INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Arista Networks Inc.’s stock got a nice bounce today after the data center networking supplier delivered better-than-expected earnings and revenue in its financial results.

The company reported second-quarter earnings before certain costs such as stock compensation of $1.58 per share, beating Wall Street’s target of $1.44 per share. Meanwhile, revenue rose by 8% from a year earlier to $1.459 billion, ahead of the company’s own guidance range of $1.35 billion to $1.4 billion and also the analyst consensus estimate of $1.378 billion.

Its bottom line also improved, as it reported net income of $491.9 million, up from $299.1 million a year earlier. In addition, the company reported an adjusted gross margin in the quarter of 61.3%, just ahead of its earlier forecast of 61%.

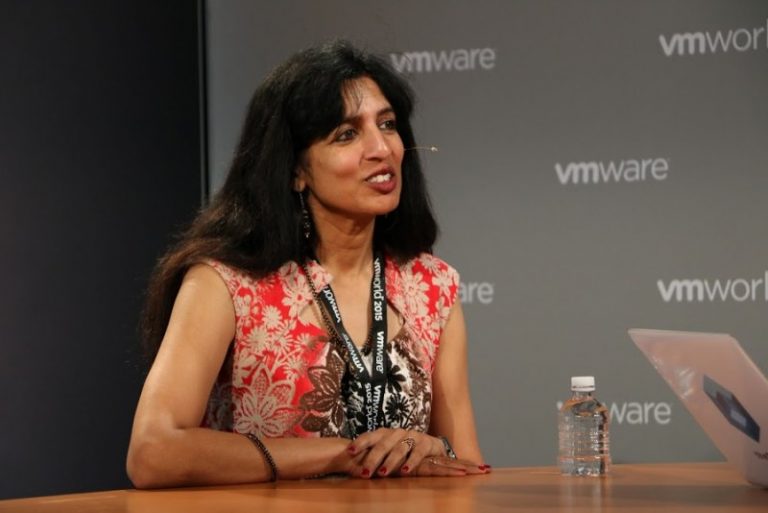

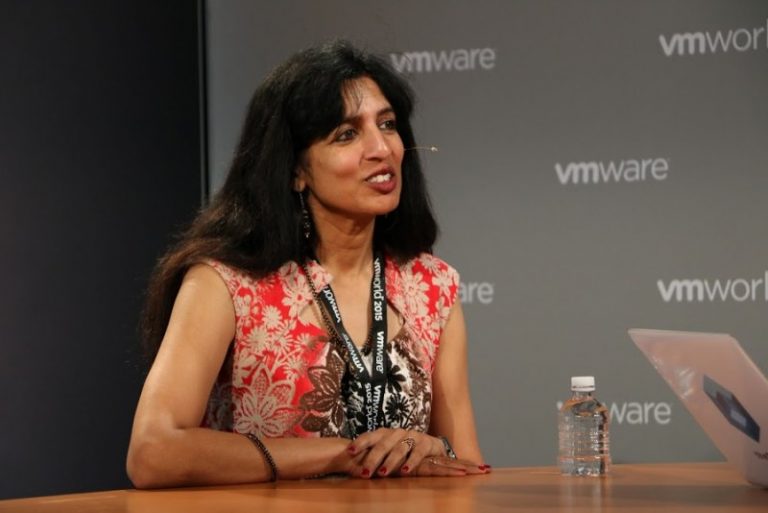

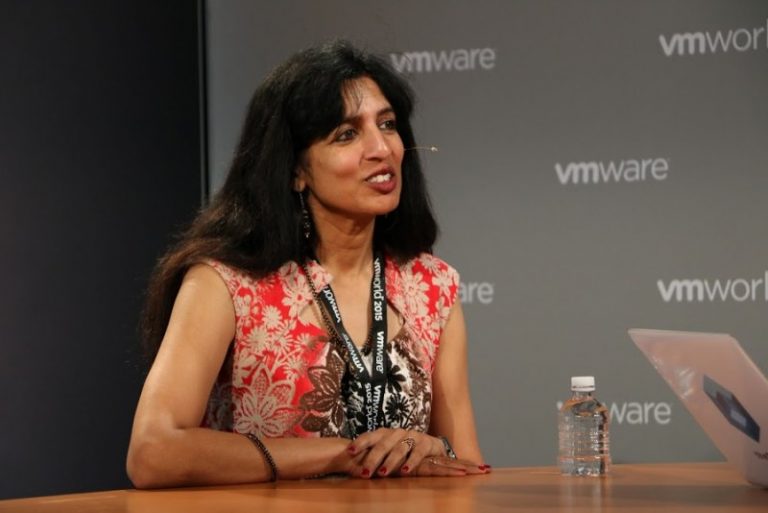

“Arista again achieved record revenue and profitability,” said Chief Executive Jayshree Ullal (pictured). “Our customers now represent more than 75 million cumulative cloud networking ports.”

Arista Networks is a rising star in the computer networking industry, rivaling the much bigger Cisco Systems Inc. with premium equipment such as high-speed switches that accelerate communications between racks of computer servers in corporate data centers.

One week earlier, Arista’s stock took a hit on concerns over a possible slowdown in data center infrastructure demand. That came after another rival, Juniper Networks Inc., posted disappointing financial results of its own. Moreover, signs of more moderate spending from Arista’s two biggest customers – Microsoft Corp. and Meta Platforms Inc. – further weighed on its stock.

In a statement, Chief Financial Officer Ita Brennan said the company is seeing a “return to shorter lead times and reduced visibility,” which seemed to underscore those fears. Nevertheless, Arista’s results were much better than expected, and its shares gained more than 14% in extended trading, adding to a gain of more than 2% during the regular session.

Holger Mueller of Constellation Research Inc. said Arista benefits from the fact that digital economies need networking, no matter how good or bad they are currently doing. “Arista is in the middle of this and it continues to grow, albeit more slowly,” he said. “However, it managed its costs well, becoming more profitable compared to a year earlier. Arista is one of the few technology vendors that spends less than half of its research and development budget on sales and marketing, and it shows with both innovation and profitability.”

For the third quarter, Arista is projecting revenue of between $1.45 billion and $1.5 billion, more or less in line with Wall Street’s consensus estimate of $1.48 billion. It’s also projecting full-year revenue growth of more than 30%, ahead of Wall Street’s estimate of 26.5% growth.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.