BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

Robinhood Markets Inc. bucked market trends and its own recent history today as its share price rose in late trading today on a surprising earnings beat in its fiscal third quarter.

For its third quarter that ended Sept. 30, Robinhood reported a net loss of $175 million, or 20 cents per share, down from $295 million, or 34 cents per share, in the second quarter. Revenue rose 14% sequentially, to $361 million. Analysts had expected a loss of 29 cents a share on revenue of $355.6 million.

Although the headline figures are a definite positive for Robinhood, its cryptocurrency trading business, which drove much of the company’s success and led it to go public in July 2021, continues to slump. Overall transaction-based revenue in the quarter rose 3%, to $208 million, but they were driven by options trading — up 10% from the previous quarter — and equities, up 7%, whereas cryptocurrency trading dropped 12%, to $51 million.

Operating expenses, which Robinhood is addressing through layoffs announced in April and then expanded in August, dropped 5% in the quarter, to $425 million, including $90 million in restructuring charges. Excluding share-based compensation and restructuring charges, operating expenses were $335 million, a sequential improvement of $94 million.

Monthly active users fell by 1.8 million over the previous quarter to 12.2 million, net cumulative funded accounts rose 60,000, to 22.9 million, and assets under custody inched up 1%, to $64.6 billion. In a sign of a potential turnaround, average revenue per user increased to $63, up from $56 in the second quarter.

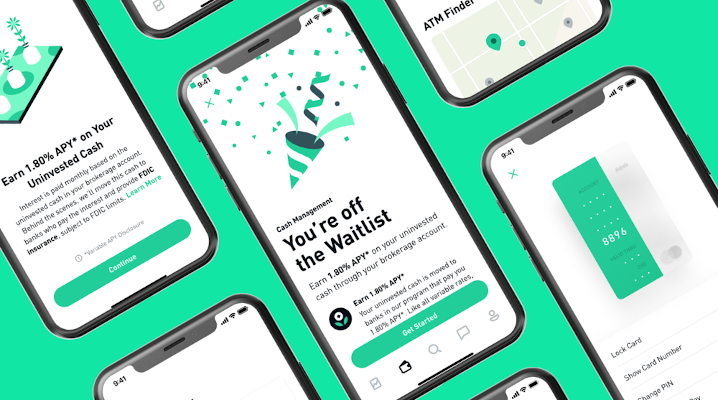

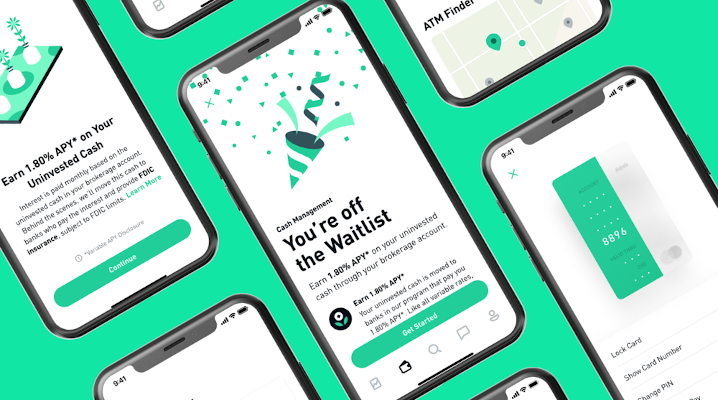

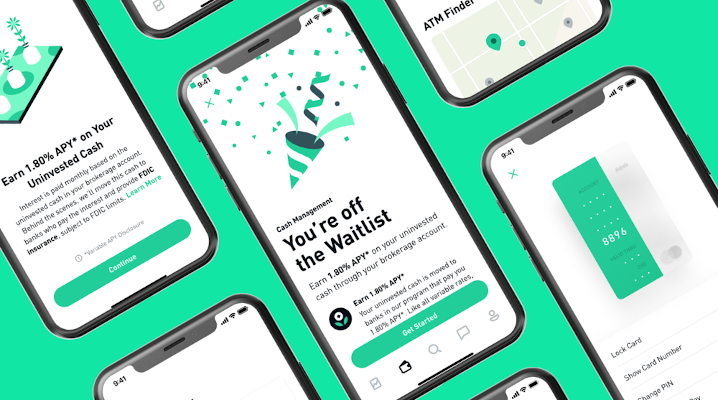

Highlights in the quarter included Robinhood rolling out the ability for customers to trade options in cash accounts, new charts that give advanced customers additional capabilities and Robinhood Wallet, a Web3 wallet that provides customers the ability to trade and swap crypto with no network fees.

“We remained focused on serving our customers and driving long-term shareholder value in Q3,” Jason Warnick, chief financial officer of Robinhood, said in a statement. “We drove positive adjusted [earnings before interest, taxes, depreciation and amortization] by increasing revenues and reducing expenses.”

For the quarter ahead, Robinhood did not provide estimates for revenue or earnings, instead saying that it expected net expenses for the full-year 2022 to be in the range of $2.34 billion to $2.4 million, a decline of 31% to 32% from the prior year. Total operating expenses minus share-based compensation is expected to be $1.69 billion to $1.71 billion, down 9% to 10% year-over-year.

Investors liked the numbers, particularly that Robinhood has brought its expenses under control. The company’s stock was up 2.6% in late trading.

THANK YOU