INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Updated with stock price rise on Wednesday:

Shares of Advanced Micro Devices Inc. erased earlier losses in today’s extended trading session as the chipmaker talked up the opportunity it sees in artificial intelligence, just minutes after its guidance for the fourth quarter came up light.

The company’s stock, which gained 2% during the regular session, fell by more than 5% after-hours in the wake of its third-quarter earnings report. But after AMD executives gave an upbeat assessment of the company’s progress and prospects in AI, those losses were quickly clawed back. Update: On Wednesday, AMD’s shares rose more than 9%.

The company reported net income for the third quarter of $299 million, up from a profit of just $66 million in the year ago quarter. Earnings before certain costs such as stock compensation came to 70 cents per share, just ahead of the analysts’ consensus estimate of 68 cents per share. Revenue climbed just 4%, to $5.8 billion, but it came in ahead of Wall Street’s target of $5.7 billion.

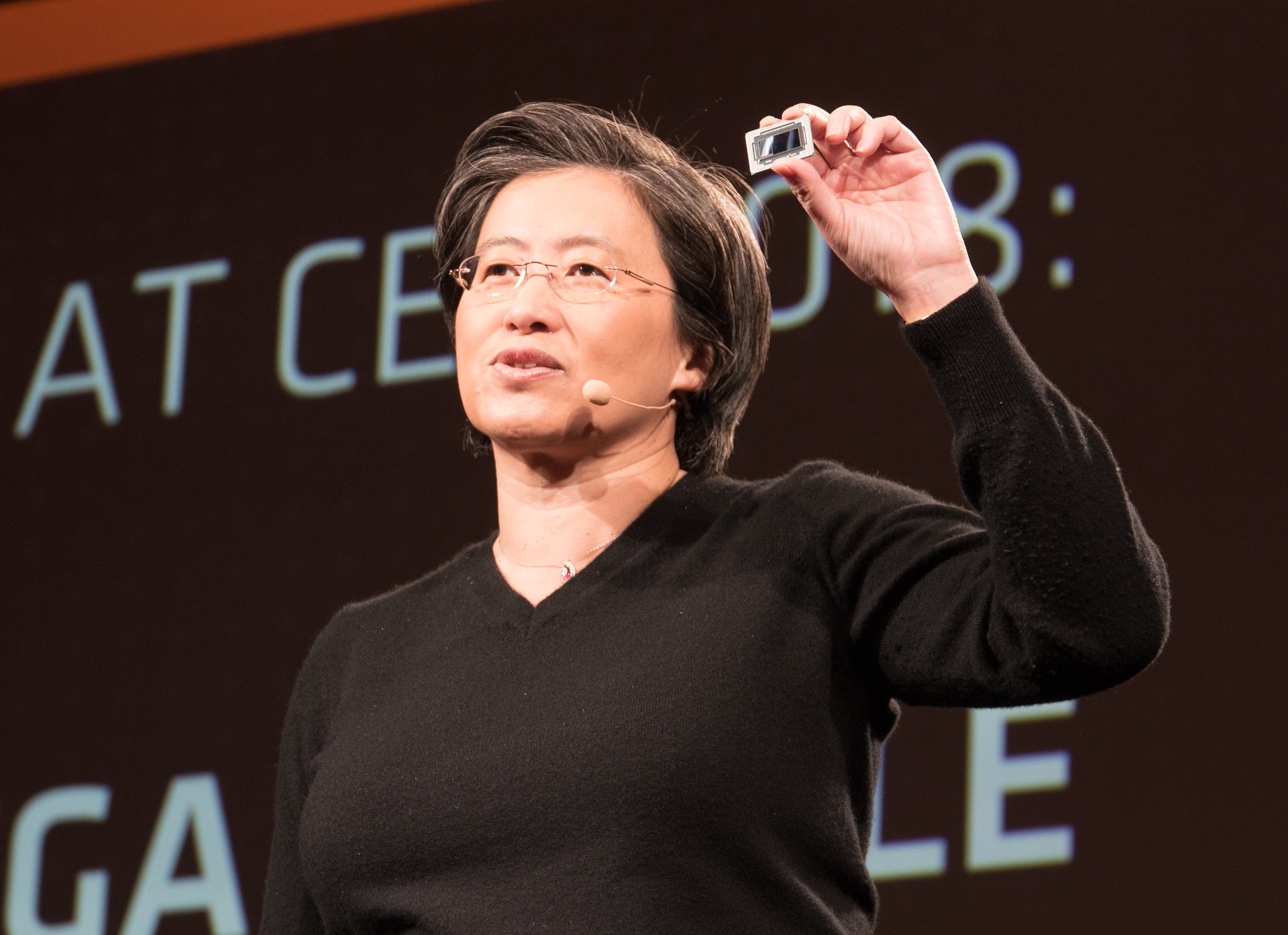

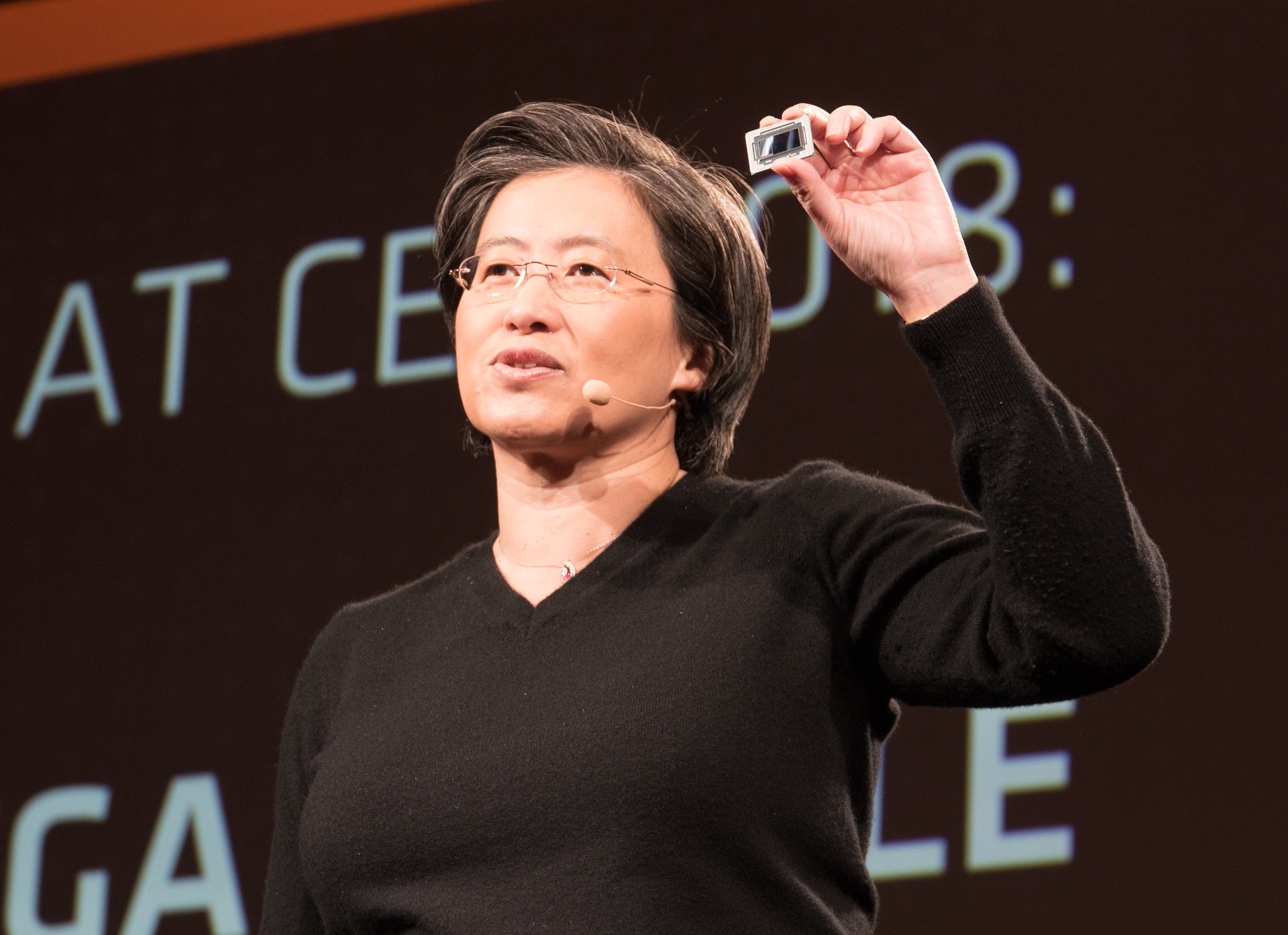

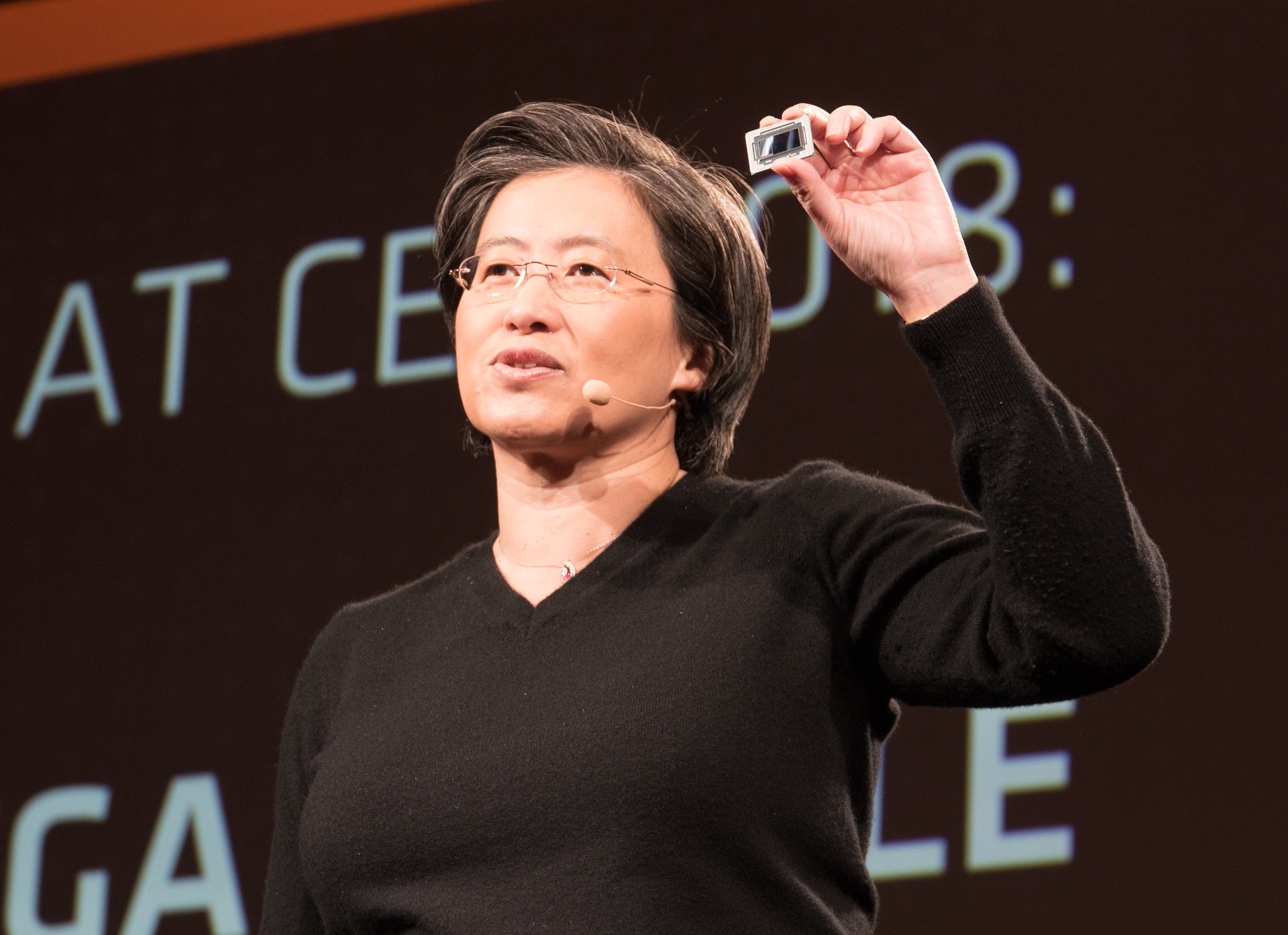

AMD Chair and Chief Executive Lisa Su (pictured) said the strong earnings and revenue growth was driven largely by demand for its Ryzen 7000 series chips for personal computers, along with record sales of server chips. “Our data center business is on a significant growth trajectory based on the strength of our EPYC CPU portfolio and the ramp of Instinct MI300 accelerator shipments to support multiple deployments with hyperscale, enterprise and AI customers,” she said.

However, Wall Street watchers seemed surprised when AMD could only offer disappointing guidance for the current quarter. For the fourth quarter, AMD said it’s modeling revenue of $5.8 billion to $6.4 billion, the midpoint of which is well off Wall Street’s call for $6.4 billion in sales.

As the price of AMD’s stock declined, executives turned their attention to the progress they’re making in AI. During a conference call with analysts, Su spoke of “rapid execution” being made on the company’s AI roadmap, saying it had secured a number of purchase commitments from cloud computing providers. According to Su, AMD is expecting to generate about $400 million in sales from its graphics processing units for AI workloads in the fourth quarter alone, rising to $2 billion in fiscal 2024.

“The way to think about it is, in the fourth quarter, we said revenue would be approximately $400 million, and that’s mostly HPC,” Su said, referring to high-performance computing. “As we go into the first quarter, we actually expect revenue to be approximately similar in that $400 million range, and that will be mostly AI, so with a very small piece being HPC,” she continued.

The CEO explained where her optimism stems from, saying the company has seen “a lot of interest in MI300,” which is the company’s new flagship accelerator chip geared for AI. She said most of this interest is concentrated in cloud with “several large hyperscalers,” before adding that the company is also very engaged across the enterprise.

Su’s bullish stance on the MI300’s prospects is likely to have eased investor’s concerns over the company’s light forecast, said Charles King of Pund-IT Inc. But although that optimism may well be warranted, he noted that there’s still much work to be done. “There’s some distance between a product that is on track for volume production in the fourth quarter, and one that’s delivering $2 billion-plus in revenues in the following year,” he said.

Assuming Su is right about the growth in AI, those extra sales should inject a bit of spark into a data center business that has struggled lately. AMD reported data center revenue of $1.6 billion in the quarter, flat from the same period one year earlier and in line with consensus estimates. However, the revenue rose more than 20% on a sequential basis, suggesting it may improve in the near future.

Elsewhere, AMD reported sales of $1.5 million in its client segment, which makes chips for PCs, up 42% from a year earlier due to lots of interest in its latest Ryzen chips. The consensus estimate for that unit was just $1.2 billion.

Gaming revenue declined 8% from a year earlier to just $1.5 billion, in line with forecasts, while embedded chip sales fell 5% to $1.2 billion, below the analyst forecast of $1.3 billion.

“Overall, AMD’s performance was unexpectedly good, especially given the weakness in its gaming and embedded solution sales and flat data center chip performance,” King said. “The biggest surprise was the robust demand for its PC chips, which is a segment that many believed was in freefall less than a year ago.”

Holger Mueller of Constellation Research Inc. said AMD’s inability to grow its data center revenue was a big surprise and means there is an urgent need for Lisa Su and her team to deliver the MI300 GPUs as soon as possible. The other surprise, he said, was AMD’s increased profit, which largely came from the embedded segment, which covers less powerful chips for networking and low-powered devices.

“Just over 50% of the embedded segment’s revenue was operating income, and it delivered more than profit than the three other divisions combined,” Mueller explained. “In the fourth quarter, investors will be looking at the embedded segment for more profit and the data center segment for growth, while hoping that it can stem or at least reduce its losses in the client and gaming segments.”

THANK YOU