SECURITY

SECURITY

SECURITY

SECURITY

SECURITY

SECURITY

Israeli enterprise application programming security startup Noname Security is reported to be in advanced talks to be acquired by Akamai Technologies Inc. for $500 million, a figure that’s half of the company’s valuation as of its last venture capital round.

The report comes from TechCrunch, citing a person familiar with the deal. Though there has been no secondary confirmation, there were reports in February that Noname Security was in negotiations to be acquired for “hundreds of millions of dollars,” with Akamai named as a potential suitor.

The TechCrunch report says the potential deal, at least as it stands, would be for cash and that the deal is not final and could change or not happen at all.

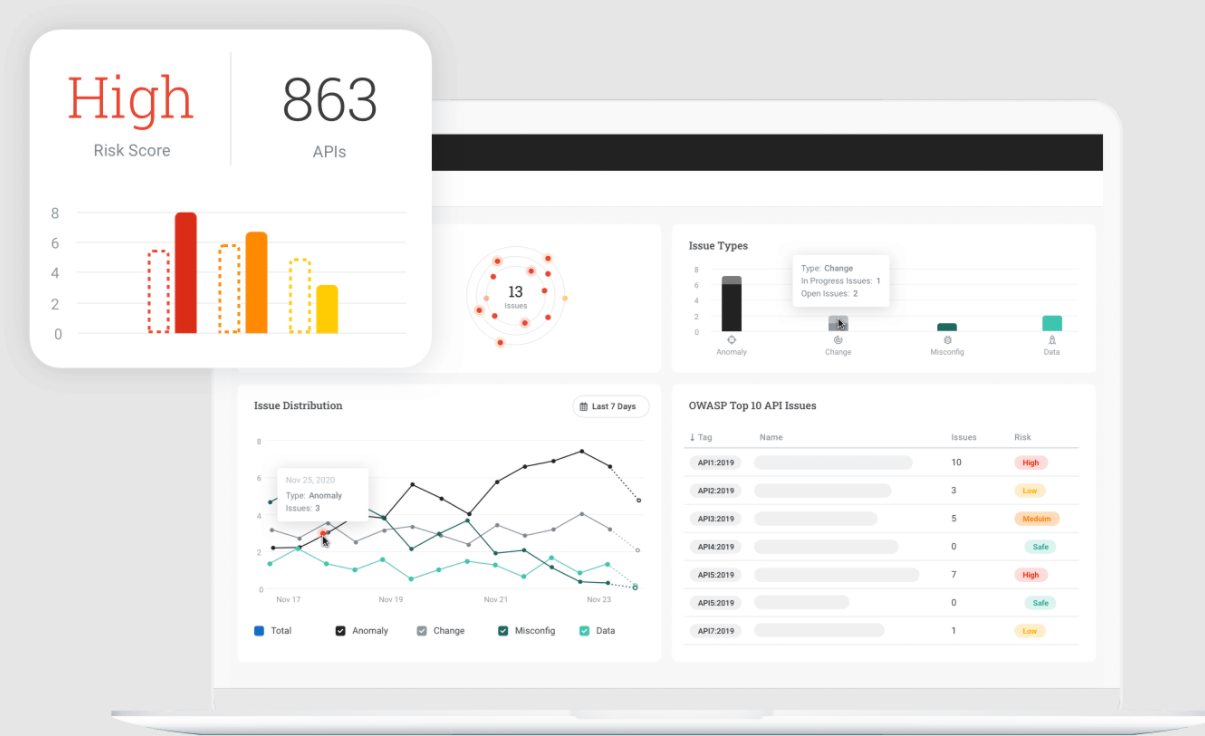

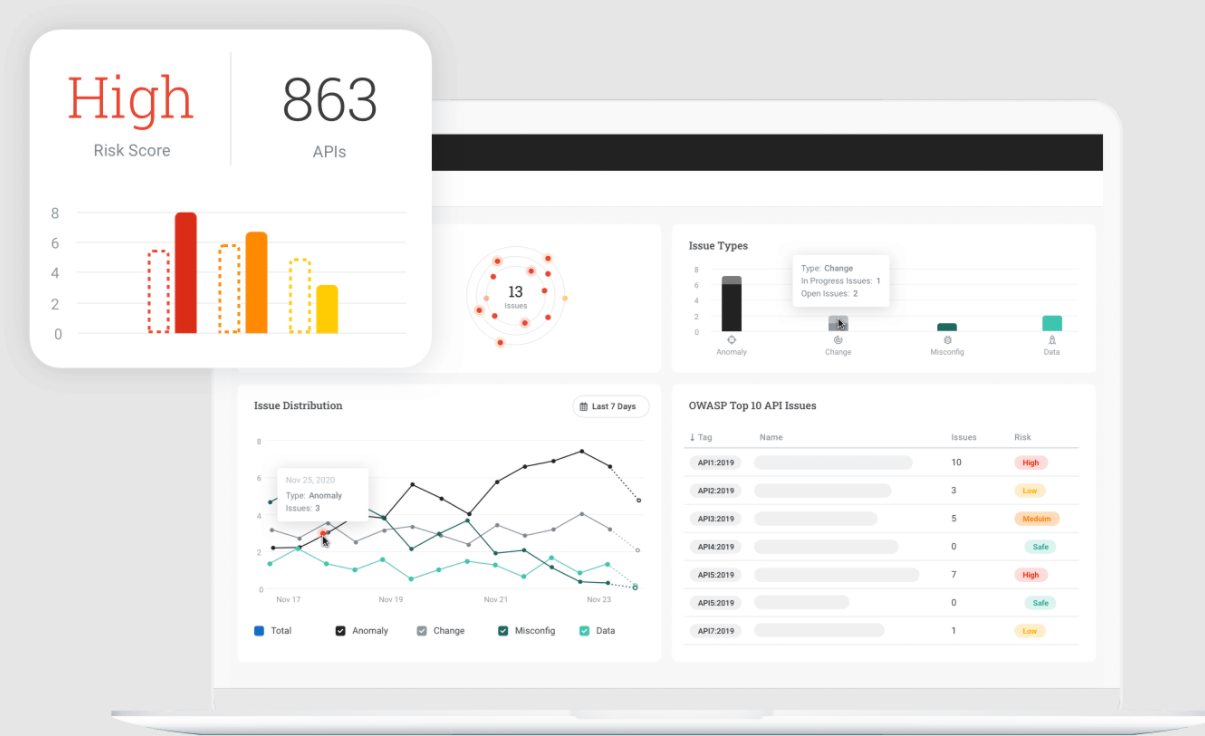

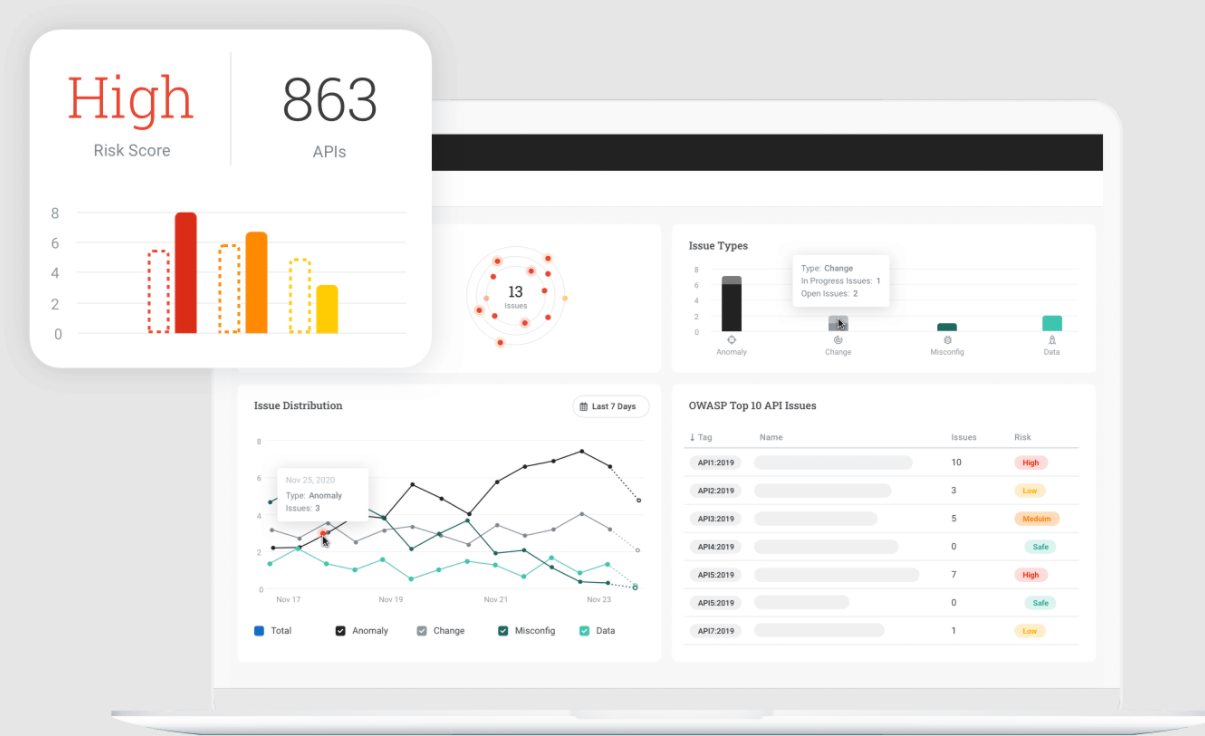

Founded in 2020, Noname Security offers a holistic security platform that allows enterprises to see and secure managed and unmanaged application programming interfaces. Designed to “eliminate API blind spots,” the company’s platform protects enterprises from data leakage, authorization issues, abuse, misuse and data corruption.

The company’s platform includes support for discovery and analysis through remediation and testing, covering every aspect of API security. The platform creates a complete inventory of an organization’s APIs, then uses artificial intelligence and machine learning to detect attackers, suspicious behavior and misconfiguration.

In November, Noname Security announced integrations with leading security orchestration, automation and response platform providers Swimlane Inc., Tines Inc. and Palo Alto Networks Inc., allowing joint customers to automate and streamline their security incident response processes for APIs.

Coming into its potential acquisition, Noname Security had raised $220 million in venture capital, according to Tracxn, including a round of $135 million on a $1 billion valuation in December 2021. Investors include Georgian Partners Inc., Lightspeed Venture Partners Inc., Insight Partners LP, Cyberstarts Venture Capital Ltd., Next47 GmbH, Forgepoint Capital LLC and The Syndicate Group Inc.

If the deal does go through at $500 million, the obvious question is why has the company’s valuation dropped by half in two and a half years.

There’s no one answer to that question, but one factor is that the company’s last round came near a peak of investor activity in startups, a frenzy that has since significantly waned, be it with some small signs of recovery.

Another possibility is that Noname is running out of money, given that The Information reported in January that it was trying to raise money on a down round. Cashed-up companies don’t try to raise money on down rounds unless they need to.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.