INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Updated:

Investors have been punishing graphics chipmaker Nvidia Corp. lately, its shares down by more than a quarter on concerns about growth forecasts. The spanking continued today.

The Santa Clara, California-based maker of graphics processing unit chips used for gaming and artificial intelligence computing missed most Wall Street estimates both for the third quarter and guidance for the current quarter, both reported today.

Nvidia blamed the less-than-stellar results on too much inventory related to cryptocurrency mining, which requires the kind of computing power Nvidia’s chips work well for. But that’s a volatile business, especially as cryptocurrencies’ value has dropped precipitously.

On top of that, gaming machine makers were forced to over-order to get adequate supplies, resulting in too many graphics cards in the sales channel. To clear that inventory, Chief Financial Officer Colette Kress said on a conference call, sales of midrange gaming GPUs will be minimal in the current quarter.

The company reported a net profit of $1.94 a share, beating analysts’ estimate of $1.71, but after adjusting for items such as stock compensation, the profit was $1.84, missing the Street’s $1.94 estimate. Revenue rose 21 percent, to $3.18 billion, missing the consensus of $3.23 billion.

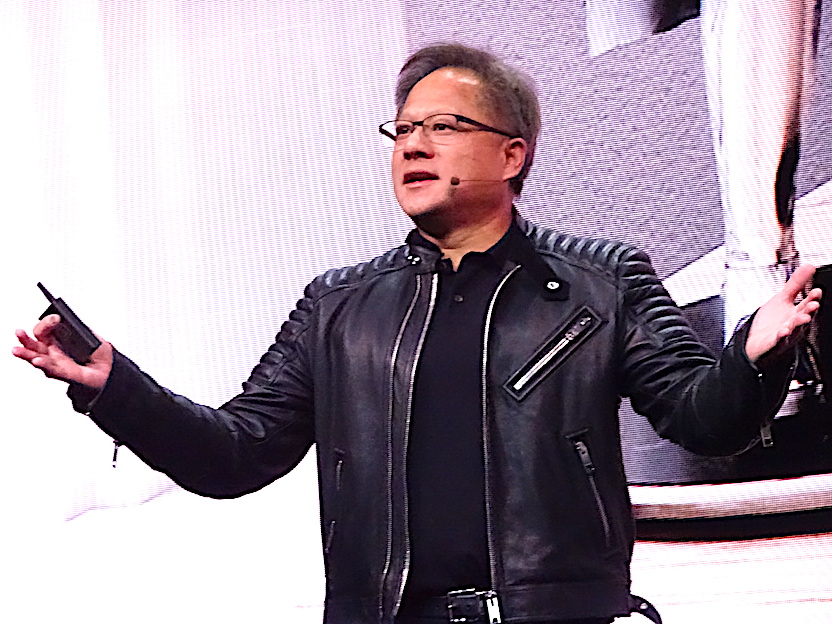

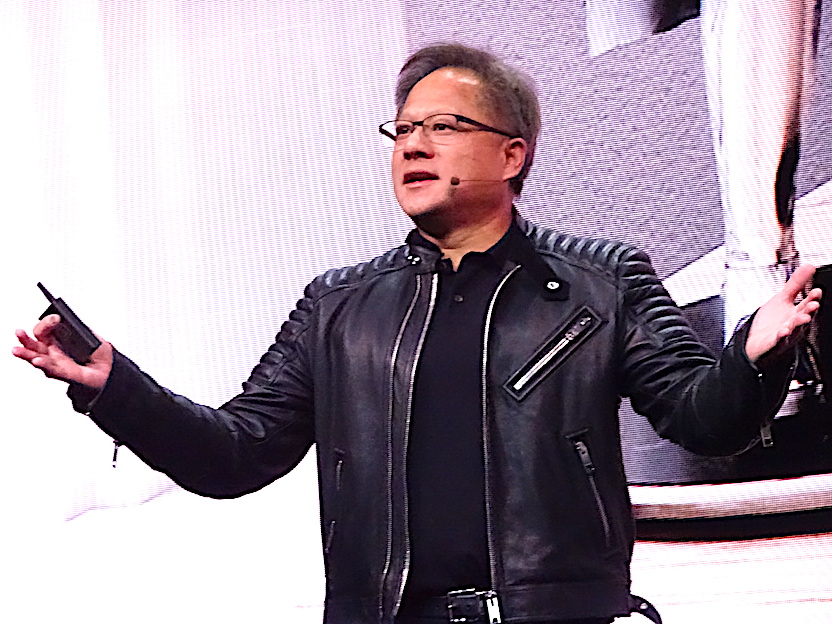

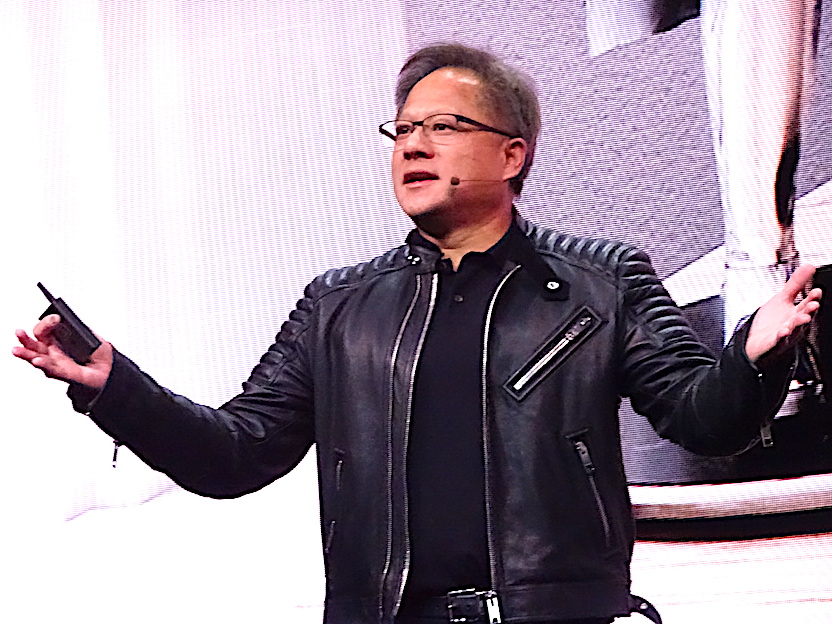

“Our near-term results reflect excess channel inventory post the crypto-currency boom, which will be corrected,” Nvidia Chief Executive Jensen Huang (pictured) said in prepared remarks. He added: “Our market position and growth opportunities are stronger than ever.”

But Nvidia revenue forecast is about $2.7 billion in the current quarter, well below analysts’ forecast of $3.4 billion.

As a result, investors fled the stock in after-hours trading today, as shares plummeted almost 19 percent — a loss maintained on Friday. Shares had closed up 2.6 percent, to $202.39 apiece, in the regular market session.

Nvidia stock hit an all-time high of $292.76 on Oct. 2, but shares are down by about 30 percent since then as growth issues emerged. One issue involved the disappearance in the second quarter of revenue from systems sold for cryptocurrency mining, an issue the company had warned about for some time and one that also came up in Advanced Micro Devices Inc.’s last quarterly report, after which its shares fell 15 percent. AMD shares were down more than 4 percent Friday.

Revenue from Nvidia’s Gaming segment, its largest, rose 13 percent from a year ago, to $1.76 billion, but again that fell below a $1.89 billion consensus. “Gaming revenue was short of our expectations, and our fourth quarter outlook is impacted by excess channel inventory of mid-range Pascal products,” the company said in additional comments by the CFO. “We believe this is a near-term issue that will be corrected in one to two quarters, and remain confident in our competitive position and market opportunities.”

Patrick Moorhead, president and principal analyst at Moor Insights & Strategy, explained that gaming customers were buying two to three times as much as they needed to assure adequate supplies during the crypto boom when miners were competing for every graphics card available. “I have no question that this is a short-term blip that will be quickly corrected,” he said.

Datacenter segment revenue, the second-largest, jumped 58 percent, to $792 million, also a bit below the $821 million consensus.

In the second quarter, just before Nvidia’s new Turing architecture was announced, investors also figured sales growth might be muted as some customers paused their buying of existing systems until new chips ship. Gaming-oriented graphics cards based on Turing started shipping in the third quarter, but their use will require new software, which could take some time.

On Monday, the company announced that its newest cloud GPU, called the T4 and introduced in September, will be available on Google LLC’s cloud as well as dozens of servers from most major computer makers. Nvidia made a point of noting that the chips have seen “record adoption” for a server GPU and said T4 sales contributed to revenues in the last quarter.

Huang continued to emphasize Nvidia’s AI opportunity. “AI is advancing at an incredible pace across the world, driving record revenues for our datacenter platforms,” he said. “We expect to continue to do well in data centers.”

At the same time, Nvidia faces increasing competition in AI — both from other chipmakers, such as Advanced Micro Devices Inc., Intel Corp. and Xilinx Inc., and other kinds of chips, such as custom chips called field-programmable gate arrays and application-specific integrated circuits.

Meanwhile, Automotive revenue rose 19 percent, to $172 million, beating analysts’ forecast of $162 million. Professional visualization revenue rose 28 percent, to $305 million, ahead of the $284 million consensus. Finally, revenue from sales to original equipment manufacturers and from intellectual property fell 23 percent, to $148 million, partly because of the cryptomining issue, but that beat the Street’s $102 million forecast.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.