AI

AI

AI

AI

AI

AI

Cisco Systems Inc. hasn’t enjoyed much organic revenue growth in more than a decade. It just rolled into San Diego claiming this year’s Cisco Live is the “most consequential” event in the company’s history. Hyperbole? Maybe.

But after three days on-site comprising a Q&A with Chief Executive Chuck Robbins and President and Chief Product Officer Jeetu Patel (pictured), closed-door roadmap dives, and a flood of product reveals in public, our assessment is that Cisco finally has a credible, end-to-end story for the AI era.

Key take: Cisco’s value proposition is no longer “best-of-breed boxes.” It’s a platform that fuses networking, programmable silicon and security into what the company claims is a single control plane, made more resilient by Splunk’s data fabric. The narrative is tight considering the vast estate that Cisco controls. The execution and “show me” risk is at a high bar.

The numbers are stark. Cisco’s 2015 TTM revenue was around ~$49 billion. TTM revenue in April 2025 ~$56 billion. That’s a CAGR of ~1.35%, well below inflation, comprising north of ~$40 billion of M&A which essentially papered over flat organic growth. Historically, Cisco’s answer to strategic pivots has been to buy its way in—Webex, Duo, ThousandEyes and now Splunk for $28 billion. Wall Street hasn’t been enthusiastic.

This time feels different because the driver isn’t “grow share” in a mature market; it’s become the critical infrastructure for the agentic AI era. Just as Cisco was fundamental for the Internet buildout, the company wants to bring this posture with an enhanced playbook to the AI era. The focus is on three broad areas: 1) Building AI data centers; 2) Future proofing workspaces; and 3) Building resilience throughout with a network-centric focus. As generative systems evolve from chatbots to autonomous agents that hammer networks 24×7, the fabric matters again. Latency is the new currency; trust is table stakes.

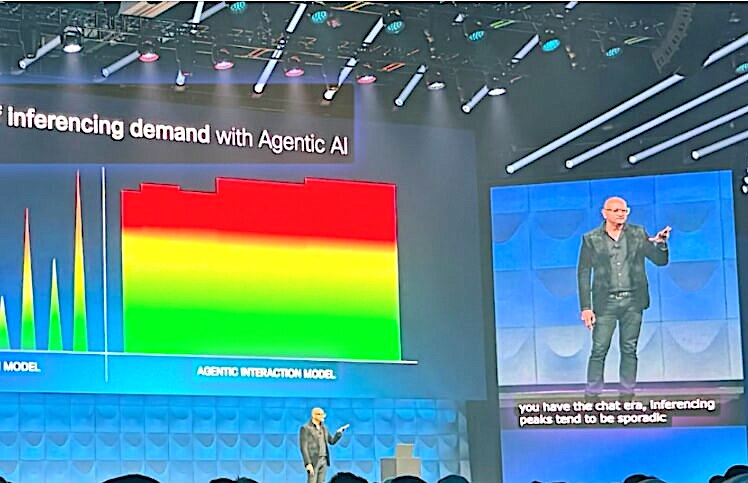

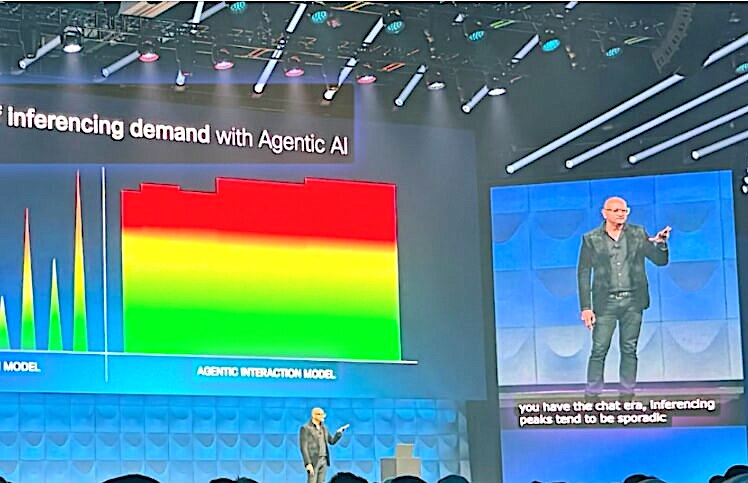

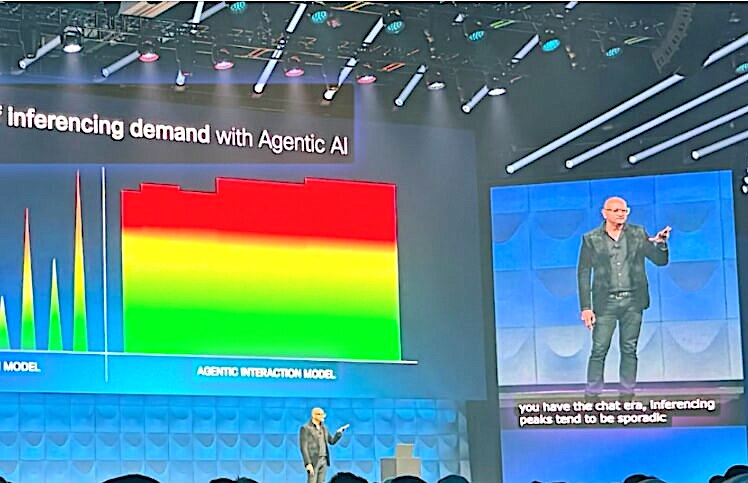

In the chart below, Jeetu Patel explains the difference in network demand as LLMs become more capable. The left hand side depicts the demand from chat interactions and the right most visual demonstrates inference as LLMs become more advanced and reason will put continuous demand on the network. Cisco’s premise is that network must be ultra low latency, resilient and highly secure.

Chuck Robbins and Jeetu Patel conveyed that they’re betting on three pillars:

If Cisco can stand up those pillars, the company has a great shot at re-inserting itself into the critical path of enterprise AI. If they stumble, the company risks sliding into the same rut that has plagued so-called box vendors of prior eras.

Jeetu Patel is a builder and has a proven track record of executing on product roadmaps. He has a strong command of the portfolio and is an inspirational leader. As such we have increased confidence that he can attract other builders to join Cisco and/or inspire existing engineers to work at world class levels and deliver.

In his new role for under 11 months, he has brought about cultural change and momentum around innovation and product delivery. Cisco historically confused customers with overlapping lines — Catalyst vs. Meraki, ASA vs. Firepower vs. Umbrella.

In contrast, under Patel:

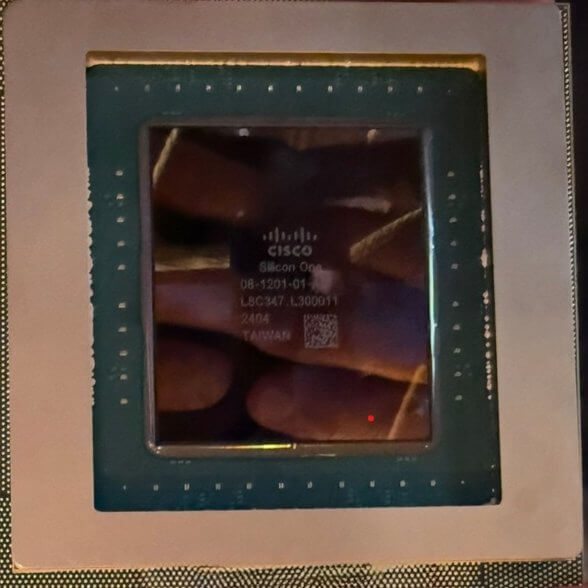

Cisco’s SiliconONE programmable ASIC

We believe this is the first time in 15 years that Cisco has shown a truly integrated roadmap instead of a stitched-together portfolio with several acquisitions on slideware. Integration however isn’t a press-release game, customers will judge when the upgrades hit daylight.

Moreover, as we like to say, technology vendors like Cisco must move at the speed of Nvidia, and Cisco appears to be keeping pace. Datacenters traditionally move at the speed of the CIO, which is deliberate and mostly focusing on running the business (RTB). Grow the business (GTB) and transform the business (TTB) take longer and Cisco must show that it can shepherd customers through the balance of RTB to TTB.

Why pay enterprise-software multiples for a SIEM vendor? Cisco’s premise is because in AI, whomever owns the telemetry owns the model. Splunk’s indexed time-series engine now soaks up:

Jeetu Patel in his keynote said: One reason why Cisco paid $28 billion for Splunk is to be able to take all the network, infrastructure, applications, ops, user device and security data into one place and correlate it.

One might ask, “Why couldn’t I just put all this data into Snowflake and build a Splunk killer or at least a robust security data lake for less than $28 billion? The answer to that question relates to both Cisco’s appetite for revenue via acquisition but also the challenges of time to market to build a solution as robust as Splunk’s, with an installed base to cross sell into.

Our view is if Cisco can drive a 20% uptick in Splunk ingest volumes simply by virtue of owning the pipes, the acquisition math starts to make a lot of sense. The bigger question is whether Cisco can keep Splunk’s developer mindshare intact while folding it into Cloud Control. That cultural integration will be harder than the technical challenges in our view and thus far it seems to be working. That said it’s hard to tell as Cisco can shuffle revenue deck chairs around and place dollars into any bucket it likes.

Cisco’s talking point — “only we have both networking and security” — isn’t new, but Live Protect shields and Hybrid Mesh Firewall add significant substance in our view:

Cisco’s argument that its security competitors don’t own the network and their network competitors don’t have security warrants consideration. In other words, the fusion of security and networking, Cisco believes, is fundamental to its competitive advantage. They’re not off base in our view. We’ve always said that Cisco can thrive in security coming in from its strength in networking.

Security vendors may counter with the fact that they are singularly focused on security; and or, in the case of CrowdStrike, for example, all the bad stuff happens at the endpoint and the network, is the highway for bad guys to traverse – but CrowdStrike has visibility on what happens at the endpoint.

Regardless, chief information security officers at the event liked the concept. They’ll love more in our view if licensing is transparent, a chronic Cisco pain point. Our belief it that bundling these features into Cisco One software-as-a-service-style subscriptions will accelerate adoption.

We believe investors will grant Cisco the benefit of the doubt if the company clears these milestones:

| Milestone | Deadline | Evidence We’ll Track |

| Mid-single-digit organic growth | FY-26 | AI-ready switch backlog → revenue, Splunk attach in network deals |

| Cloud Control GA <90-day deployment | Jan 2026 | Customer case studies showing day-1 Catalyst+Meraki parity |

| Live Protect activation on >50 % Nexus 9K ports | Dec 2026 | Subscription metrics in security ARR disclosures |

| Annual Silicon One throughput leap (≥1.7×) | Each June | Spec sheets vs. Arista and Nvidia Spectrum-X refreshes |

Miss too many of these and the “One Cisco” promise will be significantly less impactful.

Our research indicates Cisco finally has a story that resonates comprising programmable silicon, a single control plane, security that travels at line-rate and a data platform to feed AI. That’s more than table stakes for agentic AI infrastructure, and few vendors can stitch all four layers under one roof.

Yet Cisco’s decade-long growth challenges and habit of integration drift are the legacy blockers in its path. The company has one, maybe two fiscal years to show that its culture has flipped from serial acquirer to relentless builder. If Patel’s team ships on time and Splunk lights up the data flywheel, Cisco reclaims strategic relevance and earns multiple expansion. If not, the industry will treat this Live 2025 payload as just another keynote super-set of impressive demos.

For now, the ball is squarely in Cisco’s court. We’ll be watching the telemetry.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.