APPS

APPS

APPS

APPS

APPS

APPS

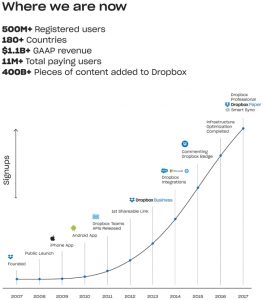

One of the most long-awaited initial public offerings of stock could finally happen soon, as cloud storage giant Dropbox Inc. today officially filed for an IPO.

The company had reportedly filed confidentially to go public last month, but today, the Securities and Exchange Commission unsealed the plans. The offering could come as early as March 19.

The filing indicates the San Francisco-based firm, valued most recently at $10 billion, plans to raise at least $500 million, though that figure could be a placeholder that could change as pricing of the offering firms up. However, according to sources cited by the Wall Street Journal, the IPO will value Dropbox at $7 billion to $8 billion. In any case, it’s still likely to be one of the largest U.S. tech IPOs in recent years.

The IPO, which would provide an exit more than a decade after Dropbox was founded, also could spur other large “unicorns,” or companies valued at more than $1 billion, ranging from Uber Technologies Inc. to Pinterest Inc. to test the waters. Many startups have become huge in terms of revenue but have held off going public longer than startups traditionally have because they’ve been able to raise large amounts of private cash. But IPOs have historically spurred wealth creation that keeps the startup cycle going year after year, and the dearth of IPOs in recent years has spurred fears of the end of that cycle.

Like many high-growth companies going public, Dropbox continues the lose money, the SEC filing revealed. It reported revenue of $1.11 billion last year, up 31 percent from the previous year, but it showed a net loss of $111.7 million, though that’s down significantly from a loss of $210.2 million in 2016. What’s more, the company turned free cash flow-positive in 2016. Rival Box Inc., which went public in 2015, hasn’t turned profitable yet.

Source: Dropbox

Unlike some other cloud companies that have needed to hire big sales forces to sell to large enterprise customers, Dropbox has managed to avoid that cost, at least so far. “Historically, our business model has been driven by organic adoption and viral growth, with more than 90 percent of our revenue generated from self-serve channels,” the filing said.

The money from the IPO will be used to expand by getting more users to opt for paid subscriptions and integrating more with other software companies, following previous integrations with Google LLC, Microsoft Corp., Slack Inc. and others.

The company said it has 500 million registered users, 100 million of whom have signed up since the start of 2017, but only 11 million paid users. Some 300,000 teams also use its beefier Dropbox Business service, which starts at $12.50 a month for teams of three users.

“We estimate that approximately 300 million of our registered users have characteristics — including specific email domains, devices, and geographies — that make them more likely than other registered users to pay over time,” the company said in the filing.

“Dropbox’s financial metrics highlight an impressive combination of growth, profitability, and cash flow,” Rohit Kulkarni, managing director and head of research at SharesPost Inc., a fund for private-company stocks, said in an email. “All three are rare to find among today’s crop of unicorns.”

Kurkarni added that Dropbox compares favorably to rival Box and other recent cloud software companies that have gone public recently. “Dropbox deserves a premium valuation to its storage counterpart, Box, and a comparable valuation to recent IPOs, as well as high-growth SaaS companies such as Atlassian, Mulesoft and Okta,” he said.

The filing said co-founder and Chief Executive Drew Houston (pictured) has 24.4 percent of voting power in the company. Investor Sequoia Capital has 24.8 percent. The company employed 1,858 people as of the end of 2017.

The stock will trade under the ticker symbol DBX. The main underwriters for the offering are Goldman Sachs Group Inc. and JPMorgan Chase & Co., though the filing lists many other participating banks: Deutsche Bank Securities, Allen & Co. LLC, BofA Merrill Lynch, RBC Capital Markets, Jefferies, Macquarie Capital, Canaccord Genuity, JMP Securities, KeyBanc Capital Markets and Piper Jaffray.

THANK YOU