SECURITY

SECURITY

SECURITY

SECURITY

SECURITY

SECURITY

Several private equity firms are competing to buy Japanese cybersecurity provider Trend Micro Inc., Reuters reported today.

If it materializes, the deal could mark one of the largest enterprise technology acquisitions in recent memory. Trend Micro had a market capitalization of $8.54 billion on Wednesday and a takeover offer is likely to value it higher.

The company’s shares jumped 16%, the maximum daily increase possible on the Tokyo Stock Exchange, following the Reuters report.

The potential buyers seeking to acquire Trend Micro reportedly include Bain Capital, Advent International, EQT AB and KKR. Reuters’ sources said that the private equity firms have expressed acquisition interest in “recent weeks.” However, they cautioned that Trend Micro could still opt to remain independent instead of pursuing a sale.

Trend Micro launched about 30 years ago in Los Angeles and relocated its headquarters to Tokyo a few years later after acquiring a local software company. Around the same time, the company’s cybersecurity business received an early boost from a reseller agreement with Intel Corp. Today, its software is used by over 500,000 organizations and protects more than 250 million user devices.

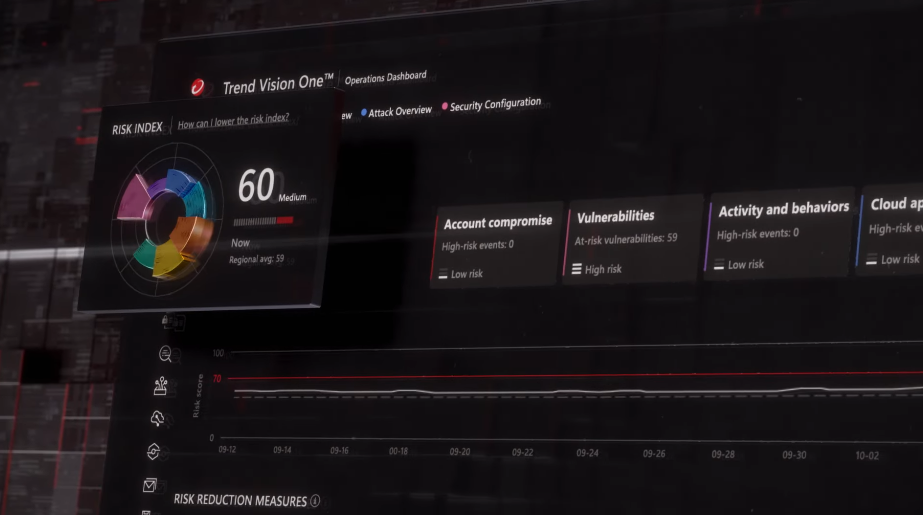

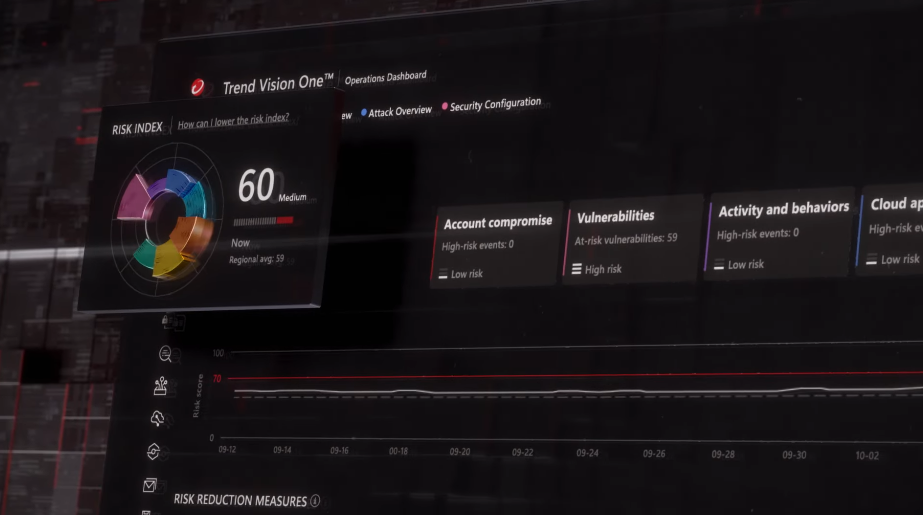

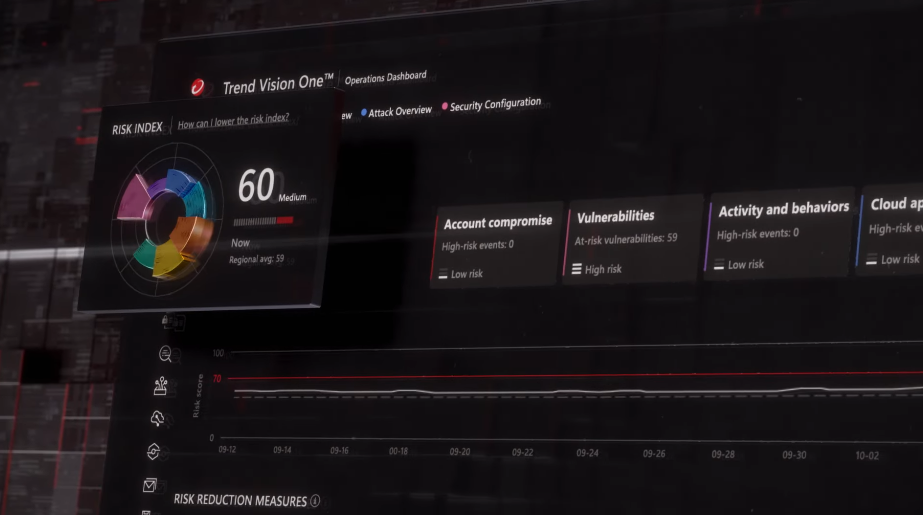

Trend Micro’s flagship offering is an enterprise-focused cybersecurity platform called Vision One. It can block cyberattacks across cloud environments, network equipment, employee devices and other systems. A threat investigation console enables administrators to map out the impact of the breaches that Vision One detects.

Trend Micro provides an artificial intelligence assistant, Trend Companion, to make its platform easier to use for customers. The AI generates natural language explanations of breach alerts and the associated code. It can also help administrators collect technical data for cyberattack investigations.

Trend Micro’s other offering is an antivirus application for the consumer market. In addition to fending off cyberattacks, the software includes a password manager that helps users manage their login login credentials. It also promises to speed up customers’ devices.

Trend Micro’s revenue grew 6% year-over-year in its fiscal third quarter to 68.1 billion yen, or about $456 million. The company signed up more than 780 new customers to its Vision One platform. Operating income jumped 42% to the $99 million.

The private equity firms reportedly seeking to buy Trend Micro aren’t new to the cybersecurity market.

In 2022, KKR bought Barracuda Networks Inc. from Thoma Bravo at a reported valuation of $4 billion. Barracuda makes cybersecurity tools for protecting employee inboxes and business applications from hacking attempts. Two years earlier, Avent International participated in a $1.9 billion deal to acquire Forescout Technologies Inc., which helps enterprises scan their networks for insecure devices.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.