INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

SolarWinds Corp.’s share price closed 4.6% higher today after the company posted first-quarter revenue and earnings that topped the consensus estimate.

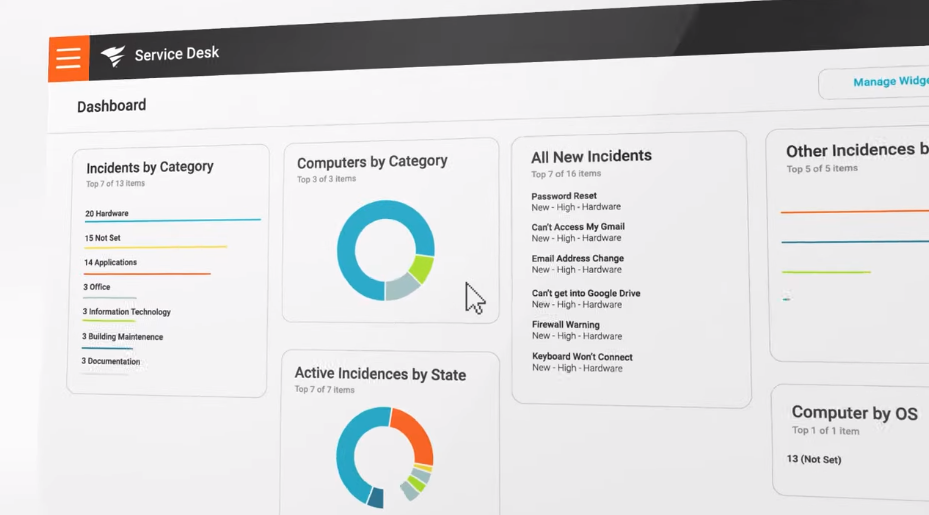

Austin-based SolarWinds sells software for managing information technology infrastructure. Administrators use it to check that network devices’ configuration is in order, ensure the attached storage hardware isn’t running slowly and perform related tasks. SolarWinds has more than 300,000 customers worldwide.

The company ended the three months ended March 31 with revenue of $193.3 million, up 4% from a year earlier. That number is higher than both the consensus analyst estimate and SolarWinds’ own sales projection for the quarter. Annual recurring revenue accounted for 93% of the company’s top line.

SolarWinds likewise topped expectations with its adjusted EBITDA, or earnings before interest, taxes, depreciation and amortization, which reached $92.1 million in the first quarter. That represents a 19% year-over-year jump. On a per share basis, SolarWinds’ adjusted EBITDA amounts to earnings of 29 cents, seven cents above the consensus estimate.

“We started the year strong, exceeding the high end of our guidance for total revenue and adjusted EBITDA, and also delivering our highest quarterly adjusted EBITDA margin in over three years,” said SolarWinds Chief Executive Officer Sudhakar Ramakrishna.

About three and a half years ago, SolarWinds disclosed a high-profile breach that saw Russian hackers access several its customers’ infrastructure. The company’s trailing-12-month maintenance renewal rate, a metric used to track customer retention, dropped from 92% to 88% over the subsequent year. SolarWinds revealed in an investor presentation today that its maintenance renewal rate stood at 97% at the end of the first quarter.

In the same time frame, the number of organizations that spend more than $100,000 per year on its software nearly doubled. SolarWinds counted 1,021 such customers as of March 31.

The company’s recurring revenue, which accounts for the bulk of its sales, mostly comes from maintenance contracts. Those contracts provide customers that buy perpetual software licenses with access to updates, support and other benefits. In today’s investor presentation, SolarWinds detailed that it’s working to shift its recurring revenue base from maintenance contracts to software subscriptions.

As of March 31, subscriptions accounted for annualized recurring revenue of $251 million. That amounts to a 36% increase over the same time a year earlier. As a percentage of SolarWinds’ total annual recurring revenue, subscriptions accounted for a 7% larger portion than 12 months earlier.

The company also shared details about its product roadmap for 2024. SolarWinds plans to enhance its platform’s built-in AIOps capabilities, which use machine learning to automate repetitive tasks for administrators. The feature set includes a chatbot called Virtual Agent that reduces the amount of work involved in processing support requests.

SolarWinds expects to end 2024 with revenue of $771 million to $786 million, which would represent a 3% year-over-year increase at the midpoint of the range. Adjusted EBITDA is projected to range between $360 million and $370 million, a 11% improvement over 2023 at the midpoint.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.