INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Enterprise data storage has suffered a long, steady siphoning of demand, coinciding with the rise of cloud computing. But although there are few signs of that trend reversing, opportunities still exist for the market’s most nimble and innovative players.

In his latest Breaking Analysis video, Dave Vellante, chief analyst at SiliconANGLE sister market research firm Wikibon and co-host of SiliconANGLE’s video studio theCUBE, weighs in with his thoughts on the state of the storage market today, together with some forecasts of what might happen in the coming months.

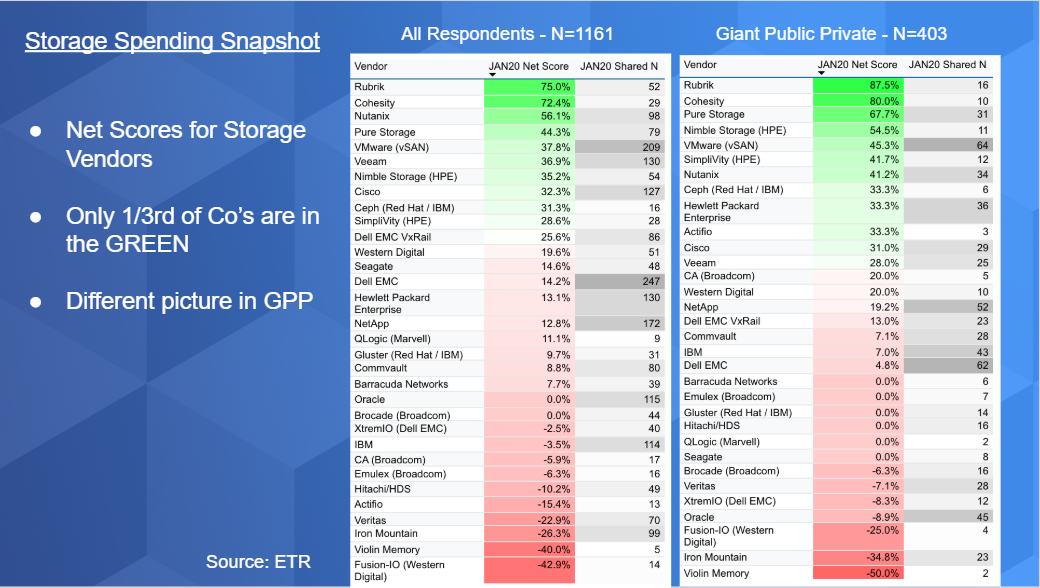

The most recent spending data from Enterprise Technology Research shows that most storage companies are struggling to maintain momentum relative to spend on other IT initiatives. ETR ranks storage providers according to their “Net Score,” which is a measure of spending velocity that takes into account whether a customer is planning to spend more or less on a particular vendor.

The Net Score data for the main storage players paints a pretty bleak picture of the market today, with barely a third of the listed vendors currently in the green. Exceptions include hot companies like Cohesity and Rubrik, which stand out from the pack, along with Pure Storage Inc. and Nutanix. VMware Inc.’s vSAN business is also showing some momentum. But for the most part, traditional storage providers are struggling to attract as much money as they used to.

There’s not much improvement when we look at the spending data for what ETR calls “GPP giant public” companies, which are the 403 largest public and private companies that are often cited as the best indicator of spending momentum. In the graphic above, the story is pretty much the same, with just a third of the storage providers in ETR’s analysis showing “green” net scores.

“Generally speaking this picture is not great for storage with the exception of a few players like Rubrik, Cohesity, Pure and Nutanix,” Vellante said. In particular, Rubrik, Cohesity and Pure, along with vSAN improve in the largest company sector.

Several trends explain the storage market’s ongoing malaise, the main one being the rise of the public cloud. That is pressuring demand for legacy storage systems as more companies choose to store their data offsite.

Another force at work is the rise of flash storage technology. Whereas before companies would often buy extra hard drives in to boost performance, these days there’s so much flash in most firms’ data centers that they simply don’t need to do this anymore, which once again means less revenue for the storage players. In addition, storage firms are suffering from the current falling price of NAND flash, which is putting downward pressure on the prices they can charge for the systems they sell.

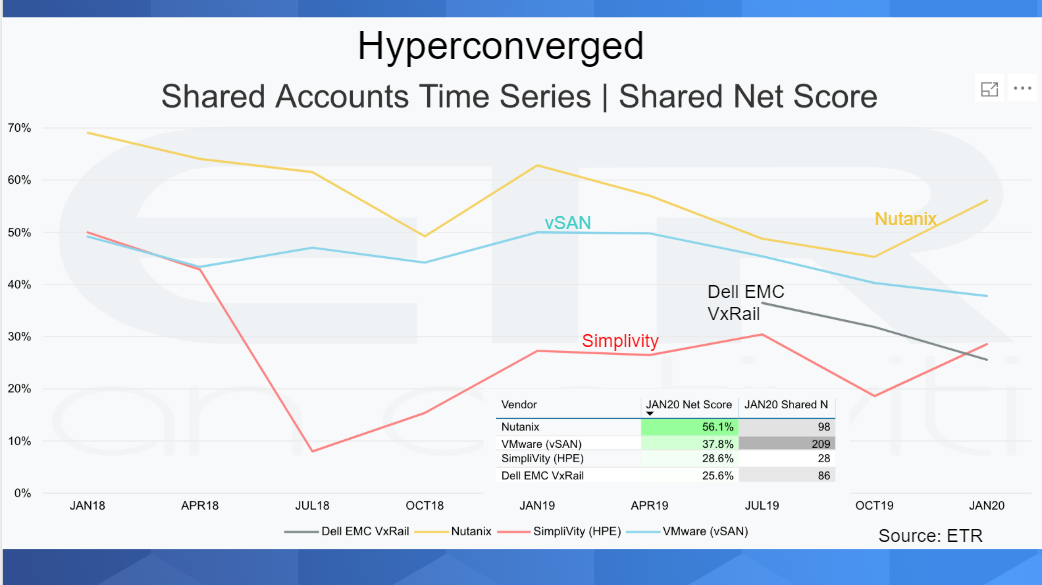

“The third thing is you’re still seeing in primary storage is the consolidation dynamics play out with hyperconverged,” Vellante said. “Hyperconverged is the software-defined bringing together of storage, compute and networking into a single, logical managed unit, and it is taking share away from traditional primary storage.”

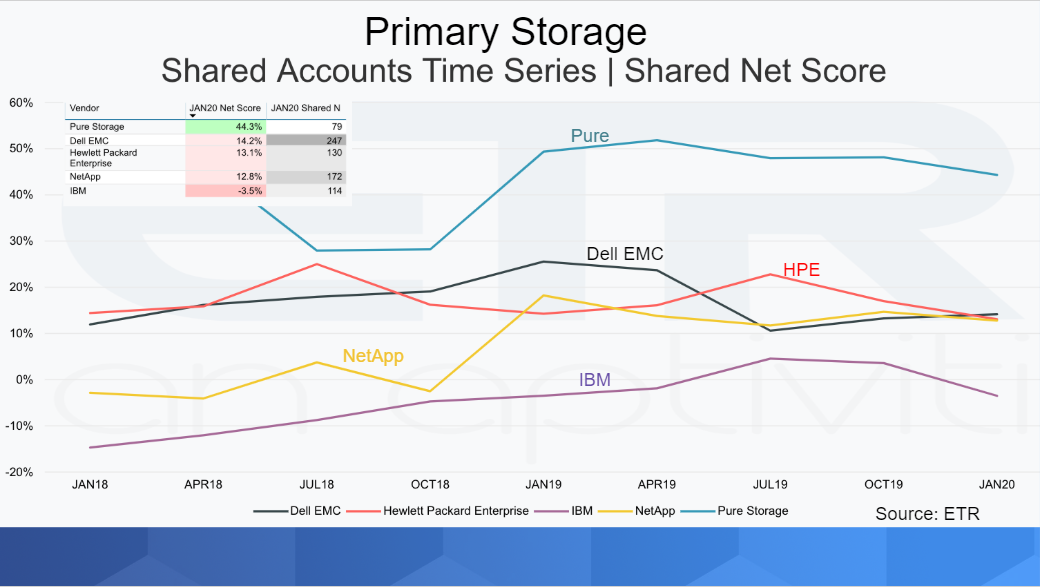

That’s not to say it’s doom and gloom for everyone, though. A quick look at the primary storage market leaders shows that while most of the traditional vendors are struggling to maintain momentum, Pure Storage stands out as the exception to that rule with its 44.3% net score.

“There’s only one company in the green and that’s Pure Storage,” Vellante said. “You can see they’re trending down just a little bit from previous quarters but you know they’re still far and away the company with most spending momentum.”

The other primary storage market leaders are struggling from a planned spending perspective, though, with Dell EMC, Hewlett-Packard Enterprise Co., NetApp Inc. and IBM working to keep their heads above water by mining the installed base

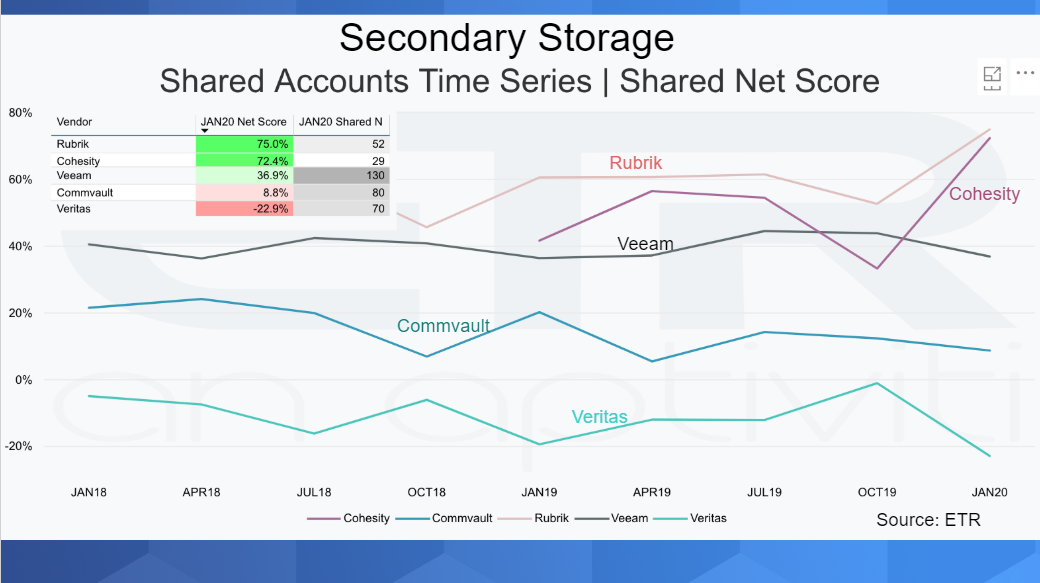

The secondary storage market, which refers to storage systems for data protection, backup and so on, seems to be showing a bit more life. That market has seen a massive injection of venture capital funding in recent months, with around $0.5 billion dollars invested into the top companies over the past year or s0. There have also been some big acquisitions recently, the most obvious one being Veeam Inc., which was bought out by the private equity firm Insight Partners for $5 billion earlier this month.

“There’s a lot of action going on there, and we have seen big total addressable market expansions with companies like Rubrik and Cohesity garnering much of that venture capital money and really expanding the notion of data protection from backup into data management into analytics and security,” Vellante said.

ETR’s net score data for secondary storage paints a much healthier picture, with the likes of Rubrik, Cohesity and Veeam all in the green and showing good progress, while CommVault Inc. and Veritas, along with Dell EMC and IBM are trying to keep their portfolios current to fend off the upstarts.

Hyperconverged is the third and final piece of the storage puzzle and also where a good opportunity lies, according to the ETR data.

“We’ve heard a lot of stories saying that Nutanix is in big trouble and that it’s dying and so forth, but the data show something different,” Vellante said. “You can see the net scores here, everybody’s in the green because overall this is a strong market. Everybody has at least some spending momentum – especially Nutanix – and they’re taking share from primary storage.”

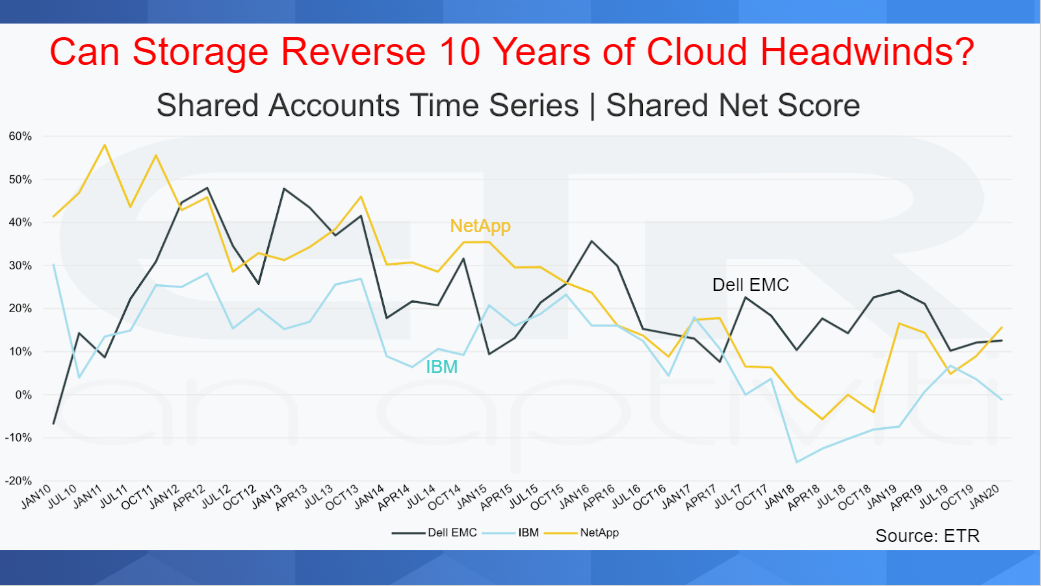

Going forward, the big question is whether or not the storage industry can reverse the decade-long trend that has seen the cloud suck away much of its momentum. It’s not clear at this point, but ETR’s spending velocity data for the storage market leaders over the past 10 years is not encouraging.

As we can see, NetApp Inc. and IBM have been steadily under pressure for years, while Dell EMC has struggled to keep its storage franchise growing.

Looking ahead, Dell EMC, NetApp and HPE are all due to report earnings next month, and those statements should provide a clear indication of what’s happening with overall demand in the market and what the growth trajectory is looking like.

Vellante is also expecting the market to be further disrupted by cloud players such as Amazon Web Services Inc., which up until now hasn’t really seized the opportunity that exists in storage.

“One of the things I’m watching very closely is the total addressable market expansion of the cloud players,” Vellante said. “Let’s watch for Amazon’s and the other big cloud players’ moves into the storage space. I fully expect they’re going to want to get a bigger piece of that pie because remember, most of Amazon’s IT business revenue currently comes from compute.”

Here’s the full analysis:

THANK YOU