INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Arista Networks Inc. delivered a higher profit in the fourth quarter, thanks to a double-digit sales increase driven by growing demand for artificial intelligence networks.

The cloud networking company also forecast revenue for the current quarter that came in above Wall Street’s estimates. It reported a net profit of $801 million in the quarter, up from just $613.6 million in the year-ago period. Earnings before certain costs such as stock compensation came to 65 cents per share, easily beating the Street’s 57-cent guidance. Revenue rose 25% from a year earlier, to $1.93 billion, topping the $1.9 billion consensus estimate.

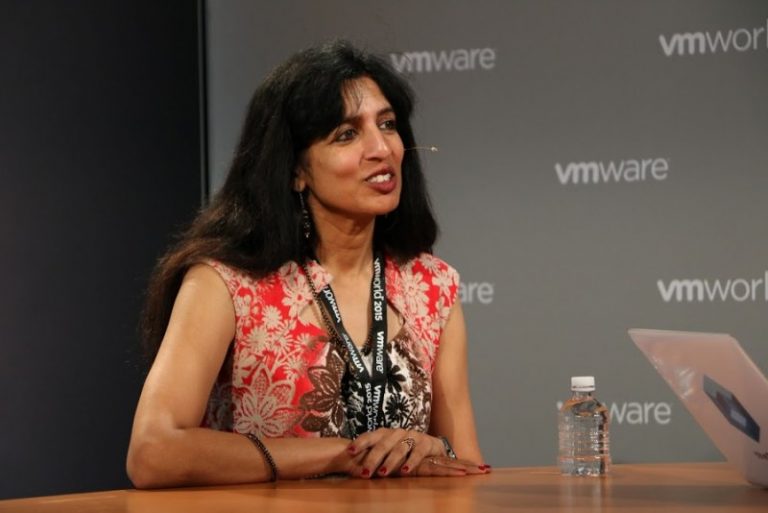

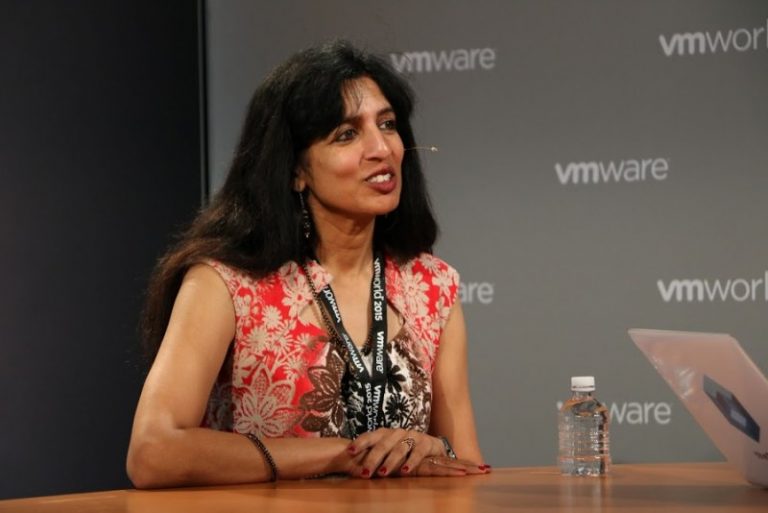

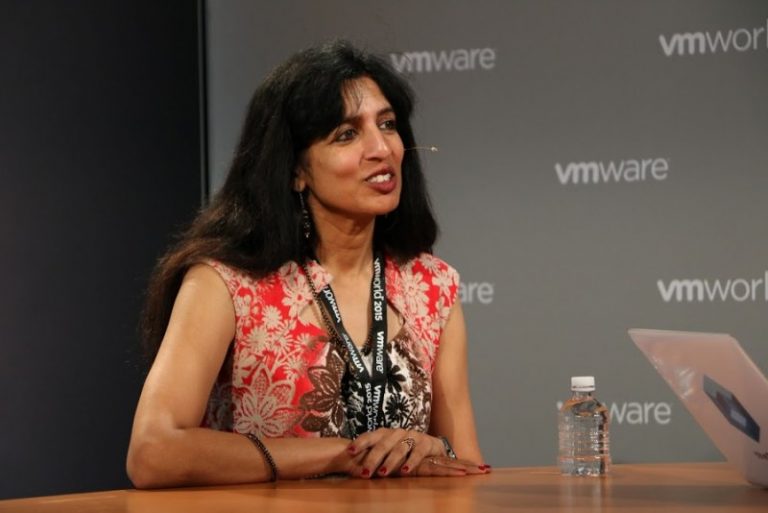

Chief Executive Jayshree Ullal (pictured) hailed fiscal 2024 as a “remarkable year” for the company, in which it generated a record $7 billion in revenue.

The latest results highlight the growing demand for the advanced networking infrastructure needed to support complex AI workloads. Over the last year, Arista has delivered a string of successive earnings and revenue beats as its main customers scramble to build out their AI capabilities. Unlike traditional data center workloads, AI applications require a blazing-fast communications infrastructure to operate effectively, which is what Arista specializes in.

The company is a rival to the much larger Cisco Systems Inc., focused on selling premium networking gear such as switches that facilitate high-speed communication between racks of computer servers in corporate data centers. Its biggest customers are the so-called hyperscaler cloud infrastructure providers, such as Microsoft Corp. and Meta Platforms Inc., but it also has a strong presence in the enterprise market, helping organizations to build out their on-premises data centers.

“We continued to innovate for our customers with best-of-breed platforms enabling AI for networking and networking for AI,” Ullal said.

Analysts believe that Arista is likely to continue to benefit from the rising demand for robust networking platforms for the foreseeable future. Its prospects have been bolstered by recent statements from its biggest customers, which intend to double down on their AI spending. Earlier this month, Meta Platforms, Microsoft, Google LLC and Amazon Web Services Inc. all announced plans to increase their capital expenditures this year.

What’s surprising is that Arista’s forecast for the current quarter doesn’t quite appear to match that optimistic outlook. The company said it’s looking for first-quarter sales of between $1.93 billion and $1.97 billion, ahead of the Street’s target of $1.91 billion, but more or less flat compared to the prior quarter.

That may explain why Arista’s stock declined more than 4% in the extended trading session, erasing an earlier gain of 3% that occurred during regular trading. Then again, it may simply be the case that investors are opting to take profits, as Arista’s stock has gained more than 70% in the last 12 months.

Holger Mueller, an analyst with Constellation Research Inc., said Arista has been quietly growing very fast because the network is just as vital for AI as the powerful processors that steal all of the headlines. “Faster processors are the workhorses, but they also need much faster networks to work properly, and Arista has found itself in the eye of the storm because that’s what it caters to,” Mueller said.

The analyst said investors will be pleased to see Arista’s cost management, which ensured that 60% of its revenue found itself in the bottom line, driving a 40% increase in earnings per share for the full year.

“The only mystery, which is probably a concern for investors, is the company’s flat guidance, suggesting zero growth on a sequential basis,” Mueller added. “But it may just be that Jayshree Ullal and her team are being conservative in their expectations. They may yet surprise us.”

During the quarter, Arista completed a four-for-one stock split, which means that each shareholder received three additional shares in the company. The split was designed to make Arista’s stock more accessible to smaller retail investors.

Arista isn’t the only networking firm that’s being boosted by rampant AI sales. Earlier this month, another rival, Juniper Networks Inc., also topped analysts’ expectations on earnings and revenue.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.