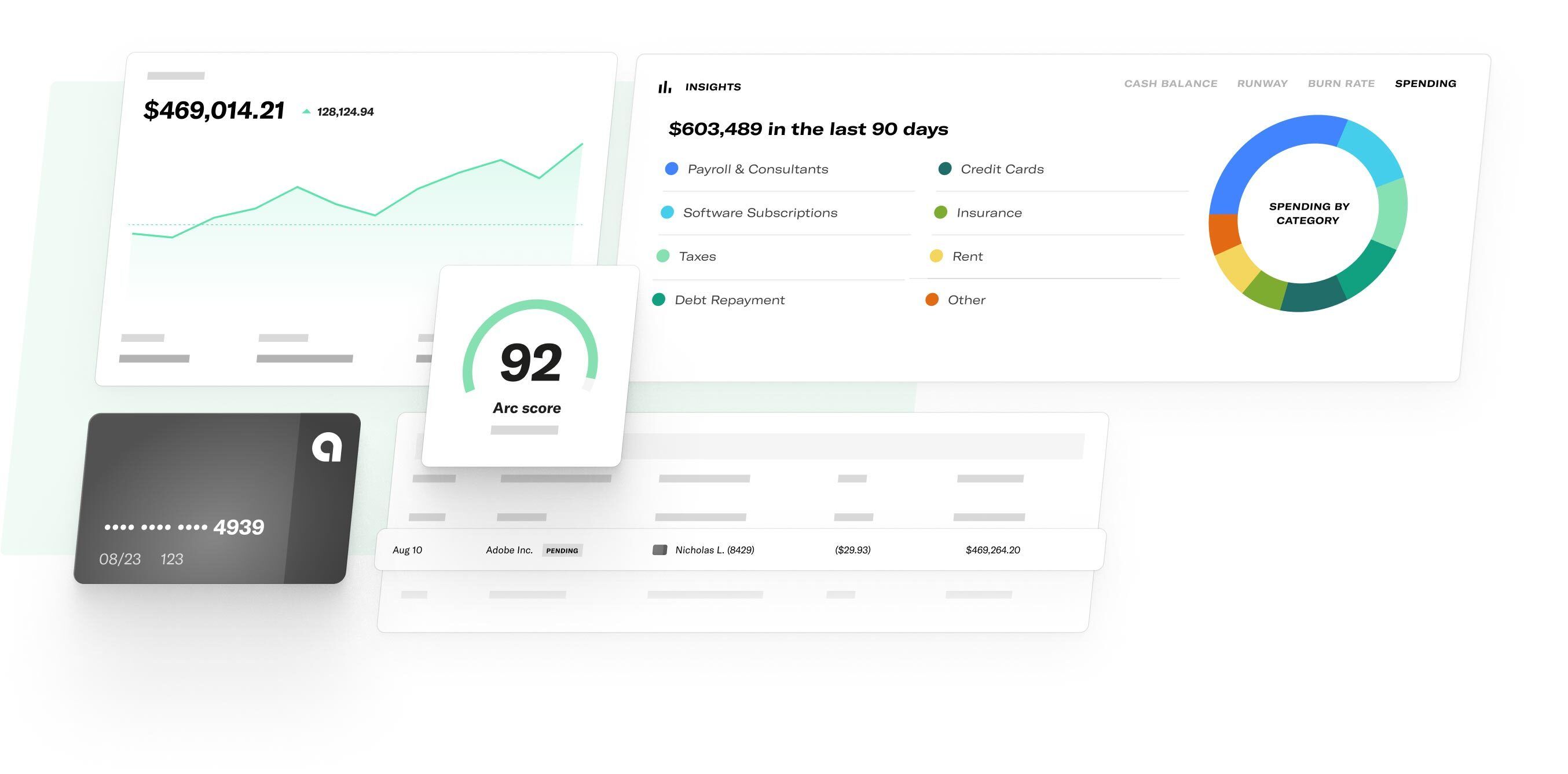

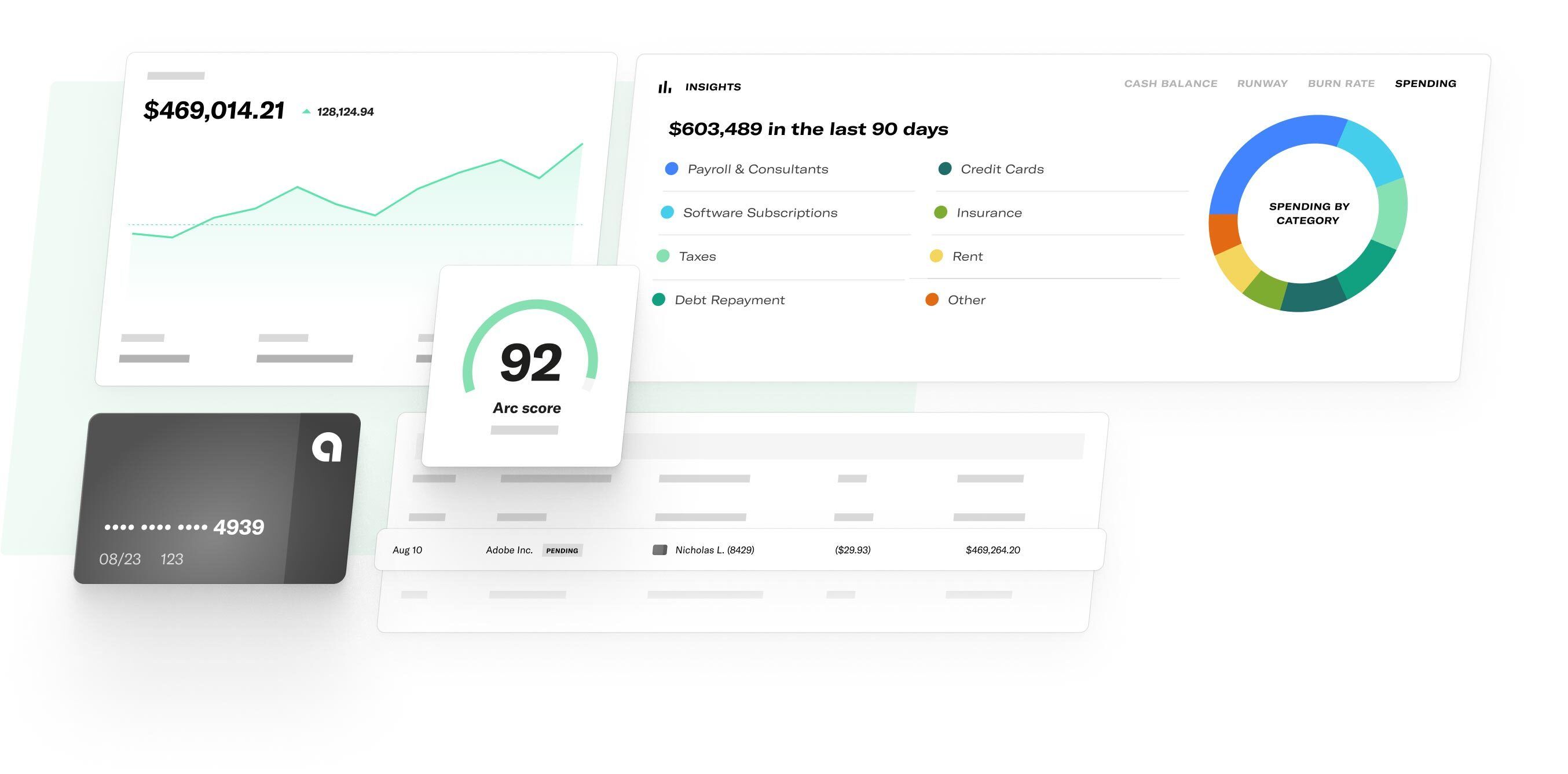

According to Arc co-founder and Chief Executive Don Muir, the company can be thought of as a “digital bank for software startups.”

“For the first time, startups can tap into their future revenue to access capital without dilution, deposit those funds into an FDIC-eligible account, and leverage proprietary finance software to optimize growth,” Muir said in a statement.

In June, Arc announced the launch of Arc Treasury, which was built in partnership with Stripe Inc. and is described as a “digitally native and vertically integrated deposit account.” Through this, startups can access a variety of banking services, including instant deposits, checking, card issuance, money movement, spend control and FDIC insurance products. It also enables future revenue to be transformed into immediate capital.

“This capital injection will help us build and scale Arc Treasury to meet the digital banking needs of a new generation of software-driven businesses,” Muir added.

Holger Mueller of Constellation Research Inc. said Arc is onto something good with its alternative funding platform. While funding is the lifeblood of startups, they face significant challenges in getting the attention of investors and securing money from them. “It’s good to see an alternative approach to financing with Arc, which provides a very interesting alternative to VCs and angel investors with its non-dilutive approach,” he said. “Ultimately and ironically, Arc also needs capital itself, so it deserves congratulations for today’s investment round.”

Arc reckons it has attracted a lot of interest from startups since it announced its seed funding round in January. Today, it supports more than 1,000 fledgling companies through its platform and has deployed “tens of millions of dollars in volume.” It adds that its revenue has grown by 250% each month since the fourth quarter of 2021.

Dan Ahrens, managing partner at Left Lane Capital, said he’s backing Arc because it’s setting a new industry standard by allowing early-stage startups to spend money without giving up equity. “We’re confident that the Arc team has the leadership, vision and expertise to redefine the alternative financing category and help startups grow sustainably, innovate and create new markets as we enter the next era of the economy,” he said.

THANK YOU