POLICY

POLICY

POLICY

POLICY

POLICY

POLICY

The frontiers of what is considered medicine are expanding as technology takes over the medical field. From nanobots that target cancerous tumors to virtual reality therapy for pain relief, the field has advanced far beyond online medical assistance and step-monitoring devices. And like many technological fields, the growth has happened fast.

But that may be changing. Digital health is facing issues with data privacy and security, market confusion, lack of integration with existing workflows and solutions that are more flash than substance.

Does this signal the end of the boom years for digital health? Or is it the natural correction of a bubble market?

At theCUBE, SiliconANGLE Media’s mobile livestreaming studio, we asked leaders in digital health investment their thoughts on the current state of digital health — aka healthcare information technology.

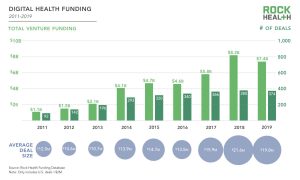

In 2011, $1.1 billion dollars of funding went to 92 companies categorized within the digital health industry, according to figures from digital health venture capital firm Rock Health Inc. By 2014, that had shot up to 298 companies receiving $4.1 billion. And in 2018, nearly 400 companies shared in $8.2 billion dollars of investor funding with an average deal size of $21.6 million.

The champagne corks were popping.

Then the upward trend in investment dropped. In 2019, total funding came in $800 million under 2018’s total. However, that still made it the second-biggest year for funding on record.

Image: Rock Health

Keith Figlioli, former healthcare technology executive and current general partner at the venture capital firm LRVHealth, and Eric Heil, senior vice-president global growth and opportunity at Health Quality Partners, agree there is a small slowdown in the market.

“It feels like it will be a new normal, which is a little bit flat off those up to the right graphs that we’ve had for the better part of almost a decade now,” Figlioli told theCUBE in an interview. “It’ll start to look like fintech or general tech.”

The question is: When will that leveling-out happen? “Does that level out where we are? Does that level out 10% to 20% lower?” Figlioli asked.

Heil agreed: “We have seen a change in investor attitudes toward digital health.” He attributed that change to a market increase in “demands and expectations that new solutions take financial risk alongside the purchaser. Investors are increasingly realizing that more capital and more time is needed to ‘price’ in this execution and payment risk.”

Speaking from the point of view of a startup, Eran Orr, founder and chief executive officer of XRHealth USA Inc., sees investment continuing to be strong. “I’m not sure there’s a real decline,” he said, pointing out that the Rock Health report states that “just two late-stage deals in 2018 accounted for the $0.8 billion year-over-year change in total funding.”

The biggest headlines recently relate to concerns over security and privacy. We are just at the start of the battle over medical data privacy, and many experts are hinting that the more we dig, the scarier the statistics to be unearthed.

CNBC health and tech reporter Christina Farr recently tweeted a thread listing the many ways that healthcare companies are legally using patient data. From Project Nightingale to 23andMe and more, the intricacies of data privacy in the medical field are complex and far-reaching.

EMIS Health’s Richard Jarvis

“Security will be the single biggest issue in our industry for the better part of the next decade, decade and a half in my opinion,” Figlioli stated.

Cybersecurity is a hot topic across the board, with ransomware, data breaches, privacy concerns and questions on regulation affecting every industry. But in the medical field in particular, security and privacy require a delicate balance.

On one side, data can aid research and speed development of cures and advanced technological health aids. On the other, data breaches and attacks could mean life-and-death consequences.

“The implications of an attack against an MRI machine or an infusion pump could be devastating to an actual person connected to it,” Russell L. Jones, partner for cyber risk services at Deloitte Touche Tohmatsu Ltd., told theCUBE during an interview at the 2019 RSA Conference in San Francisco.

Ensuring patient data remains safe means ensuring the patient’s physical and emotional health aren’t compromised. “We hold about half a trillion patient records. How do we ensure that only the right person can see the right record, at the right time?” asked Richard Jarvis (pictured), chief analytics officer of EMIS Health (EMIS Group PLC) in a Q&A on security and privacy in the United Kingdom’s National Health Service.

Another issue faced by both investors and startups is the broad definition of digital health. As the category currently stands, meditation apps and precision devices that deliver pain medicine are under the same broad umbrella.

Exacerbating this confusion are the huge differences between products offered under the headline of “digital health.” For example, in 2019, Gympass, received a $300 million funding injection. Regardless of debate over the investment value, it does seem extreme that a company that offers global fitness facility memberships would be in the same investment category as a company such as PathAI, which trains artificial intelligence with the goal of more accurately and speedily diagnose and treat diseases. In 2019, PathAI received $75 million in strategic investment for its work.

Farr is a regular contributor to this discussion in articles and via her Twitter feed:

Collected some thoughts on the big takeaways and discussions from #JPM20 for those who aren’t here. Here are my top 5: https://t.co/gxhfFDasLm

— Christina Farr (@chrissyfarr), January 15, 2020

After attending the J.P. Morgan health conference, Farr wrote: “Some attendees felt the lack of a clear definition for ‘digital health’ might be hurting the sector.” She also said that “digital health … is so over-used and over-hyped, it’s no longer clear what it means.”

Try not to get caught up in the buzzwords because they change every day, advises LRVHealth’s Figlioli. “When we talk about where we invest, we invest in healthcare IT companies, we invest in technology enabled services companies, and we invest in devices and diagnostics,” he said. “You could probably put an umbrella over that as ‘digital health,’ but I don’t think there’s a true definition.”

Tech is known for innovation, and many startups have become famous for completely reconceptualizing existing operational models. But disruption and experimentation don’t go over as well in healthcare. Not only are current operational systems extremely entrenched and complex, but a “fail until you succeed” experimentation model could literally kill people.

The issue all three experts agree on is that innovative solutions often don’t fit into existing workflows, meaning they may be great ideas but bringing them into real-life use-case scenarios is a challenge.

Startups need to focus on how digital solutions can fit into the existing provider workflow, according to Orr. “The way to move forward is to integrate services and technology in order to reduce the friction of adoption,” he said.

“In my experience, digital health solutions are not enough,” Heil agreed. Instead, startups should focus on combining “technology and clinical services to better fit within the current healthcare delivery system while also supporting their digital health solutions,” he added.

“We have a lot of companies that aren’t starting with problem statement but starting with a really tech whiz-bang solution and trying to find the problem,” Figlioli said. “The social system of healthcare is … the single most important thing that entrepreneurs need to understand,” he said, advising entrepreneurs to “take the time and really get interested and curious about [the healthcare industry]. Why we are what we are.”

There is a disconnect in the startup arena. There are those that loudly declaim solutions that are built to sell but have little actual real-world applications. While solid, proven but less sexy solutions lack the pizzazz to attract investors.

“How do we bridge this gap between ‘built to sell’ and ‘spreading solutions’ that are proven to work?” Heil asked.

Discernment is one strategy advocated by LRVHealth. “There’s just not that many unbelievable companies at the end of the day,” Figlioli said.

LRVHealth is “100% proactive” in its strategy thesis, according to Figlioli. “We don’t wait for people to opportunistically throw us a bunch of companies,” he said. “We have teams where we’re out in the market looking for where the pain points are, and then backing into the type of companies and the type of investments we ultimately make.”

Successful start-up XRHealth is looking to provide substance with pizzazz by making rehabilitation and treatment fun and accessible through virtual reality games. That marks a switch in the company’s focus to providing telehealth treatment rather than in-clinic tools. Telehealth has the benefit of making attending sessions easier for the patient. Plus, by offering the technology directly to the consumer, XRHealth is able to introduce it to a wider audience, faster.

“It’s about accelerating adoption,” Orr explained.

Rather than scheduling rehabilitation sessions and traveling to a clinic, patients are able to play virtual and augmented reality games designed to promote recovery and healing at a time and place that is most convenient for them. Progress is monitored by the patient’s healthcare clinician, who has the ability to change the intensity and length of sessions, and the apps are FDA-registered.

There’s no question that digital technology is bringing huge advances in healthcare. But behind the fanfares and champagne, the real purpose for all the innovations and solutions in the health field is simple: helping people and cutting the cost of care.

Startups need to remember that technology that aids patients and saves money doesn’t always need to be cutting-edge, according to Heil. He cited an example where nurses used colored socks to identify at-risk patients. With patient falls costing U.S. hospitals millions in extra care each year, the simple change reduced injuries and saved costs.

“They didn’t need a fancy digital health alert, artificial-intelligent algorithm or digital tag in an electronic medical record,” Heil said.

THANK YOU