CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Revenue growth platform startup Fintary Technologies Inc. announced today that it has raised $10 million in new funding to expand its product capabilities and extend its artificial intelligence-powered platform into broader areas of insurance financial management.

Founded in 2021, Fintary offers a platform designed to transform how insurance companies handle their commission and financial operational challenges.

The company’s co-founder and Chief Executive Qiyun Cai was inspired to create Fintary after experiencing operational challenges earlier in her career. “I’ll never forget staying up until 2 a.m. on a Sunday, buried in spreadsheets trying to reconcile commissions,” said Cai. “And that’s when I realized it had to stop. The industry deserves better.”

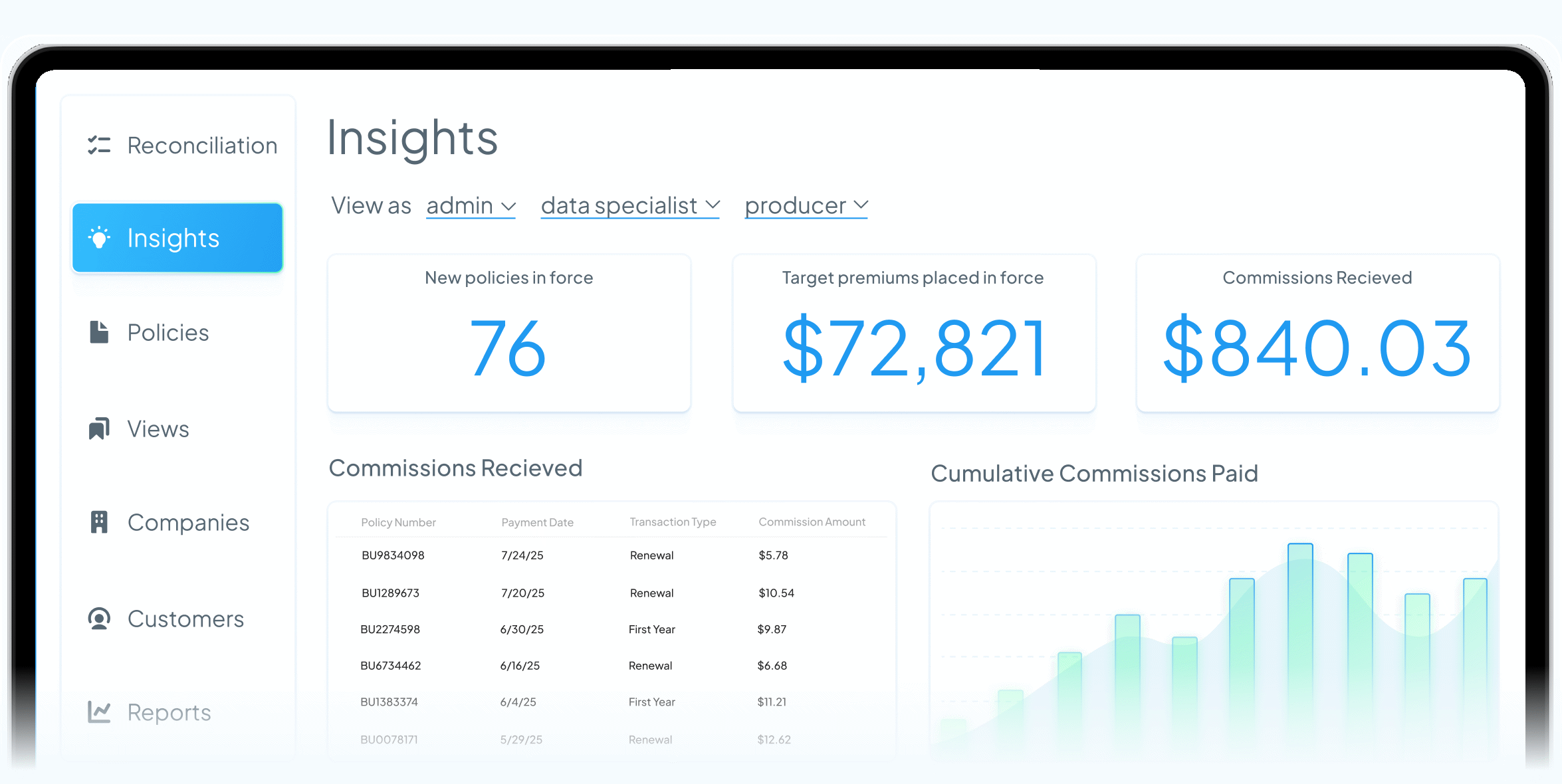

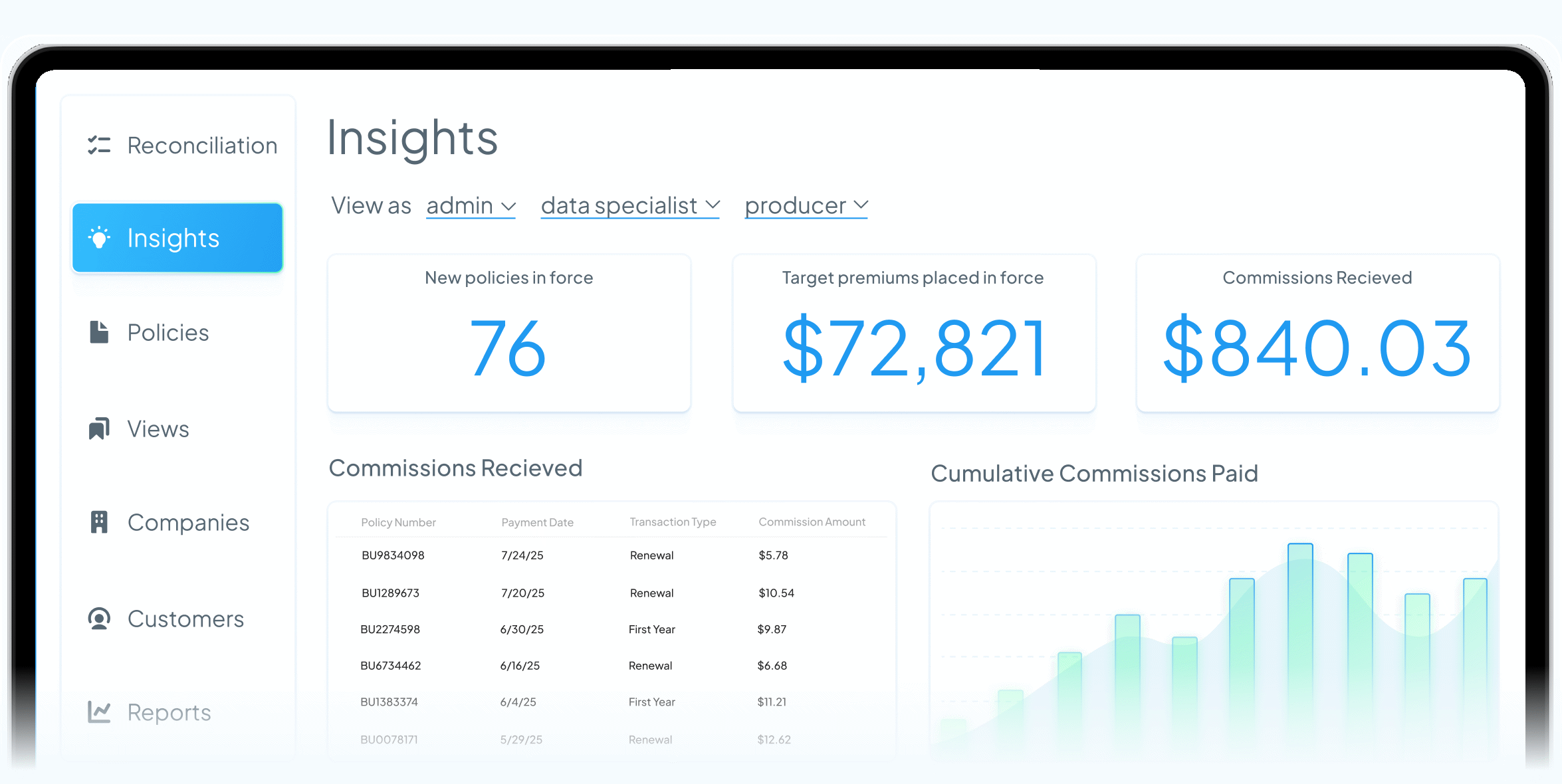

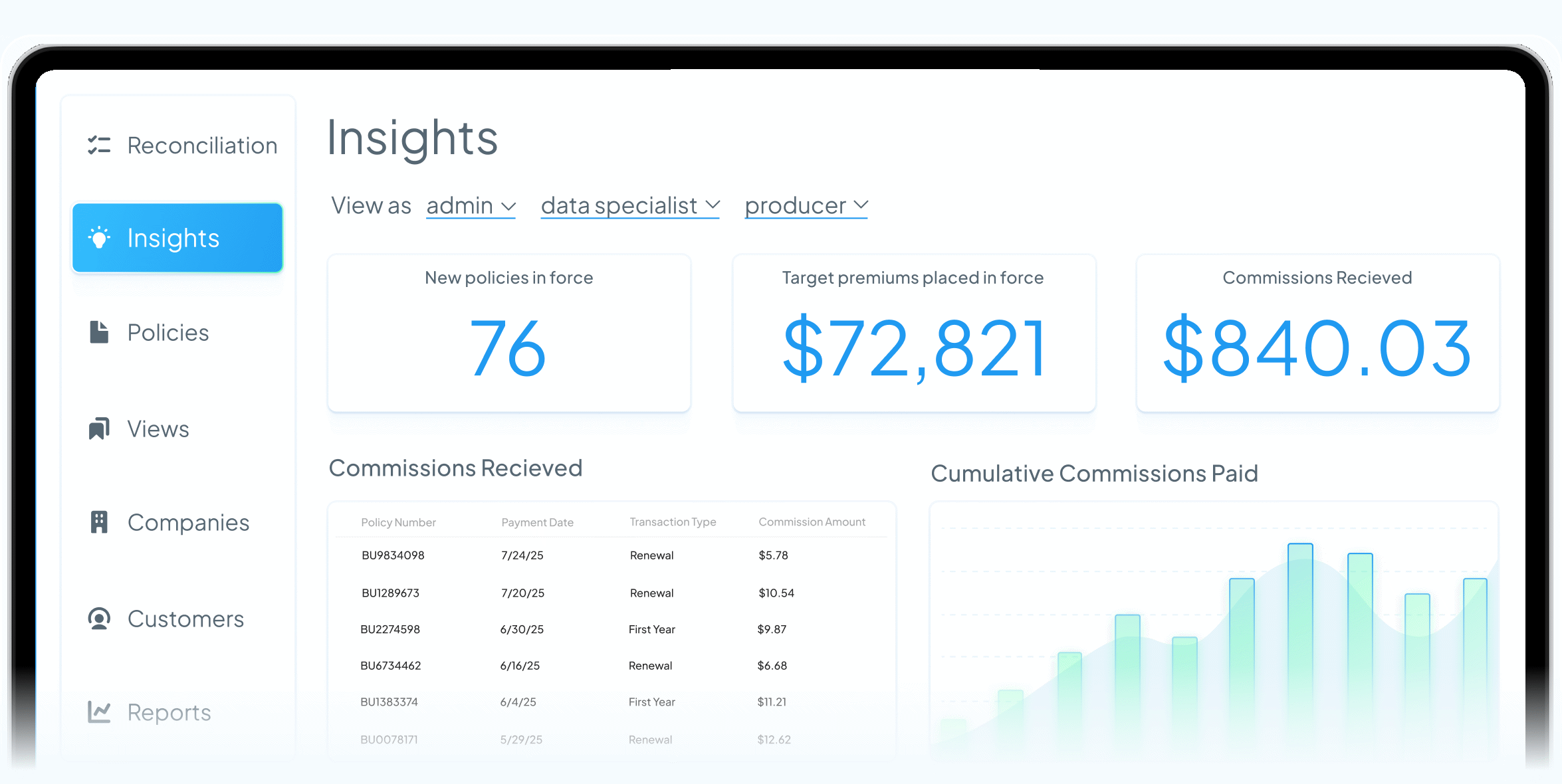

Fintary’s offering automates the entire commission lifecycle, from complex compensation calculations, including support for splits, overrides and bonuses, through reconciliation of carrier spreadsheets and timely agent payouts. The company’s platform aims to eliminate the 15 to 40 hours a week many agencies lose to manual commission processing and, in doing so, free teams to focus on growth rather than administration.

In addition to automation, Fintary provides real-time business insights and analytics that give insurers immediate visibility into profitability by carrier, product and agent. Users can anticipate chargebacks, trace revenue leaks and understand their financial operations as live data rather than guess at the margins or wait for month-end to reconcile.

Fintary also emphasizes agent experience and offers a white-label portal where agents can view their commissions at the policy level, track performance and feel confident in their payout accuracy.

The company works with insurance organizations across life and annuity, employee benefits, health and property and casualty lines. According to Fintary, customers have reduced weeks of manual reconciliation to minutes, improved accuracy and transparency in commission payouts and increased agent satisfaction and retention.

The Series A round was led by Infinity Ventures, with Sierra Ventures LP and other existing investors also participating.

“Fintary stands out because they understand the insurance world from the inside out,” said Jeremy Jonker, co-founder and managing partner at Infinity Ventures. “Their platform has processed millions in commissions — they know the pain of chargebacks and hierarchy overrides firsthand.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.