EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

Emerging technology companies face a tougher road ahead as the pandemic sends information technology buyers to what they view as safer bets.

That’s a key finding of the latest survey from Enterprise Technology Research’s Emerging Technology Study. This trend continues the theme we highlighted coming into 2020 that organizations were experimenting less and narrowing spending on emerging technologies as they begin to put their digital initiatives into operation.

Although this is generally negative for emerging companies, there are some clear exceptions that we’ll highlight.

In this segment of theCUBE Insights, powered by ETR, we share the latest survey data from the market research firm’s most recent study focusing on privately held companies. Once again, we welcomed in Sagar Kadakia, ETR’s director of research, to explain the nuances in the data.

Twice each year, ETR conducts specific research to evaluate the performance of private companies in the data set.

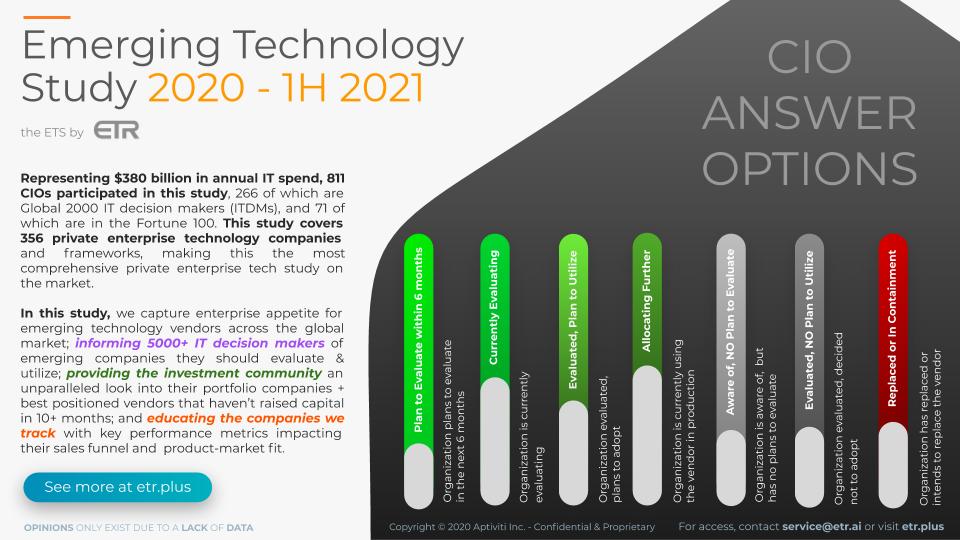

More than 800 chief information officers and IT buyers participated in the most recent survey, covering more than 350 private companies and frameworks. As shown in the graphic above, specific questions were asked of each respondent as to their evaluation and deployment intentions. Respondents were asked to comment on those vendors with which they were familiar.

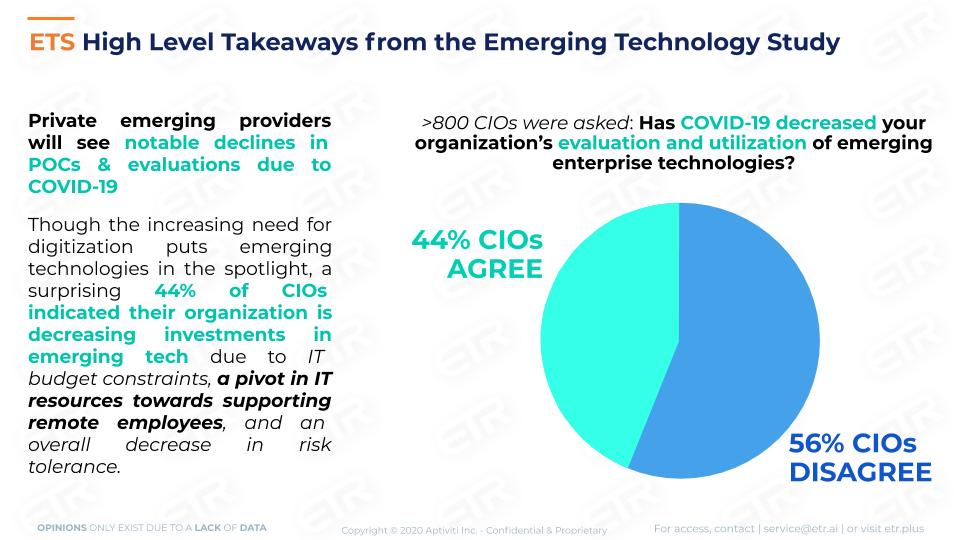

On balance, respondents are more selective with regard to placing bets on emerging technologies. As shown in the graphic below, 44% of respondents indicate they will decrease spending on emerging technologies as a direct result of the pandemic.

Not surprisingly, the risk tolerance of buyers is lower because of coronavirus. Unless the private provider fills a gap that larger, public companies can’t deliver, buyers will favor larger players, with some exceptions that we’ll highlight in the sector discussions.

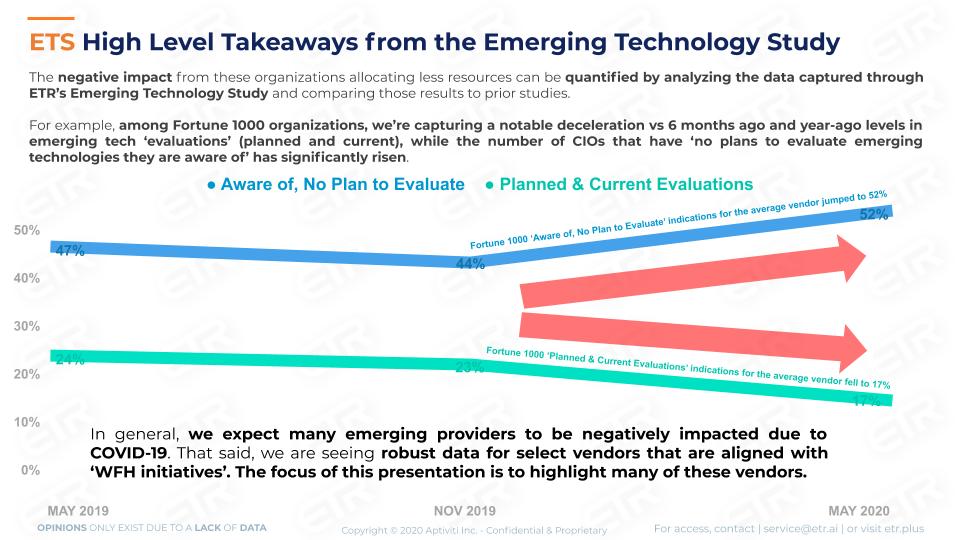

The graphic below shows a data cut that isolates the Fortune 1000, comparing the most recent ETR Emerging Technology Study to earlier surveys. The blue line shows the average percentage of respondents that are aware of a technology but have no plans to deploy. The green line shows the percentage of respondents that either plan or are currently evaluating the emerging technology. Notably:

Although this data is generally negative for many emerging technology players, there are some standouts in the sectors.

We’ve reported for some time that investments in cybersecurity will shift from hardening the perimeter (that is, the moat around the castle) to protecting distributed infrastructure. The pandemic has accelerated this trend, providing momentum to endpoint security and so-called “zero-trust” solutions. Some of the public companies we’ve highlighted that are benefiting from this trend include CrowdStrike Holdings inc., Okta Inc. and Zscaler Inc., among others.

ETR tracks more than 78 private emerging security companies and a few are seeing momentum in the form of higher planned or current evaluations or deployments. The upper right (green) section in the chart below shows companies that are seeing momentum in the survey measuring those customer responses that plan to evaluate within six months, are currently evaluating, have evaluated and plan to use, and those that are allocating more. The lower left (red) are those companies with lower scores by this definition.

Two standouts are BitSight Technologies Inc., a security rating service, and Aqua Security Software Ltd., which provides container security. WSO2 (IAM, API management), UnifyID (IAM), and Auth0 Inc. (IAM) are seeing notable upticks in buyer sentiment. Netskope Inc. (cloud security), Thycotic Software Ltd. (IAM) and OneLogin Inc. (IAM) are also seeing opportunities within enterprise accounts, though these vendors are seeing a bit more churn according to ETR data analysis.

We probably sound like a broken record with regard to Snowflake Inc., but the data tell a strong story. In many ways, Snowflake is a safer bet because it has a proven track record, is well-financed and is reportedly preparing to move forward with an initial public offering of stock this year.

Redis Labs Ltd., the in-memory specialist, and DataStax Inc., which simplifies Cassandra deployments, both show strong. In many ways the database landscape shown on the chart below comprises companies that offer different products for a variety of use cases.

Snowflake is emerging as a leader in analytic databases, and MariaDB Corp. is more focused on relational/operational workloads, while DataStax, Couchbase Inc., Redis, Aerospike Inc. and Cockroach Labs have roots in nonrelational environments.

The idea of automation has gone from scary several years ago to something to consider to a mandate as the COVID work-from-home pivot makes digital business compulsory.

In 2010, as the cloud was rising from the ashes of the financial crisis, Mitchell Hashimoto created Vagrant to simplify configuration management. That led to the formation of HashiCorp Inc., which eventually developed Terraform, a platform that’s gaining traction in cross-cloud configuration management.

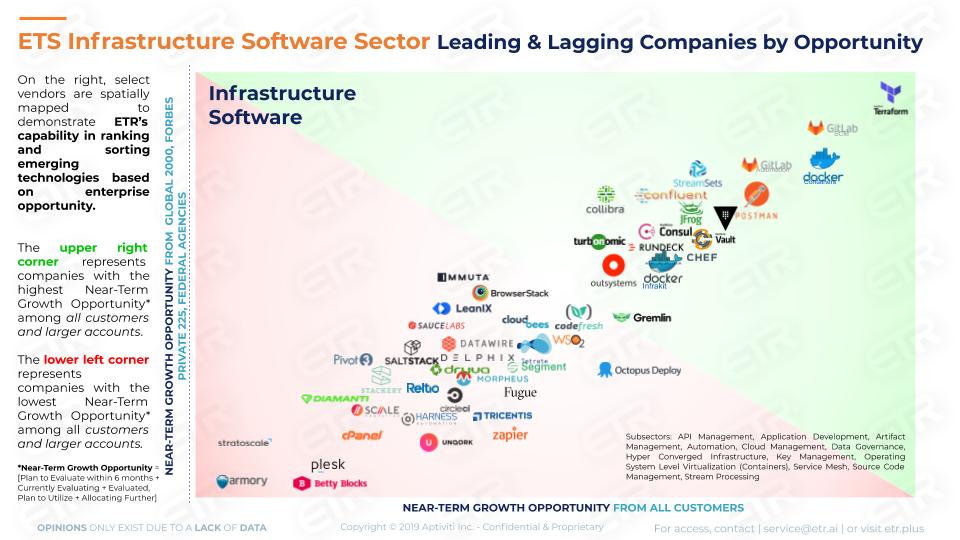

As shown in the graphic below, Hashi tooling is well-positioned in the ETR dataset, with Terraform showing strong. Vault is also showing momentum. Vault is Hashi’s security play for protecting sensitive data such as credentials and application programming interface keys and is part of the company’s monetization strategy.

Notably, the cloud players have disrupted the likes of Chef Software Inc., Puppet Labs Inc. and SaltStack Inc., which are all showing elevated churn levels in the ETR data set.

This quote from an ETR Venn CIO participant sums up the dynamic that is playing out in the configuration management space:

The Terraform tool creates an entire infrastructure in a box. … Unlike [vendors that use] procedural languages like Ansible … and Chef, it will show the infrastructure the way you want it to be. You don’t have to worry about the things that happen underneath it. I know some companies where you can put your entire Amazon infrastructure through Terraform. If Amazon disappears, if your entire availability zone drops with all 200 servers, load balancers, RDS, et cetera, you just run Terraform, and everything will be created magically in ten minutes” (Director of DevOps, Services/Consulting, Large Organization, North America | VENN 3.132, 1/30/2020).

The chart above compares a number of different types of tools. For example, GitLab Inc. specializes in application tools to deploy code more efficiently. Docker is a well-known open source container platform and Turbonomic focuses on application resource management and performance management. So it’s different tools for different jobs but all in the same general category.

In the API infrastructure business, Postman Inc. is currently showing strong momentum with utilization rates rivaling Hashi and GitLab tools.

As well, WSO2, according to the ETR data, is one of the few infrastructure software players that saw improvements in Net Sentiment relative to six months ago.

Finally, MuleSoft (now Salesforce.com Inc.) and Apigee (Google LLC) show strong momentum in the survey data.

In a word, yes. We believe that there will be a natural tendency, especially among large buyers, to flee to perceived safe bets. That will put increased pressure on those emerging suppliers that have not achieved escape velocity, are not well-capitalized or don’t have strong ecosystem support.

As witnessed in many mainstream markets, we see bifurcation occurring in many sectors where emerging vendors play. We think that will lead to increased consolidation through mergers and acquisitions. Large, established companies will freeze markets where necessary and look to fill gaps in their product lines through M&A.

However, private companies that are well-capitalized and have a disruptive value proposition relative to legacy technologies could prove to be diamonds in the rough. These firms could bring competitive advantage to buyers willing to absorb some extra risk.

ETR’s latest COVID impact survey is in-market and over the next several weeks we’ll be reporting on the data trends that emerge. Currently we’re holding at a 4% to 5% decline in IT budgets for 2020, but we’ll keep you updated as the survey data comes in.

Look for updates on the ETR Website and make sure to check out SiliconANGLE for all the news and analysis. Also, you may want to check out this ETR Tutorial we created, which explains the spending methodology in more detail.

Remember these episodes are all available as podcasts wherever you listen. Ways to get in touch: Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Here’s this week’s full video analysis:

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.