AI

AI

AI

AI

AI

AI

Salesforce Inc. has unveiled a series of prebuilt templates for creating AI agents that can perform the duties of loan officers, banking and insurance agents, financial advisers and more.

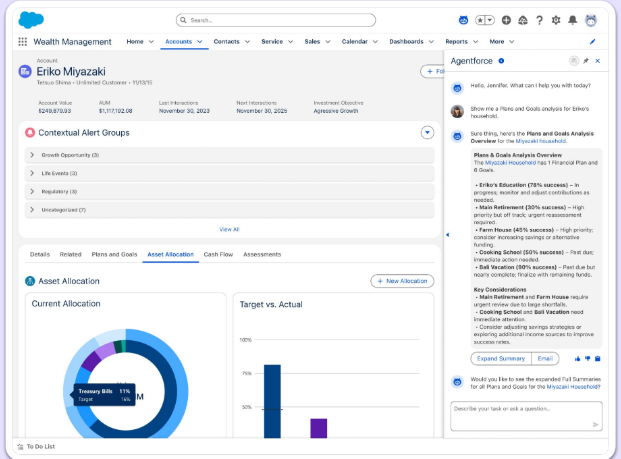

The templates can be found in a special version of Salesforce’s Agentforce artificial intelligence development platform that’s embedded within the Financial Services Cloud. It’s aimed at financial services firms ranging from banks and insurance providers to hedge funds and venture capitalists

Agentforce for Financial Services’ agents were created to work side-by-side with human experts, relieving them of the administrative burden that reduces their time to engage with customers, Salesforce said. By taking on the most laborious tasks, financial professionals can now focus their energies on higher-level work that will strengthen their relationships with clients and increase value for their employers.

When Salesforce debuted the Agentforce platform in October, it cemented its status as a pioneer of AI agents, among the first enterprise technology giants to offer generative AI-powered automation that goes further, by performing tasks on behalf of workers. It’s used to create teams of AI workers that leverage business logic and prebuilt automations to perform routine work.

Salesforce argues that even more specialized AI agents are needed for the financial services, because it’s an industry built primarily on trust. Despite this, customers often feel frustrated, being left on hold, having to repeat their information multiple times, and struggling with complex terminology.

The pre-built agent templates span roles including financial advisers and banker agents, designed to automate tasks such as meeting preparation, note-taking and follow-ups. Prior to each call with a client, the financial adviser agents can help by analyzing that customer’s data, including their financial portfolios, past interactions and more in order to surface key insights around their performance and future needs.

Armed with this data, the agent can quickly structure a meeting agenda, pulling in data from upcoming events and business milestones. It can also suggest talking points and point out areas where the human adviser might be able to provide additional value and address client concerns.

Once the meeting is done, the agent will then summarize what was said, identifying the key talking points and action items so it’s easier to follow up. These summaries will be uploaded directly into the Financial Services Cloud, along with follow-up tasks, so they can be found in one convenient place.

As for the banking and insurance agents, these are primarily designed to take care of routine customer requests, such as canceling a credit card or suggesting insurance policies.

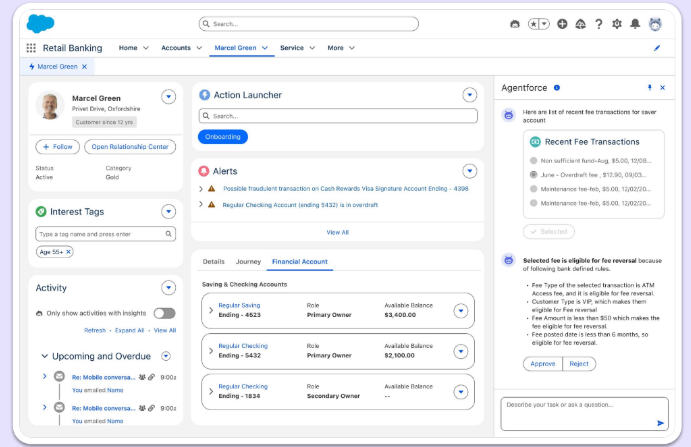

In retail banking, they’ll integrate with the bank’s core information technology system to handle customer support tasks, advising callers on their bank balance, reviewing transactions, processing new card requests, cancelling lost cards and so on. They can also process certain claims, such as transaction reversals, if allowed to do so, or simply gather all of the required information before submitting the request to a human reviewer.

For insurers, the AI agents can help guide customers through the quoting process by gathering all of the key information required, including customer demographics, risk profile and coverage needs. It will then compare this data with the available policy options, before suggesting various coverage types. The AI-powered insurance agents can provide quotes in near real time, the company said, helping to boost conversion rates.

“We’re using Agentforce to boost productivity across our service operations,” said Matt Brasch, Cumberland Mutual LLC’s vice president of digital operations. “The speed and impact of our initial deployment has opened our eyes to what’s possible, and we’re excited to explore additional use cases to help us streamline things like claims and procurement to drive even more value.”

As for the digital loan officers, these are tasked with guiding borrowers through the loan application process. They can handle personal loan and auto loan applications by asking relevant questions, gathering the necessary information and then offering various repayment options to borrowers. They’re online 24/7, and they can process loans instantly if required, freeing up human loan officers to focus on more important work such as exceptions and finalizing terms for more complex loans.

All of the AI agents built with the Agentforce for Financial Services platform are grounded in each organization’s own data, workflows and compliance rules, ensuring that all of their actions conform with internal best practices. Salesforce said there are two key components to its AI agents — Topics, which guides their behavior, and Actions, which enable them to take specific actions for financial services tasks. Customers can customize the exact nature of these actions to ensure the AI never oversteps any critical boundaries.

Salesforce also stressed the embedded compliance controls within each AI agent, which ensure they follow the same regulatory guardrails that apply to human workers.

Eran Agrios, Salesforce’s financial services senior vice president and general manager, said AI is not meant to replace the human connection, but instead help it to scale up. “Financial firms can now tap into digital labor built on a deeply unified platform to help their human teams boost productivity, efficiency and revenue, while delivering the trusted and personalized experiences their clients want,” he said.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.