CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

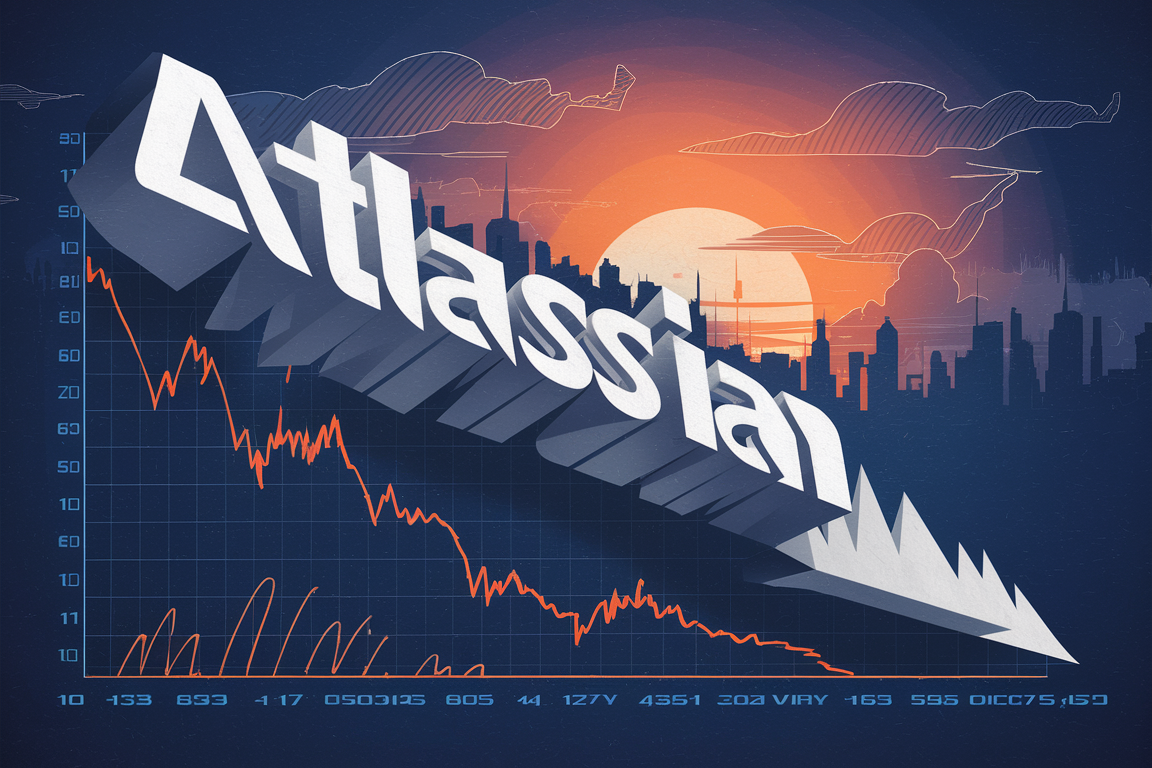

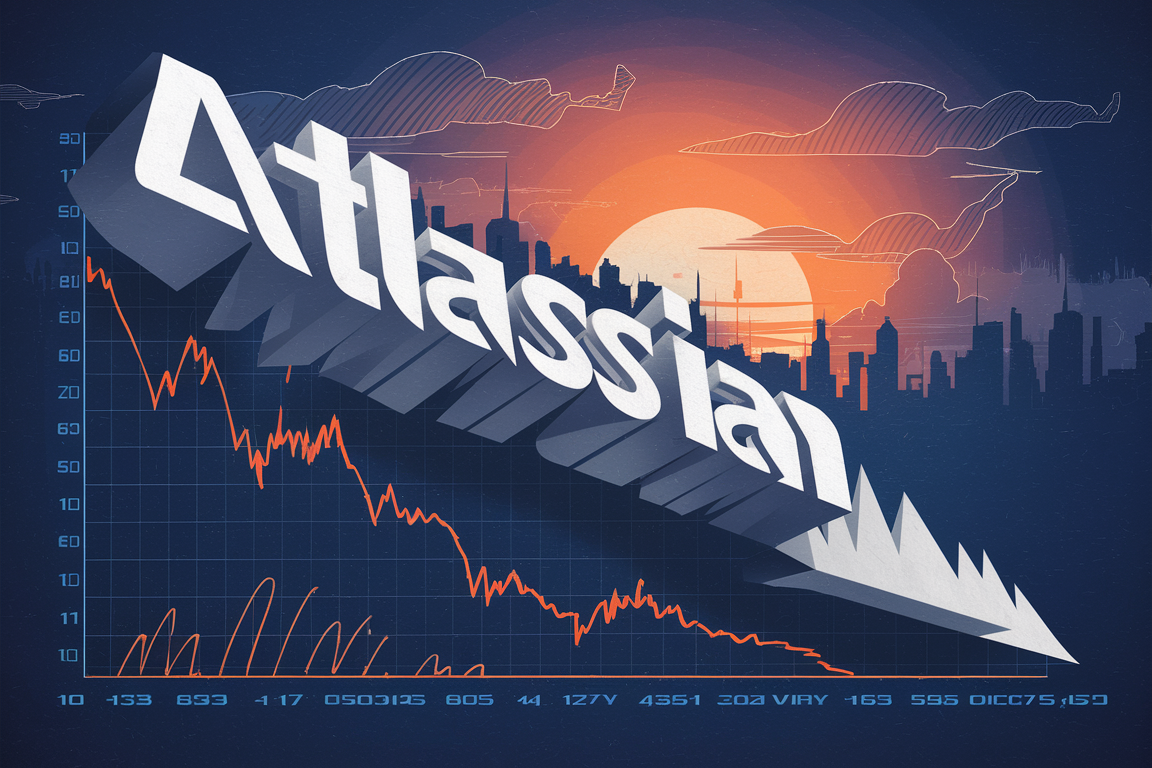

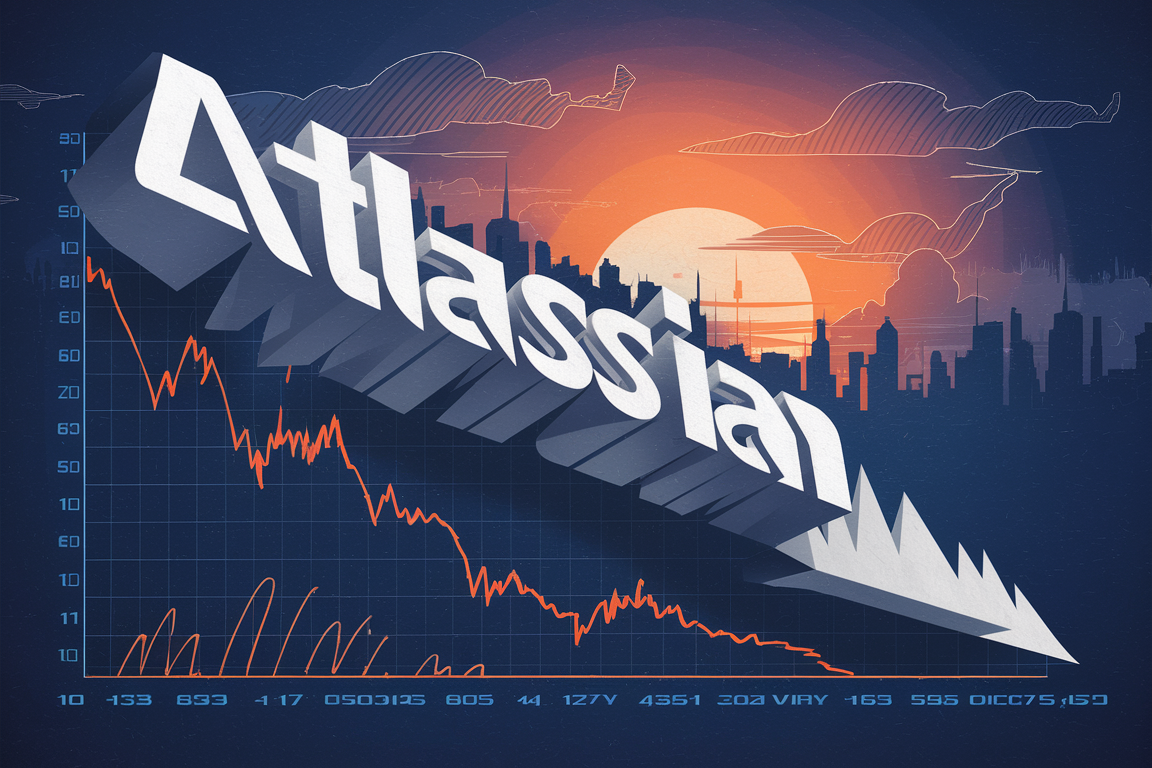

Shares in Atlassian Corp. fell nearly 14% in late trading today after the Australian collaboration software company reported solid earnings and revenue in its fiscal fourth quarter but fell short on both its first-quarter and full-year outlook.

For the quarter that ended on June 30, Atlassian reported adjusted earnings per share of 66 cents, up from 57 cents in the same quarter of the previous year, on revenue of $1.132 billion, up 20% year-over-year. Both were beats, as Zacks Consensus Estimate had expected earnings per share of 61 cents on revenue of $1.13 billion.

Atlassian’s operating loss came in at $67 million in the quarter, up from a loss of $50.4 million in the same quarter in 2023. The company’s operating margin in the quarter came in at 6% compared with 5% the year prior, and its net loss was $196.9 million, down from $59 million. Atlassian ended the quarter with $2.3 billion in cash, cash equivalents and market securities on hand.

As of the end of the quarter, Atlassian had 45,842 customers spending more than $10,000 in cloud annual recurring revenue, up 18% year-over-year, while the number of customers spending more than $1 million annually grew 48%.

Highlights in the quarter included the launch of Rovo, a generative artificial intelligence knowledge discovery product that extracts data from a company’s internal tools and can help find information stored in them and then act on it, in May. Powered by Atlassian Intelligence, Rovo helps companies find information lost amid multiple products, learn quickly and act on behalf of employees like a “virtual teammate.”

The quarter also saw Atlassian unify Jira, the company’s project management tool used for tracking and managing software development tasks, bugs and workflow processes. The unification sees the combination of Jira Software and Jira Work Management into one to streamline collaboration across teams, increase flexibility and provide a cohesive experience across an organization’s workflows. The unification of Jira is designed to create a shared space for every team to align on goals and priorities and track and collaborate on work.

For its full fiscal year, Atlassian reported an adjusted earnings per share loss of $1.16, down from $1.90 the year prior, on revenue of $4.4 billion, up 23% year-over-year.

Along with its financial results, Atlassian also noted that co-founder and co-Chief Executive Officer Scott Farquhar is stepping down from his role at Atlassian, a move announced in April. “I leave the co-CEO role knowing Atlassian is incredibly well-positioned to capitalize on the huge opportunities ahead and live its mission of unleashing the potential of every team,” Farquhar said in the company’s earnings release.

For its fiscal 2025 first quarter, Atlassian expects revenue of $1.149 billion to $1.157 billion. At the midpoint, it was below the $1.16 billion expected by analysts. For the full year, the company expects revenue of $5.06 billion at the midpoint, also falling short of expectations.

Also of interest to investors was Atlassian’s growth rate for its 2025 fiscal year, with the company predicting growth of 16% versus the 23% growth it recorded in fiscal 2024, indicating that the company’s growth prospects are slowing down.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.