CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

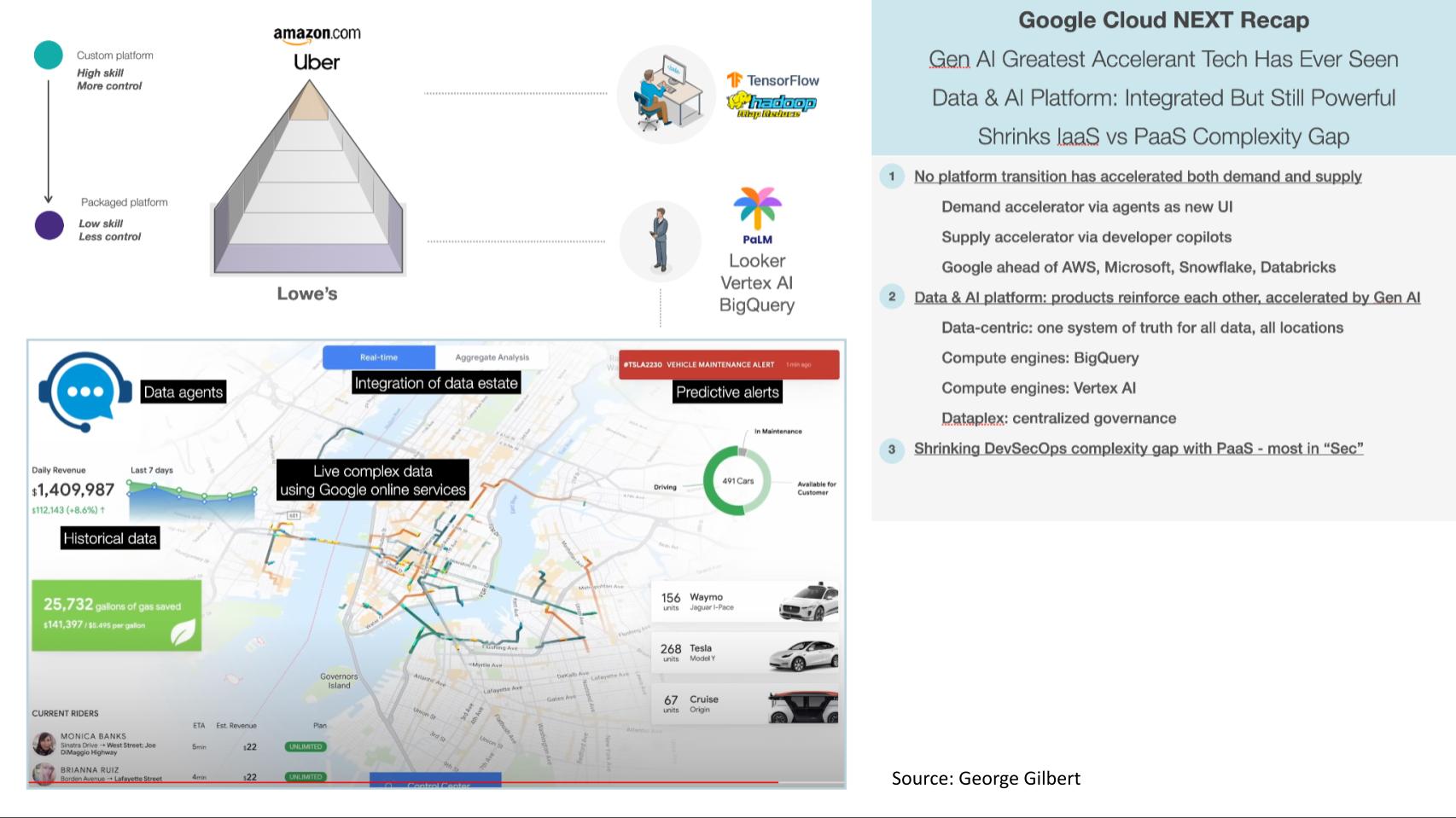

At Cloud Next, Google LLC showcased its strong leadership position in data and artificial intelligence.

In our view, Google’s messaging, demos and tech-centric narrative have broad appeal for developers and next-generation startups. As well, the company’s focus on solutions contrasts its strategy to the typically disjointed services we’ve seen from Amazon Web Services Inc. over the past decade.

Google also showed off an expanded ecosystem of global systems integrators and smaller cloud service providers, encouraging the broad use of Google’s kit globally. Although Google remains a distant third in the infrastructure-as-a-service/platform-as-a-service race, with revenue one-fifth the size of AWS, it is playing the long game and betting the house on AI as a catalyst to its cloud future.

In this Breaking Analysis, we unpack the key takeaways from Google Cloud Next this past week with Rob Strechay and George Gilbert. We’ll share Enterprise Technology Research data that positions Google’s AI relative to other leaders and we’ll contrast Google’s data-centric strategy with traditional architectural models.

The following points summarize our key takeaways from Google Cloud Next.

From the field (Rob’s perspective):

Remote observations (George’s insight):

Bottom line: In our view, Google’s latest advancements, particularly in gen AI, underscore its vision for the future of computing. By focusing on the developer experience, optimizing solutions and expanding its ecosystem, Google is setting the pace in a new phase of the cloud market where rapid innovation based on AI is paramount. Its ability to anticipate and address infrastructure challenges is also commendable, positioning it ahead of competitors such as Microsoft in this arena. The emphasis on security, especially given recent security breaches at other tech giants, further underscores Google’s comprehensive approach. We believe that Google’s strategic direction in AI and cloud will have significant ramifications for the broader tech industry as Google becomes a more viable cloud alternative for developers and industry participants.

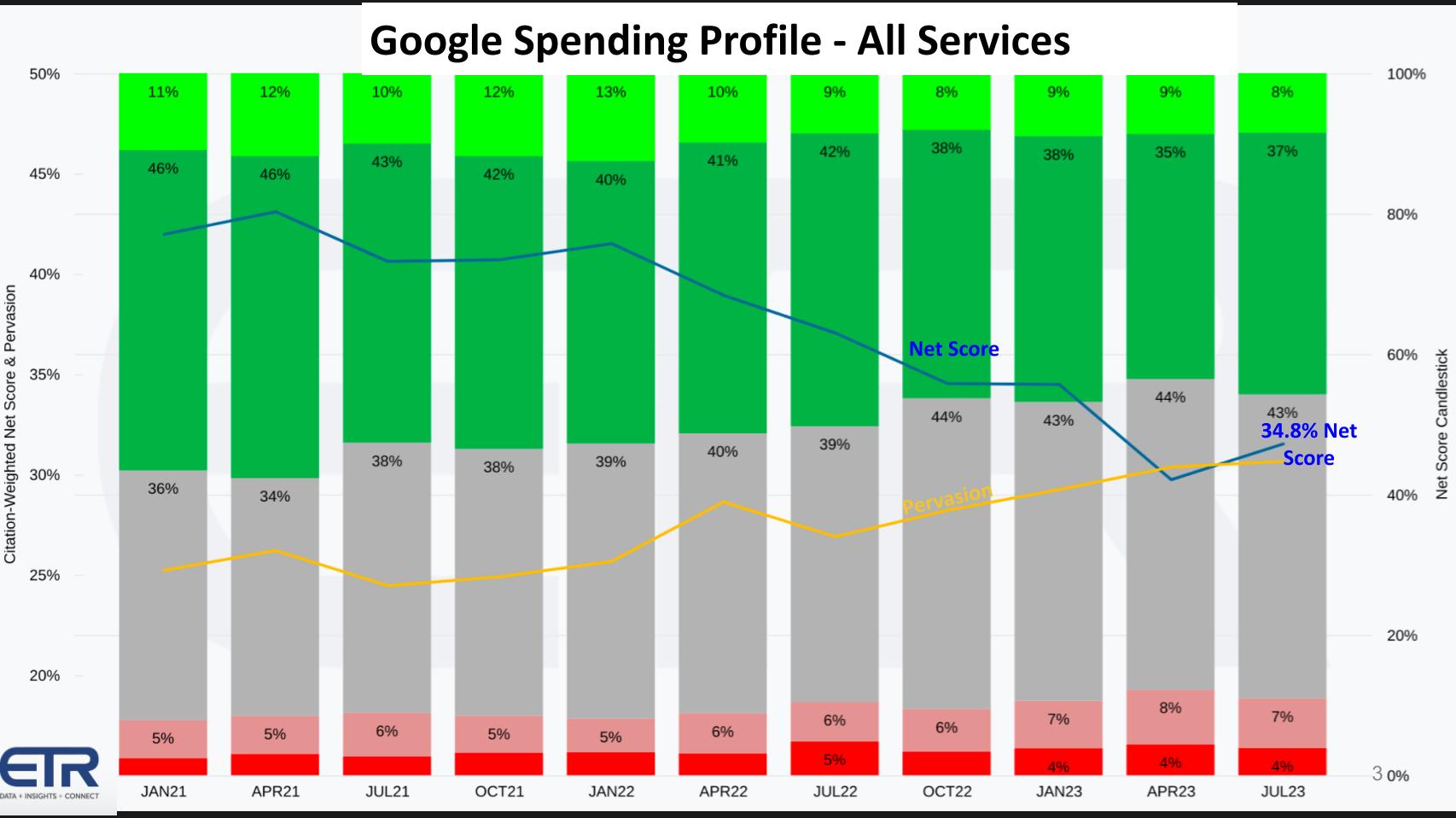

The following chart shows the overall Google spending profile across all Google Cloud services that ETR tracks.

This chart above shows the granularity of ETR’s proprietary Net Score methodology. Net score is a measure of spending momentum. The lime green boxes show new customer ads. You can see in the July survey, 8% of the customer surveyed were new to Google Cloud. The forest green, at 37% of Google customer respondents, represents customers spending 6% or more. The gray is flat spending. That’s a big chunk of Google’s profile, as it is with most vendors these days. The pinkish area at 7% represents spending down 6% or worse. And the bright red at 4% is churn.

Subtract the reds from the greens and you get a net score of 34.8%, represented by the descending blue line that bottomed in the April survey and bounced back in the July measurements.

The yellow line is pervasiveness in the dataset. In other words, it takes the total N of Google customers divided by the total N of the entire survey, which is about 1,700. This figure measures the share within the survey.

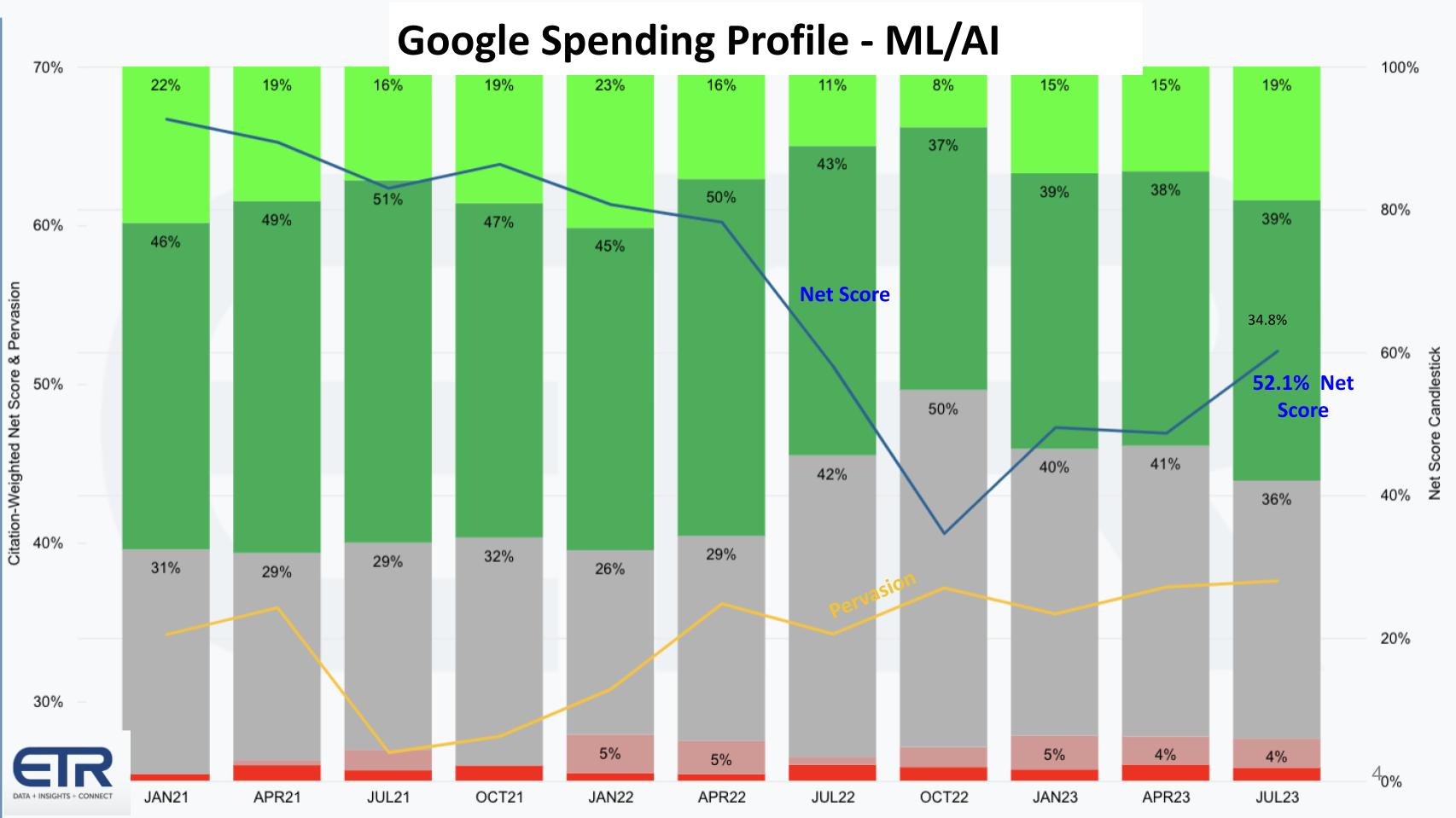

Below we show what happens when we cut the data only on Google’s AI offerings.

You can see above, Net Score bottoms in October 2022, the month before ChatGPT is announced. We were seeing the slow deceleration of AI and machine learning spend post-pandemic. And then Google responds with Bard other AI tooling at Google I/O earlier this year and you can see its next Net Score jumps to 52.1%. We should note that despite Google’s AI prowess, it still ranks lower than the other big cloud players, Microsoft and AWS, and we’ll show you some comparison data in a moment. Nonetheless, Google’s momentum is headed in the right direction and, based on what we saw at Cloud Next, it intends to make inroads.

In addition, we make the following observations:

Bottom line: In our view, Google is making inroads with developers (AWS’ historical stronghold) and solutions for enterprises (Microsoft’s strength). Google and Microsoft may have an edge thanks to their more cohesive software-centric platforms. AWS’ modular approach poses challenges in the rapid AI integration race. Despite AWS’ potential challenges, our research indicates that it would be unwise to underestimate it given its historical competitiveness. However, the broader tech landscape’s shifting generational perceptions, with younger developers leaning toward Google, could have lasting ramifications on market dominance in the coming years.

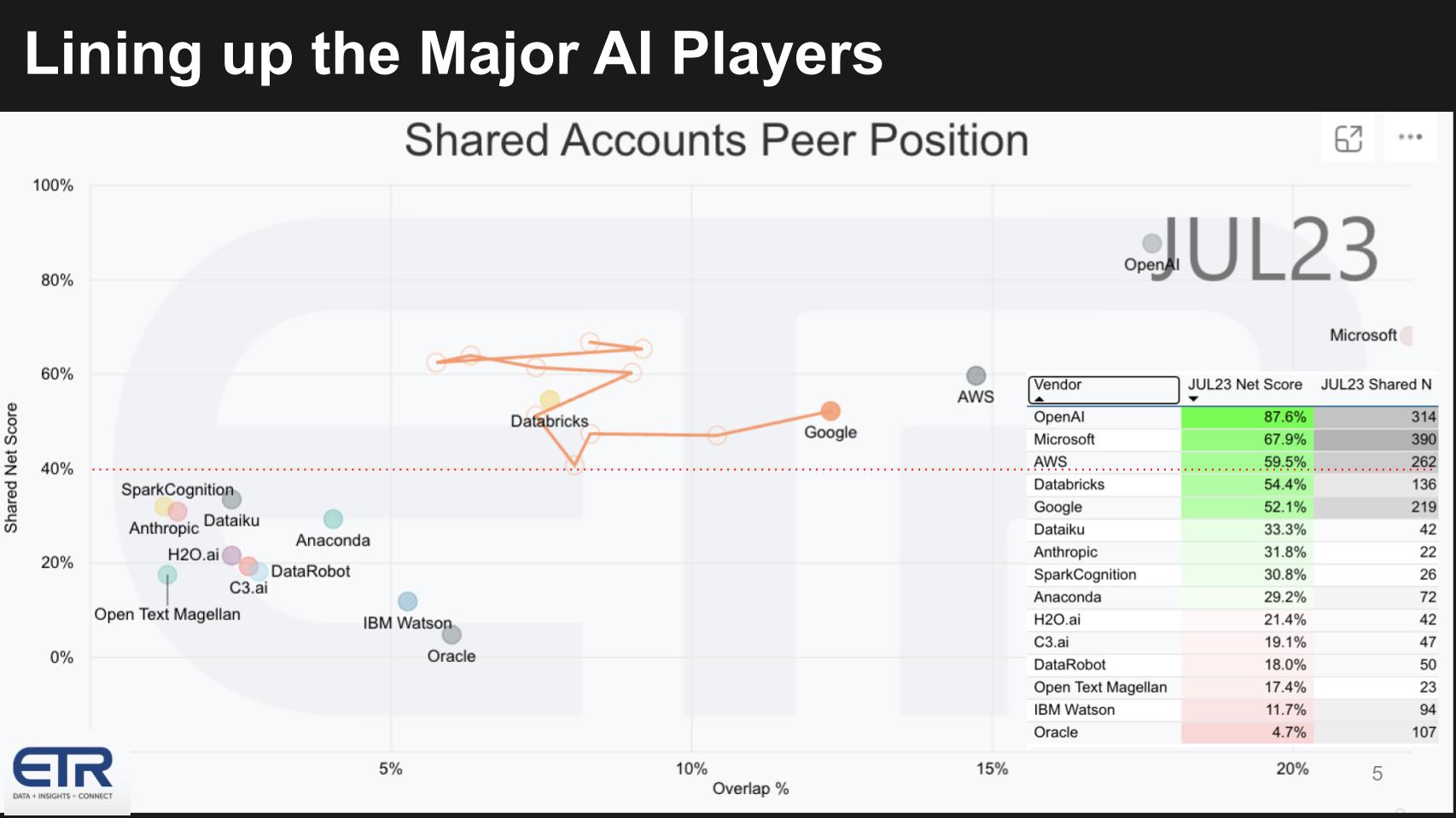

Above we show the AI spending comparison the AI leaders found within the ETR data set. In the chart, Net Score or spending momentum is on the vertical axis and the penetration in the data set or overlap is shown on the X axis. The inserted chart on the right informs how the dots are plotted.

The key points are:

And you can see the pack with Spark Cognition, DataRobot, Dataiku, Anthropic, H2O.ai, C3.AI and others, along with IBM and Oracle, by the way, which are both in the mix. They’re lower on the momentum axis, but they show up in the survey.

The point here is that though Google is strong, it still has a lot of work to do to catch up in market performance.

Next we want to address the question: Will Google’s strong technical position in AI change the game in cloud? If not, why not? If so… when?

Bottom line: In our view, Google’s strategic pivot to capitalize on its strengths in AI represents a significant shift in the cloud wars. While the broader market battles on IaaS and PaaS offerings, Google’s emphasis on AI-centric solutions, such as Vertex AI and Duet AI, may not only enhance its cloud position but also potentially redefine how cloud services are conceptualized and delivered. This approach might establish Google as the go-to cloud provider for organizations prioritizing cutting-edge AI integrations.

Let’s dig into some of the announcements and architectures Google showcased at Next. Above is a slide George created. The pyramid up top underscores the evolution of data apps. We’ve often used Uber Technologies Inc. and Amazon.com Inc. as leading examples of highly advanced companies with lots of engineers and deep technical expertise.

The following further summarizes the key points of George’s analysis:

Bottom line: In our view, gen AI represents a transformative shift in the technological landscape. On both demand and supply sides, it promises to redefine user experience and the software development paradigm. While Google is emerging as a clear leader in this new era, given its advanced tools and widespread implementation, competitors need to innovate rapidly to stay relevant. The dynamic interplay among infrastructure, development tools and user expectations will determine the next cloud champions.

Google’s strategic emphasis on BigQuery as its primary data platform is evident. This focus is a competitive response to the significant traction Snowflake has gained within AWS and Microsoft platforms. Cloud Next had less emphasis on database partnerships than, for example, re:Invent, indicating Google’s intent to prioritize its proprietary data platforms over third-party solutions.

On the topic of governance and other data platforms, our research suggests:

Bottom line: Google is making deliberate efforts to bolster its data stack, emphasizing BigQuery combined with ecosystem governance tools. However, the dynamics with third-party solutions like Databricks and Snowflake could further strengthen existing cloud partnerships and integrations with AWS and Azure.

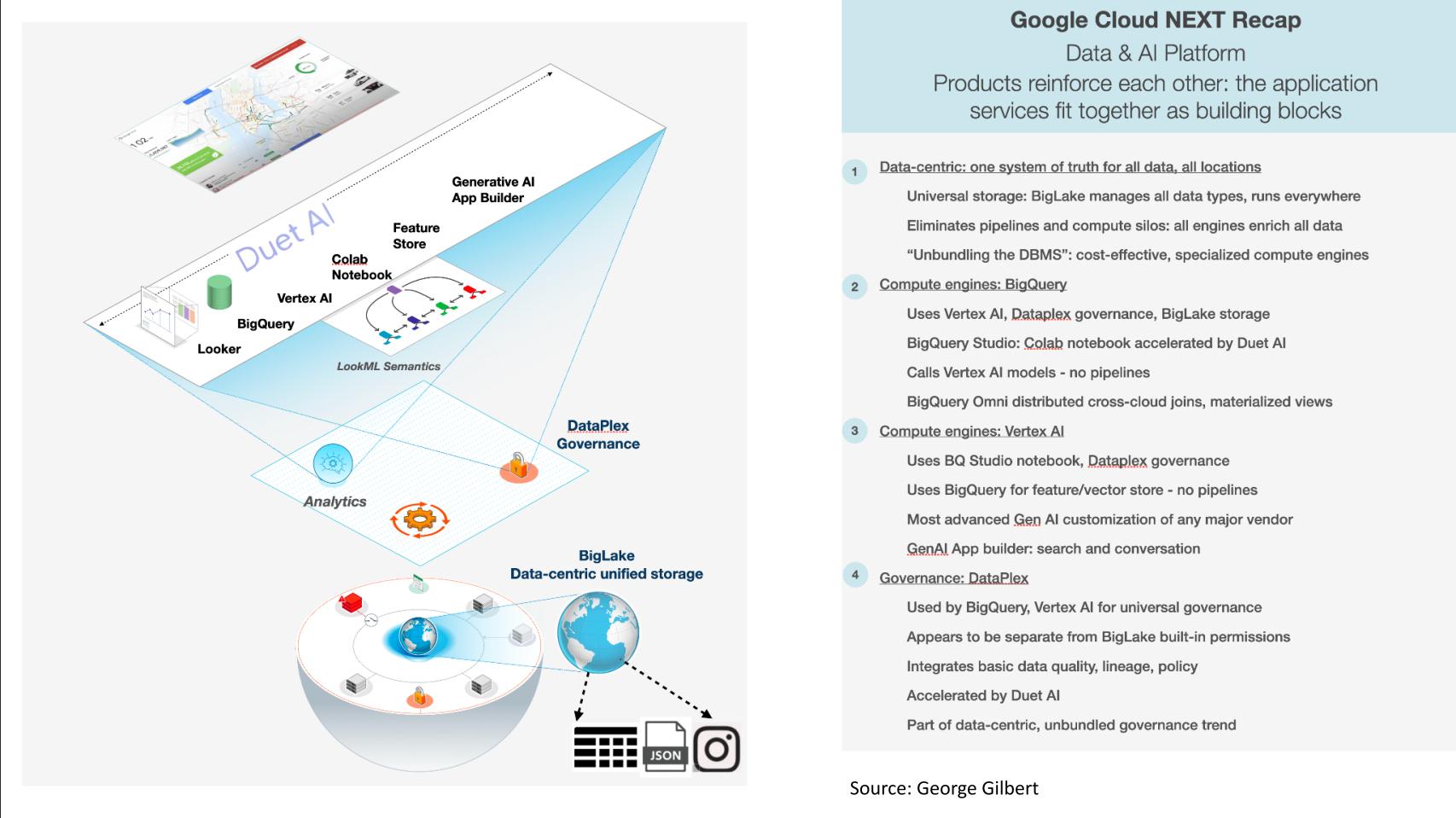

The graphic below represents a form of the Google flywheel and speaks to how Google’s product portfolio across infrastructure, data and AI reinforce each other. In this next section we examine in more detail, the tools Google showcased at Next such as Vertex AI – the framework – and Duet AI — the solution-oriented chat capability — and how they fit into Google’s broader portfolio.

Bottom line: Google is asserting its position in the market with a data-centric approach, integrating AI across its platform. The company’s emphasis on cost-effectiveness, universal storage and coherent interplay among components shows its commitment to a unified experience. Our research indicates that Google is indeed making a compelling case for its data and AI platform, differentiating from cloud competitors with a stronger data and AI play in specific areas.

Many thanks to Alex Myerson and Ken Shifman on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight, who help us keep our community informed and get the word out and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of Wikibon. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.