CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

AuditBoard Inc., the developer of a software platform that helps enterprises ensure their financial reports are accurate, will be acquired by Hg Capital for over $3 billion.

The companies announced the deal on Thursday. Citing sources familiar with the matter, Axios reported today that AuditBoard had previously rejected multiple takeover bids and was preparing to go public in 2025 or 2026. Hg’s offer was reportedly so competitive that the software maker accepted it after only a four-week review.

Long-based Hg is a private equity firm with large stakes in several enterprise software companies. It’s the controlling shareholder of Visma, a Norwegian provider of accounting and human resources applications that received a $21 billion valuation last year. Hg is also one of the largest investors in Iris Software Group Ltd, which raised funding at a $4 billion valuation in December.

AuditBoard, in turn, provides a platform that helps enterprises comply with the Sarbanes-Oxley Act. This is a piece of legislation that outlines what steps a publicly-traded company must take to ensure the financial data it shares with investors is accurate. Using AuditBoard’s platform, accounting teams can track how well they’re adhering to the rules specified in the legislation.

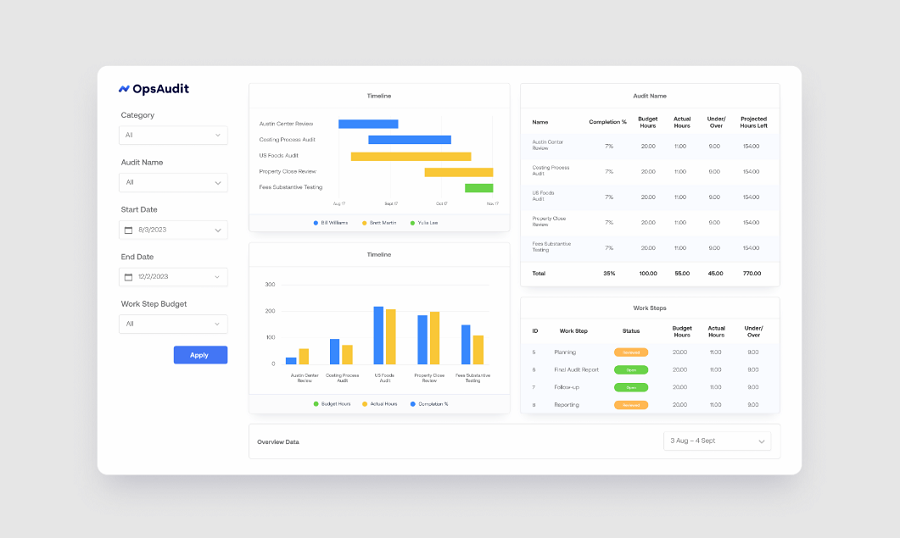

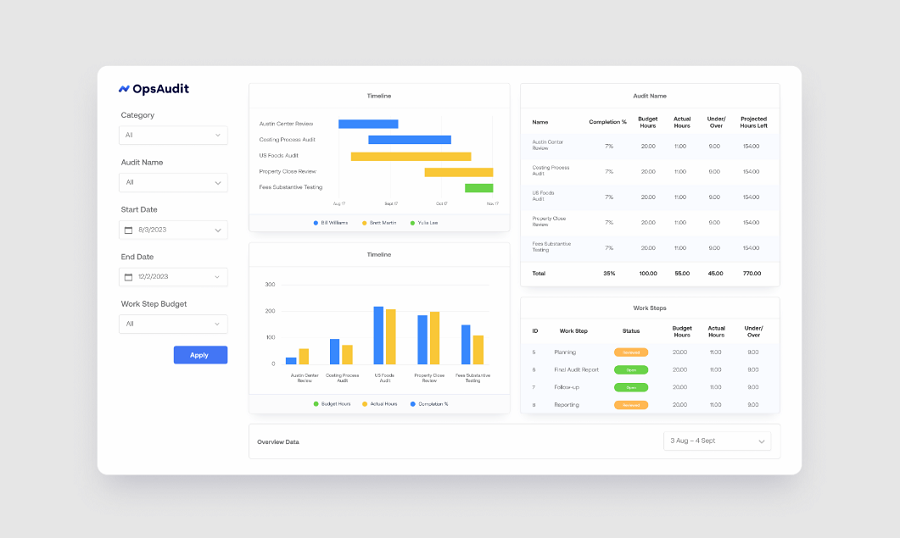

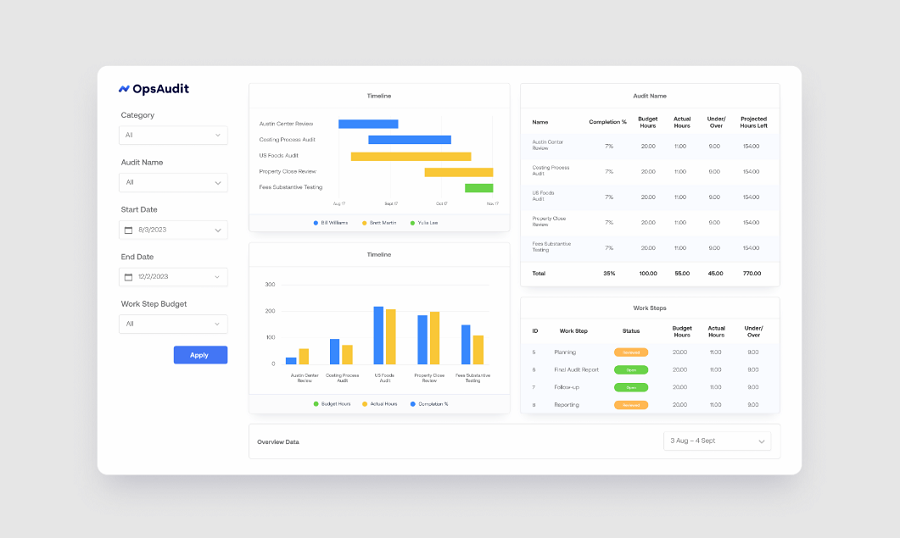

The software also includes modules for more than a half-dozen other tasks. One module is designed to help enterprises monitor risks to their information technology infrastructure, such as cybersecurity weak points. Another tool, OpsAudit, can be used to audit a company’s product quality and other aspects of its business operations.

AuditBoard also promises to help enterprises identify potential issues beyond the four walls of the organization. One of its platform modules, TPRM, can be used to evaluate if a company’s suppliers have effective cybersecurity mechanisms in place. The software makes it possible to request information from a newly onboarded supplier about its breach prevention program, as well as track how the program changes over time.

Over the past few months, AuditBoard has equipped its software portfolio with a number of artificial intelligence features. They’re designed to automate tasks such as writing descriptions of business risks.

“When we founded AuditBoard back in 2014, our goal was to use software to solve the serious challenges that exist for an auditor,” said co-founder Daniel Kim. “This acquisition represents a realization of not only our vision, but validates how taking a customer and practitioner-centric approach is the right way to develop technology that users will be passionate about.”

AuditBoard detailed this week that its platform is used by more than 2,000 companies, including nearly half of the Fortune 500. Those customers spend more than $200 million per year on its software. Moreover, AuditBoard has been profitable since 2018, the year it raised its most recent $40 million funding round.

THANK YOU