INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

As an American, you can’t help but root for Intel Corp. CEO Pat Gelsinger to succeed.

His vision to bring semiconductor manufacturing leadership back to the United States is more than just a quaint nationalistic sentiment. Rather, it’s a strategic imperative for the country, its military, global competitiveness and access to future technological innovations in the AI era. But his strategy is dependent upon the success of Intel both as a designer and a leading manufacturer of advanced chips.

As such, this choice puts Intel in a multifront war with highly capable leaders in several markets, including names such as Advanced Micro Devices Inc. Nvidia Corp., Amazon Web Services Inc., Google LLC, Microsoft Corp., Apple In. Tesla Inc. and other chip designers… even perhaps OpenAI. As well, Intel competes with with established manufacturers such as Taiwan Semiconductor Manufacturing Corp. and Samsung Electronics Co. Ltd.

Moreover, Intel’s business model has been disrupted by Arm Holdings Ltd., which has created a volume standard powered by the iPhone and mobile technologies. Finally, China Inc. looms as a long-term competitor, further underscoring the imperative.

But the trillion-dollar questions are: 1) What are the odds that Intel’s strategy succeeds; and 2) Are there more viable alternative strategies for both Intel and the United States?

In this Breaking Analysis, we try to address these uncertainties and to do so we welcome Ben Bajarin, CEO and principal analyst at Creative Strategies.

Before getting into the discussion, let’s look at the broad enterprise technology market.

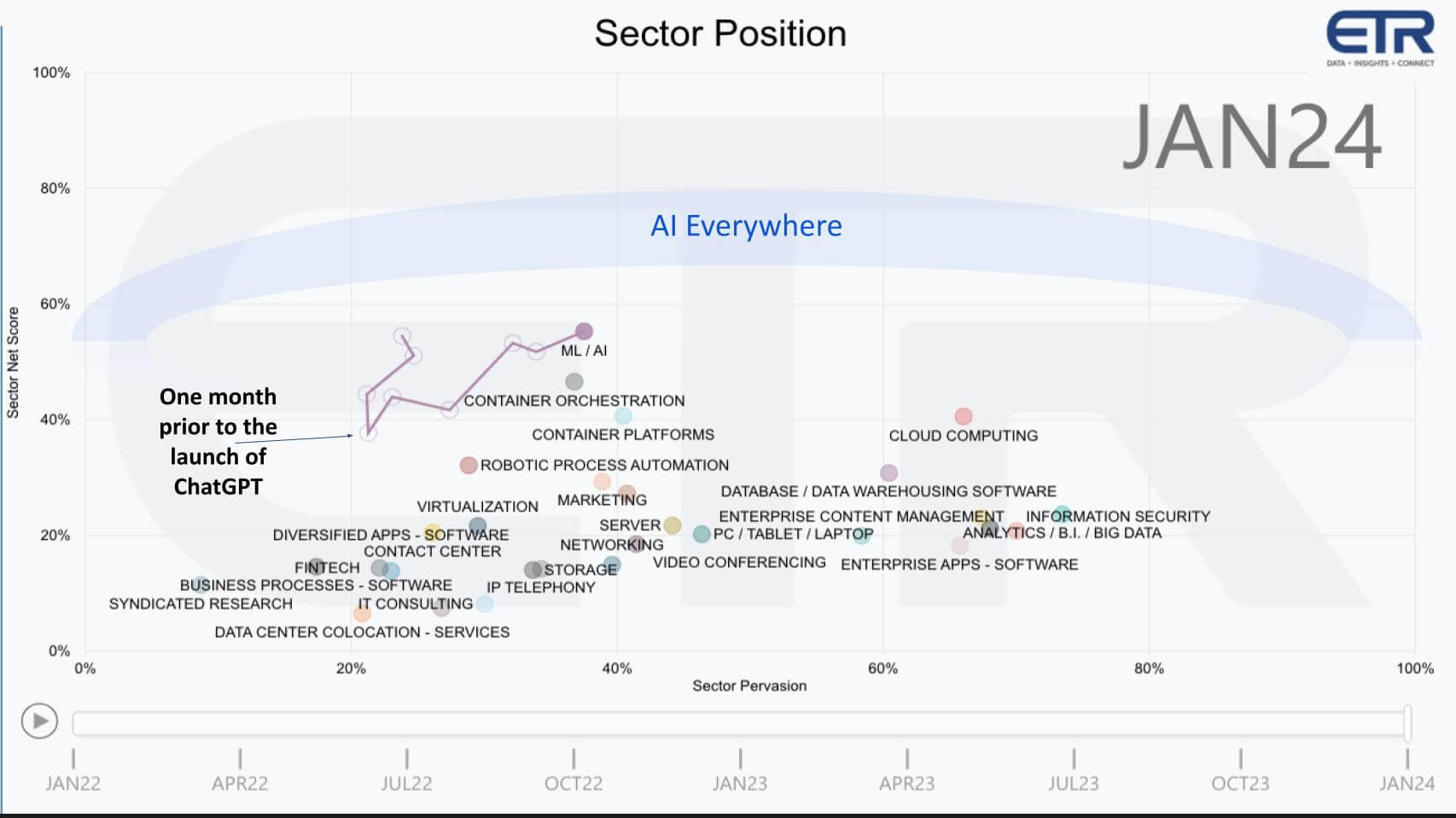

This Enterprise Technology Research survey data comes from more than 1,700 information technology decision makers and plots the Net Score or spending momentum of a platform on the vertical axis and its presence in the data set on the horizontal plane. The enterprise market accounts for a large and representative portion of the $4 trillion worldwide information technology market.

The graphic shows that artificial intelligence has become the sector with the most spending velocity since the announcement of ChatGPT. But the real point is AI is not going to be a distinct sector. Rather, it will be embedded everywhere in every sector from IT hardware, software, AI PCs, mobile devices, consumer electronics, autos…. Virtually every product will have AI.

And that AI will be powered by silicon chips.

The market has changed dramatically over the past two decades. Firms such as AMD and IBM got out of the foundry business. Arm capitalized on the smartphone revolution and completely disrupted established business models. When PC volumes peaked in 2011, Intel’s monopoly began to erode and TSMC became the dominant manufacturer. Firms such as Samsung rose up along with many others, including a spate of novel chip designers such as Apple, AWS, Tesla and many others.

Q1. Ben how would you describe the changes that have taken place in the market?

The following summarizes Ben’s analysis:

There have been pivotal transitions in the semiconductor industry, where Intel’s dominance in product design and foundry manufacturing process technology was overtaken by TSMC over the last decade. Intel’s failure to maintain pace with Moore’s Law, characterized by its shift from a “tick-tock” to a “tick-tock, tock, tock, tock” model reflected challenges in innovation and foundry utilization.

During this period, TSMC capitalized on a more predictable and conservative approach towards process development cycles, becoming the preferred option for major chip designers such as AMD, Nvidia, Apple, Qualcomm Inc. and MediaTek Inc. TSMC’s strategy, focusing on stable process development without aggressive jumps, alongside its scale and capacity to serve as a reliable manufacturing partner, established it as the leader in process technology — a position previously held by Intel. These market changes highlight the importance of leading-edge process technology in attracting chip designers seeking competitive advantages for their products.

Key points

Bottom line

TSMC’s rise to leadership in process technology, overtaking Intel, underscores the strategic significance of innovation, predictability and adaptability in the semiconductor industry. The ability to meet the demands of leading chip designers and manufacturers has been central to TSMC’s success, highlighting the ongoing battle for technological superiority in a highly competitive market.

Listen to Ben Bajarin comment on the changing market forces.

People often talk about the global semiconductor supply chain. And it is comprised of companies in many geographies, but it’s really not a global supply chain, rather it’s a supply chain highlighted by some very tenuous choke points, as shown in the graphic below.

This graphic depicts just some of these bottlenecks.

Taiwan manufacturing. Taiwan is the epicenter of advanced chip manufacturing and is on the razor’s edge with China threatening to reintegrate Taiwan. Apple and its customers (and other firms) rely on TSMC for advanced chips.

Netherlands EUV machines. ASML Holding NV, a Dutch company, is the sole supplier of EUV lithography machines, which are required for manufacturing the most advanced chips. These machines cost more than $100 million and comprise more than 400,000 parts. There is no second source to ASML’s EUV machines.

California EDA software. Silicon Valley is the leader in electronic design automation software or EDA.

Japan wafers and thin-film technology. Japan is where you get silicon wafers and other thin film technologies from a small number of specialized firms.

China rare earth elements. China, which is currently enduring chip supply sanctions, is where critical rare earth elements are found in concentrated deposits, making that country the leader in global supply. These elements are critical in many phases of the chip manufacturing process.

Q2. Ben, how would you describe the current state of supply in semis? How should we think about these choke points and the challenges they present to chip supply?

Ben’s analysis can be summarized as follows:

The semiconductor industry is characterized by a lack of centralized control over silicon manufacturing. Suppliers are spread out across the globe with an intricate supply chain. This complexity is a source of concern, and despite talk of doing so, it’s basically impossible today to nationalize semiconductor production to meet all needs. The industry’s distributed global nature requires close collaboration to ensure a smooth supply chain. Disruptions having severe consequences, as observed in recent years with COVID. The management of supply chains, whether for leading or trailing edge technologies, is critical to minimizing risks amidst inherent challenges.

Key points

Bottom line

The semiconductor industry’s reliance on a globally dispersed supply chain presents key challenges, highlighting the critical need for international cooperation and effective risk management. Despite efforts to diversify and stabilize the supply chain, inherent vulnerabilities and geopolitical tensions continue to pose threats to the industry’s resilience and efficiency.

Watch and listen to Ben Bajarin’s analysis on the global supply and demand equation.

Every country, including China, will be challenged to create a national supply chain.

Let’s pivot to Intel’s strategy generally and its foundry prospects specifically.

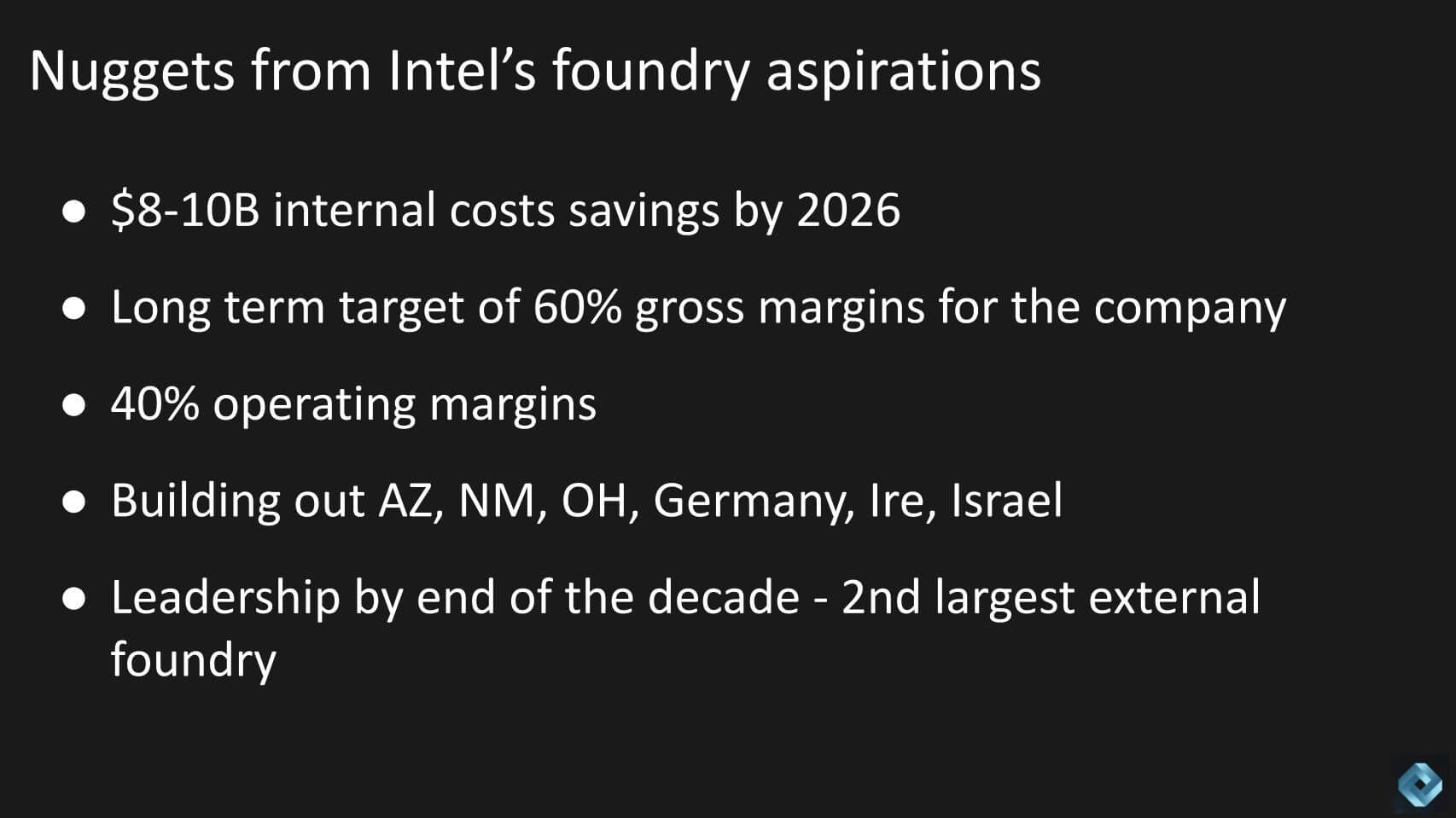

Above we show just a few of the relevant promises Intel has made to the investor community. Its IDM 2.0 strategy is designed to make manufacturing more competitive and efficient for both internal and external customers, promising to save $10 billion by the time it exits 2025. The company used to have gross margins in the 60%-plus range and is well below that today in the mid-40s.

Intel plans to get back there eventually with a very aggressive 40% long-term operating margin goal. Intel is building out at least six new fabs by our count to support Gelsinger’s vision of having 50% of global manufacturing outside of Asia.

The company’s objective is to return to process leadership and be the second-largest foundry behind TSMC by the end of the decade.

Q3. Ben, Pat Gelsinger called Intel’s first foray into foundry a “hobby.” Why do you feel or do you feel this time around it will be different?

The following summarizes Ben’s analysis:

According to Ben, Intel’s initial forays into offering foundry services to other companies were half-hearted and marked by significant challenges, primarily due to the prioritization of their own product technologies over those of potential foundry customers. This approach led to a lack of trust and tense collaboration with other firms. Intel didn’t share its leading-edge technology and signaled to customers that it was not fully committed to the foundry business. This time around, Intel is structuring its foundry business separate from its core design organization and is learning from its past mistakes.

Key points

Bottom line

Intel’s transformation in its foundry business approach, from an insular focus on its own products to establishing a credible, customer-centric foundry service, underscores a strategic pivot essential for its success in the competitive semiconductor manufacturing sector. By addressing past shortcomings through clear operational divisions, enhanced customer service and a commitment to technological advancement, Intel is making strides toward rebuilding trust and establishing itself as a legitimate player in the foundry space. This shift is critical for Intel’s ambition to compete with established foundries like TSMC and for the broader semiconductor industry’s health and dynamism.

Listen to Ben Bajarin’s analysis of Intel’s strategy and prospects in foundry.

How can Intel achieve five nodes in four years, something that has never been done?

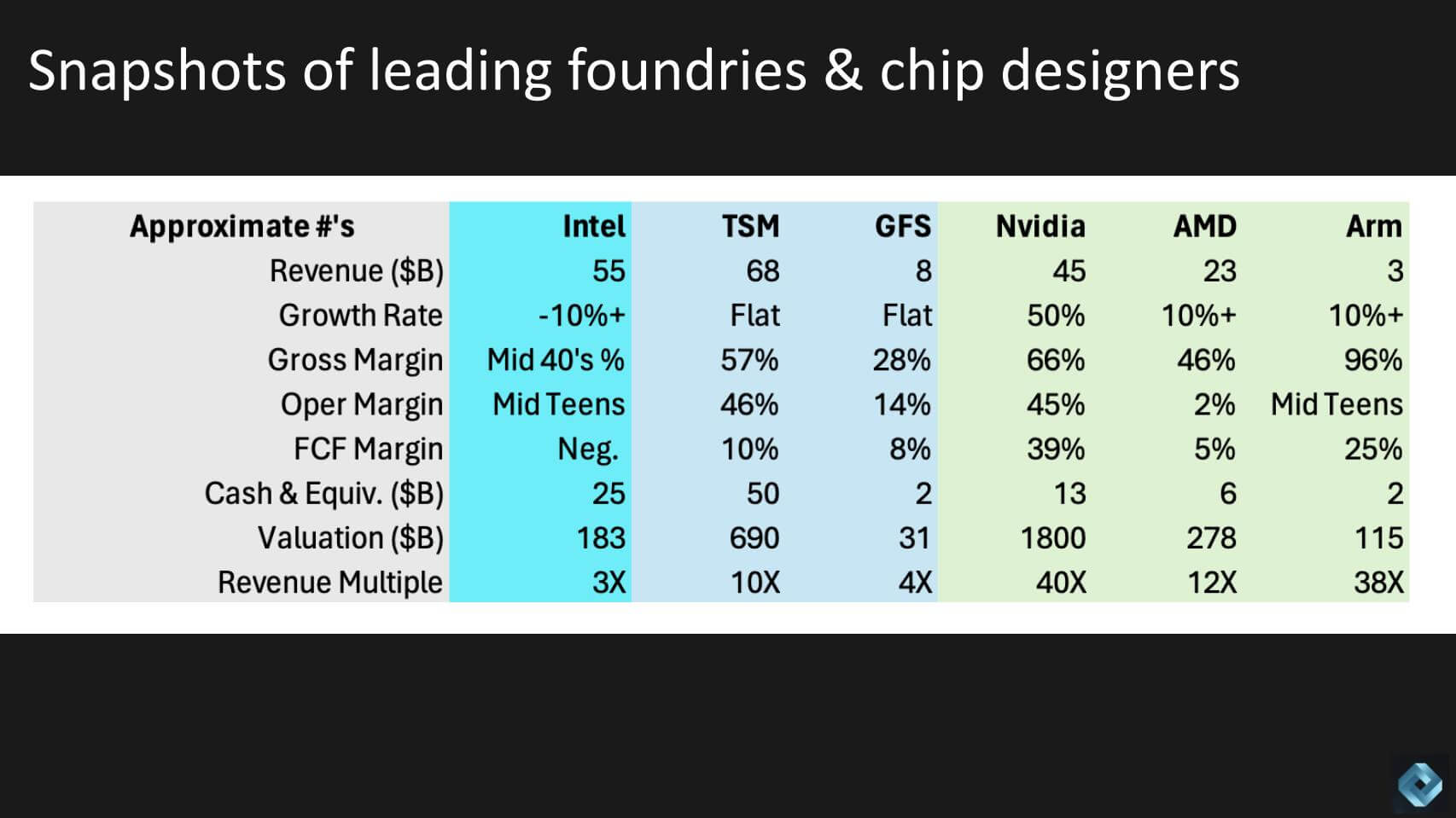

Below is a financial snapshot of selected chip manufacturers and designers compared to Intel. It underscores the multifront war we discussed earlier. Just a caution, these are rough estimates and not precise. For expediency and convenience we’ve sometimes used trailing-12-month revenue while at other times we’ve used run rate revenue. As well, growth rates in semis fluctuate wildly. Investors will use forward-looking estimates but for our purpose we want to simply paint a picture of the relative quality of each company’s financials.

Intel’s revenue growth has been stagnant although it’s promising improvement. Its gross margins have been decimated along with its operating margin. Its balance sheet is not large enough to fund all those fabs we showed earlier and its free cash flow margin is drastically compressed. All this has crushed the company’s valuation. In 2000, Intel was worth around $500 billion and along with Cisco Systems Inc. was one of the most valuable companies in the world. It’s now trading at a revenue multiple that is in the low single digits, trailing the others on the chart above.

Let’s start in the light blue above with two manufacturers, TSMC and GlobalFoundries Inc. TSMC is the leader, as you can see by its financials relative to GFS. Samsung is another large player, but it’s a giant conglomerate, so we can’t really compare it to the others. TSMC is of comparable size and worth almost four times Intel. GlobalFoundries was formed by taking AMD’s manufacturing operation and later absorbed IBM’s Microelectronics division. It had a deal with IBM to manufacture 10- and seven-nanometer technologies, but it had to back out because it was too hard and too capital-intensive.

Q4. Ben, how do you see Intel Foundry Services stacking up today relative to these two and Samsung? Intel’s learning curve is steep. How does it effectively compete in foundry and how does it fund it?

Ben’s analysis is summarized below:

TSMC is the best comparison to Intel given TSMC’s size and leading position in advanced process technology. Intel’s strategic moves toward leveraging leading-edge technology, and its efforts to utilize depreciated assets in collaboration with UMC, mark a notable shift toward a new model for Intel, taking a page out of TSMC’s playbook. However, there continues to be a scarcity of leading-edge manufacturing capacity, with Intel emerging as a viable alternative to TSMC for major tech companies seeking advanced semiconductor technology, despite Samsung’s involvement, which is unclear to many observers.

Key points

Bottom line

Intel’s strategic pivot toward embracing leading-edge technology, while leveraging older assets, is akin to TSMC’s successful model. These are necessary but insufficient steps in securing a strong position to capitalize on the industry-wide demand for advanced semiconductor manufacturing capacity.

This shift, coupled with the industry’s pressing need for additional leading-edge suppliers and Samsung’s unclear strategy, are an opportunity for Intel to potentially emerge as a critical alternative for major technology companies. The focus on leveraging depreciated assets further enhances Intel’s competitive edge by providing a financial buffer. Questions remain as to whether it will be enough for Intel to achieve its objectives.

Ben Bajarin analyzes Intel’s position relative to TSMC, the key benchmark in foundry.

Coming back to that same chart above, let’s look at the companies in green. These are a few of Intel’s chip design rivals — Nvidia, AMD and Arm, which licenses its architecture. This is why Arm has nearly 100% gross margin. But all three of these firms have more attractive financial profiles, far better multiples and they don’t have to fund factories.

Q4a. Ben, Pat Gelsinger says it now costs $30 billion to build an advanced chip making facility. Can Intel throw off enough cash from its design business to fund its foundry aspirations and at the same time compete with the likes of Nvidia and AMD?

A summary of Ben’s response follows:

Ben’s analysis focuses on Intel’s strategic challenges and opportunities in financing and operationalizing its foundry business out of its core. A key issue for many investors is should Intel split the company to manage the high fixed costs associated with running foundries given the massive capital required. Intel’s approach, seeking co-investment for its foundries and leveraging government support, reflects the intensive capital needs of the semiconductor manufacturing sector.

Despite the high costs, Intel’s strategy includes becoming a significant customer of TSMC, allowing designers to use outside manufacturing for parts of its chip production. This move, while beneficial for Intel’s product line, does not alleviate the broader industry’s capacity constraints at the leading edge. Intel’s long-term economic outlook hinges on its ability to keep foundries full and improve margins through efficient process technology and strategic customer engagements.

Key points

Bottom line

Intel’s journey to monetize its foundry operations and improve margins is a complex, long-term endeavor that necessitates strategic co-investments, government support and efficient use of existing capacity. Though Intel’s role as a TSMC customer partially addresses its product needs, the broader industry challenge of leading-edge capacity constraints remains. The upcoming Intel Foundry Services day will offer deeper insights into Intel’s strategy and financial model for its foundry business, important for understanding its potential to navigate the high fixed costs and achieve a sustainable turnaround in profitability and value creation.

Ben Bajarin’s analysis of Intel’s moves to compete in multiple domains.

Sam Altman’s effort to raise between $5-$7 trillion underscores the need for wafer scale customers.

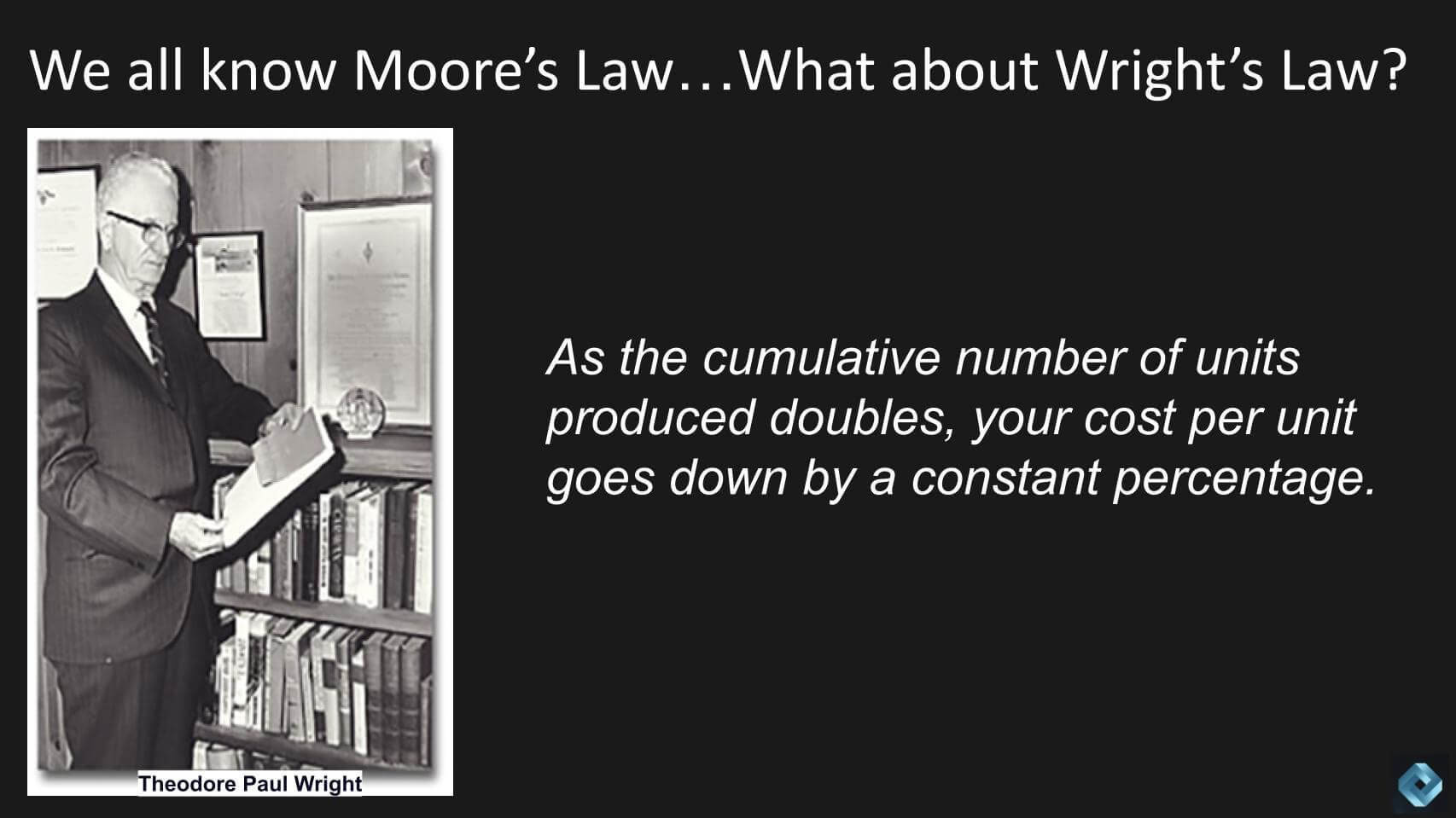

Let’s revisit Wright’s Law. We all know Moore’s Law, but the lesser-known Wright’s Law becomes important in this discussion.

Theodore Wright was an aeronautics engineer and was famous for formulating Wright’s Law, or the experience curve effect. It says basically that, for any manufacturer, as the cumulative number of units produced doubles, the cost per unit goes down by a constant percentage. And this law is highly applicable to chip manufacturing because each new generation of technology initially costs more to build per unit than the previous generation. So when you start manufacturing a new process node, you lose money.

Intel’s monopoly was won when it beat RISC. Our premise is that it did so because it became the PC standard and PCs were the volume king until early last decade. And today, Arm-based designs have the volume advantage.

Q5. Ben, it’s estimated that Arm wafer volumes are 10 ties those of x86. Please share your scenario as to how Wright’s Law plays in this game of semiconductor manufacturing. How does Intel, whose volumes are basically flat, get to a point where it’s not bleeding money trying to catch TSMC?

Ben’s comments are summarized below:

Bajarin is emphatic that for IFS to succeed, Intel needs wafer-scale customers to sustain its foundry operations. The shift from Intel’s dominance in the PC industry means it has to find other high-volume customers. Historically, Intel filled its fabs with its own high-margin chip production.

However, the landscape has changed, requiring partnerships with large-scale consumers such as Qualcomm, Broadcom Inc., Marvell Technology Inc. and potentially Tesla. Perhaps even Apple, despite its deep ties with TSMC. Intel’s ability to produce Arm chips for any interested party, including the possibility of serving Qualcomm and MediaTek for IoT and other applications, is a strategic opportunity assuming the company can provide a leading service. The potential collaboration with Qualcomm is of particular interest and could be a game-changer, given Qualcomm’s volume needs for leading-edge process technology to compete more effectively against Apple, which currently enjoys preferential access to TSMC’s most advanced nodes.

Key points

Bottom line

Intel’s strategic pivot to serving wafer-scale customers is pivotal in leveraging its foundry capabilities to the fullest. By potentially partnering with companies such as Qualcomm, Intel could not only secure the volume needed to sustain its foundry operations but also influence the competitive dynamics within the semiconductor industry.

Such collaborations would affirm Intel’s process technology’s competitiveness and potentially shift market positions by enabling players such as Qualcomm to challenge dominant forces such as Apple more effectively. Intel’s success hinges on its ability to deliver technological excellence and customer-focused services, marking a significant shift from its historical business model.

And it must somehow throw off enough cash and find funding partners to keep factories up to date.

Ben Bajarin analyzes Intel’s wafer-scale volume prospects.

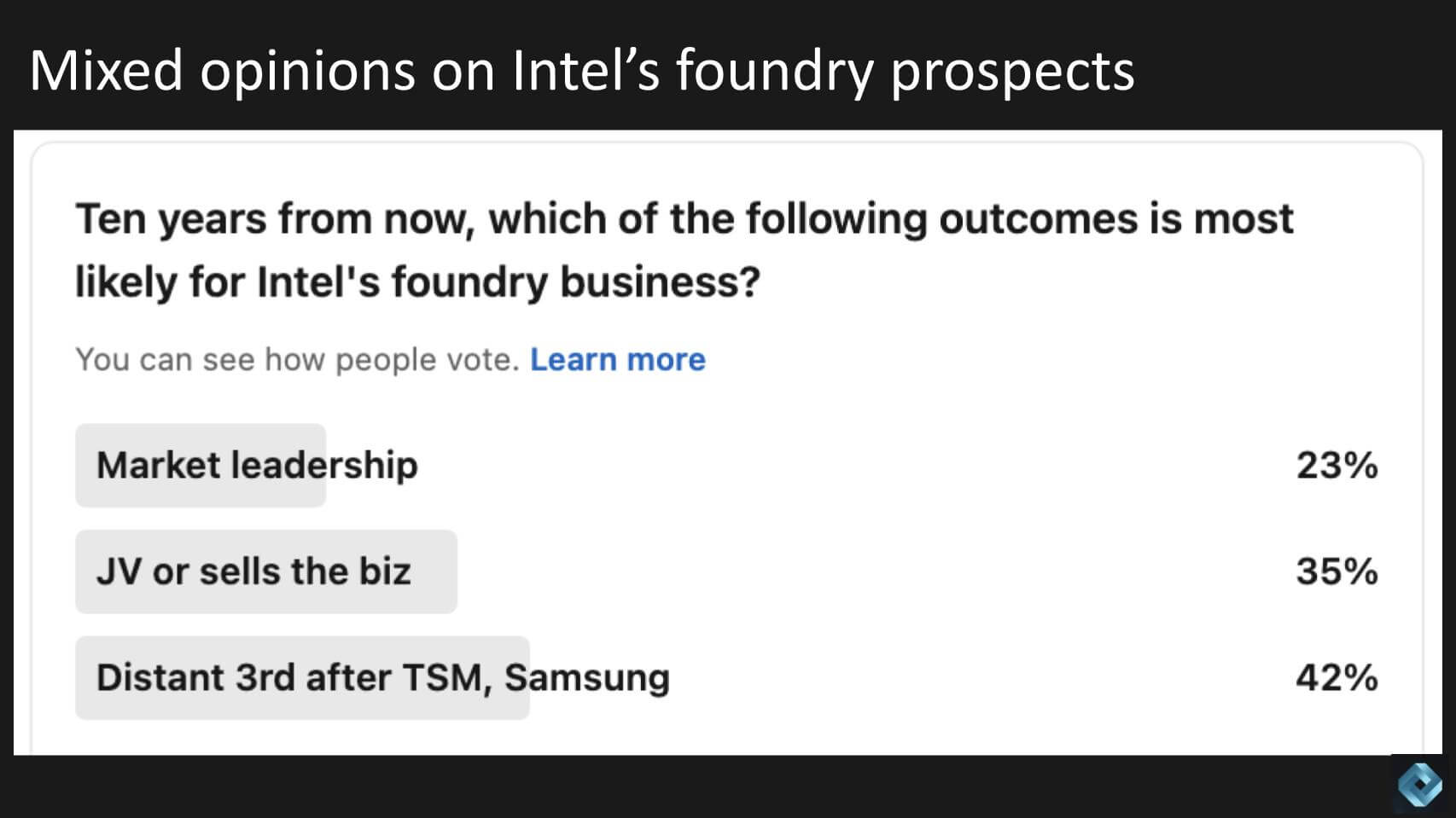

We put up a LinkedIn poll to capture the community’s opinion on the following three scenarios. Ten years from now, will Intel’s foundry business: 1) Achieve leadership; 2) Be forced to find a partner; or 3) Be a distant third behind TSM and Samsung?

Three-fourths of our small sample of 40-plus respondents said the outcome would not be leadership.

Q6. Ben, how would you respond and why?

A summary of Ben’s analysis follows:

Ben looks at market leadership for Intel Foundry not in terms of technological dominance or surpassing TSMC in revenue. TSMC’s revenue is projected to surpasses $100 billion, a milestone Intel is unlikely to match in the foreseeable future. The focus for Intel is the strategic positioning of Intel Foundry, with an emphasis on securing significant capital investment and leveraging partnerships, akin to its collaboration with UMC, which, while not officially termed a joint venture, effectively functions as one.

The necessity of Intel Foundry’s success is underscored by its critical importance to national security, which suggests that government intervention to prevent its failure is a potential scenario. The realistic ambition for Intel is to become the second-largest foundry by revenue, a goal Ben believes is achievable within the next decade, contingent on Intel’s ability to attract wafer-scale customers and effectively compete at the leading edge.

Key points

Bottom line

Intel’s foundry path to market leadership won’t come from eclipsing TSMC in volume or revenue but by securing a solid second place in the global foundry market. This objective must be supported by strategic partnerships, capital investments and the crucial role of government support in safeguarding Intel’s operations due to their significance to national security. The ambition to become a key player, alongside the goal of attracting significant wafer-scale customers, is where Intel’s foundry future lies.

IBM was the dominant technology company prior to the ascendency of the microprocessor-based revolution. IBM’s mainframe business held a monopoly that far eclipsed the dominance of today’s companies. To give you a sense of IBM’s power, at one point in the 1970s, IBM accounted for 50% of the industry’s revenue and 66% of its profits. That would equate to a company like Microsoft generating $1.5 trillion to $2 trillion in annual revenue today. By current valuations, that would put Microsoft’s market cap well over $10 trillion.

IBM was also the world’s leader in semiconductor design and manufacturing with, at the time, leading-edge manufacturing facilities around the globe. In 2014, IBM inked a deal with GlobalFoundries where IBM essentially paid GFS to take its microelectronics business off its books. IBM took a pretax loss of almost $5 billion for the transaction. In exchange, GFS committed to providing IBM with leading-edge process manufacturing capabilities. This proved to be too difficult and expensive for GFS and it backed out of that commitment.

In the 1980s, IBM unwittingly handed its mainframe operating system and hardware monopoly to Microsoft and Intel. The latter became the hardware monopoly and enjoyed mainframe-like margins for decades.

IBM’s unwillingness to adapt quickly to changing market forces was the result of many factors, but the two most relevant were: 1) PCs were an unattractive, low-margin business compared with mainframes; and 2) hubris. It’s not easy to transition as a public company, so managers often turn a blind eye to the realities of the market, buy back stock, raise their dividend and pass the baton to the next generation of leaders to figure it out. Pat Gelsinger is that next generation and our hope is it’s not too late. But the mountaintop of profitability for foundries is far off.

The IBM story is instructive and Intel’s path in many ways mirrors that of IBM’s. IBM couldn’t continue to fund its semiconductor fabs and had to pay GFS to take them. Intel is staring at hundreds of billions in capital spending to build out its factories and will have to rely on its own free cash flow and government subsidies to pay for these fabs.

IBM, like Intel, lost its volume advantage and could never make semiconductor manufacturing profitable again.

The key question is: Can Intel achieve adequate profitability to succeed on its own? The key will be how much volume is enough to be profitable, and we don’t have that precise answer, but we know it’s substantial. The U.S. government is awash in debt and future cash injections are far from assured. Sam Altman’s trillion-dollar gambit is a potential savior, but the path to viability remains unclear.

Ben is optimistic on the future of Intel’s foundry business. He’s an expert in the field and has much deeper knowledge of the space than our team at theCUBE Research. For the sake of the nation and like-minded countries… we hope he’s right.

Listen to our closing conversation – where does the cash come from to build Intel factories?

What do you think?

Thanks to Alex Myerson and Ken Shifman on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight, who help us keep our community informed and get the word out and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish each week on theCUBE Research and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter/X and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from theCUBE Research and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai or research@siliconangle.com.

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of theCUBE Research. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.