INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Advanced Micro Devices Inc. reported solid earnings and sales today and provided an upbeat revenue forecast for the coming quarter, pushing its stock higher in late trading.

The results suggest AMD is finally emerging as a serious rival to Nvidia Corp. in the artificial intelligence chip industry, with its growth powered by strong sales of its new MI300X AI chip.

The company reported second-quarter earnings before certain costs such as stock compensation of 69 cents per share, just ahead of Wall Street’s target of 68 cents per share. Revenue for the period rose 8%, to $5.84 billion, well ahead of the $5.72 billion expected by analysts.

As for the coming quarter, AMD said it’s looking for sales of around $6.7 billion, much more than the $6.61 billion target sought by Wall Street’s analysts.

AMD also boosted its bottom line, reporting net income for the period of $265 million, well up from the $27 million profit it delivered in the same period one year earlier.

The company’s stock gained almost 8% in the extended trading session, helping to reverse declines that had seen it fall 6% in the year to date. That happened even though AMD is the second-largest producer of graphics processing units in the world after Nvidia. GPUs are essential for most AI processing and training workloads, and rising sales of those chips have helped Nvidia’s stock to more than double in value this year.

Wall Street investors have been urging AMD to up its game in the GPU arena and take more market share away from Nvidia, which is believed to have a commanding lead in the AI industry, accounting for more than 80% of related chip sales. The company duly responded with the launch of its MI300X AI chip earlier this year, and it has helped drive strong growth in its data center business.

Earlier this year, AMD said it’s expecting to rake in around $4 billion in AI chip sales, which would represent about 15% of its expected revenue.

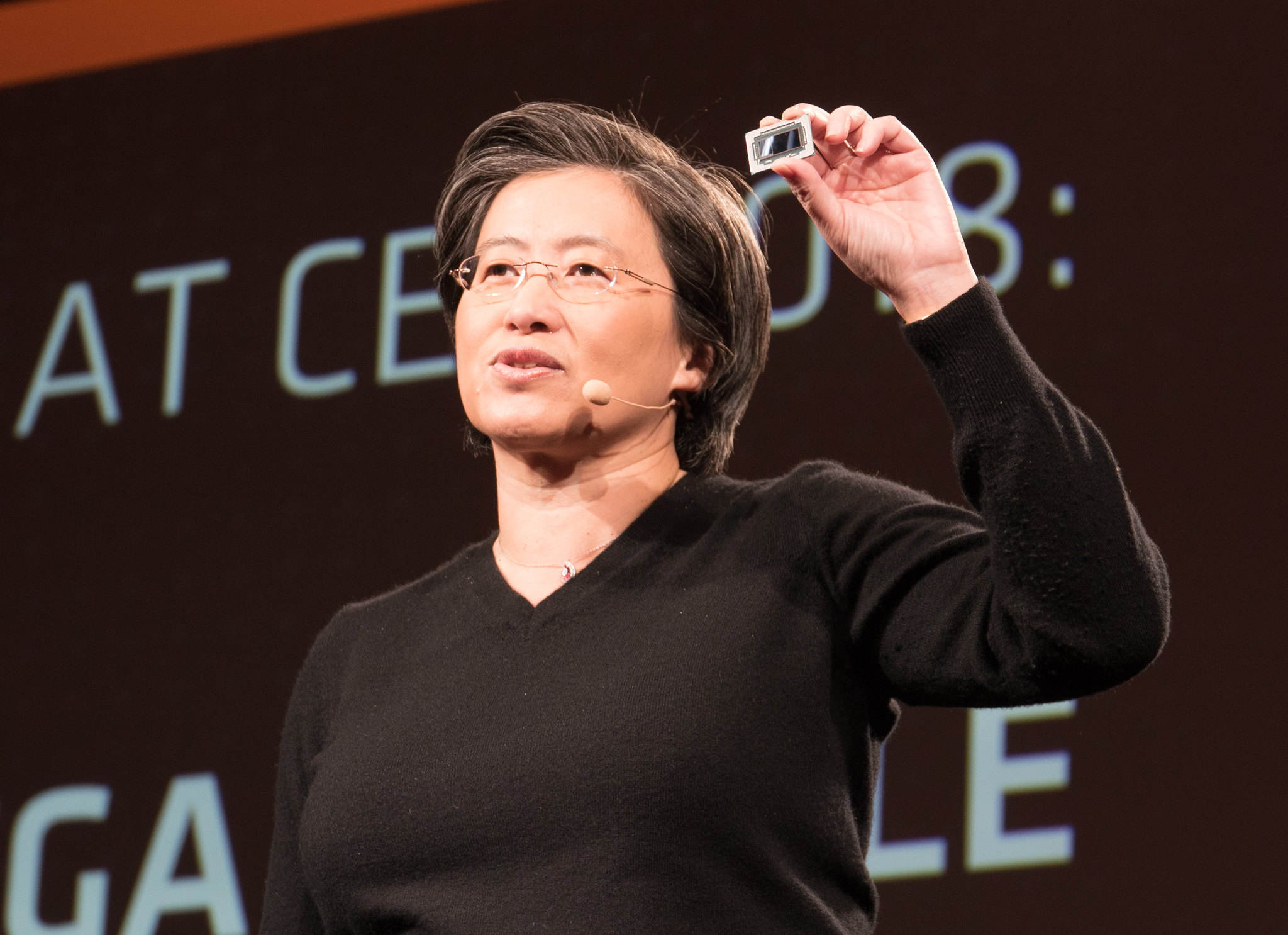

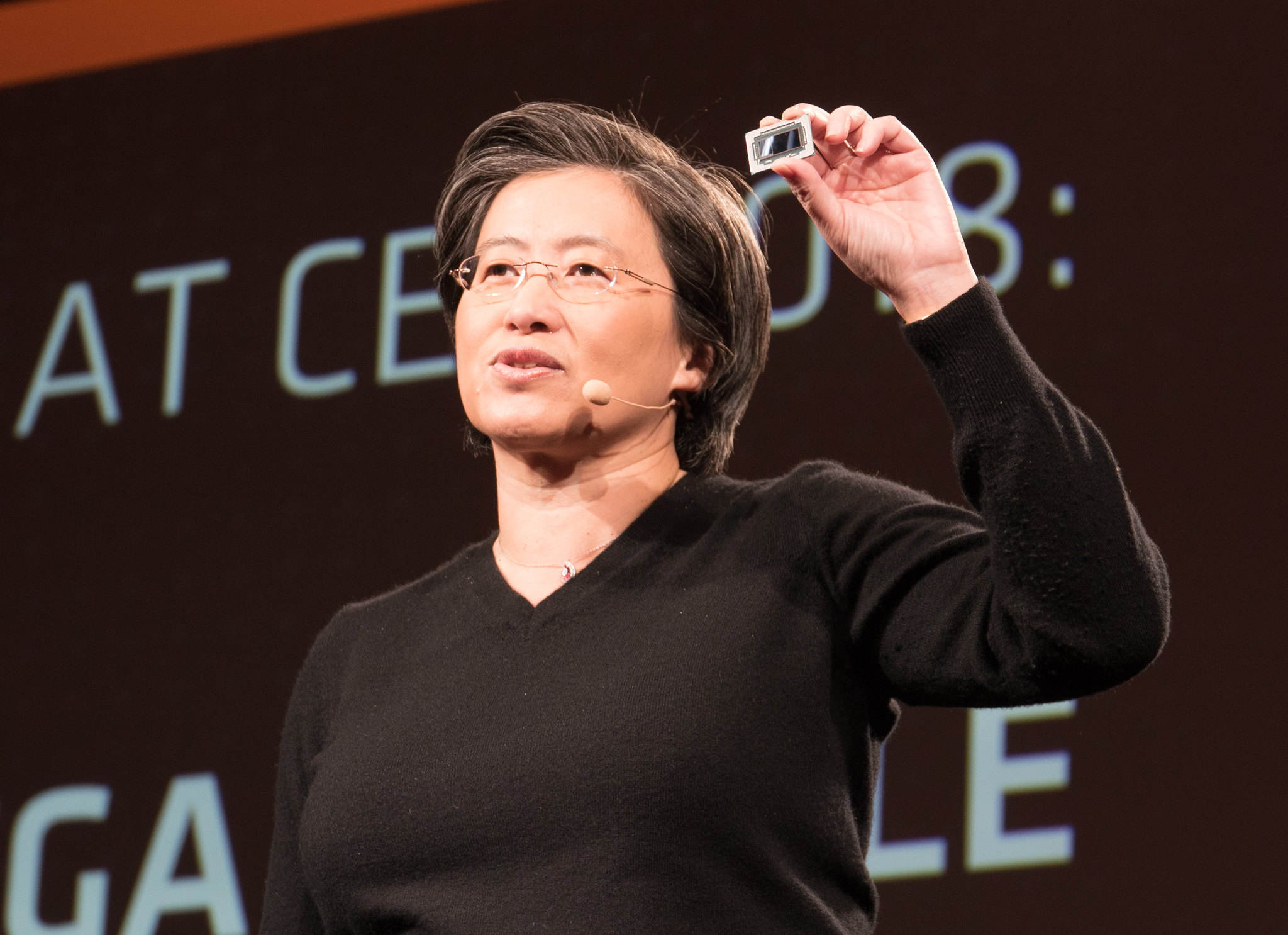

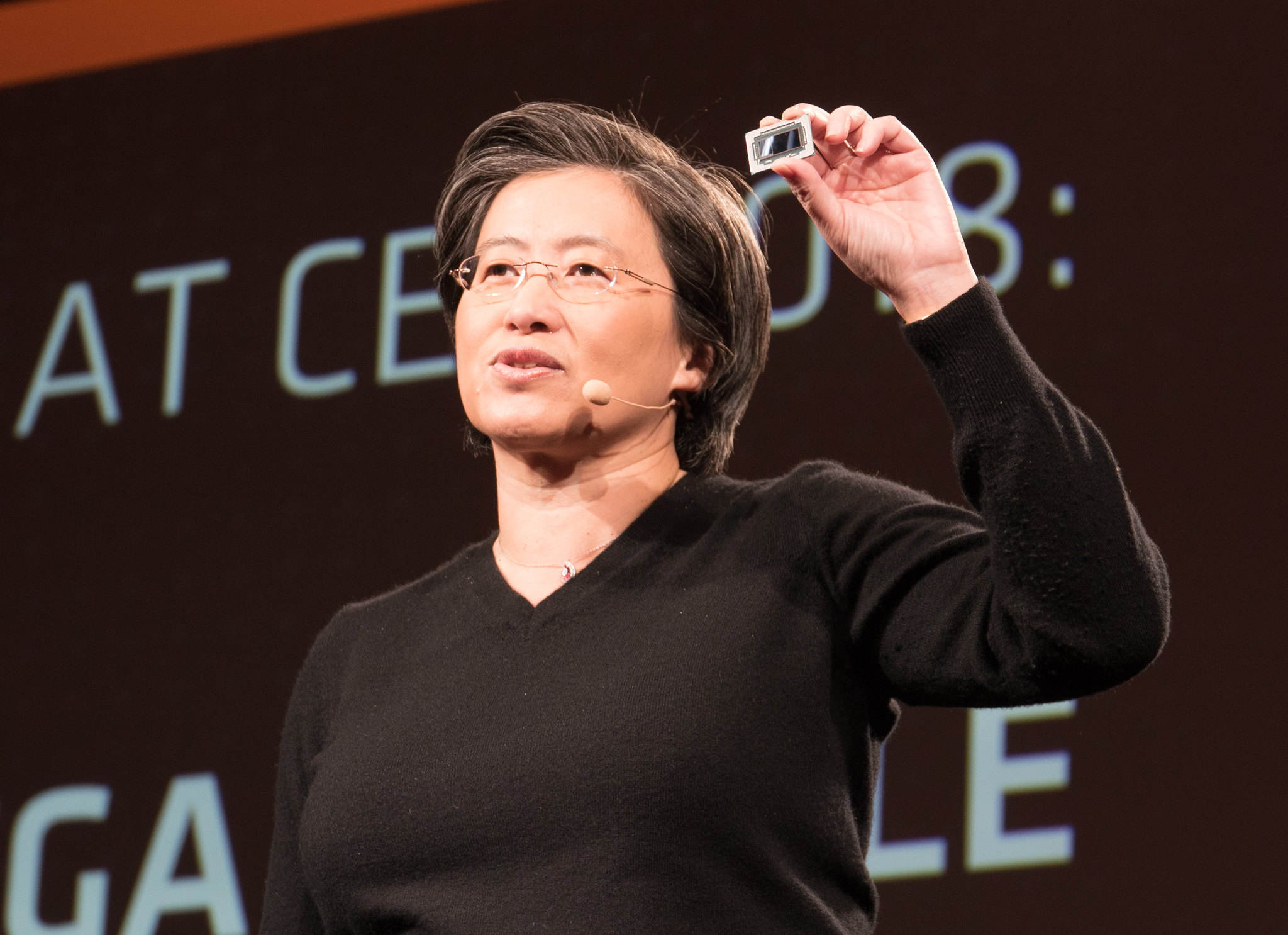

In an update today, AMD Chief Executive Lisa Su (pictured) told analysts that the company saw “higher than expected” sales of the MI300X chips. Although she didn’t provide an exact number, she said revenue from that product exceeded $1 billion during the quarter.

“As a result, we now expect data center GPU revenue to exceed $4.5 billion in 2024, up from the $4 billion we guided in April,” she said on a conference call with analysts.

Su also fielded questions from analysts who raised concerns that the race to build out AI infrastructure is slowing down. She insisted that the company’s customers still seem eager to buy as many AI chips as they can.

“The overall view on AI investment is: We have to invest — the potential of AI is so large,” she told the analysts. “The investment cycle will continue to be strong.”

AMD’s MI300X sales helped to boost a data center segment that saw revenue rise more than 115%, to $2.8 billion, beating the Street’s target of $2.75 billion.

The company’s traditional business has always been central processing units for personal computers, laptops and servers, and that also did well in the quarter. The client segment reported sales of $1.5 billion, up 49% from a year earlier and ahead of the Street’s forecast of $1.43 billion. Su said the results show that the PC market is recovering from its post-COVID-19 pandemic slump.

AMD’s third business segment involves chips for video games consoles and GPUs for 3D graphics, and it delivered $648 million in sales, down 59% from a year earlier and below the Street’s target of $676 million.

Last is the company’s embedded segment, which primarily consists of networking chips. It delivered $861 million in sales, down 41% from a year ago, but still ahead of the $856 million target.

Holger Mueller of Constellation Research Inc. said AMD is in full transformation mode now, becoming far less reliant on its historic gaming and embedded systems businesses, thanks to its stellar data center and client business growth.

“AMD grew its revenue by approximately $500 million thanks to increases in data center and PC revenues, and that enabled it to swing back into a profit,” Mueller said. “The challenge for Lisa Su and her team is to repeat this performance in the third and fourth quarters and keep the company on a growth curve. A lot will depend on the success of its MI325X AI accelerator which is expected to ship sometime this year. Investors will be looking for strong uptake in the public cloud, and the signs are good with Microsoft Azure already on board.”

“We will see how it pans out, but for now things are looking up,” he added.

The company’s report is the first in a busy week of earnings updates from top chipmakers, with Intel Corp., Qualcomm Inc. and Arm Holdings Plc all set to follow with their own results later this week.

The results bode well for a chip industry that has recently lost the enthusiasm of investors, who are concerned that AI spending is losing its momentum. The Philadelphia Stock Exchange Semiconductor Index, which is a closely watched benchmark of chipmaker stocks, was down 11% this month, prior to today’s report.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.