CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Salesforce Inc. shares dropped in late trading today after the cloud-based software company came up short in its quarterly and full-fiscal year outlook.

For its second quarter ended July 31, Salesforce reported a profit before costs such as stock compensation of $1.19 a share, down from $1.48 per share in the same quarter last year. Revenue rose 22%, to $7.72 billion. Analysts had expected an adjusted profit of $1.02 a share on revenue of $7.69 billion.

Subscription and support revenue in the quarter rose 21% year-over-year, to $7.14 billion, and professional services revenue rose 35%, to $580 million. Adjusted operating margin was 19.9%. Cash flow fell 13% from a year ago, to $330 million, and remaining performance obligation at the end of the quarter rose 15%, to $41.6 billion.

Highlights in the quarter included Salesforce entering the nonfungible token business in June. The service allows brands to create and sell NFTs representing virtual items such as artwork and games. Along with its latest earnings, Salesforce also announced a $10 billion stock buyback program.

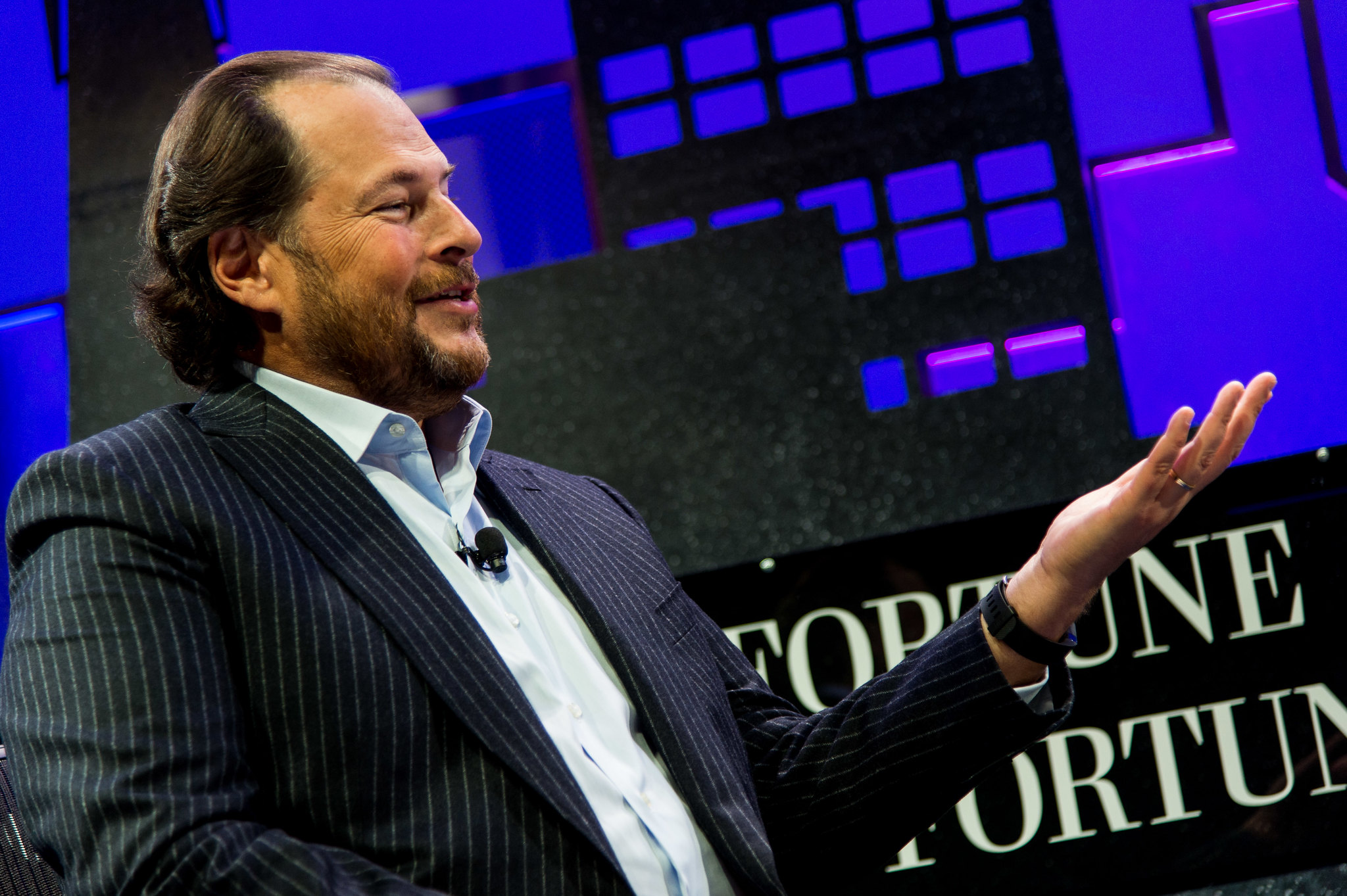

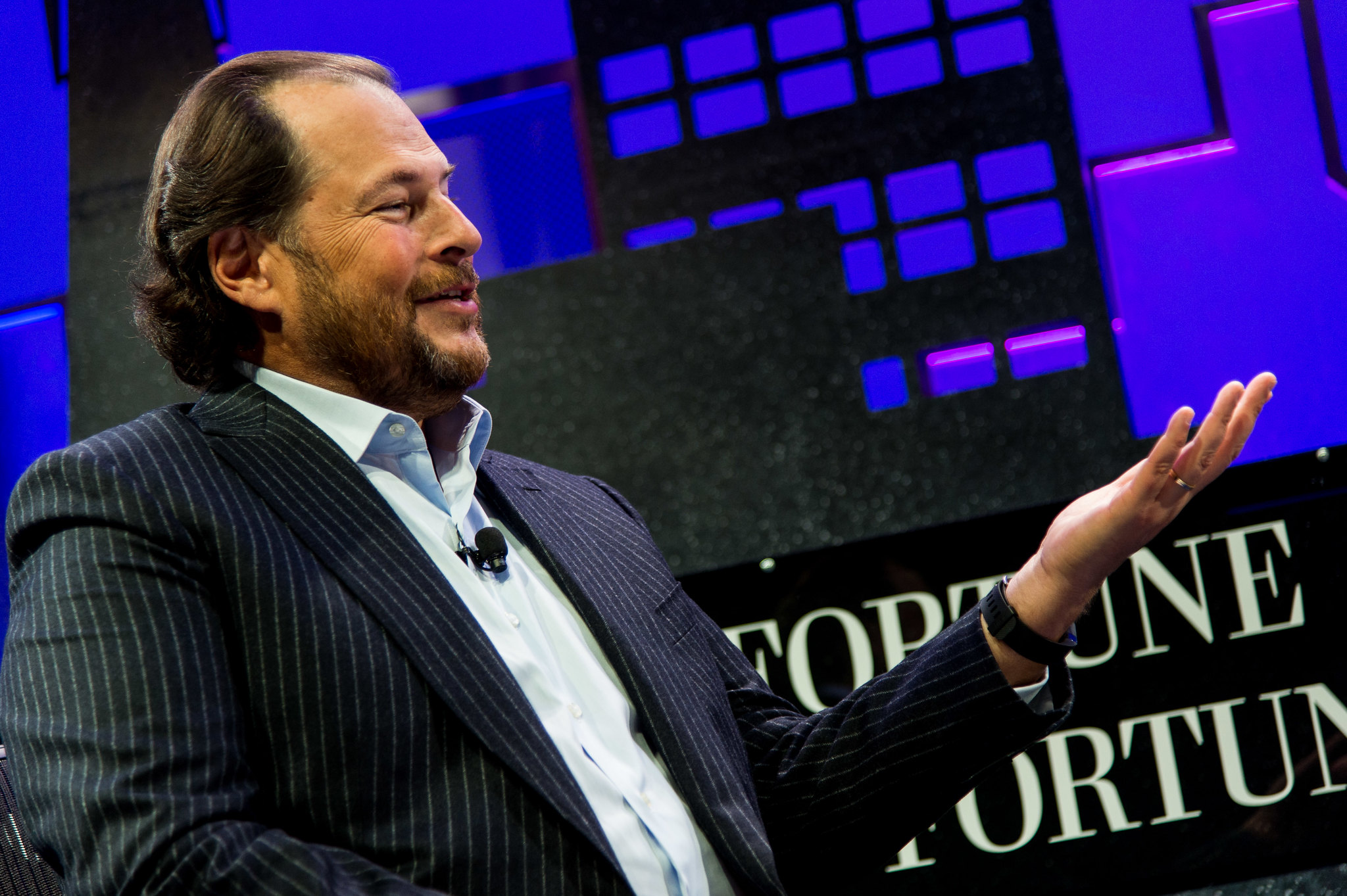

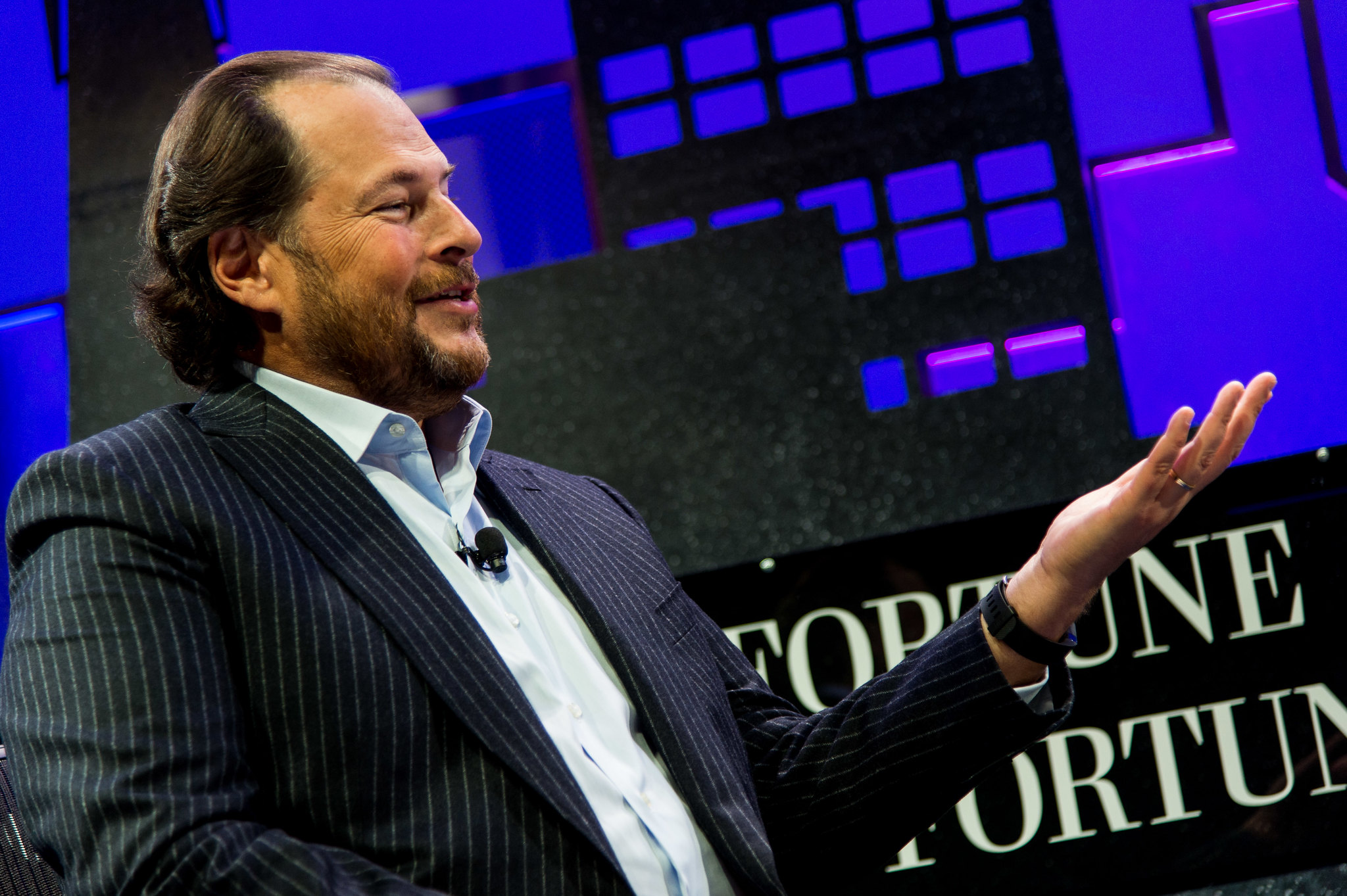

“We had another strong quarter, with revenue of $7.7 billion growing 22% year-over-year and 26% in constant currency, showing yet again the durability of our business model,” Marc Benioff (pictured), Salesforce chairperson and co-chief executive officer, said in a statement. “And, we’re thrilled to initiate our first-ever share repurchase program to continue to deliver incredible value to our shareholders on our path to $50 billion in revenue in FY26.”

Looking ahead to its fiscal third quarter, Salesforce predicts an adjusted profit of $1.20 to $1.21 on revenue of $7.82 billion to $7.83 billion. For the full fiscal year 2023, EPS is projected to be $4.71 to $4.73 on revenue of $30.9 billion to $31 billion.

The figures were all lower than expected. Analysts had been predicting an adjusted profit of $1.29 a share on revenue of $8.07 billion in the third quarter and $4.75 a share and revenue of $31.73 billion for the full year.

Benioff addressed the lower-than-expected outlook on an investor call, saying that the company had previously endured weaker economic cycles.

“Sales cycles can get stretched, deals are inspected by higher levels of management and all of this we began to start to see in July,” Benioff said. “Nearly everyone I’ve talked to is taking a more measured approach to their business. We expect these trends to continue in the near term, and we’ve reflected this in our guidance.”

Amy Weaver, Salesforce’s chief financial officer, noted that the slowdown was not across the board, with demand slowing only among small and medium-sized enterprises in North America and Europe.

Salesforce shares fell almost 7% after the bell.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.