CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Smartsheet Inc., a company with a popular work management platform of the same name, today announced that it has agreed to be acquired by Blackstone and Vista Equity Partners in a $8.4 billion deal.

The software maker’s investors are set to receive $56.50 in cash for each of their shares. That represents a 41% premium to Smartsheet’s volume-weighted average stock price from the past 90 days. The acquisition offer is not unexpected: Reports of Smartsheet’s efforts to draw a takeover bid first emerged in July.

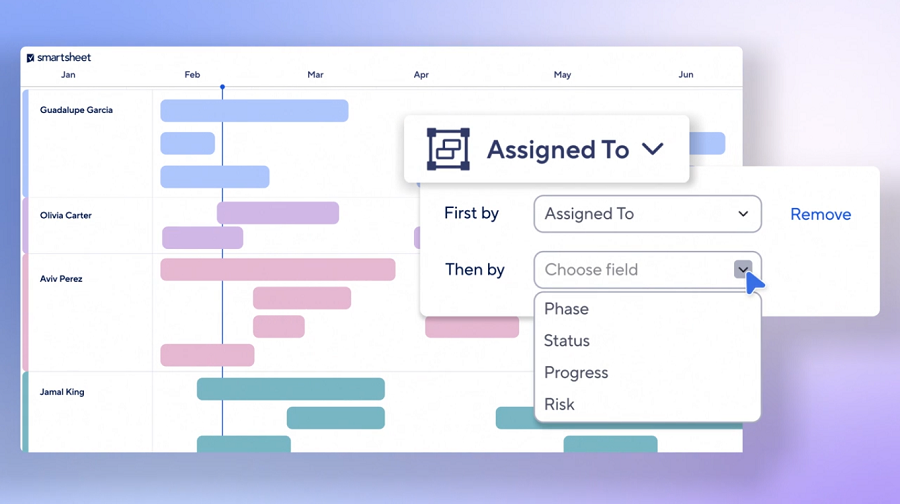

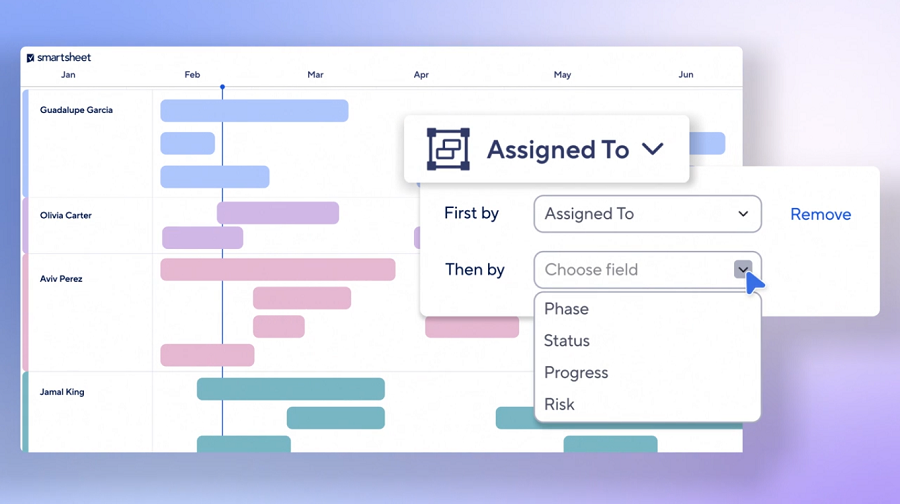

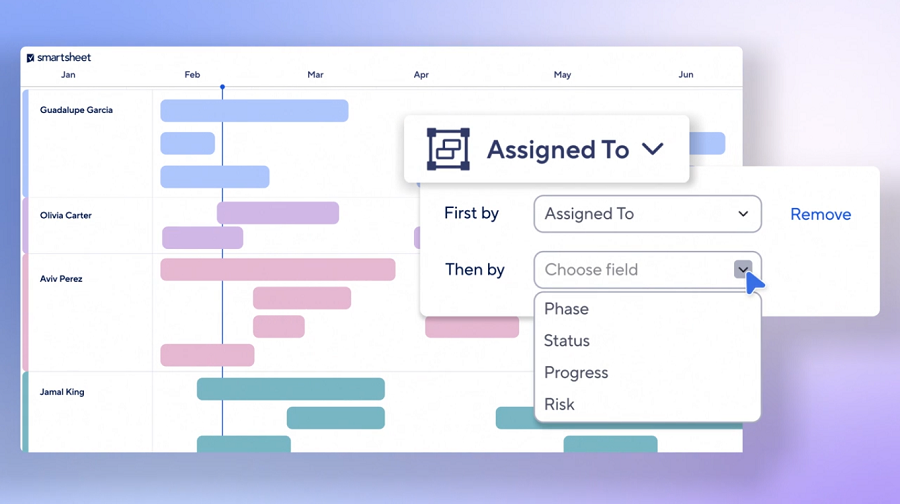

Smartsheet’s platform is used by more than 13 million professionals to coordinate their day-to-day work. It’s built around a project management tool that allows managers to track their teams’ outstanding tasks, the deadline of each task and related details. It can display that information as a spreadsheet or in the form of visualizations, such as a timeline view that organizes to-do items based on their urgency.

Customers also have access to various time-saving features. One such capability makes it possible to create automation workflows that can perform simple tasks without manual input. A manager could, for example, configure Smartsheet to notify members of the help desk team whey they’re assigned a high priority technical support ticket.

Over the years, the company has expanded its focus beyond work management to a number of other areas. One of the features it ships with its platform can automatically sync business data to and from other services. Another capability, a low-code development tool, allows users to create simple business applications.

In the past two years, artificial intelligence has emerged as a major focus of Smartsheet’s feature development roadmap. Last July, the company debuted a tool that allows workers to turn business data into charts with natural language prompts. Another built-in AI tool can automatically summarize lengthy documents.

Smartsheet generated $276.4 million in revenue last quarter, up 17% from the same time a year earlier. In the same time frame, the number of organizations that spend more than $1 million per year on its platform jumped 50%, to 77. The company’s customer base includes more than 90% of the Fortune 500 along with a long list of other organizations.

“We are confident that Blackstone and Vista’s expertise and resources will help us ensure Smartsheet remains a great place to work where our employees thrive, while driving innovation and delivering even greater value for customers and stakeholders,” said Smartsheet Chief Executive Officer Mark Mader.

The acquisition offer that Blackstone and Vista have put forth for Smartsheet allows for a 45-day go-shop period. The software maker has until Nov. 8 to seek other bids. If a higher offer doesn’t arrive and the deal’s other closing conditions are met, Smartsheet will go private by next February.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.