AI

AI

AI

AI

AI

AI

Appian Corp. shares climbed more than 5% in today’s trading session after it reported better-than-expected revenue and earnings for the first quarter.

McLean, Virginia-based Appian debuted on the Nasdaq in 2017. The company, which raised $10 million in equity funding before going public, sells automation software that can be used to speed up repetitive business tasks. The company counts large enterprises such as Santander and multiple U.S. government agencies among its users.

Appian’s sales rose 11% in the first quarter to $166.4 million, just above the consensus estimate. The growth was driven by the company’s subscription segment, which brought in 14% more revenue than a year earlier. The segment includes the cloud editions of its software, on-premises term licenses and customer support contracts.

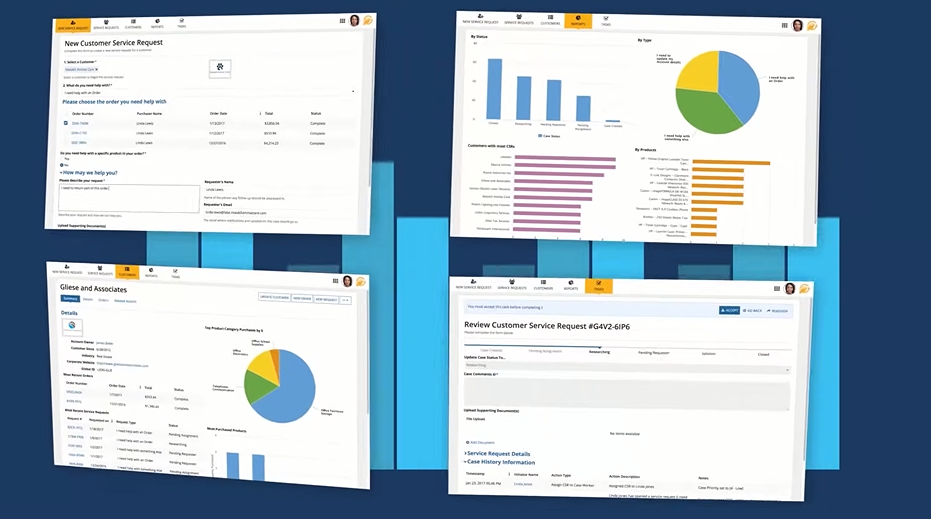

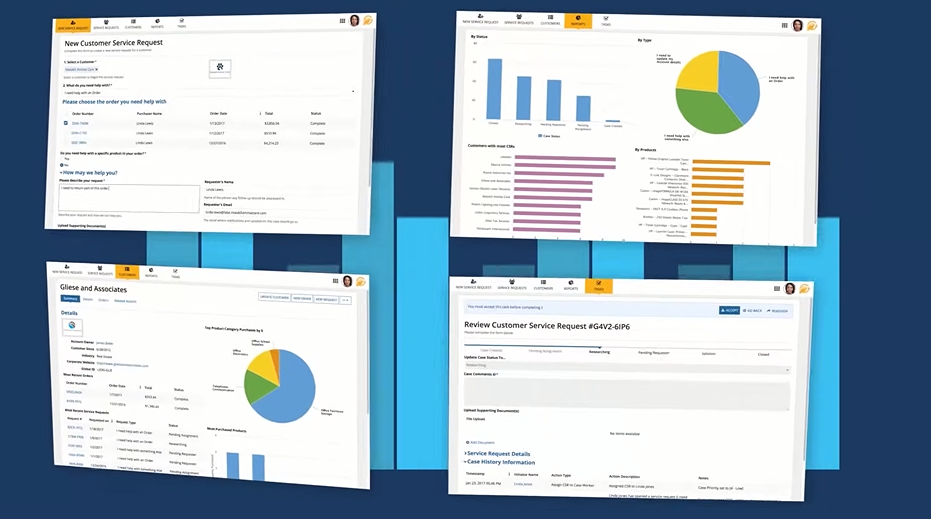

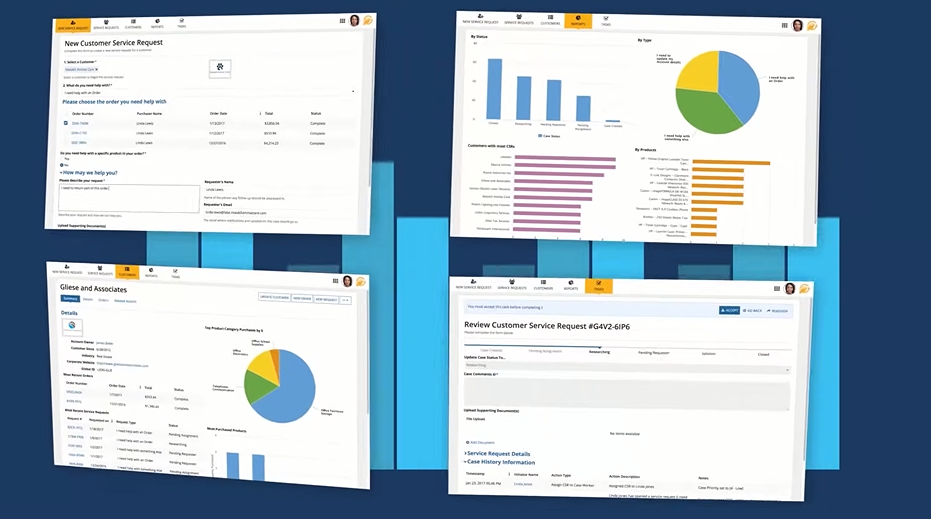

The company’s platform allows workers to automate a business task by creating a diagram that describes the steps it includes. This diagram can be assembled by dragging and dropping components onto a virtual canvas. From there, Appian automatically turns the visualization into an automation workflow.

Automation workflows can draw on information in a company’s applications using a tool called Data Fabric. A workflow could, for example, enrich ad performance metrics with click-through statistics from a marketing tool. Data Fabric makes internal datasets available through a kind of catalog that removes the need to move records into Appian’s platform before analysis, which eases administrators’ work.

Alongside automation workflows, the platform can be used to create business applications. An internet provider, for example, could build a mobile app that gives field technicians access to information about malfunctioning network equipment.

Last year, Appian started rolling out higher-priced editions of its platform that include artificial intelligence features. Those capabilities automate tasks such as extracting data from business documents. Appian Chief Executive Officer Matt Calkins told investors today that revenue from those product tiers more than doubled to $9 million during the first quarter.

“This is not yet a large share of our quarterly subscriptions revenue, but it demonstrates our early moves to monetize AI, and our customers’ willingness to pay for it,” Calkins said.

In parallel with its AI-focused revenue growth initiative, Appian is working to increase profit margins by making its sales organization more efficient. “This Q1, our net new bookings per sales rep rose more than 30% compared to the same period last year,” Calkins detailed.

The company’s efficiency drive helped boost its profitability in the first quarter. Appian swung to an adjusted profit of $9.8 million after losing $6.8 million the same time a year earlier. That translated into earnings of 13 cents per share, well ahead of the three cents forecast by analysts.

The company’s revenue guidance for the current quarter missed the consensus estimate by a fraction of a point. On the other hand, Appian raised its full-year sales projection to between $680 million and $688 million, which would represent 12% growth on the top end of the range.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.