CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Is the glass half full or half empty? Well, it depends on how you want to look at it.

Chief information officers are tapping the brakes on spending, that’s clear. The latest macro survey from Enterprise Technology Research quantifies what we already know to be true, that information technology spend is decelerating. CIOs and IT buyers forecast that their tech spend will grow by 5.5% this year, a meaningful deceleration from their year-end 2021 expectations. But these levels are still well above historical norms – so while the feel good factor may be in some jeopardy, overall things are pretty good – at least for now.

In this Breaking Analysis, we update you on the latest macro tech spending data from ETR, including strategies organizations are employing to cut costs, and which project categories continue to see the most traction.

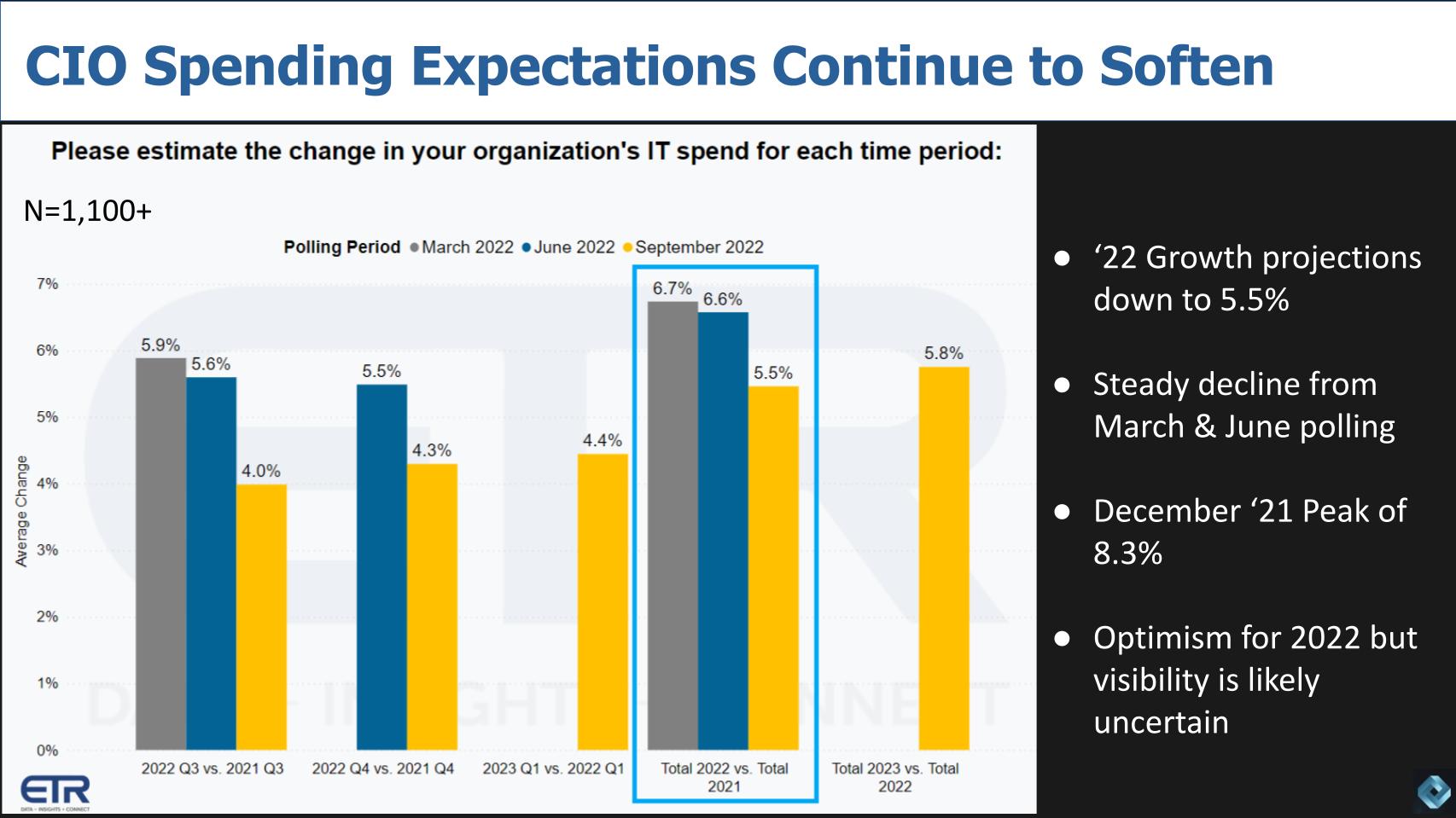

CIOs were much more optimistic at the end of last year than they are today. Back then they thought their aggregate spend would increase by more than 8%. The graphic below shows where they are today.

Of course, at that time the expectation was the economy was ready to make a semi-ordered return to normal. That didn’t happen and, as you see above, the forecast for spending this year is down to 5.5% growth. This is based on the most recent ETR CIO survey, which includes more than 1,100 respondents. We started the year above 8%, then made a meaningful decline to the mid sixes and, nine months into the year, we’re now at the mid-5% growth range.

This growth still represents 200 to 300 basis points above historical norms. And looking ahead to next year, CIOs are expecting accelerated growth, edging back toward the 6% level. As noted, visibility is less clear than in pre-COVID years. But the bottom line is digital transformations are continuing to push IT spending above historical levels.

The problem, as we know, is earnings estimates are coming down and forecasts are being lowered every day. As the saying goes, the first disappointment is rarely the last. Even the semiconductor industry is seeing softness. Just this past week we saw Advanced Micro Devices Inc. lower its quarterly revenue forecast by more than $1 billion as PC demand in the second half has significantly softened. But again – that’s relative to some pretty amazing growth years thanks to the isolation economy.

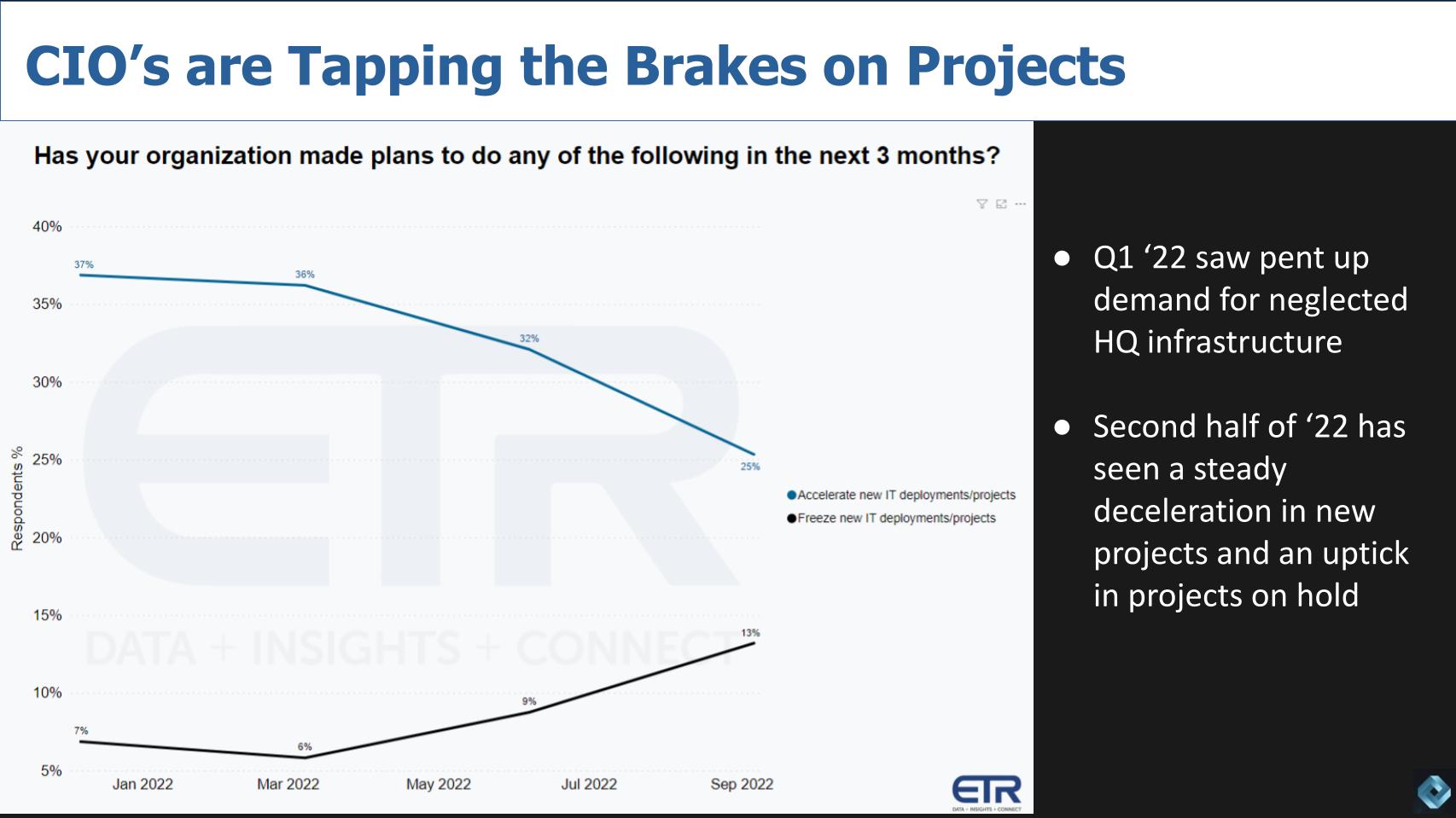

We see CIOs slowing things down a bit and these data points below tell an interesting story.

ETR asked respondents about various actions they’re taking and these two stood out. The top line is “we’re accelerating new IT projects.” The bottom line is “we’re freezing projects.” You can see the convergence of those two lines, which of course signals a slowdown.

But again, these are not alarming data points. In Q1 2020, the top line was at 12% versus 25% today and project freezes were at 22% versus 13% today. Relatively speaking, the spending dynamic is still strong.

In Q1 2020, the top line was at 12% versus 25% today and project freezes were at 22% versus 13% today. Relatively speaking the spending dynamic is still strong.

It just doesn’t feel that way because we’re coming out of an historic anomaly.

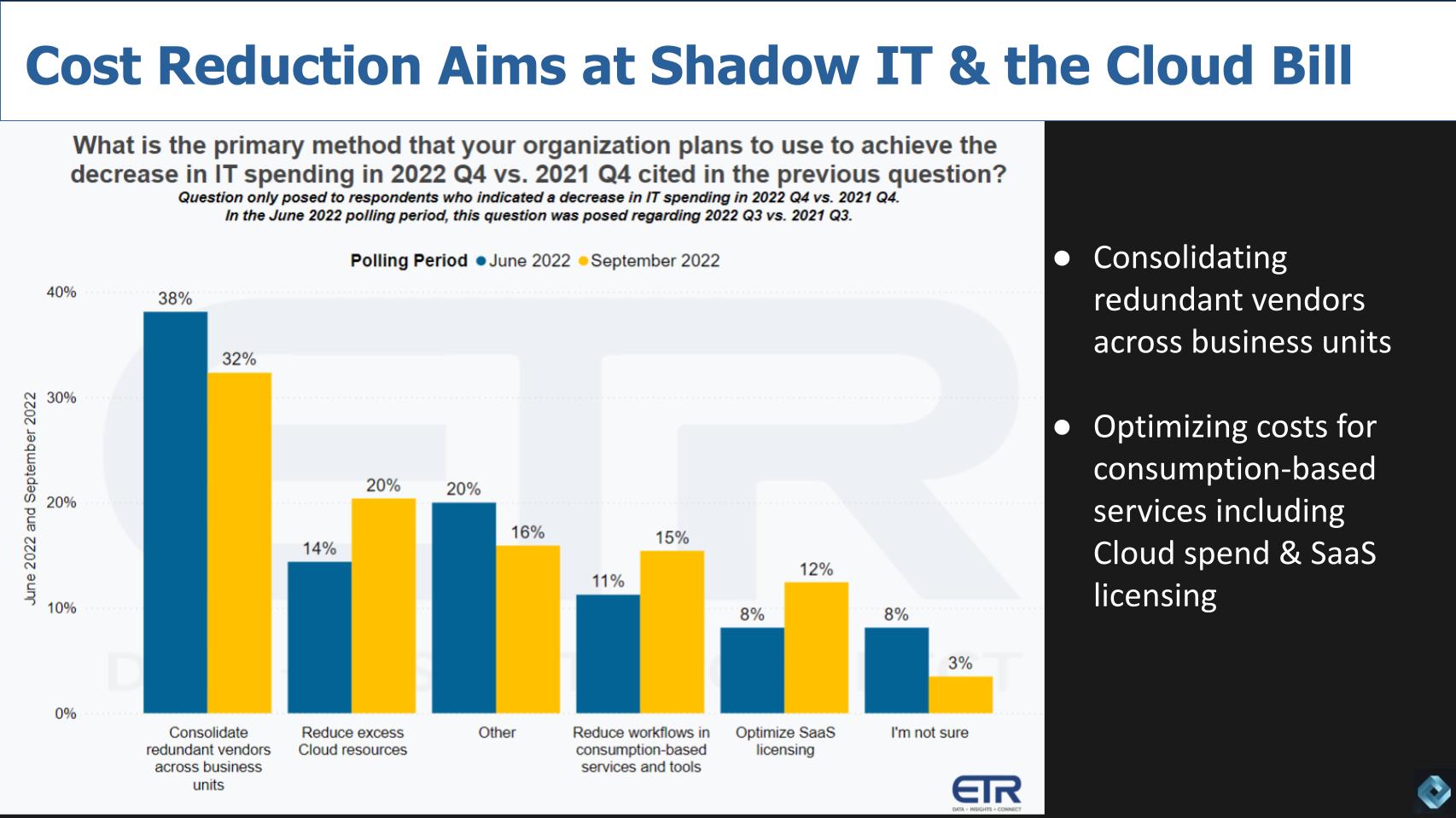

ETR asked a followup question to only those respondents that indicated spending would be down this quarter relative to the same quarter last year. They wanted to better understand the most common actions that organizations would take to save money. That data is shown below.

The chart shows the most common approach is still to consolidate redundant vendors across the lines of business. So presumably, CIOs have the latitude to go after shadow projects and implement standards across the organization via consolidation.

As well, there was a big jump in this survey – from 14% to 20% – of respondents saying they were going after the cloud bill and that relates to the fourth set of bars, which is scrutinizing consumption-based services. So combined, 45% of respondents are looking at reducing their on-demand spend. Some of that may be software-as-a-service-related but most of the SaaS spend is committed. However, we do see organizations doing more audits to eliminate or reduce orphaned licenses.

45% of respondents are looking at reducing their on-demand spend.

The last data point we want to focus on is the technology sectors that are of the highest priority. The top areas are shown below.

While cybersecurity remains the top technology area, even this sector is showing a little bit of softness. What’s really notable is the uptick in data-related areas – the second set of bars. This category is now the second most cited taking over from cloud, which remains strong and continues to be a key component of digital transformations.

As we’ve previously reported, the Machine Learning/AI and RPA sectors appear to be somewhat more strategic and discretionary. And they’ve dropped below the 40% mark in terms of Net Score in the overall survey. We’re not showing that here but we covered this in our last Breaking Analysis.

Now remember – these are the top seven sectors – there are dozens in the ETR taxonomy so making this list is goodness from a spending perspective. So even though there’s some softness in most of these categories, these are the ones CIOs are most focused on addressing.

The messages in this data are:

So although it feels like a meaningful slowdown, the sky is by no means falling. There are these “out of our control” factors such as interest rates, Ukraine, oil supply, wages, etc. that are creating uncertainty and causing firms to be more cautious.

But generally we remain optimistic as leading tech companies are well-managed and have plenty of runway on the balance sheets. As such, they can adjust costs to reflect the uncertain environment and remain flexible in doing so.

Thanks to Alex Myerson and Ken Shiffman are on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight who help us keep our community informed and get the word out, and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of Wikibon. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.

THANK YOU