CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

A better-than-expected earnings report in late August got people excited about Snowflake Inc. again, but the negative sentiment in the market has weighed heavily on virtually all growth tech stocks. Snowflake is no exception.

As we’ve stressed many times, the company’s management is on a long-term mission to simplify the way organizations use data. Snowflake is tapping into a multihundred-billion-dollar total available market and continues to grow at a rapid pace.

In our view, the company is embarking on its third major wave of innovation, data apps, while its first and second waves are still bearing significant fruit. For short-term traders focused on the next 90 or 180 days, that probably doesn’t matter much. But those taking a longer view are asking: Should we still be optimistic about the future of this highflier or is it just another overhyped tech play?

In this Breaking Analysis, we take a look at the most recent survey data from Enterprise Technology Research to see what clues and nuggets we can extract to predict the near future and the long-term outlook for Snowflake.

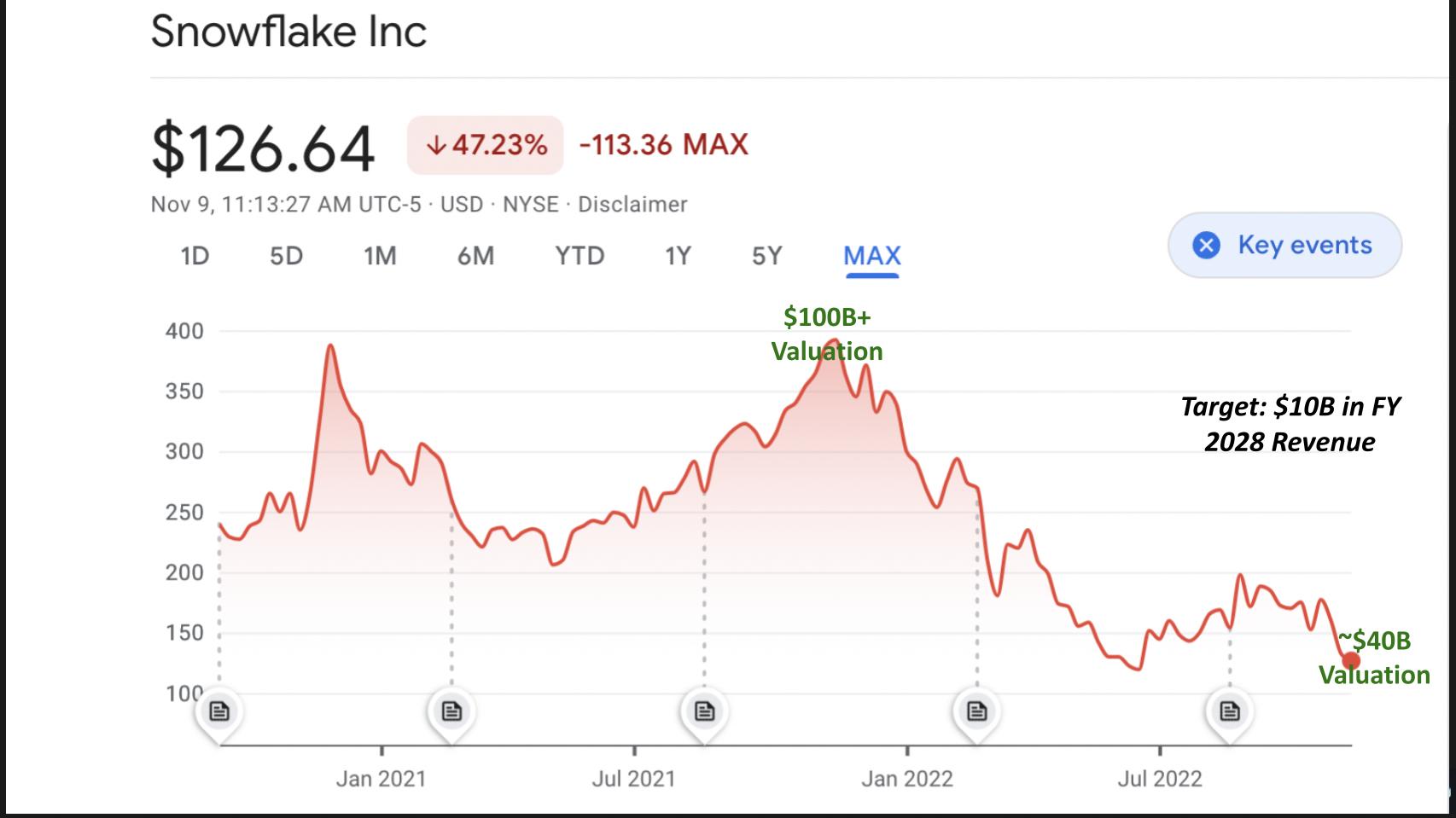

You know the story. If you’ve been an investor in Snowflake this year it’s been painful. We said at IPO, if you really want to own the stock on day one, you’d better hold your nose and just buy it. But like most IPOs, there will likely be better entry points in the future.

And not surprisingly, that has been the case. Snowflake went public at a price of $120, which you couldn’t touch on day one unless you got into a friends-and-family offer. And if you did you’re still up 5% or so. Congratulations. But at one point last year you were up well over 200%. That has been the nature of this volatile stock and we certainly can’t help you with timing the market.

We asked our expert trader and Breaking Analysis contributor, Chip Symington for his thoughts on Snowflake. He said he got out of the stock awhile ago after having taken a shot at what turned out to be a bear market rally. He pointed out that the stock had been bouncing around the 150 level for the last few months and broke that to the downside last Friday, Nov. 4. So he’d expect 150 is where the stock will find resistance on the way back up.

But there’s no sign of support right now. Maybe at 120, which was the July low and the IPO price. Perhaps earnings will be a catalyst when Snowflake announces on Nov. 30, but until the mentality toward growth tech flips, nothing’s likely to change dramatically, according to Symington.

Longer-term, Snowflake is targeting $10 billion in revenue for fiscal year 2028. That’s what’s most interesting in our view. It’s a big number. Is it achievable? Many people are asking: Why isn’t the target even more aggressive?

Tell you what – let’s come back to that topic a bit later in the post.

So now that we have the stock talk out of the way, let’s take a look at the spending data for Snowflake in the ETR survey.

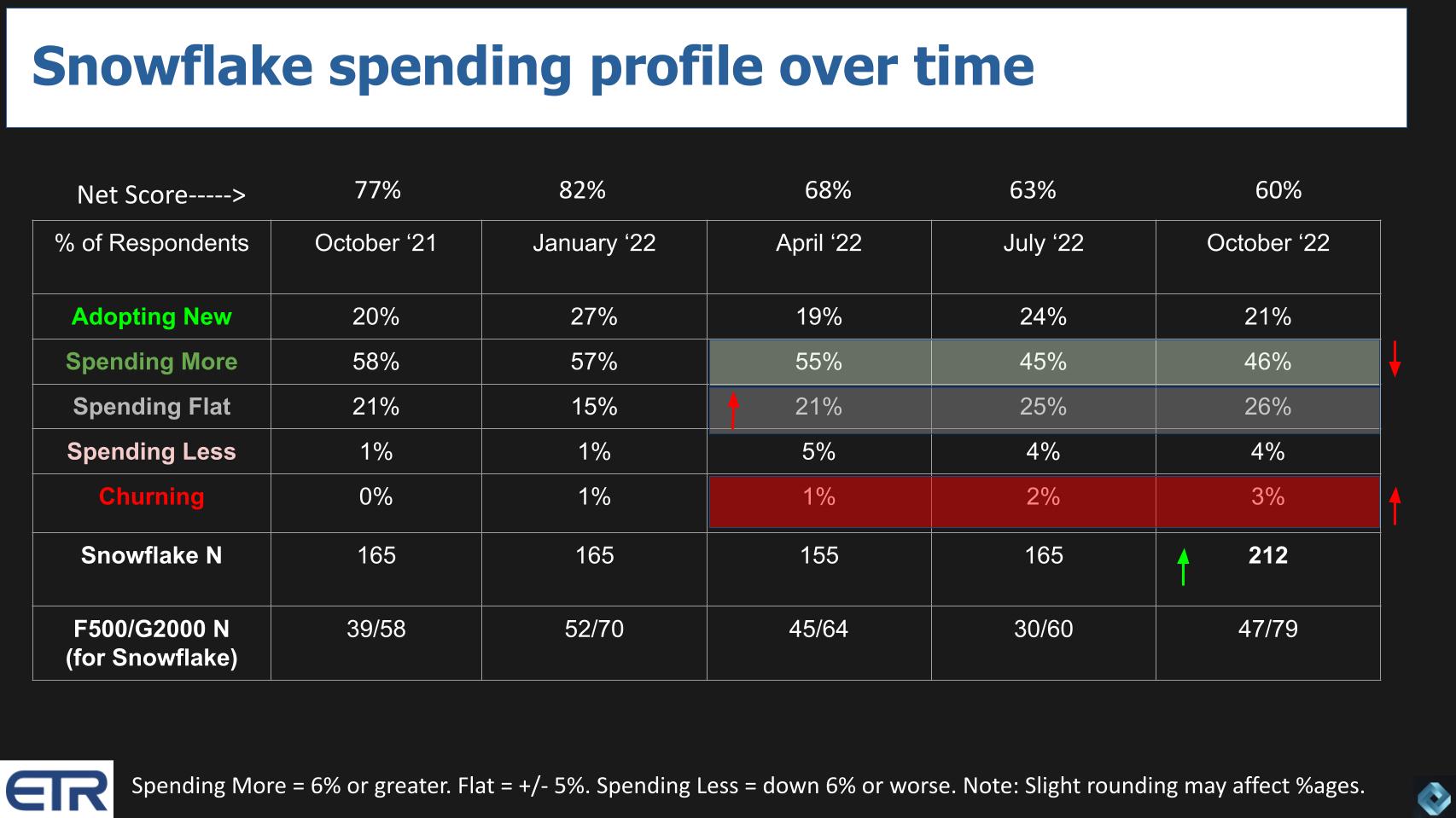

First let’s explain ETR’s proprietary methodology. Net Score is a measure of spending velocity. It’s derived from a quarterly survey of information technology buyers (N ranges from 1,200 to 1,400) and asks the respondents: 1) Are you adopting a platform new; 2) spending 6% or more; 3) spending flat levels; 4) cutting spend by 6% or more; or 5) leaving the platform.

Subtract the percentage of customers spending less or churning from those spending more or adopting and you get a Net Score, expressed as a percentage of customers responding specific to a platform.

The chart above shows the time series and breakdown of Snowflake’s Net Score going back to the October 2021 survey. At that time Snowflake’s Net Score stood at a robust 77%. The action in the survey after that time frame has been notable. In the chart we show Snowflake’s N out of the total survey for each quarter. We also show, in the last row, the number of Snowflake respondents from the Fortune 500 and the Global 2000 – two important Snowflake constituencies.

What this data tells us is the following:

The last thing to note on this chart is the meaningful uptick in survey respondents citing Snowflake – up to 212 in the survey from a previous figure of 165. Remember this is a random survey across ETR’s panel of 5,000 global customers. There is a North America bias but the data confirms Snowflake’s continued penetration into the market despite facing economic headwinds and stiff competition.

That said, it’s hard to imagine that Snowflake doesn’t feel the softening in the market like everyone else. Snowflake is guiding for around 60% growth in product revenue for the most recent quarter, which ended on Oct. 31. This comes against a tough compare with the quarter a year ago. Snowflake is guiding 2% operating margins. Like every company, the reaction of the Street will come down to how accurate or conservative the guide is, how consensus interpreted that guide and ultimately what customers consumed in the quarter.

To reiterate, it’s our understanding that Snowflake customers have a committed spend over the period of time (the term). And they can choose to delay that spend at their discretion and dial down usage to optimize cloud costs during the term. That’s clearly happening broadly in the market.

Cloud optimization is the second most commonly cited cost reduction technique in the ETR surveys (behind consolidating redundant vendors). This trend will cause lumpiness in the cloud numbers. Further, it is our understanding that this committed spend can be rolled into future credits after the initial term, as long as the customer renews their contract with Snowflake.

It’s a longer topic that we’ll dig into in a future Breaking Analysis. But the data shows customers are mixed in their preference between consumption and subscription models. Most customers in a recent ETR Drill Down survey (N=300 cloud customers) either prefer or are required to choose subscription models (48%). Twenty-nine percent prefer or are required to choose consumption-based models, with the balance indifferent.

The point is Snowflake has a hybrid model in the sense that you can dial up or down your usage (consumption) but you’re committed to a level of spend that’s negotiated (subscription). The more you spend, the better the price per credit.

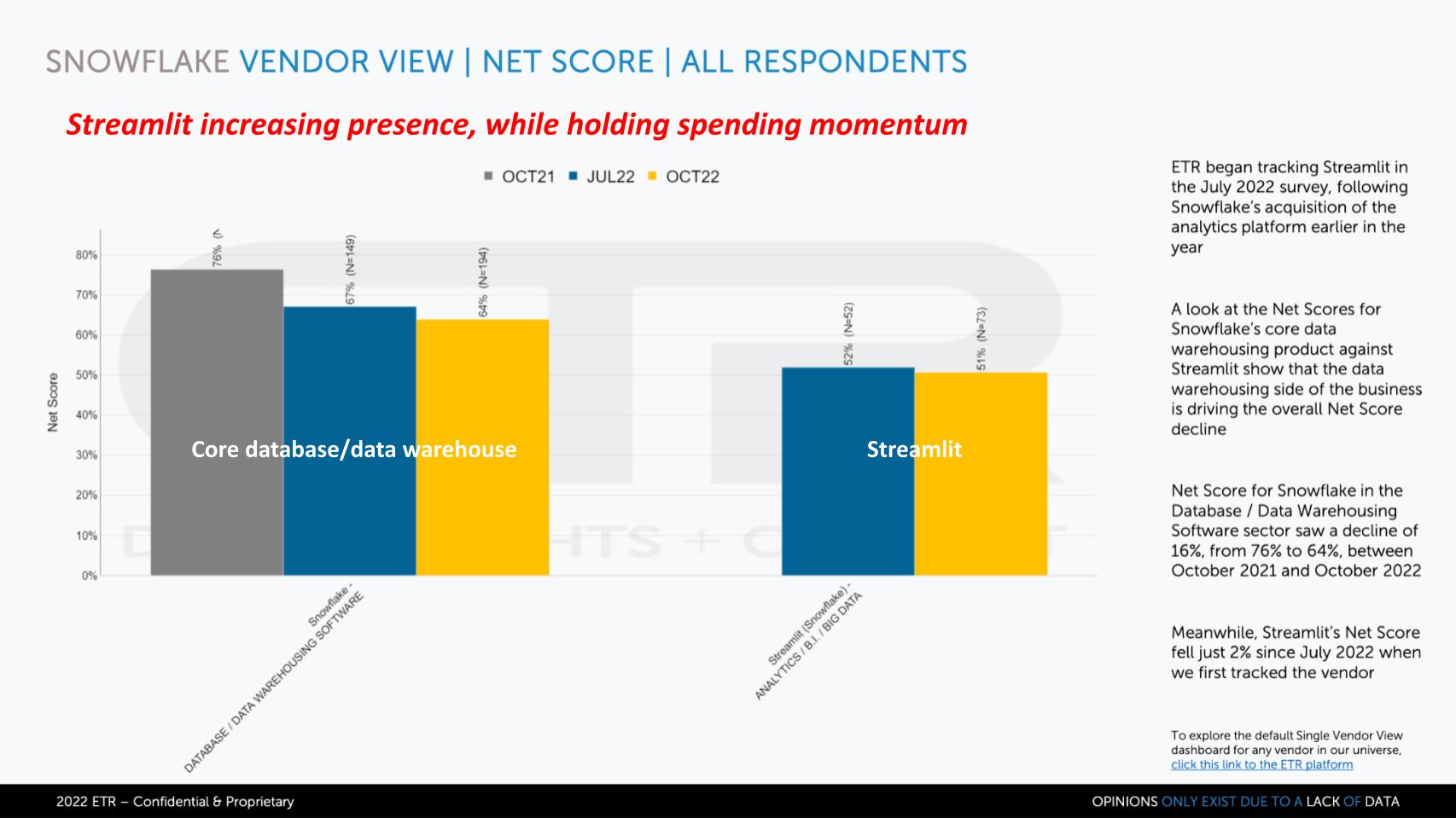

Earlier this year Snowflake acquired a company called Streamlit Inc. for about $800 million. Streamlit is an open-source Python library that makes it easier to build data apps with machine learning. And like Snowflake generally, its focus is on simplifying the complex – in this case making data science easier to integrate into data apps that business people can use. Snowflake made a number of related announcements this past week, including native Python support.

We were excited this summer to see some meaningful data on Streamlit in the July ETR survey, which we’re showing below in comparison to Snowflake’s core business.

In the chart above we show Net Score over time for Snowflake’s core database/data warehouse offering as compared to Streamlit. Snowflake’s core product had 194 responses in the October 2022 survey. Streamlit had an N of 73, up noticeably from 52 in the July survey. It’s hard to see, but Streamlit’s Net Score stayed pretty constant at 51%, while core Snowflake came down to 64% – both well over the magic 40% mark.

There are two key points here:

The Streamlit acquisition expands Snowflake’s TAM and is a critical chess piece in attracting developers. We’ll dig more into this topic later in the post.

In previous Breaking Analysis segments, we’ve assessed various competitive angles with a number of analysts. Snowflake is moving from its enterprise analytics roots into the realm of data science while Databricks Inc. is coming at the traditional data warehouse/analytics market from its stronghold position as a data science platform. Streamlit extends Snowflake’s moves into Databricks’ domain. Meanwhile, Databricks is behind a number of open projects – e.g. Delta Sharing — that are designed to substantially replicate Snowflake’s value proposition.

And these two players are far from the only two going after the prize.

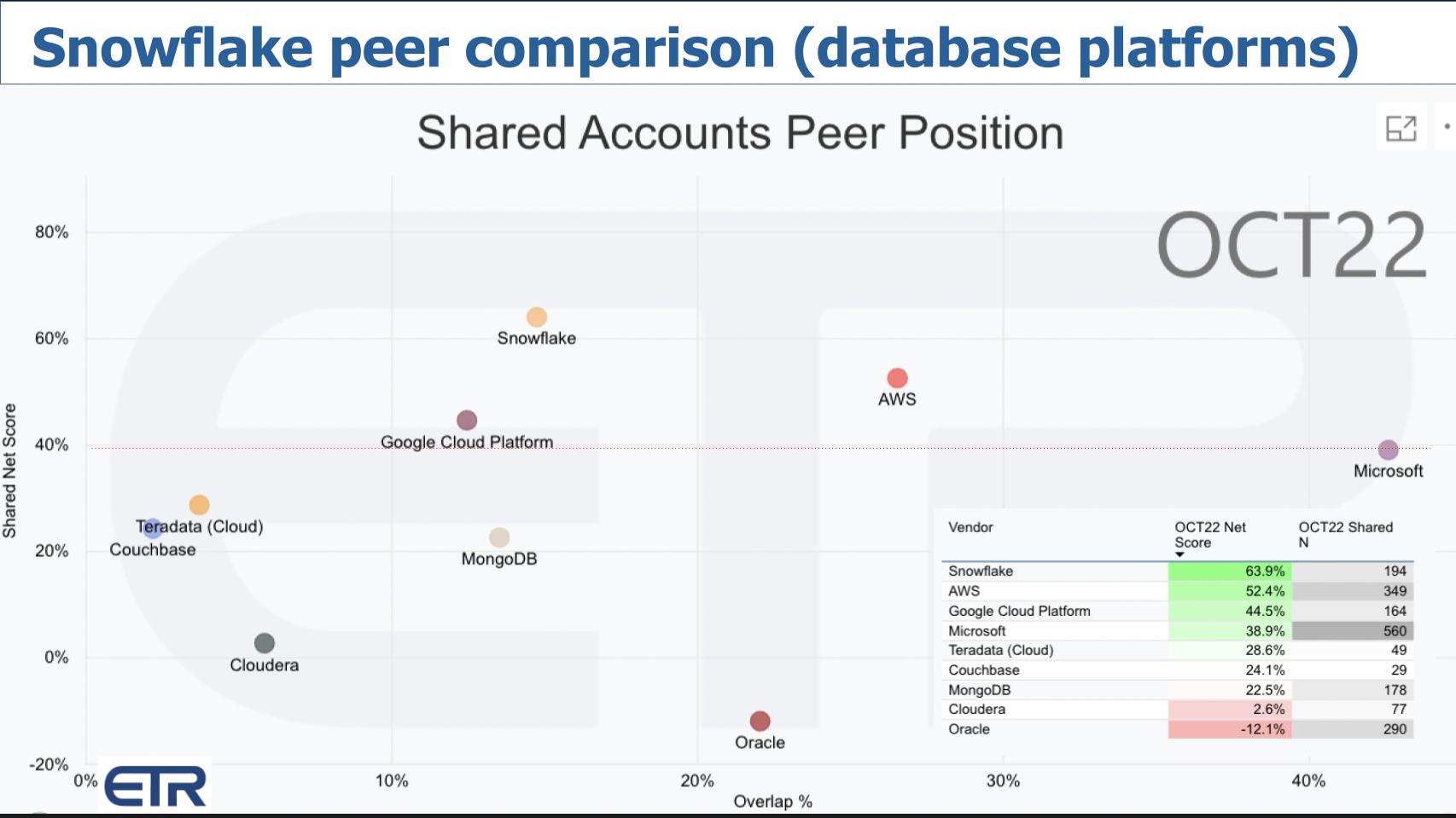

The chart above shows Net Score or spending velocity on the Y axis and Overlap or presence in the data set on the X axis. The red line at 40% represents a highly elevated Net Score. And the table insert informs as to how the companies are plotted – Net Score Y and Shared Ns X.

Here we compare a number of database players purposely, excluding Amazon Web Services Inc., Microsoft Corp. and Google LLC (for now). We include Oracle Corp. for reference because it is the king of database. Note that the Oracle data includes Oracle’s entire portfolio (including apps), but we have it here for context.

What are the key takeaways?

In the previous chart we compared companies that primarily sell database solutions, but we included other parts of their portfolios. Below we bring in the three U.S.-based cloud players and isolate the data only on the database/data platform sector.

For this analysis we have the same XY dimensions, but we’ve added in the database-only responses for AWS, Microsoft and Google. Notice that those three plus Snowflake are just at or above the 40% line. Snowflake continues to lead in spending momentum and keeps creeping to the right.

Now here’s an interesting tidbit. Snowflake is often asked how it competes with AWS, Microsoft and Google, which offer Redshift, Synapse and BigQuery. Snowflake has been telling the street that 80% of its business comes from AWS. And when Microsoft heard that, it said, “Whoa, wait a minute, let’s partner up Snowflake.”

That’s because Microsoft is smart and it understands that the market is enormous. If it expand its partnership with Snowflake: 1) It may steal some business from AWS; and 2) even if Snowflake is winning over Microsoft in database… if it wins on Azure, Microsoft sells more compute, more storage, more AI tools and more other stuff.

AWS is really aggressive from a partnering standpoint with Snowflake, constantly negotiating better prices. It understands that, when it comes to data, the cheaper you make it to process and store, the more people will consume. Scale economies and operating leverage are really powerful things at volume. While Microsoft is coming along in its Snowflake partnership, Google seems resistant to that type of go-to-market partnership.

Rather than lean into Snowflake as a go-to-market partner and make pricing attractive for Snowflake customers, Google’s field force is fighting fashion. Google itself at Cloud Next heavily messaged what it called the “Open Data Cloud” — a direct ripoff from Snowflake.

What can we say about Google? It continues to be behind when it comes to enterprise selling.

Just a brief aside on competitive posture. We’ve observed Snowflake Chief Executive Frank Slootman in action with his prior companies and the way he convincingly and passionately depositions the competition. At Data Domain he eviscerated Avamar (owned by EMC) with its expensive and slow post-process architecture. At one point we recall him actually calling it “garbage” (at least that’s our memory). EMC ended up acquiring Data Domain.

We saw Slootman absolutely destroy BMC Software Inc. when he was at ServiceNow Inc., alluding to the IT departments supported by BMC Remedy (the competitive product) as the equivalent of the Department of Motor Vehicles.

So it’s interesting to hear how Snowflake today openly talks about the data platforms of AWS, Microsoft, Google and Databricks.

Here’s the bumper sticker, sifting through Snowflake’s commentary:

The interesting thing about Databricks and Snowflake is the relationship used to be much less contentious. Last decade on theCUBE we said a new workload type is emerging around data where you have AWS cloud + Snowflake + Databricks data science. And we felt at the time that this would usher in a new vector of growth for data. And it has.

But we now see the aspirations of all three of these platforms colliding. It’s an interesting dynamic — especially when you see both Snowflake and Databricks putting venture money and getting their hooks into the loyalties of the same companies such as dbt Labs Inc. and Alation Inc.

At any rate… Snowflake’s posture is, “We are the pioneer in cloud-native data warehouse, data sharing and data apps. Our platform is designed for business people who want simplicity. The other guys are formidable but we (Snowflake) have an architectural lead… and, unlike the big cloud players, we run in multiple clouds.”

It’s pretty strong positioning – or depositioning – you have to admit. Not sure we agree with the BigQuery competitive knockoffs – that’s a bit of a stretch – but Snowflake as we see in the ETR survey data is winning.

In thinking about the longer-term future, let’s talk about what’s different with Snowflake, where it’s headed and what the opportunities are for the company’s future — and specifically address the $10 billion goal.

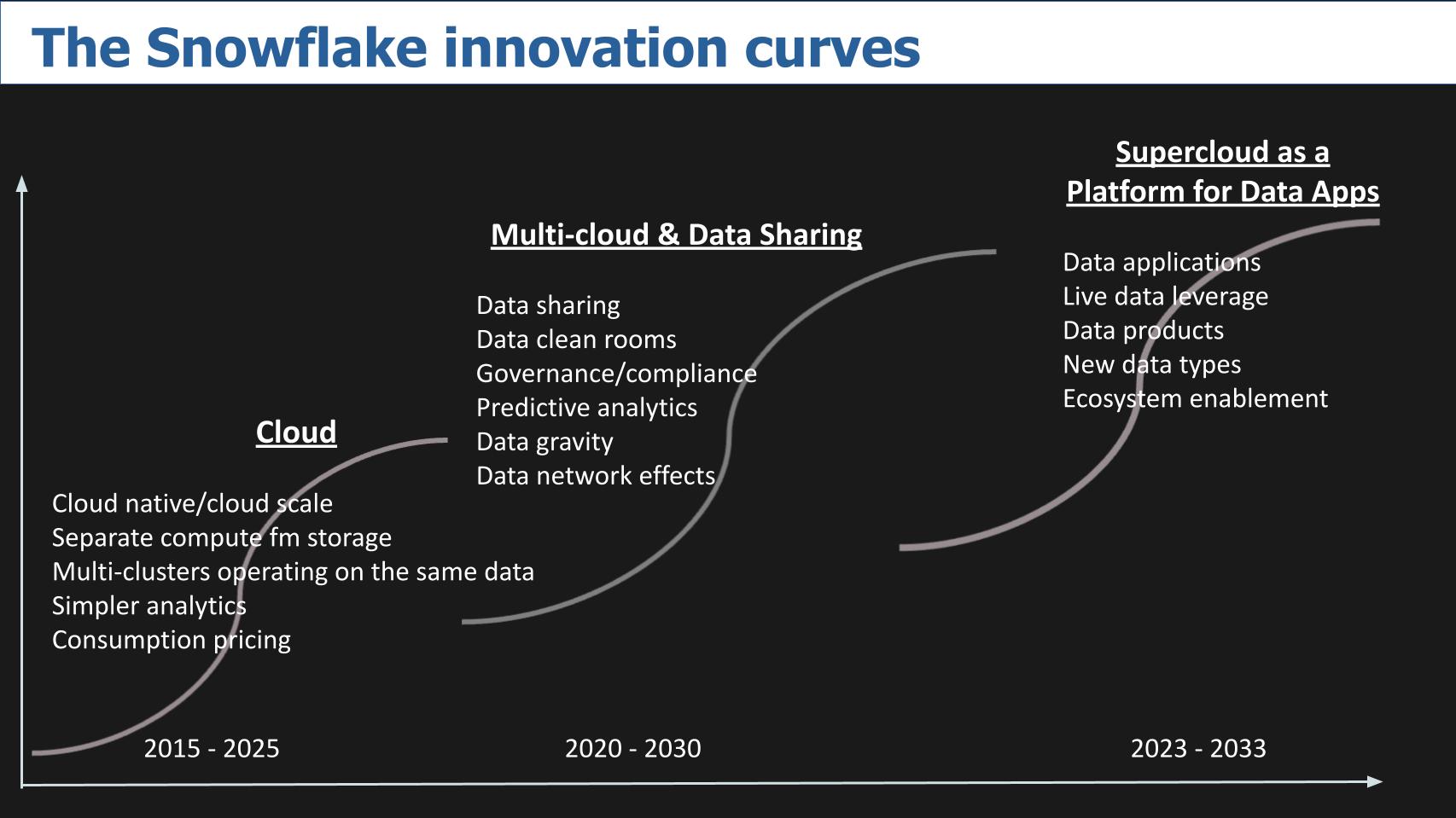

Snowflake in our view is riding three major decade-long waves. We describe our perspective below.

Snowflake put itself on the map by focusing on simplifying data analytics. What’s interesting about the company is the founders are, as you probably know, from Oracle. And rather than focusing on transactional data, Oracle’s strong suit, the founders said we’re going to attack the data warehousing problem. And they completely reimagined the database and what was possible with virtually unlimited compute and storage capacity.

Of course, Snowflake became famous for separating compute from storage: Being able to shut down the compute so you didn’t have to pay for it. The ability to have multiple clusters hit the same data without making endless copies. And a consumption/cloud pricing model. Then everyone on the planet realized what a good idea this was and venture capitalists in Silicon Valley have been funding companies to copy that move. And that has pretty much become table stakes today.

But we would argue that Snowflake not only had the lead but when you look at how others approach this problem, it’s not as clean and elegant as Snowflake’s built-from-scratch implementation. AWS is a good example. Its version of separating compute from storage was an afterthought. While it’s good and customers like the feature, it’s more of a tiering to lower-cost storage solution as opposed to a true separation from compute.

Having said that, we’re talking about competitors such as AWS with lots of resources and cohort offerings and so we don’t want to make this all about the product nuances. All things being equal, though, architecture matters and Snowflake gets some props for its well-thought-out approach.

So that’s the cloud S-Curve and Snowflake is still on that curve. In and of itself it has legs, but it’s not what is going to power the company to $10 billion.

The next S-Curve we denote is the Multicloud & Data Sharing curve in the middle. Although 80% of Snowflake’s revenue comes from AWS, Microsoft is ramping and Google… well, we’ll see. But getting traction in multiple clouds is a differentiator for Snowflake relative to the public cloud players. Snowflake’s global instance that spans multiple regions and multiple clouds sets it up for the third wave. For now, making a consistent experience irrespective of which cloud you’re running in is an important step to simplify data management.

But the more interesting part of that curve is data sharing and this idea of data clean rooms. And this is all about network effects and data gravity, and you’re seeing this play out today — especially in regulated industries like financial services and increasingly healthcare and government, highly regulated verticals where folks are super paranoid about compliance.

And what Snowflake has done is tell customers: Put all the data into our data cloud and we’ll make sure its governed. Of course, that triggers a lot of people because Snowflake is a walled garden. That’s the tradeoff – it’s not the Wild West – it’s not Windows – it’s Mac. It’s more controlled. Both models can thrive.

But the idea is that as different parts of an organization or even partners begin to share data, they need it to be governed, secure and compliant. Snowflake has introduced the idea of stable edges. It’s a metric it tracks. Our understanding is a stable edge – or persistent edge – is a relationship between two parties that lasts some period of time – like more than a month. It’s not a one-and-done type of data sharing, it has longevity to it. And that metric is growing at more than 100% per quarter.

About 20% of Snowflake customers are actively sharing data and the company tracks the number of persistent edge relationships within that base. So that’s something that is unique because again, most data sharing is all about making copies of data. Great for storage companies… bad for auditors and compliance officers.

This data sharing trend is just starting to hit the base of the steep part of the S-curve and we think will have legs through this decade.

Finally, the third wave we show above is what we call supercloud, the idea that Snowflake is offering a platform-as-a-service layer that’s purpose-built for a specific objective — in this case, building data apps that are cloud-native, shareable and governed. This is a long-term trend that will take some time to develop, in our opinion. Adoption of application development platforms can take five to 10 years to mature and gain significant traction.

But this is a critical play for Snowflake. If it is going to compete with the big cloud players, it has to have an app dev framework such as Snowpark. It has to accommodate new data types such as transactional data – that’s why it announced Unistore last June.

The pattern that’s forming here is that Snowflake is building layer upon layer with its architecture at the core. It’s not (currently anyway) going out and buying revenue to show instant growth in new markets to contribute to its $10 billion goal. Rather, the company is buying firms with tech that complements Snowflake, fits into the data cloud that the company can organically turn into revenue for growth.

As to the company’s goal to hit $10 billion by FY 2028: Is that achievable? We think so. With the momentum, resources, go-to-market, product and management prowess that Snowflake has, yes. One could argue $10 billion is too conservative. Indeed, Snowflake Chief Financial Officer Mike Scarpelli will fully admit his forecasts are built on existing offerings. He’s not including revenue from all the new tech in the pipeline because he doesn’t have data on its adoption rates just yet. So unless Snowflake’s pipeline fails to produce, that milestone is likely beatable.

Now, of course, things can change quite dramatically. It’s possible that Scarpelli’s forecasts for existing businesses don’t materialize. Or competition picks them off, or a company such as Databricks actually is able to, in the longer term, replicate the functionality of Snowflake with open-source technologies, which would be a very competitive source of innovation.

But in our view – there’s plenty of room for growth. The markets for data are enormous. The challenges with data silos have been well documented. The real key is: Can and will Snowflake deliver on the promises of simplifying data? We’ve heard this before from data warehouses and data marts and data lakes and MDM and ETLs and data movers and data copiers and Hadoop and a raft of technologies that have not lived up to expectations.

At the same time, we’ve also seen some tremendous successes in the software business with the likes of ServiceNow and Salesforce Inc. So will Snowflake be the next great software name and hit the $10 billion mark?

We think so. Let’s reconnect in 2028 and see. Or if you have an opinion, let us know.

Thanks to Alex Myerson and Ken Shifman, who are on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight, who help us keep our community informed and get the word out, and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of Wikibon. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.