AI

AI

AI

AI

AI

AI

Artificial intelligence agents are coming to the real estate industry.

A startup called Smart Bricks Real Estate LLC has just raised $5 million in pre-seed funding to develop autonomous reasoning agents that can help investors to identify, evaluate and acquire high-performing real estate assets without spending endless hours searching and struggling with due diligence.

Today’s round was led by the prominent venture capital firms Andreessen Horowitz and saw participation from a host of other backers. They included Techstars, 500 Global, Cornerstone, South Loop Ventures, Harvard Business School Alumni Angels and Centro Ventures, plus angel investors from AI powerhouses OpenAI Group PBC and Anthropic PBC.

Smart Bricks founder and Chief Executive Mohamed Mohamed says real estate investing is ripe for agentic automation because it’s the only trillion-dollar asset class that doesn’t already have its own AI-native computing stack. While investors in the stock market are crunching through millions of data points using AI tools, most real estate financiers are still tapping away at calculators.

“Most individual investors are still operating with PDFs, WhatsApp threads and incomplete data, and they lack visibility into the opaque fee structures in real estate,” he said. “Institutions have proprietary data, AI underwriting and benefit from integrated execution, but everyone else is still flying blind.”

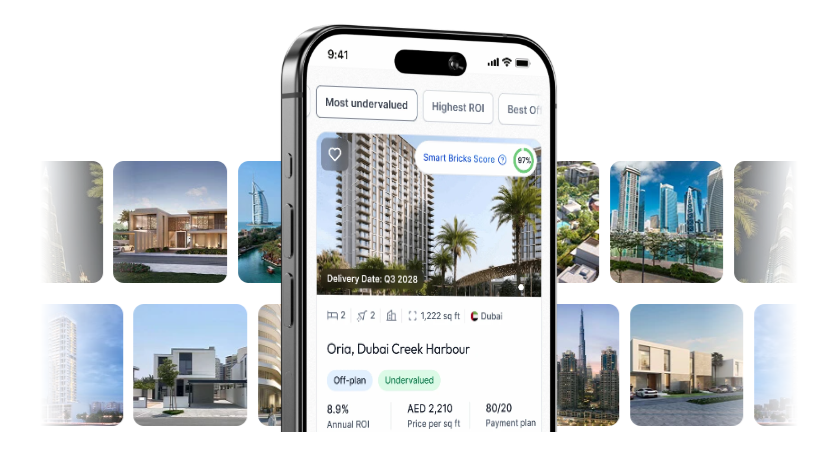

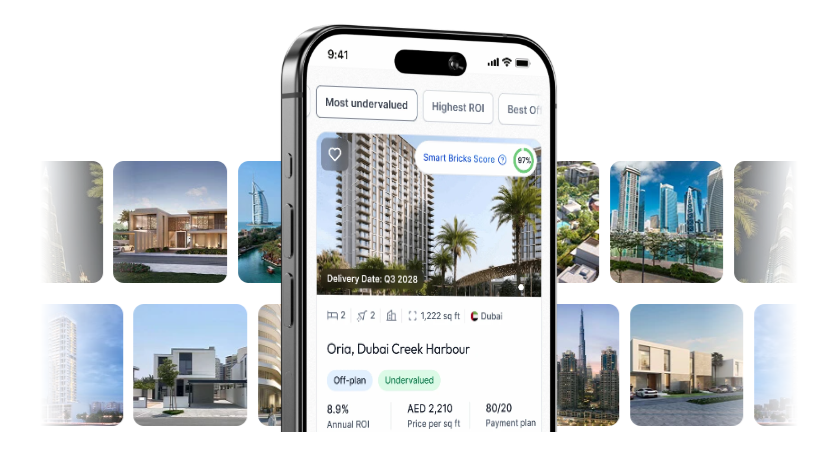

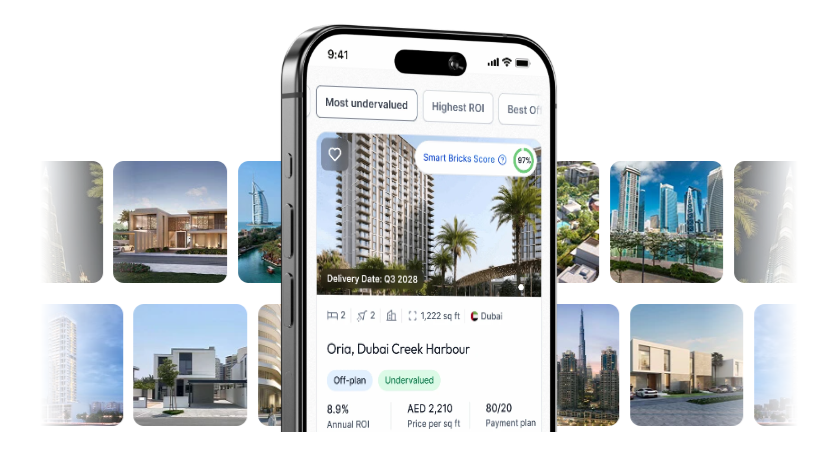

Smart Bricks aims to change that dynamic. It’s building an AI infrastructure layer for real estate investing that taps into more than 1 million public and proprietary data feeds. Its autonomous agents will continuously analyze these feeds to assess the state of supply in key markets, as well as other key metrics such as pricing, liquidity, regulation and risk. By crunching this data, Smart Bricks’ agents can provide investors with a complete picture of the most rewarding opportunities, based on current market dynamics.

The platform considers more than 1,000 meaningful variables to rank real estate assets by their expected risk-adjusted return, and to make life easier for investors, it will only surface the top 0.1% within the area they’re looking for. By eliminating the less desirable properties, it means investors only need to consider the most compelling opportunities, and once they’ve made a decision, Smart Bricks will streamline the transactional side too. In addition to its AI analysts, it has built agents that automate workflows including valuation, underwriting, due diligence, negotiation and financing to help transactions close more rapidly.

Mohamed said Smart Bricks gives investors the same kinds of ranked opportunities, real-time intelligence and execution workflows that were previously available only to the world’s biggest private equity and institutional real estate funds. “Investors in public markets already expect instant insights, scenario analysis and AI-driven recommendations,” he said. “We bring that same level of speed, intelligence and confidence to global real estate, allowing capital to move with institutional precision across borders.”

Smart Bricks is bringing a much-needed dose of automation to one of the world’s largest and most complex asset classes. Real estate’s investment infrastructure is remarkably archaic compared to that of public markets, resulting in lost opportunities and higher risks for the vast majority of investors. With its AI-native infrastructure layer, Smart Bricks promises to level the playing field by helping regular investors move away from a reliance on incomplete data and eliminate human bias from the critical screening phase.

Mohamed believes agentic automation in real estate investing will trigger a profound shift in global capital allocation, increasing market liquidity and compressing the timeline for real estate transactions. “Capital and talent have already gone global, but the tooling for real-estate investing has not,” he said. “Smart Bricks is building the intelligence layer that finally allows real estate to operate at the speed, transparency and scale modern markets demand.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.