BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

Data analytics firm Splunk Inc. beat expectations on earnings and revenue today and its outlook for the next quarter was just above consensus, sending its stock up almost 2% in extended trading.

The company reported a second-quarter loss before certain costs such as stock compensation of 62 cents per share on revenue of $606 million, growing 23% from the same period one year ago.

Wall Street was looking for a loss of 69 cents per share on revenue of just $563 million, so it was a pretty strong performance.

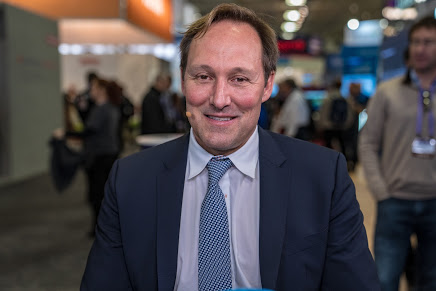

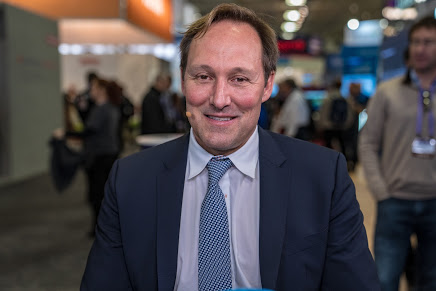

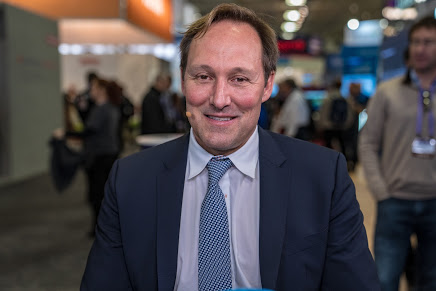

Splunk Chief Executive Doug Merritt (pictured) hailed the company’s leadership team and said the results validate the “high strategic value” it delivers to enterprises. “Our second-quarter execution was broad-based, with each of our major geographic regions exceeding our own expectations as more and more customers around the world rely on Splunk and our market-leading data platform and cloud-based capabilities,” he added.

Splunk sells tools that are used by enterprises to monitor, search, analyze and visualize machine-generated data in real time. Essentially, it provides easy access to enterprises’ operational data and delivers insights that can aid in business decision-making.

The company has been steadily transitioning customers to cloud-based versions of its software. That has seen its revenue model change from one that’s based on perpetual licenses to cloud subscriptions, which provide a more predictable income stream.

The transition seems to be going well, as the company reported annual recurring revenue from cloud computing sales of $976 million, up 72% from a year ago and also well above the forecast of $950 million to $960 million it gave three months ago.

Cloud revenue rose 73% to $217 million, the company said. Merritt added that Splunk doubled to 234 the number of customers with a cloud ARR of more than $1 million a year.

Splunk Chief Financial Officer Jason Child said the company outperformed its own expectations in terms of ARR in the first half of the year, and that it’s well-positioned as it heads into the latter part. “We expect $1.3 billion in cloud ARR and total ARR of well over $3 billion by the fiscal year end,” he added.

The quarter just gone was an unusually busy one for the company as it made a number of big changes in its executive management. In July it appointed Sendur Sellakumar as its first-ever chief cloud officer at the same time as it announced new chief marketing and chief product officers. Two weeks later, Splunk revealed it had managed to lure the pioneering computer scientist David DeWitt into its fold. DeWitt was given the role of vice president and technical fellow and has been tasked with supporting software engineering efforts at the company.

Splunk also raised a huge chunk of cash, with Silver Lake investing $1 billion in the company in June to support growth initiatives and buy back shares.

The company also found the time to launch a new Security Cloud offering for security operations teams that combines advanced analytics with automation, investigations, threat intelligence and response capabilities.

Looking ahead to the current quarter, Splunk told analysts it’s looking for sales of $625 million to $650 million. The midpoint of that range is just ahead of Wall Street’s forecast of $636 million in third-quarter revenue.

For its full fiscal year, Splunk said it sees revenue of between $2.35 billion and $2.6 billion, just below the consensus of $2.54 billion.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.