AI

AI

AI

AI

AI

AI

Predictions about the future of enterprise tech are streaming to our inboxes, literally by the thousands. Most are thoughtful and we will review those prior to publishing our 2024 predictions later in January.

As is our tradition, we try to make our own predictions more challenging by citing forecasts that are measurable and have either a numeric tied to them or a binary outcome. Our belief is if we make a prediction, you should be able to look back a year later and say with some degree of certainty whether the prediction came true or not — with some empirical evidence to back that up.

In this Breaking Analysis, we grade the 2023 predictions we made with Enterprise Technology Research’s Erik Bradley. We look back at what we said in January about the macro information technology spending environment, cost optimization, security, generative AI, cloud, blockchain, data platforms, automation and tech events.

First, here’s a quick scan of our 2023 predictions:

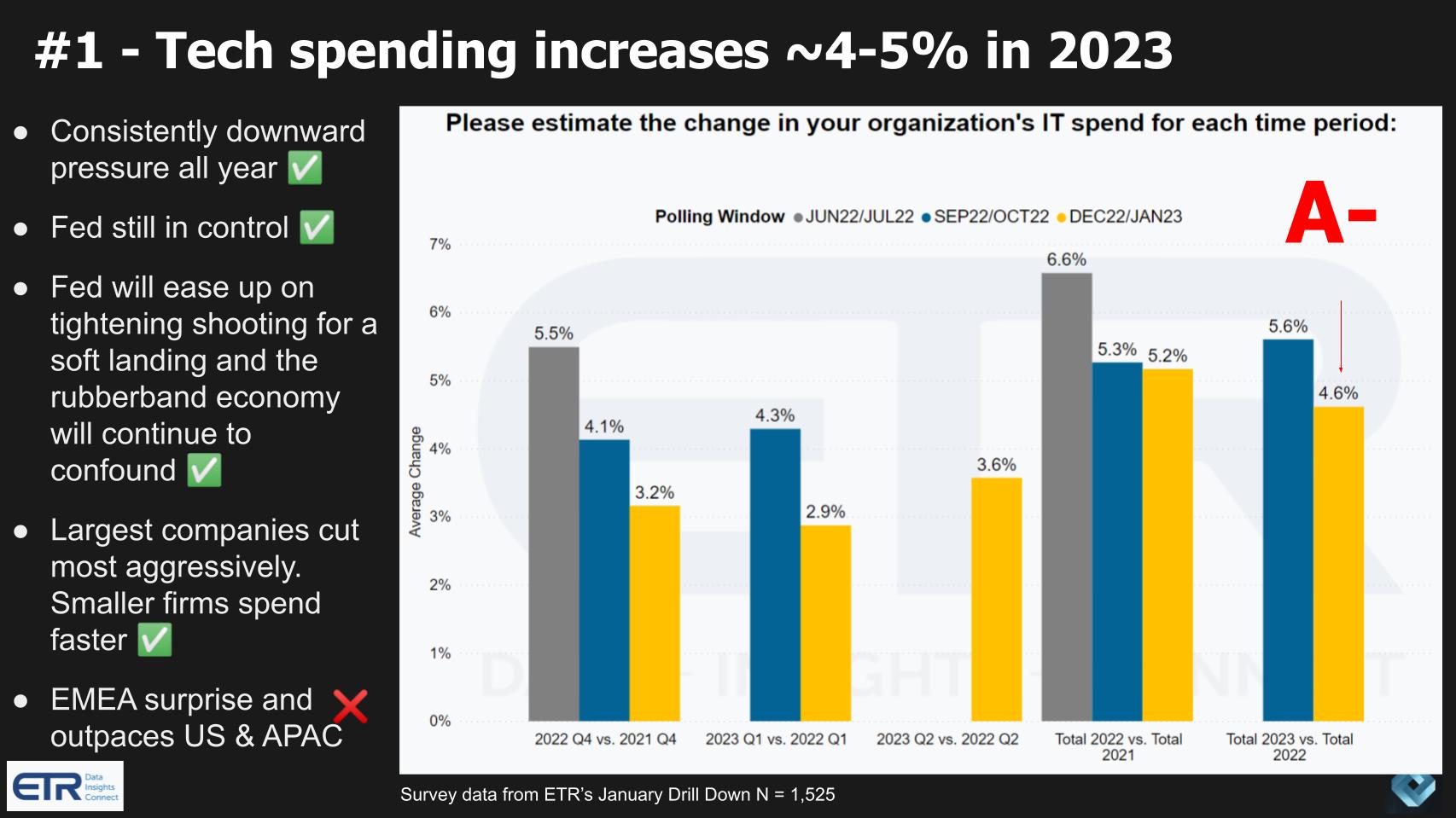

In January we said tech spending would grow in 2023 between 4% and 5%. It turns out this was just a bit too optimistic, but we got the themes right and came within one point, hence the A minus grade.

We correctly predicted the consistent downward pressure on budgets for the year and the pause in Fed tightening. We also correctly called that large companies would feel the pinch more than small firms as the data coming in today suggests that small and medium-sized businesses will come right on our 4% to 5% figure, whereas the Global 2000 is showing less than one-half that growth rate. Gartner is currently calling 2023 at 3.5% growth relative to 2022, for what it’s worth.

We said that Europe, the Middle East and Africa would surprise to the upside, but it didn’t. It came in right at the global number and Asia-Pacific looks like it’s coming in at a half a percentage point above the global average. But we correctly predicted that government spending would significantly outpace overall IT spending and it did this past year.

So overall we got this call directionally correct, with the exception of EMEA, and will give a grade of A-.

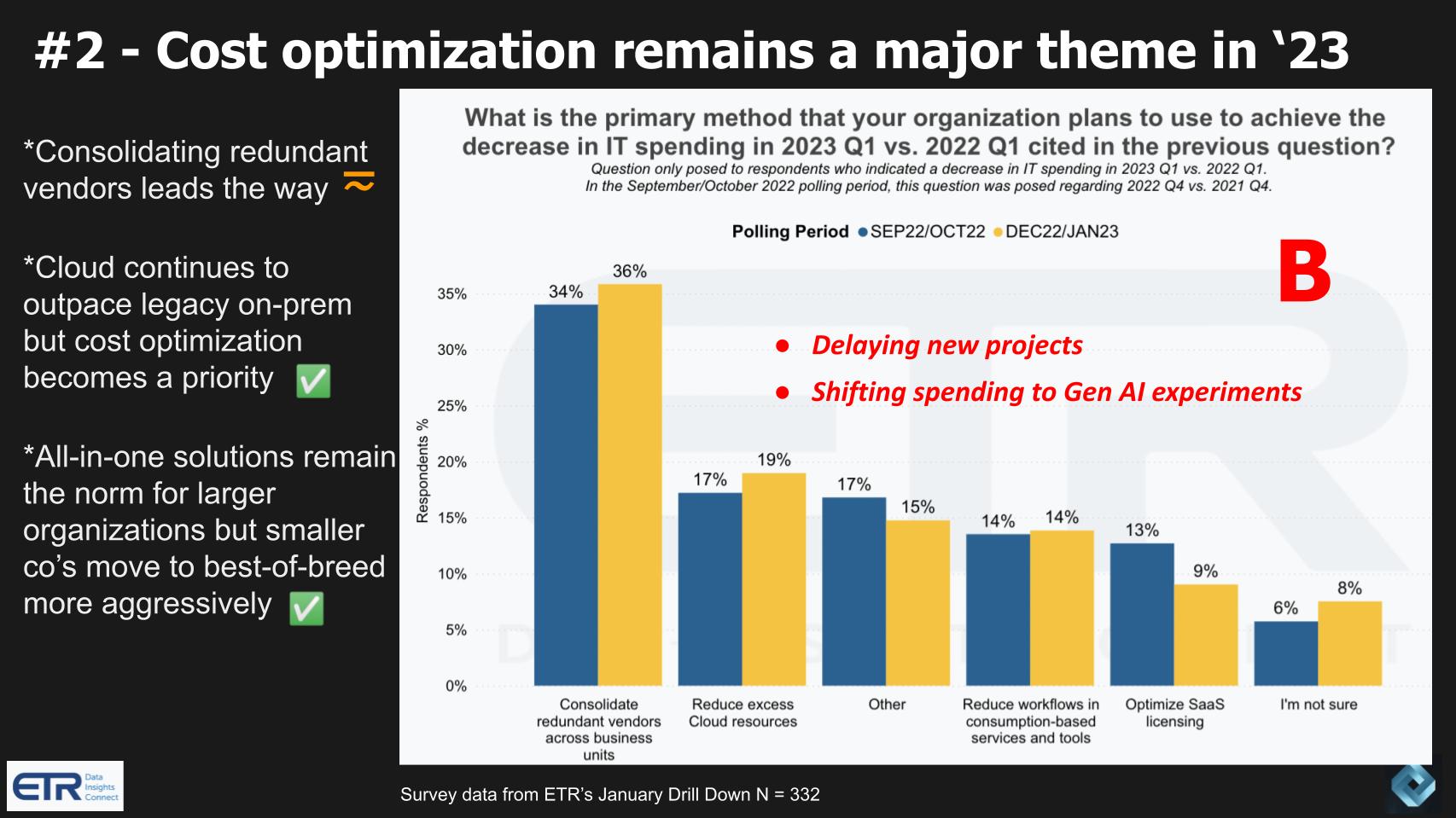

The upside benefits of dynamically scaling cloud computing resources up has the equal and opposite benefit for customers as well – that is, the ability to dial resources down. We clearly saw that in 2022 and projected continued cost optimization in 2023.

Though this call was spot on, part of the reason for only giving ourselves a B is that we said consolidating vendors would be the primary means of optimizing costs, taking over for cloud optimization. The vendor consolidation trend was particularly acute in security but generally proved somewhat more difficult than forecast. Two other factors dominated spending strategies in 2023:

We saw the latter steal from other budget buckets. Meanwhile, the pressure on overall budgets remained in 2023 and as such these were two key trends that were not explicitly part of our prediction, so we’ve taken the grade down to a B.

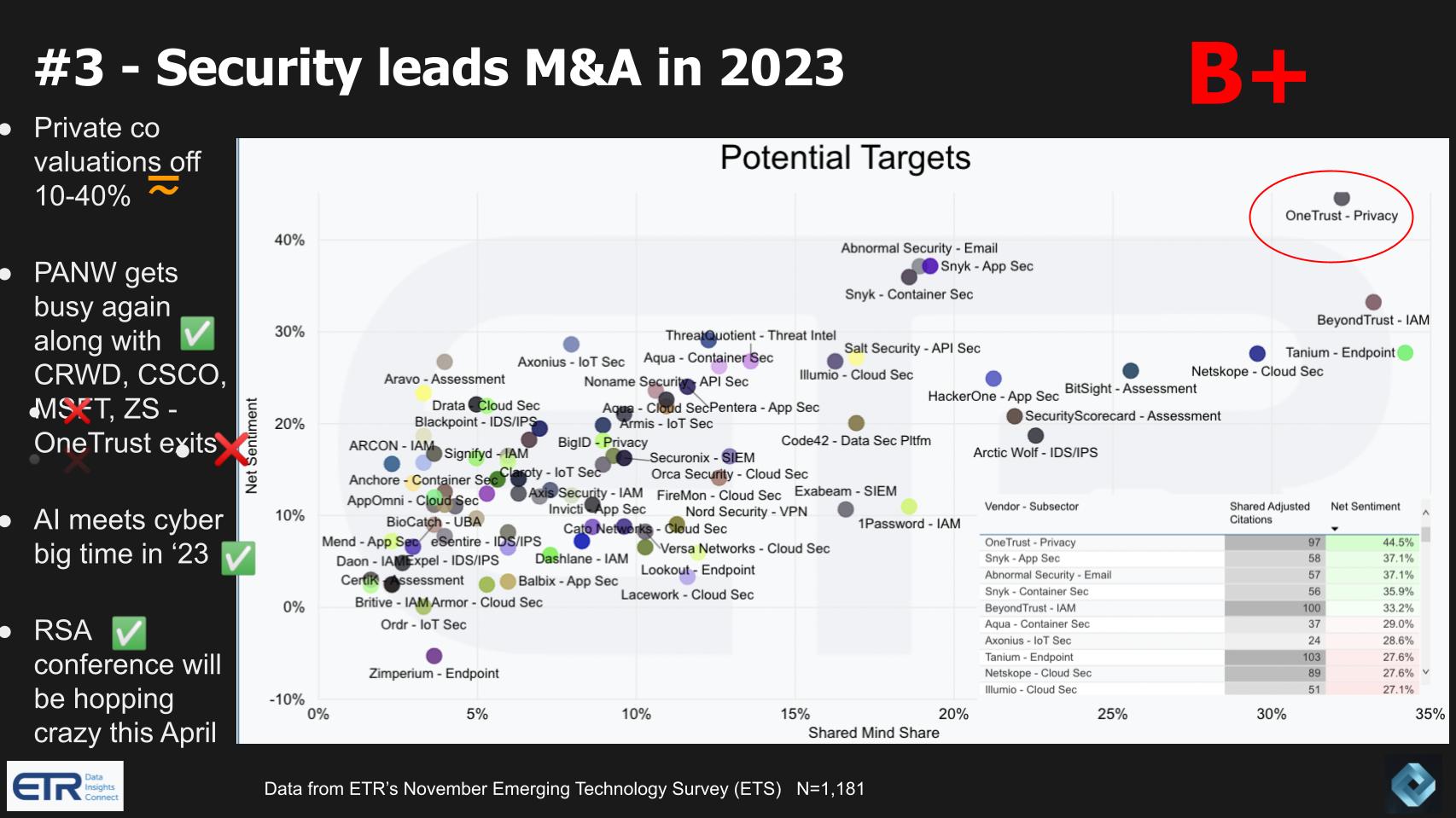

We said that though the first part of this prediction is probably safe, the more challenging call is what we forecast specifically about the five companies cited, and a prediction that OneTrust LLC would have an exit in 2023. Palo Alto Networks Inc. spent $1 billion acquiring Dig Security Solutions Inc. and Talon Cyber Security Ltd. CrowdStrike took out app security player Bionic.ai and Zscaler bought Canonic Security, a software-as-a-service supply chain security firm. But the big news of 2023 was Cisco Systems Inc.’s planned $28 billion acquisition of Splunk Inc.. Microsoft Corp. was active with new cloud security announcements but was focused on other areas for acquisitions.

As for the prediction of downward pressure on valuations, though true for many in the crowded security market such as Cybereason Inc., which saw a 90% reduction in its value in the spring, the likes of Wiz Inc. and Arctic Wolf Networks Inc. saw upward momentum. And though OneTrust didn’t get acquired or go public, it likely will in the coming year.

The last two items on this chart came in right on with AI a major theme for all cybersecurity firms. CrowdStrike’s Charlotte LLM announcement was particularly notable and as predicted the RSA Conference last April was back in full swing.

So we took a B+ on this one.

Related to our cybersecurity predictions, we said that zero-trust security would get real in 2023. Though true, practitioners continue to tell us they struggle to operationalize the salient aspects of zero trust. And though it remains a priority and north star for most organizations, they continue to aspire for more mature implementations.

But because virtually all chief information security officers we talk to take this topic seriously and are on a zero-trust journey, we grade ourselves a B+ on this prediction.

Don’t look now, but Meta Platforms Inc.’s pivot from the metaverse to AI with Llama, combined with cost-cutting, has the company’s value pressing toward $1 trillion again.

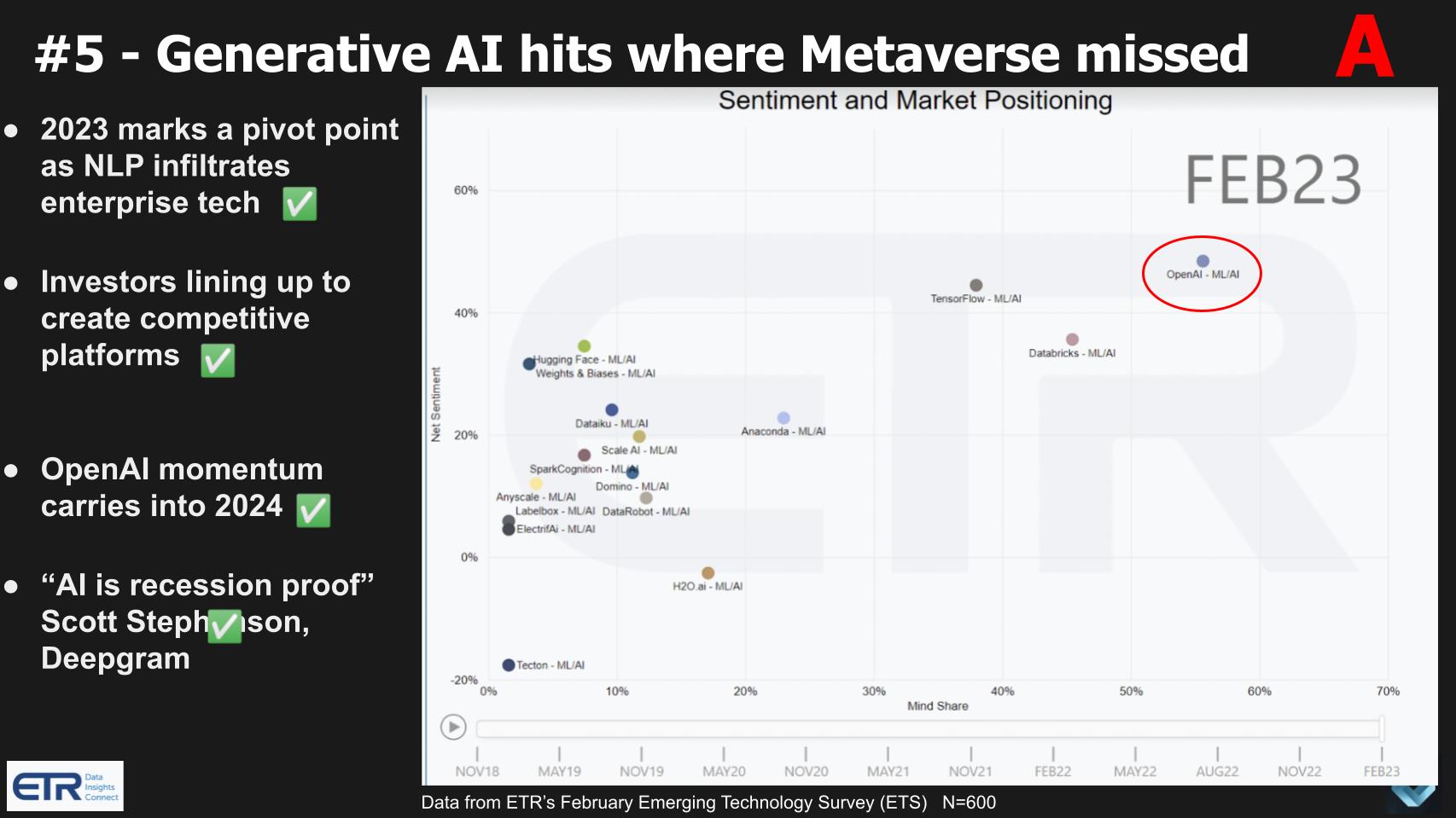

We pointed out last January that OpenAI’s momentum was unprecedented in the ETR spending data and predicted that would not only continue but also attract a spate of investment to competitive or adjacent platforms. It did. Anthropic PBC was the most notable with investments from the likes of Amazon.com Inc. and Google LLC driving a reported $20 billion to $30 billion valuation. But others such as Cohere Inc., Stability AI Ltd., ScaleAI Inc., Inflection AI Inc. and more benefited from the considerable AI hype.

Perhaps a lock prediction, but we nailed this one and earned an A.

We predicted that 2023 will see the expansion of cloud to the edge and the continued evolution of what we call supercloud. Cloudflare Inc. in our view will be a major beneficiary of this trend. Cloudflare overtook Google in terms of spending momentum in late 2022 and early 2023 as an indication of the company’s momentum. Cloudflare is considered a good fit for the definition of supercloud as it brings all aspects together and is cloud-agnostic. It is already highly pervasive in networking and security and is considered the No. 1 leader in SaaS, web access firewall or WAF, distributed denial-of-service and bot protection.

Cloudflare’s stock is up 98% year to date, compared with the red-hot Nasdaq’s 42%. This was a good call and so we took the A.

At the time of this prediction, Erik Bradley argued that blockchain is a niche solution that requires a lot of custom work, and that it is unlikely to gain widespread adoption in the enterprise. He also points out that though blockchain is a database ledger, it is not clear why businesses would want to move to a different database ledger when they already have one that works well.

So this part of the prediction we got right. We did, however, hold out hope that developers would embrace solidity as Ethereum continued to be the developer platform of choice. Although crypto made a comeback in 2023 and Ether benefited, there is no overwhelming evidence that enterprise developers are on board. In fact, the data suggests many blockchain developers jumped to catch the generative AI S-curve.

So we should have stopped with Erik Bradley’s commentary but took it on the chin with this one and gave ourselves a C+.

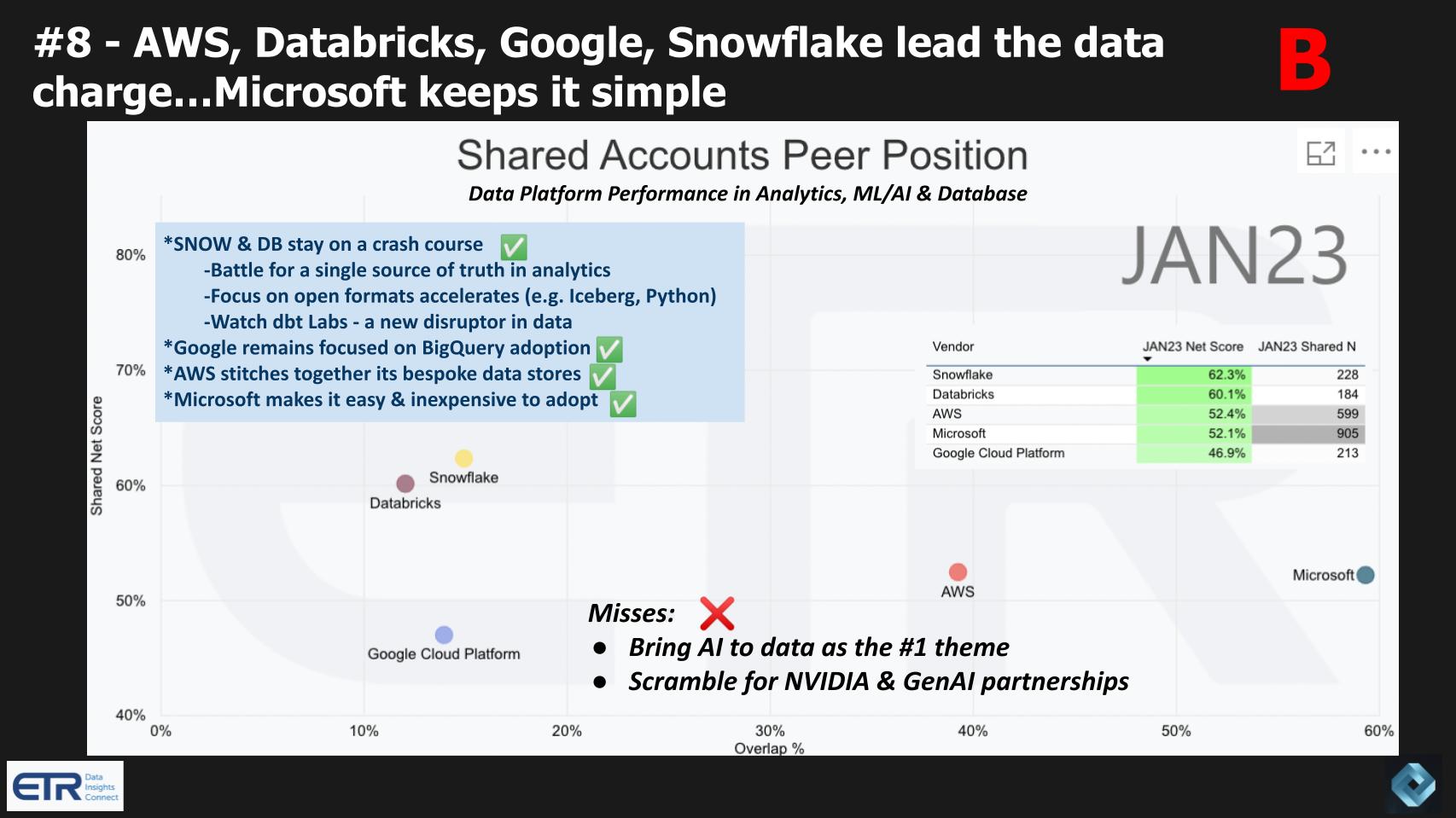

In the data platform market for analytics, machine learning and databases, Amazon Web Services Inc., Databricks Inc., Google and Snowflake Inc. are leading the charge with Microsoft making it easy to do business. Snowflake and Databricks continued on their collision course, as they both aim to become the single source of truth in analytics.

We predicted a big focus on, and greater adoption of, open formats and languages that are popular in the data science and open-source communities. We also predicted that AWS would continue to make moves to simplify its bespoke data platforms, which it has, albeit slowly.

Though generally all true, we took a B grade on this one because we didn’t call out the biggest theme of the year in data – bringing AI to data and the scramble for Nvidia Corp. graphics processing units and other AI partnerships. Hence the penalty on our grade.

We predicted that automation would make a resurgence in 2023, with UiPath and Microsoft Power Automate leading. Although those two companies continued to show gains, we believe much of their success was the result of other factors rather than market fundamentails. For example, UiPath’s momentum, we believe, has come from better sales execution, while Microsoft has had a tailwind from its OpenAI partnership.

The fact is that AI is a two-edged sword for automation companies. On the one hand, they can inject AI into their platforms to make them significantly more functional. The flip side is AI has the potential to cannibalize many of the mundane tasks that robotic process automation and other automation platforms are designed to address.

So we weren’t as forceful about that dynamic as we could have been. Moreover, the move from back office to front office, software testing, end-to-end AI and low code adoption, while moving in the right direction, was not an overwhelming trend in 2023. We were a bit early on this prediction, so we gave ourselves a B-.

We correctly predicted that the number of physical events is going to increase dramatically in 2023, but many of the biggest events are going to get smaller. This was not the case with some events such as AWS re:Invent, Snowflake Summit, Databricks Data + AI Summit and some others. But traditionally large customer events from the likes of Oracle CloudWorld and Dreamforce were scaled down in size… as were many others. In addition, we saw many more regional events and road shows take shape in 2023 as a means of driving customers intimacy locally.

As the “OG of Live Tech Event Coverage” we know a little about this topic. With theCUBE we’ve had a front row seat for 13 years to see how events operate and this was an easy A+ for us.

So with that – add them up and divide by 10 we earned a solid B+ this year, which seems to be our pattern. It seems hard given our quest for measurable predictions to break through a B+ grade, but overall we feel pretty good about our calls.

Next up – our 2024 predictions which we’ll drop in late January after ETR releases the results of their spending intentions survey, which is currently in the field.

Thanks to Alex Myerson and Ken Shifman on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight, who help us keep our community informed and get the word out, and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of Wikibon. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.