INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Computer chipmaker Advanced Micro Devices Inc. today warned that it’s likely to miss its third-quarter sales projections by more than $1 billion, stoking concerns over the sputtering market for semiconductors and sending its stock down.

AMD’s stock fell more than 4% in the extended trading session, and the drop had a knock-on effect on rivals Intel Corp. and Nvidia Corp., which both lost more than 2%.

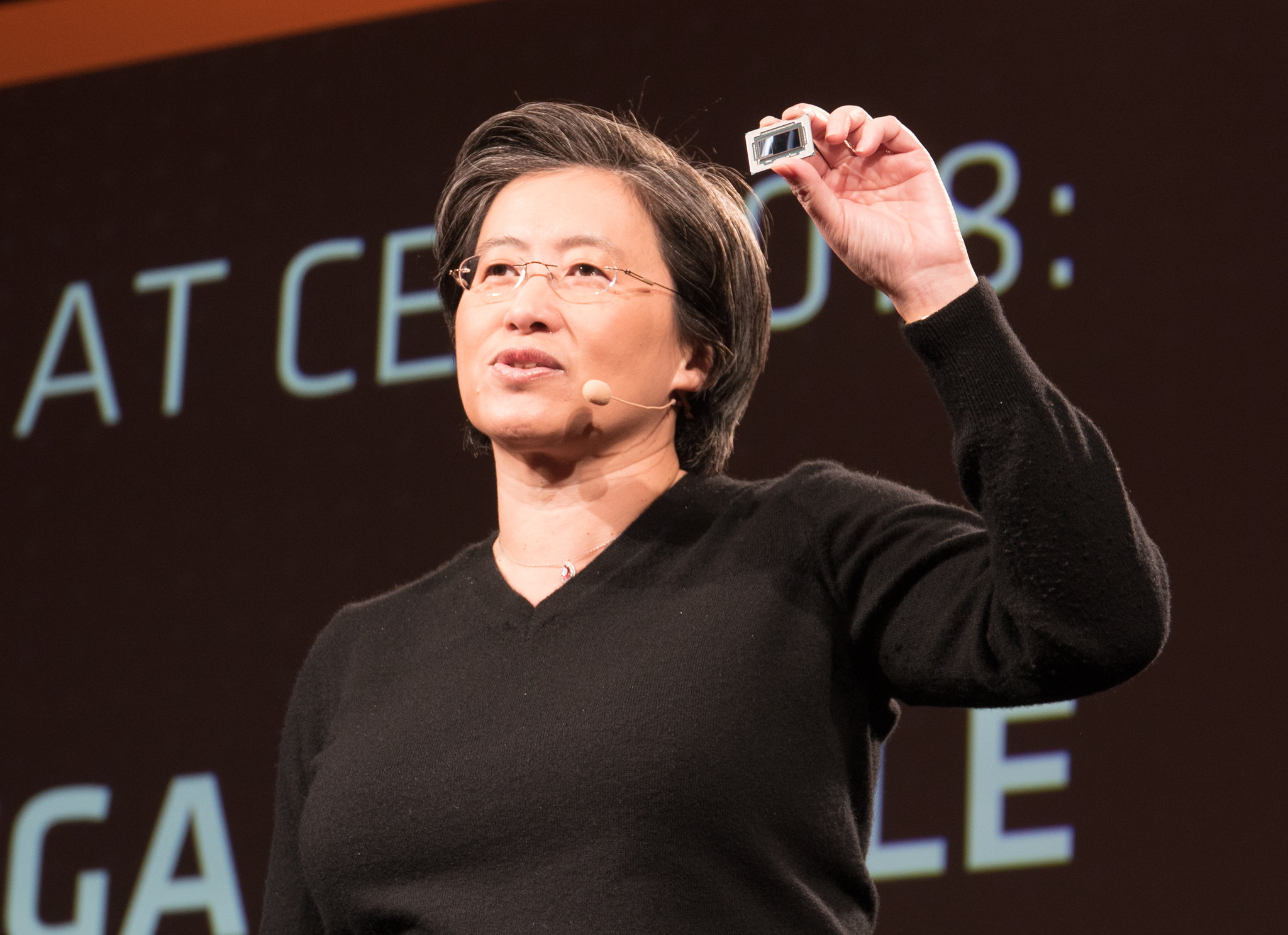

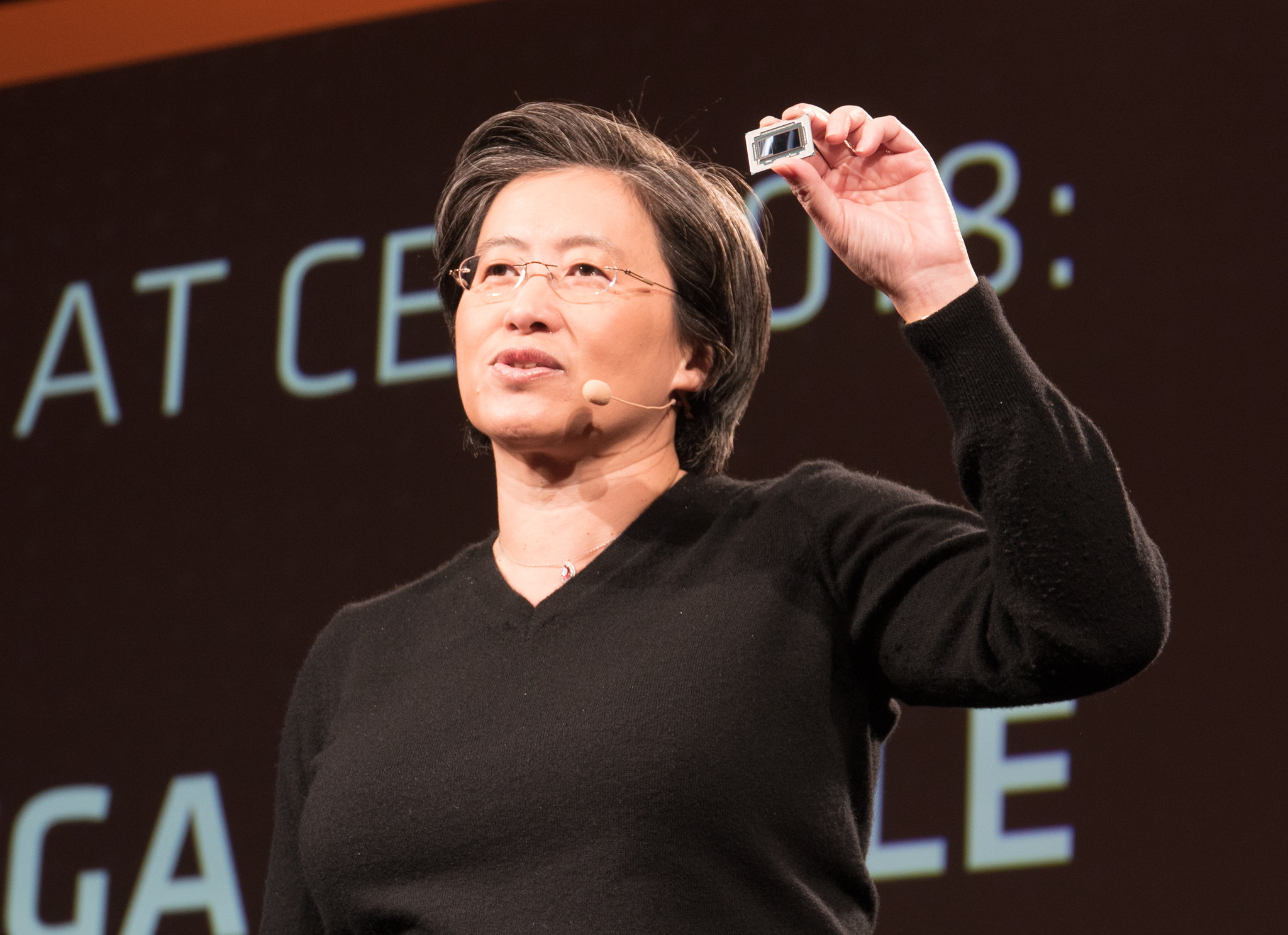

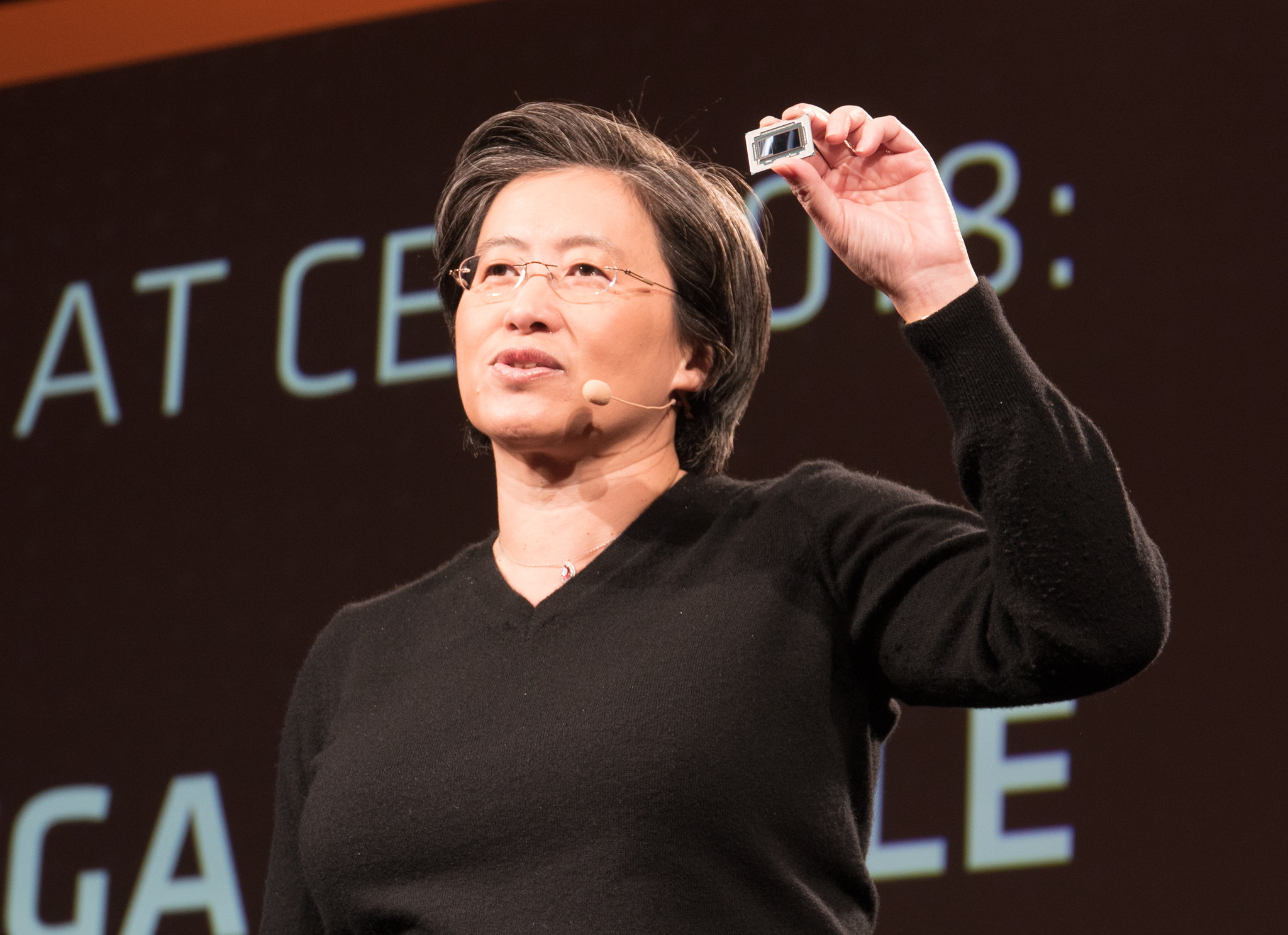

“The PC market weakened significantly in the quarter,” AMD Chief Executive Lisa Su (pictured) said in a statement. She added that macroeconomic conditions were responsible for reducing personal computer demand more than expected.

Meantime, Samsung late Thursday reported that, also because of the chip downturn, its operating profit is likely to drop more than 31% from a year ago, to 10.8 trillion won ($7.6 billion). When the company, which makes memory chips as well as consumer products, reports final earnings later this month, it also expects revenue to rise 2.7%, to 76 trillion won ($53.9 billion).

The estimated earnings fell far below what analysts had forecast. It would be the company’s first profit decline year-over-year since the first quarter of 2020, when the COVID pandemic started.

The economy is slowing amid high inflation, while the reopening of schools and offices mean people are no longer as interested in buying PCs as they were during the COVID-19 pandemic. Chipmakers are also feeling the sting from ongoing COVID concerns in China, which remains a key market. The Ukraine war has worsened supply problems and the economy as well, reducing demand further.

AMD is only the latest chipmaker to warn that its business is suffering. Last week, Micron Technology Inc. warned investors it is facing a rocky road ahead, saying it would slash its capital expenditure by around a third to ensure it remains profitable. Intel and Nvidia have both also said they’re expecting much lower revenue in their current quarters. Meanwhile, the Philadelphia Semiconductor Index, which tracks the price of major players in the industry, is down 36.4% this year, having risen more than 40% in the year prior.

“If anyone had any doubts the world’s economy is heading towards a recession, this should make things clear, as all of the major chipmakers have now issued revenue warnings,” said Holger Mueller of Constellation Research Inc.

AMD said it’s now expecting third-quarter revenue of just $5.6 billion, way down from its previous forecast of $6.7 billion — an estimate that was already lower than Wall Street’s expectations. The $5.6 billion revenue forecast is down 15% from the prior quarter.

AMD also expects its gross margins to fall to just 50%, down from a previous expectation of 54%. The company said that’s the result of lower revenue from reduced client processor unit shipments and average sales prices, as well as about $160 million of inventory, pricing and related charges involving PC chips.

Client computing revenue, which includes chips for personal computers, is forecast to come to just $1 billion, down 40% from a year earlier. However, AMD is still growing in terms of its projected gaming revenue. The company is looking at $1.6 billion in sales from that business, which would be up 14% from a year ago. Data center revenue, which is also estimated at $1.6 billion, is forecast to grow more than 45%.

Though AMD’s warning makes for a depressing read for shareholders who are focused on short-term profitability, analysts said the numbers also underscore the company’s longer-term potential.

“AMD might still take more of the overall chip market pie,” Mueller said. “It’s just that this pie is growing much more slowly, and may even get smaller for a while. What chipmakers need to do is to try and sustain their level of investment in R&D and production, as any who fail to do so would be sending up a red flag.”

“This is 100% the result of demand crashing for PCs, along with PC makers who’re still clearing inventory,” said Patrick Moorhead of Moor Insights & Strategy. “Datacenter is still up 45% which is, frankly, a more strategic business. Long term I’m still bullish on the company.”

“Between global inflation, saber rattling by North Korea and China and OPEC’s decision to prop up Russia’s criminal invasion of Ukraine, consumers and markets have a lot to be nervous about,” said Charles King of Pund-IT Inc. “That said, AMD’s decision to let shareholders know what to expect from the earnings call at the end of the month is interesting strategically. At one level, the company should be applauded for its candor. But at the same time, the announcement allowed AMD to highlight the primary trouble spot – PCs – and clarify how its other focus areas, including data center, edge and gaming products are still doing well.”

AMD is expected to report its third-quarter earnings in full on Nov. 1, followed by a conference call to discuss the results.

With reporting from Robert Hof

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.